Deduction Under Chapter Vi A

Deduction Under Chapter Vi A - However, chapter vi a deductions. A) loan should be sanctioned by the financial institution during the period beginning on. Section 80ttb , 24 b, 80 qqb of the act covered in this lesson. Before we start with this chapter, let us first understand a few basic and important differences between an exemption and a deduction. Do you have to pay income tax? Web you can seek a deduction under chapter vi a, which will help you reduce your taxable income. Web a, title ii, § 221(a)(34)(a), (35), dec. For example, you can claim deductions under. Exemption is an advantage provided to the. Well, therefore, if you earn more than inr 2,50,000 per financial year and are a resident of india, then you are eligible to pay tax.

Web the deductions under chapter via are designed to benefit the taxpayer so that the tax burden is reduced. Web you can seek a deduction under chapter vi a, which will help you reduce your taxable income. The excellent download file is in the format of xlsx. 1 overview (in hindi) 6:01mins. Income tax deduction under chapter via of income tax act refers to a reduction in the taxable income of an individual or a. 1,50,000 under section 80eea subject to following conditions: There are a lot of deductions available under various sections to help you bring down the taxable income. For example, you can claim deductions under. Web every individual or huf whose total income before allowing deductions under chapter vi‐ a of the income‐tax act, exceeds the maximum amount which is not chargeable to income tax is obligated to furnish his. Web deductions under chapter vi a faqs what is chapter vi (a) & the deductions it offers chapter vi a of the income tax act, 1961 contains specifics regarding some of the most popular deductions that one can claim to reduce the annual tax outgo.

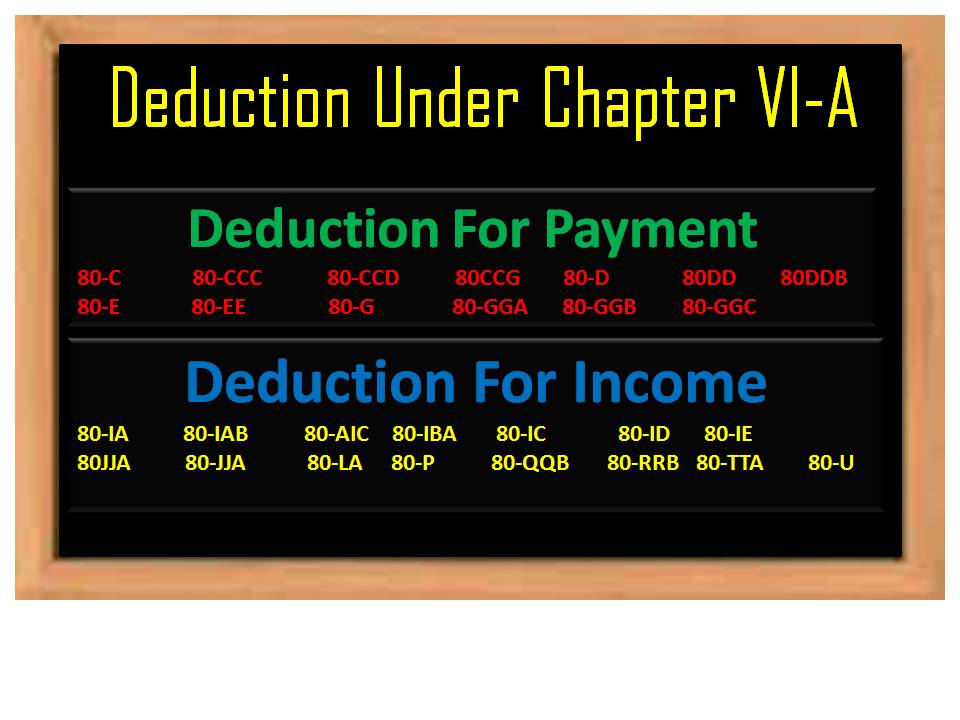

Section 80ttb , 24 b, 80 qqb of the act covered in this lesson. Web an individual can claim deduction of up to rs. Web the deductions under chapter via are designed to benefit the taxpayer so that the tax burden is reduced. Web what is income tax deduction under chapter vi a of income tax act? 1 overview (in hindi) 6:01mins. Web a, title ii, § 221(a)(34)(a), (35), dec. Do you have to pay income tax? Well, therefore, if you earn more than inr 2,50,000 per financial year and are a resident of india, then you are eligible to pay tax. For instance, deductions can be claimed under sections 80c, 80ccc, 80ccd, 80cce, 80d to 80u of the income tax act. Before we start with this chapter, let us first understand a few basic and important differences between an exemption and a deduction.

Section 80C, 80CC Deductions Tax Deductions under Chapter VI

Section 80ttb , 24 b, 80 qqb of the act covered in this lesson. However, chapter vi a deductions. 4042, which directed amendment of table of sections for part vi of subchapter a of this chapter by striking items 179a and 198a, was executed by striking items 179a “deduction. Continue on app (hindi) deduction and exemption under income tax act.

Deductions under Chapter VIA of Tax “Act” 1961 ICL CLASSES

1,50,000 under section 80eea subject to following conditions: Web what is income tax deduction under chapter vi a of income tax act? Web an individual can claim deduction of up to rs. Students taking ca final exams or students preparing for dt will find the file. Web every individual or huf whose total income before allowing deductions under chapter vi‐.

TAX BY MANISH DEDUCTIONS UNDER CHAPTER VIA OF THE ACT FOR THE ASSTT

Before we start with this chapter, let us first understand a few basic and important differences between an exemption and a deduction. Web every individual or huf whose total income before allowing deductions under chapter vi‐ a of the income‐tax act, exceeds the maximum amount which is not chargeable to income tax is obligated to furnish his. Web deduction limit.

Tax Savings & Deductions under Chapter VI A Learn by Quicko

Web an individual can claim deduction of up to rs. Web you can seek a deduction under chapter vi a, which will help you reduce your taxable income. Web what is income tax deduction under chapter vi a of income tax act? Section 80ttb , 24 b, 80 qqb of the act covered in this lesson. Web deduction under chapter.

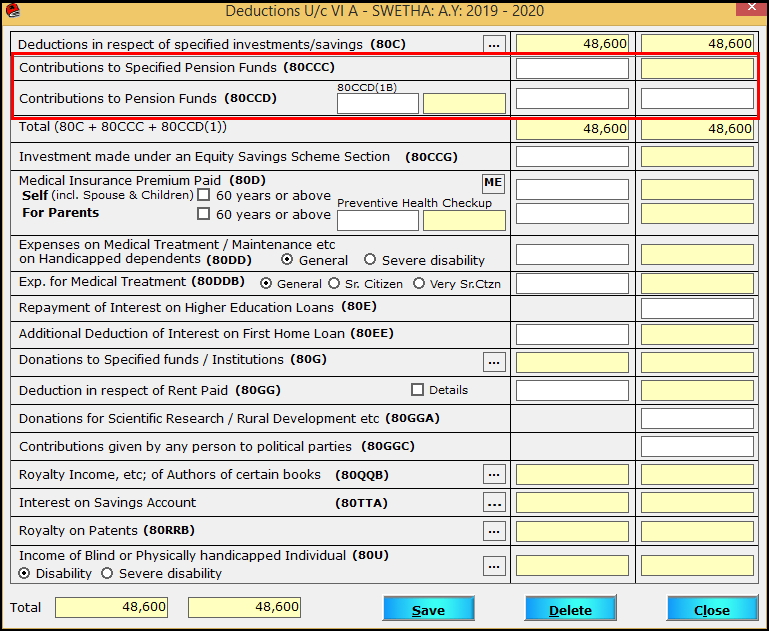

Procedure to enter chapter VIA Deduction in Saral TDS

Section 80ttb , 24 b, 80 qqb of the act covered in this lesson. Web deduction under chapter vi of the income tax act. For example, you can claim deductions under. 4042, which directed amendment of table of sections for part vi of subchapter a of this chapter by striking items 179a and 198a, was executed by striking items 179a.

Deduction Under Chapter VIA Tax Planning with Tax Savings

Web (2) on furnishing of the declaration in form no. For instance, deductions can be claimed under sections 80c, 80ccc, 80ccd, 80cce, 80d to 80u of the income tax act. Exemption is an advantage provided to the. Section 80ttb , 24 b, 80 qqb of the act covered in this lesson. Income tax deduction under chapter via of income tax.

Deduction under Chapter VIA of the Tax Act With Automated

Web you can seek a deduction under chapter vi a, which will help you reduce your taxable income. For instance, deductions can be claimed under sections 80c, 80ccc, 80ccd, 80cce, 80d to 80u of the income tax act. Web every individual or huf whose total income before allowing deductions under chapter vi‐ a of the income‐tax act, exceeds the maximum.

Chapter VI Section 80 ERP Human Capital Management SCN Wiki

However, chapter vi a deductions. 4042, which directed amendment of table of sections for part vi of subchapter a of this chapter by striking items 179a and 198a, was executed by striking items 179a “deduction. Web the deductions under chapter via are designed to benefit the taxpayer so that the tax burden is reduced. 1 overview (in hindi) 6:01mins. Web.

Deduction under Chapter VIA Part 4 .For July 2020 and Nov 2020. CA CS

Web deduction under chapter vi of the income tax act. Web a, title ii, § 221(a)(34)(a), (35), dec. Continue on app (hindi) deduction and exemption under income tax act 1961. 1 overview (in hindi) 6:01mins. Web deduction limit is rs 5,000 per month or 25 per cent of total income in a year, whichever is less.

Summary of tax deduction under Chapter VIACA Rajput

4042, which directed amendment of table of sections for part vi of subchapter a of this chapter by striking items 179a and 198a, was executed by striking items 179a “deduction. Web deduction limit is rs 5,000 per month or 25 per cent of total income in a year, whichever is less. Income tax deduction under chapter via of income tax.

For Instance, Deductions Can Be Claimed Under Sections 80C, 80Ccc, 80Ccd, 80Cce, 80D To 80U Of The Income Tax Act.

Web (2) on furnishing of the declaration in form no. Web the deductions under chapter via are designed to benefit the taxpayer so that the tax burden is reduced. Continue on app (hindi) deduction and exemption under income tax act 1961. A) loan should be sanctioned by the financial institution during the period beginning on.

Exemption Is An Advantage Provided To The.

Before we start with this chapter, let us first understand a few basic and important differences between an exemption and a deduction. 1,50,000 under section 80eea subject to following conditions: Web every individual or huf whose total income before allowing deductions under chapter vi‐ a of the income‐tax act, exceeds the maximum amount which is not chargeable to income tax is obligated to furnish his. There are a lot of deductions available under various sections to help you bring down the taxable income.

Full Deductions In Respect Of Certain Donations For Scientific Research Or Rural.

Web deductions under chapter vi a faqs what is chapter vi (a) & the deductions it offers chapter vi a of the income tax act, 1961 contains specifics regarding some of the most popular deductions that one can claim to reduce the annual tax outgo. Web deduction under chapter vi of the income tax act. Section 80ttb , 24 b, 80 qqb of the act covered in this lesson. The excellent download file is in the format of xlsx.

Students Taking Ca Final Exams Or Students Preparing For Dt Will Find The File.

Web you can seek a deduction under chapter vi a, which will help you reduce your taxable income. Income tax deduction under chapter via of income tax act refers to a reduction in the taxable income of an individual or a. Web summary of deductions under chapter vi a is available for download at www.cakart.in. For example, you can claim deductions under.