Deferred Revenue On The Balance Sheet

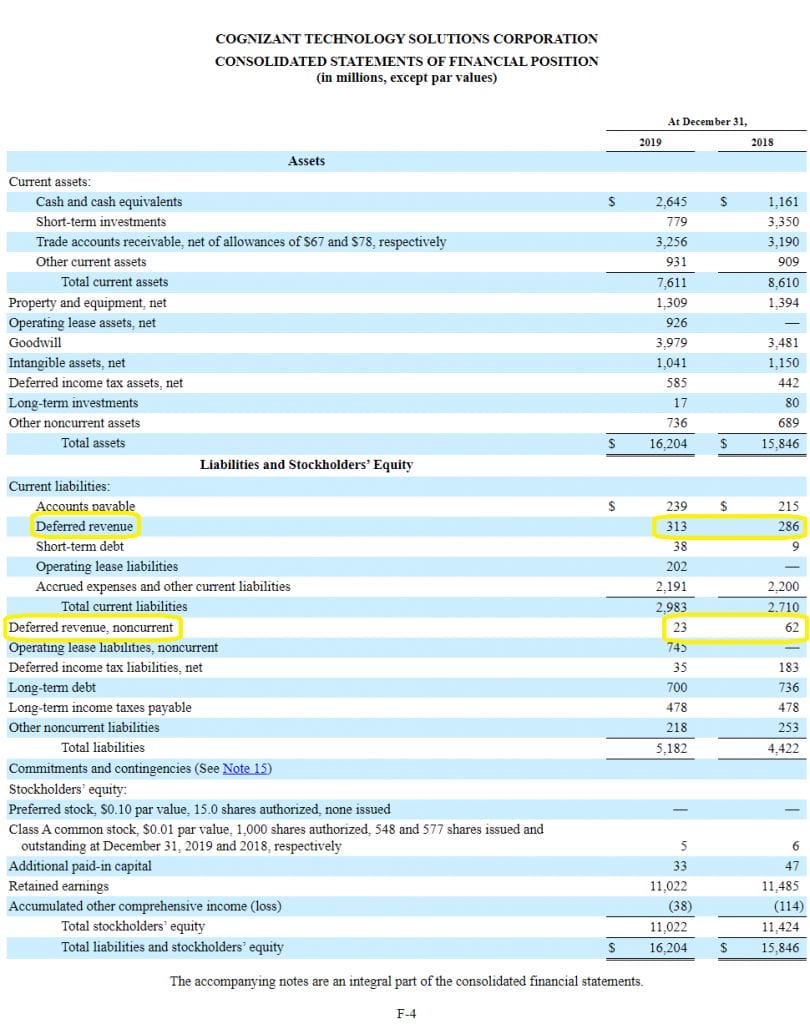

Deferred Revenue On The Balance Sheet - Web yes, deferred revenue is a liability, so it is on the balance sheet. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Deferred revenue is an obligation of the.

Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web yes, deferred revenue is a liability, so it is on the balance sheet. Deferred revenue is an obligation of the.

Web yes, deferred revenue is a liability, so it is on the balance sheet. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Deferred revenue is an obligation of the.

What is Deferred Revenue in a SaaS Business? SaaSOptics

Deferred revenue is an obligation of the. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web yes, deferred revenue is a liability, so it is on the balance sheet.

What Is Deferred Revenue? Complete Guide Pareto Labs

Web yes, deferred revenue is a liability, so it is on the balance sheet. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Deferred revenue is an obligation of the.

What is Unearned Revenue? QuickBooks Canada Blog

Deferred revenue is an obligation of the. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web yes, deferred revenue is a liability, so it is on the balance sheet.

What is Deferred Revenue in a SaaS Business? SaaSOptics

Web yes, deferred revenue is a liability, so it is on the balance sheet. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Deferred revenue is an obligation of the.

What is Unearned Revenue? QuickBooks Canada Blog

Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web yes, deferred revenue is a liability, so it is on the balance sheet. Deferred revenue is an obligation of the.

Deferred Revenue Debit or Credit and its Flow Through the Financials

Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Deferred revenue is an obligation of the. Web yes, deferred revenue is a liability, so it is on the balance sheet.

Deferred Revenue Definition + Examples

Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Deferred revenue is an obligation of the. Web yes, deferred revenue is a liability, so it is on the balance sheet.

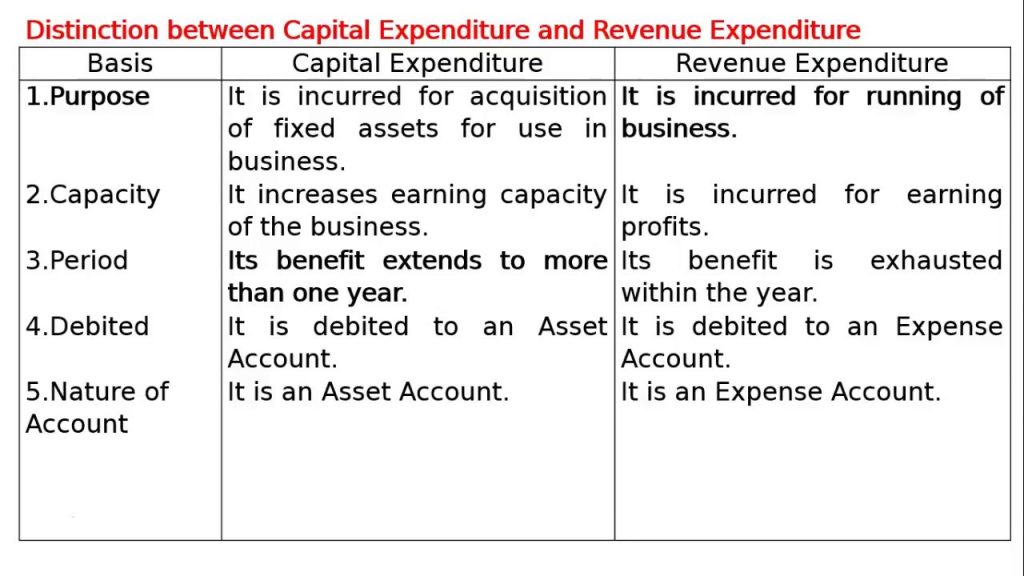

Deferred Revenue Expenditure Study Equation

Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web yes, deferred revenue is a liability, so it is on the balance sheet. Deferred revenue is an obligation of the.

What is Deferred Revenue? The Ultimate Guide (2022)

Deferred revenue is an obligation of the. Web yes, deferred revenue is a liability, so it is on the balance sheet. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created.

Web Yes, Deferred Revenue Is A Liability, So It Is On The Balance Sheet.

Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Deferred revenue is an obligation of the.