Deferred Tax In Balance Sheet

Deferred Tax In Balance Sheet - The liability is deferred due to a. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. It is the opposite of a deferred tax liability, which represents. Web common types of deferred taxes fixed assets. Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. Tax basis may differ from the. Deferred tax assets and liabilities, along. Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost.

It is the opposite of a deferred tax liability, which represents. Deferred tax assets and liabilities, along. The liability is deferred due to a. Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. Tax basis may differ from the. Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. Web common types of deferred taxes fixed assets. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost.

It is the opposite of a deferred tax liability, which represents. Web common types of deferred taxes fixed assets. Deferred tax assets and liabilities, along. Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. Tax basis may differ from the. The liability is deferred due to a. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost.

Nice Deferred Tax Liability On Balance Sheet Finance Department Positions

Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. In many.

What is Deferred Tax Liability (DTL)? Formula + Calculator

The liability is deferred due to a. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. It is the opposite of a deferred tax liability, which represents. Web a deferred income tax is a liability recorded on a balance.

Tariq PDF Deferred Tax Balance Sheet

Web common types of deferred taxes fixed assets. Deferred tax assets and liabilities, along. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. Web key takeaways a deferred tax asset is an item on the balance sheet that results.

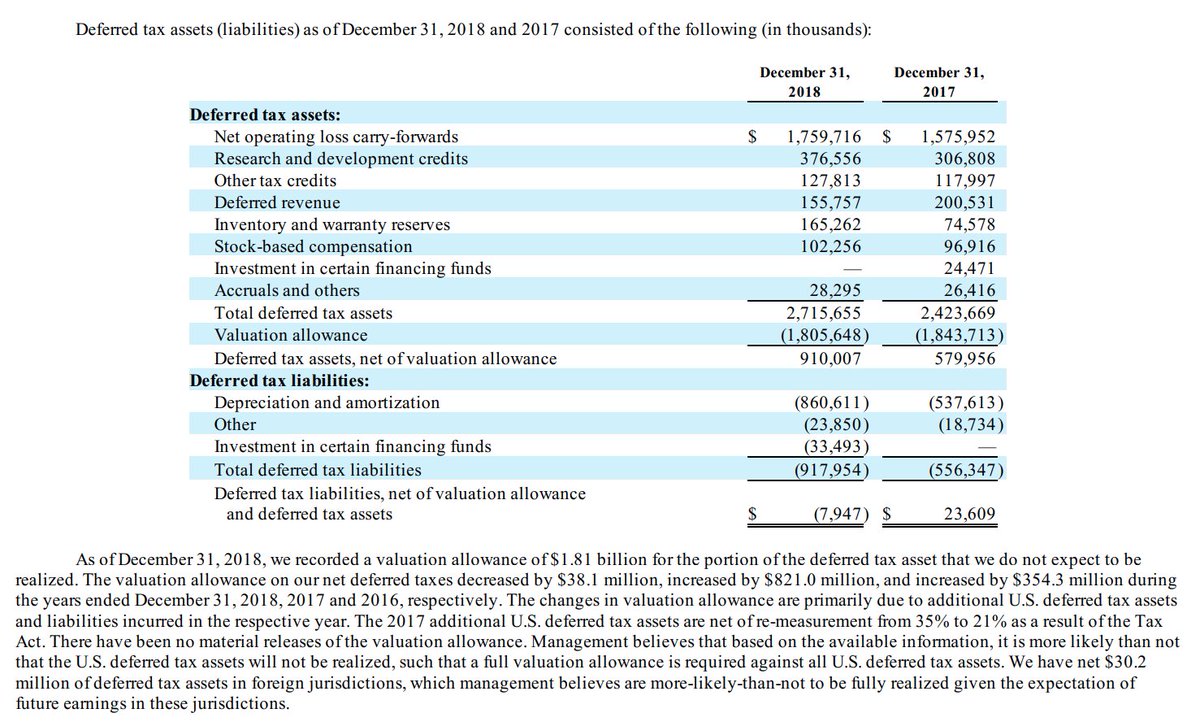

Net Operating Losses & Deferred Tax Assets Tutorial

Web common types of deferred taxes fixed assets. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost. It is the opposite of a deferred tax liability, which represents. Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and.

Deferred tax and temporary differences The Footnotes Analyst

In many cases, tax basis may be less than the respective book carrying value, given accelerated cost. It is the opposite of a deferred tax liability, which represents. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. Web a.

Deferred Tax Liabilities Explained (with RealLife Example in a

Deferred tax assets and liabilities, along. It is the opposite of a deferred tax liability, which represents. Tax basis may differ from the. Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. The liability is deferred due to a.

Deferred Tax Worksheet Balance Sheet Accounts Carrying Amount Future

Deferred tax assets and liabilities, along. Web common types of deferred taxes fixed assets. Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax.

Thread by ReflexFunds Some thoughts on the advantages of TSLA's

Tax basis may differ from the. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost. Web common types of deferred taxes fixed assets. Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. The.

Bookkeeping To Trial Balance Example Of Deferred Tax Liability

Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. Web a deferred income tax is.

deferred tax assets meaning JWord サーチ

Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. The liability.

It Is The Opposite Of A Deferred Tax Liability, Which Represents.

Web common types of deferred taxes fixed assets. Deferred tax assets and liabilities, along. Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. Tax basis may differ from the.

Web Key Takeaways A Deferred Tax Asset Is An Item On The Balance Sheet That Results From An Overpayment Or Advance Payment Of Taxes.

Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. The liability is deferred due to a. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost.

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)