Dc Nonresident Tax Form

Dc Nonresident Tax Form - Get ready for tax season deadlines by completing any required tax forms today. You qualify as a nonresident if: Sales and use tax forms. Web you qualify as a nonresident if: Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Web 1 best answer keithb1 new member if you work in dc and live in any other state, you're not subject to dc income tax. Type of property address #1. You can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the. Web registration and exemption tax forms. Web where can i get tax forms?

You can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the. Your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in the tax year. Web you qualify as a nonresident if: Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. You qualify as a nonresident if: You qualify as a nonresident if:. You can download or print. You qualify as a nonresident if: Web 1 best answer keithb1 new member if you work in dc and live in any other state, you're not subject to dc income tax. • your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in.

Web 1 best answer keithb1 new member if you work in dc and live in any other state, you're not subject to dc income tax. You qualify as a nonresident if:. If the due date for filing a. Web registration and exemption tax forms. Miscellaneous tax forms and publications prior year tax forms real property tax forms and publications. Upon request of your employer, you must file this. Sales and use tax forms. You can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in the tax year.

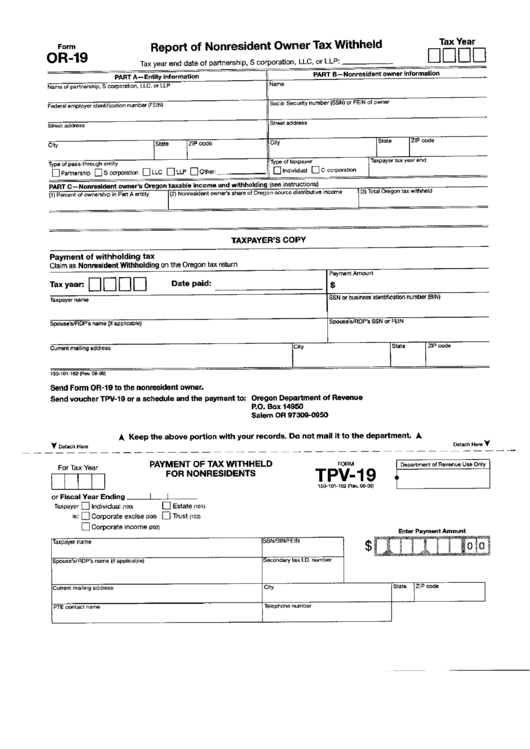

Form Or19 Report Of Nonresident Owner Tax Withheld/form Tvp19

Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021. • your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in. Web 1 best answer keithb1 new member if you.

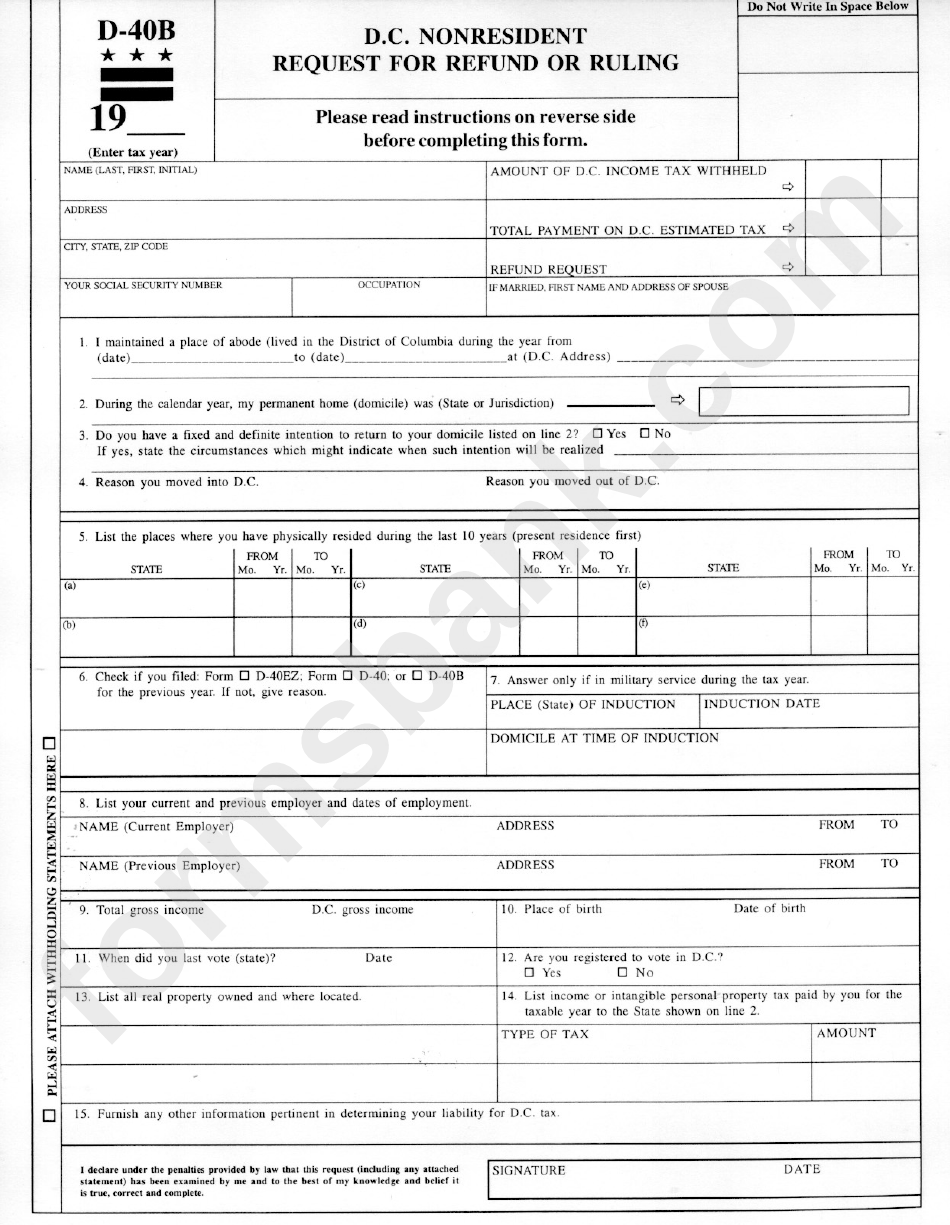

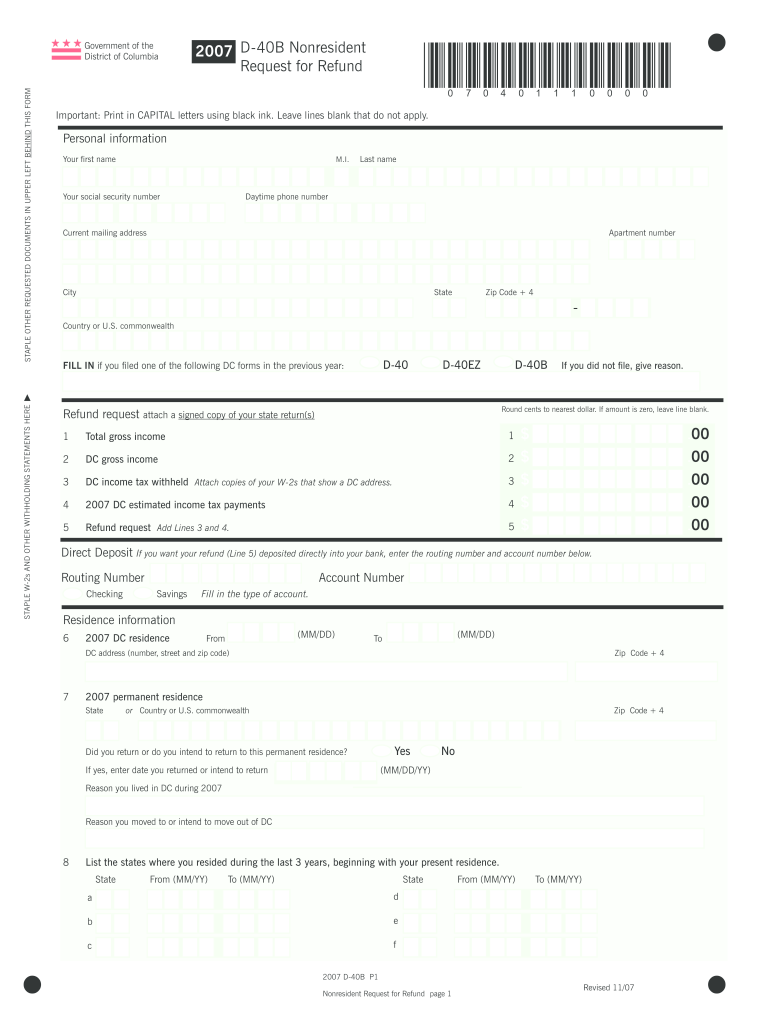

Fillable Form D40b Nonresident Request For Refund Or Ruling

You qualify as a nonresident if:. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021. Miscellaneous tax forms and publications prior year tax forms real property tax forms and publications. Web view individual income tax forms 2023 tax filing season (tax year 2022) view.

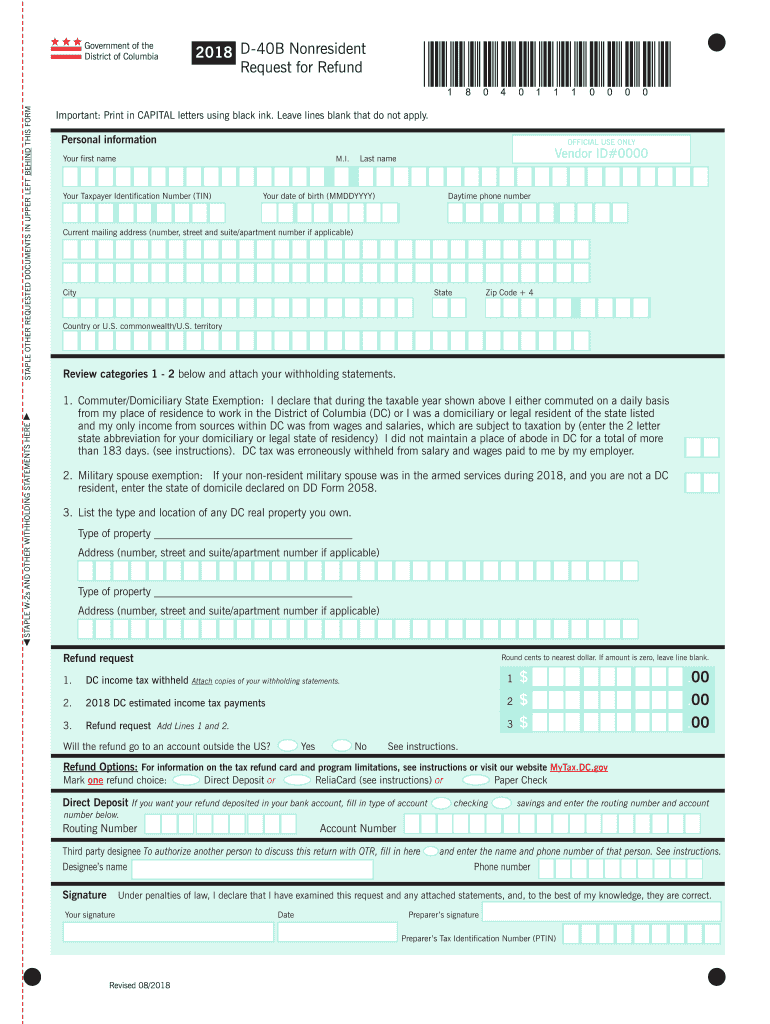

District of columbia tax form d 40 Fill out & sign online DocHub

You qualify as a nonresident if: Sales and use tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web you qualify as a nonresident if: Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021.

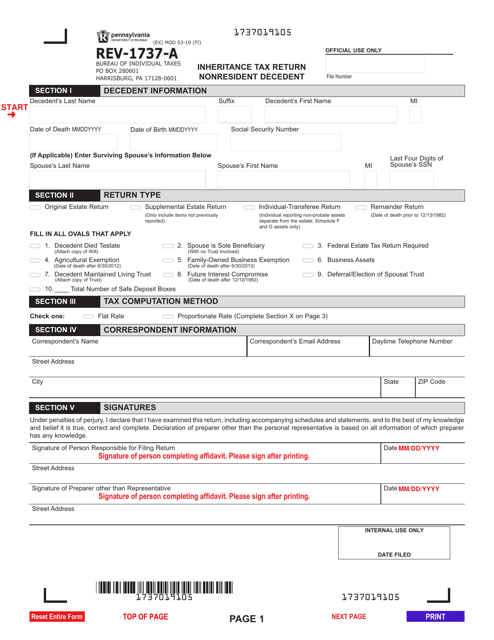

Form REV1737A Download Fillable PDF or Fill Online Inheritance Tax

You can download or print. You qualify as a nonresident if:. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. If the due date for filing a. You qualify as a nonresident if:

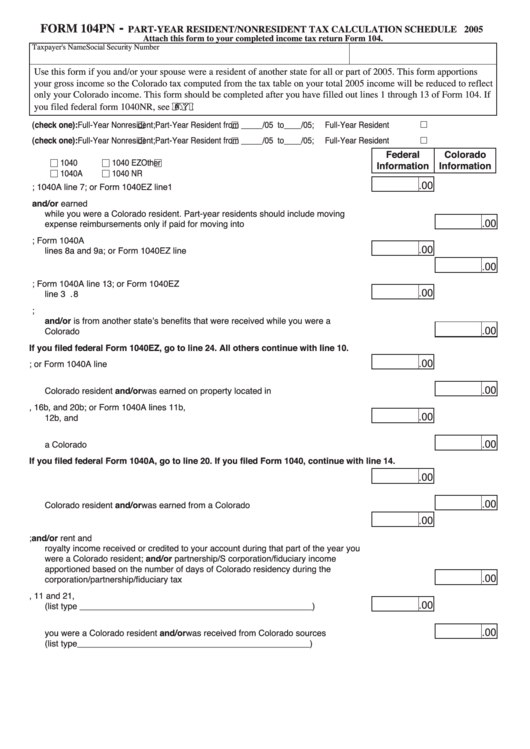

Fillable Form 104pn PartYear Resident/nonresident Tax Calculation

Web view individual income tax forms 2023 tax filing season (tax year 2022) view individual income tax forms 2022 tax filing season (tax year 2021) view individual income tax. Your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in the tax year. You qualify as.

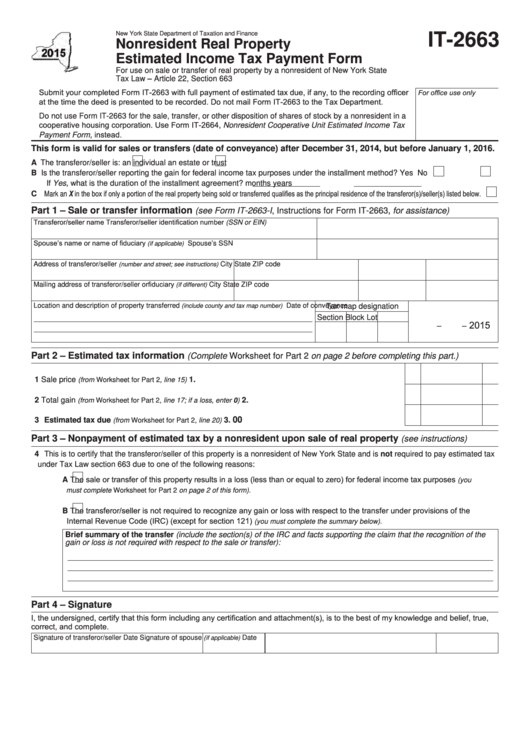

Fillable Form It2663 Nonresident Real Property Estimated Tax

Your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in the tax year. • your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in. Web dc inheritance and estate tax.

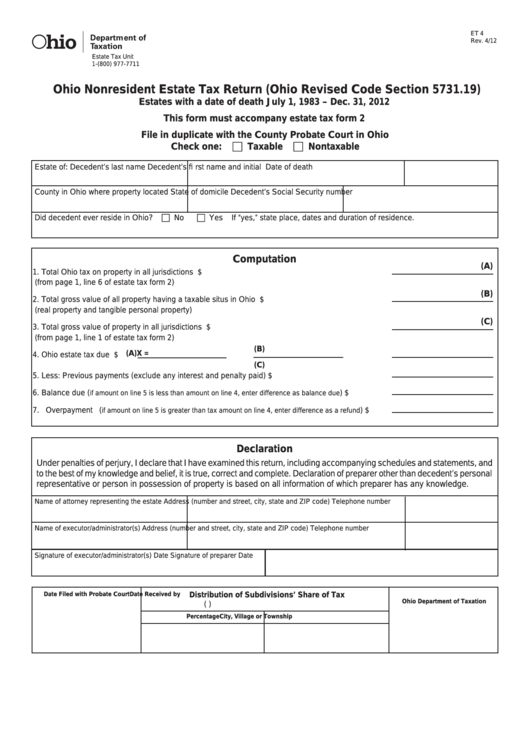

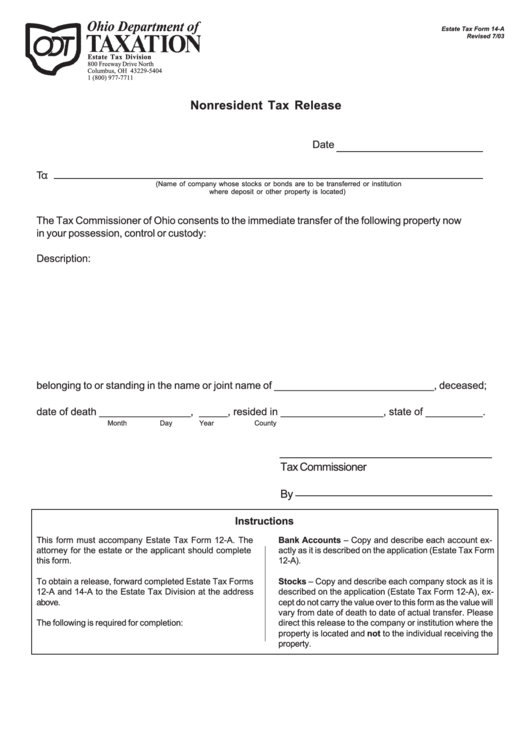

Fillable Form Et 4 Ohio Nonresident Estate Tax Return printable pdf

Miscellaneous tax forms and publications prior year tax forms real property tax forms and publications. Web dc inheritance and estate tax forms; If the due date for filing a. Get ready for tax season deadlines by completing any required tax forms today. Type of property address #1.

2007 Form DC D40B Fill Online, Printable, Fillable, Blank pdfFiller

You can download or print. If the due date for filing a. Web dc inheritance and estate tax forms; Miscellaneous tax forms and publications prior year tax forms real property tax forms and publications. List the type and location of any dc real property you own.

Fillable Form 14A Nonresident Tax Release Ohio Department Of

Upon request of your employer, you must file this. Miscellaneous tax forms and publications prior year tax forms real property tax forms and publications. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Web dc inheritance and estate tax forms; You can download or print.

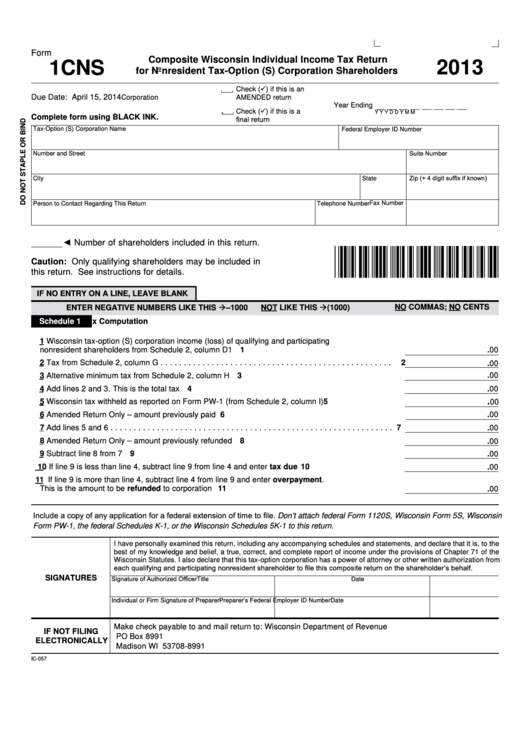

Fillable Form 1cns Composite Wisconsin Individual Tax Return

Web registration and exemption tax forms. Upon request of your employer, you must file this. You can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the. Sales and use tax forms. You qualify as a nonresident if:.

You Qualify As A Nonresident If:

You can download or print. Web where can i get tax forms? Web registration and exemption tax forms. Upon request of your employer, you must file this.

Web You Qualify As A Nonresident If:

Sales and use tax forms. Web dc inheritance and estate tax forms; If the due date for filing a. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax.

• Your Permanent Residence Is Outside Dc During All Of The Tax Year And You Do Not Reside In Dc For 183 Days Or More In.

You qualify as a nonresident if:. Type of property address #1. Web view individual income tax forms 2023 tax filing season (tax year 2022) view individual income tax forms 2022 tax filing season (tax year 2021) view individual income tax. List the type and location of any dc real property you own.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

You qualify as a nonresident if: You can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the. Web 1 best answer keithb1 new member if you work in dc and live in any other state, you're not subject to dc income tax. Your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in the tax year.