Dc Non Resident Tax Form 2022

Dc Non Resident Tax Form 2022 - Taxpayers who used this form in. Print in capital letters using black ink. You can download or print. Details concerning the various taxes used by the district are presented in this. Web rates for tax year 2022. Although we can’t respond individually to each comment. Sales and use tax forms. Upon request of your employer, you must file this. 4% of the taxable income. Web filing status / standard deduction:

Irs use only—do not write or. Web nonresidents are not required to file a dc return. Upon request of your employer, you must file this. Sales and use tax forms. File with employer when requested. Print in capital letters using black ink. The tax rates for tax years beginning after 12/31/2021 are: Web registration and exemption tax forms. You can download or print. If the due date for filing a.

Sales and use tax forms. Web registration and exemption tax forms. Print in capital letters using black ink. Commonwealth signature signature under penalties of law,. Although we can’t respond individually to each comment. If the due date for filing a. 4% of the taxable income. If you work in dc but are a resident of another state, you are not subject to dc income tax. File with employer when requested. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021.

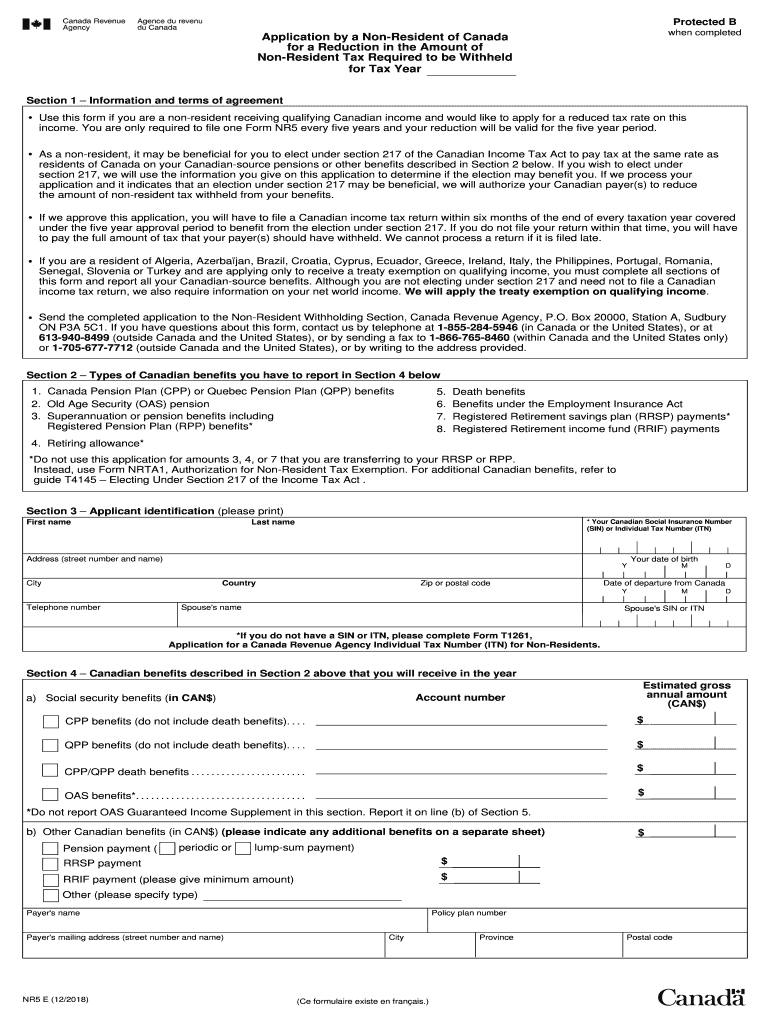

Nr5 Fill Out and Sign Printable PDF Template signNow

If the taxable income is: Web nonresidents are not required to file a dc return. Sales and use tax forms. Taxpayers who used this form in. You can download or print.

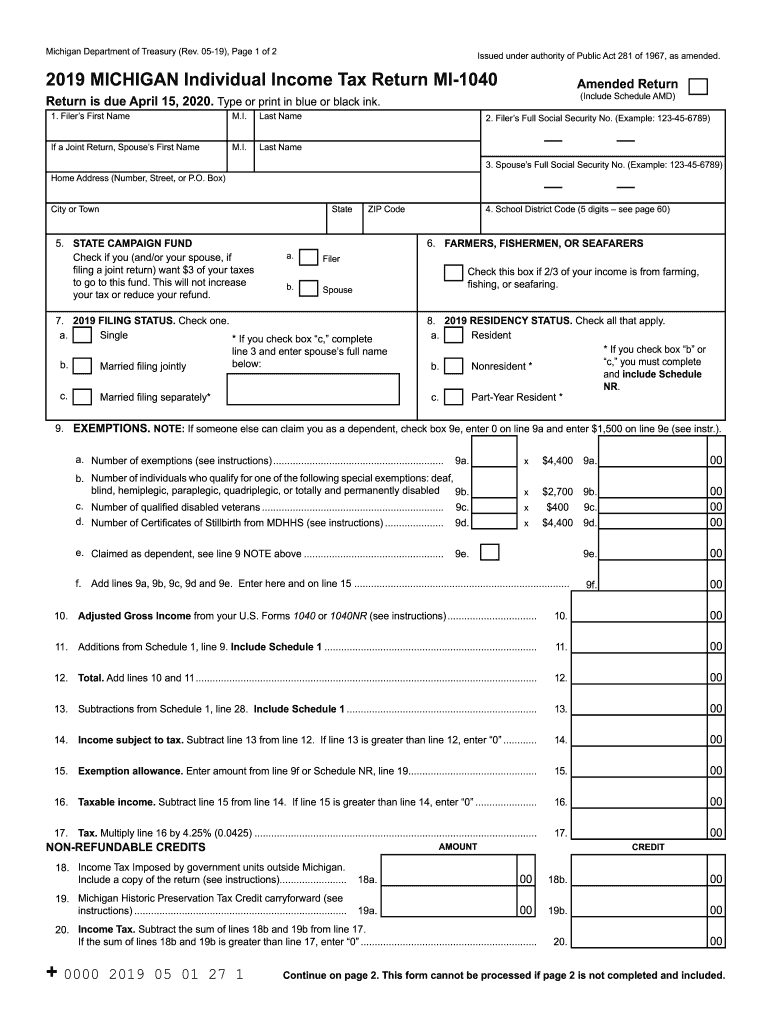

Michigan 1040 Fill Out and Sign Printable PDF Template signNow

Web individual income tax forms 2023 tax filing season(tax year 2022) due to production delays, paper forms/booklets for the district of columbia 2022 individual income tax (d. Taxpayers who used this form in. File with employer when requested. Although we can’t respond individually to each comment. Details concerning the various taxes used by the district are presented in this.

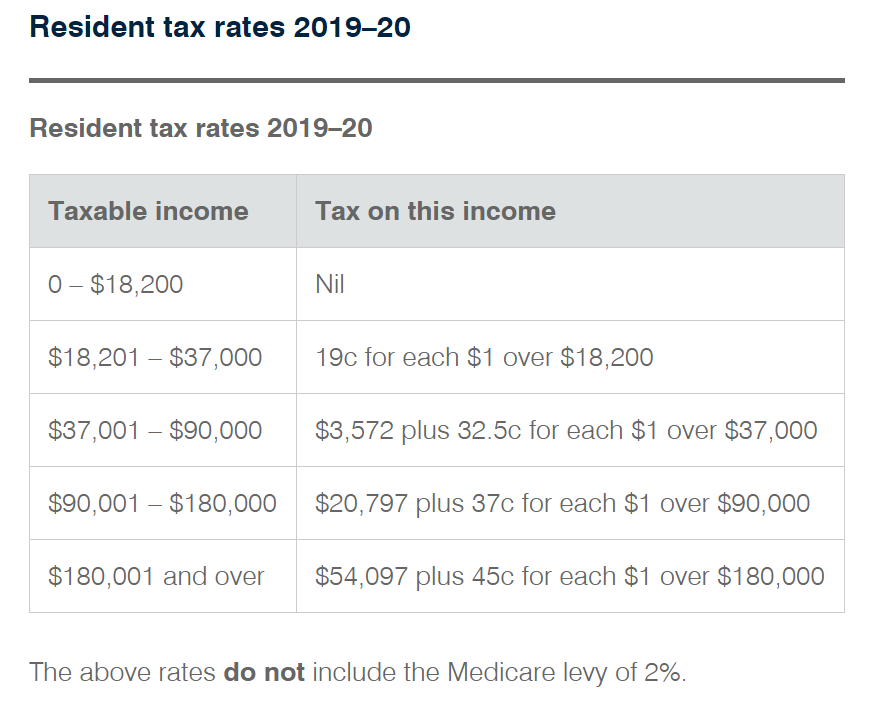

Doing business in Australia from India(n) perspective. Accurate

Print in capital letters using black ink. Commonwealth signature signature under penalties of law,. Web registration and exemption tax forms. The tax rates for tax years beginning after 12/31/2021 are: Nonresident alien income tax return.

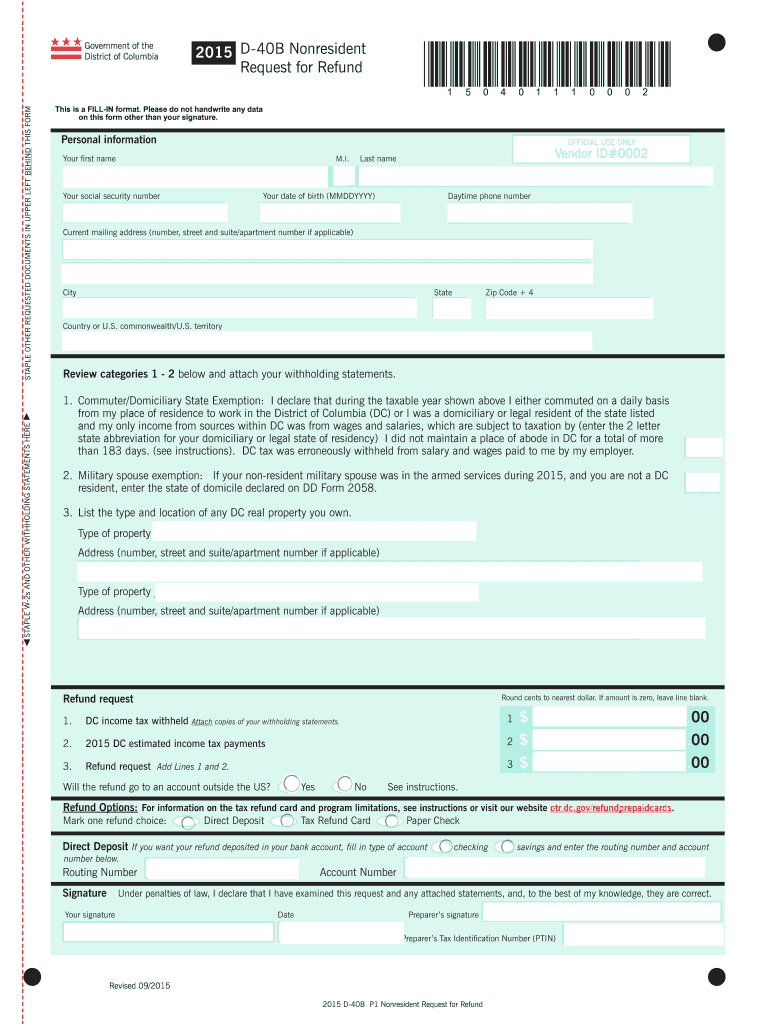

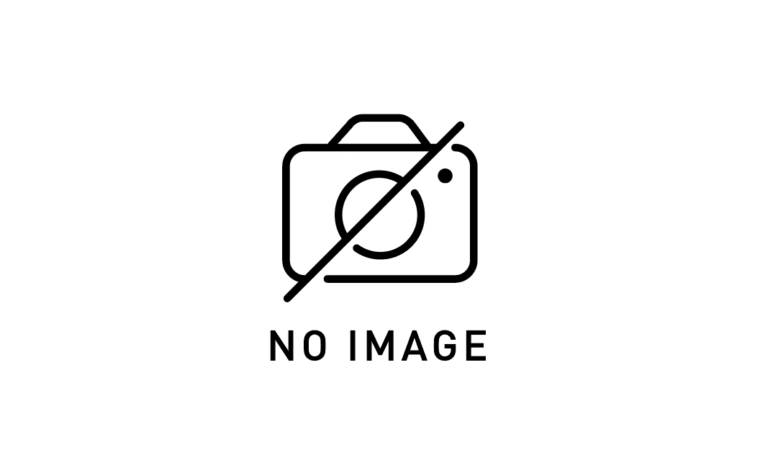

D 40B Fill Out and Sign Printable PDF Template signNow

Commonwealth signature signature under penalties of law,. Details concerning the various taxes used by the district are presented in this. Web the internal revenue service, tax forms and publications, 1111 constitution ave. If the due date for filing a. Sales and use tax forms.

Tax from nonresidents in Spain, what is it and how to do it properly

You can download or print. 4% of the taxable income. Web registration and exemption tax forms. If you work in dc but are a resident of another state, you are not subject to dc income tax. Nonresident alien income tax return.

Dc d 40 2019 online fill in form Fill out & sign online DocHub

Details concerning the various taxes used by the district are presented in this. Web individual income tax forms 2023 tax filing season(tax year 2022) due to production delays, paper forms/booklets for the district of columbia 2022 individual income tax (d. Nonresident alien income tax return. Print in capital letters using black ink. 4% of the taxable income.

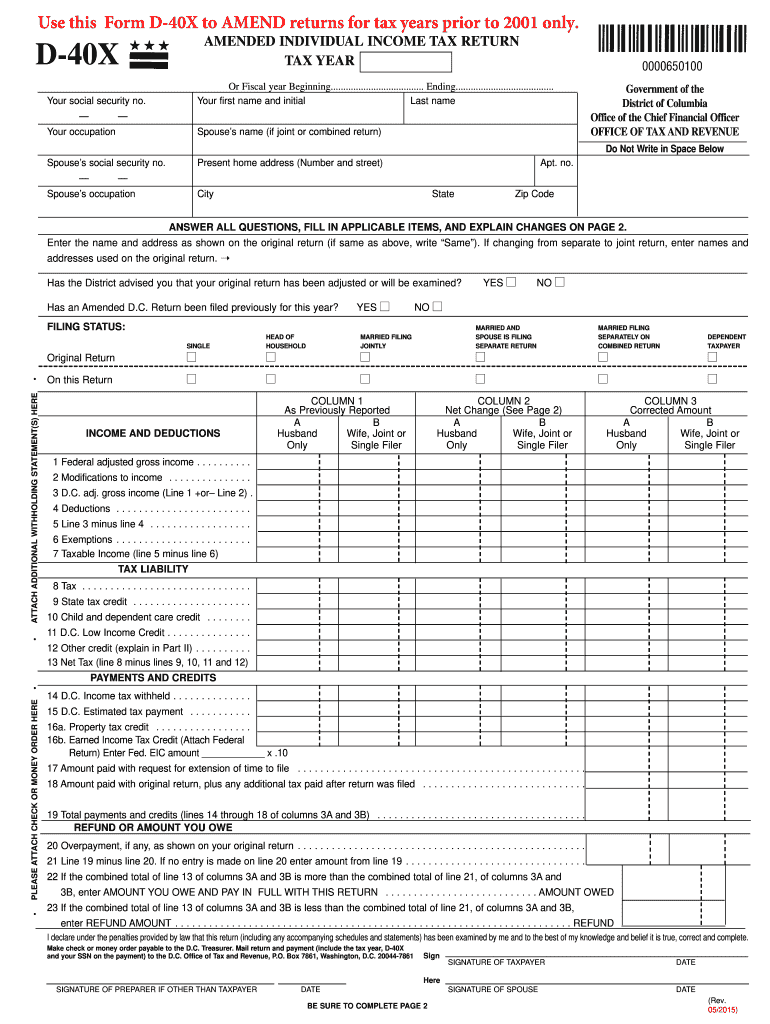

Resident tax filing season 2020 when are taxes due? Taxpatria

Web registration and exemption tax forms. Web the internal revenue service, tax forms and publications, 1111 constitution ave. Irs use only—do not write or. You can download or print. If you work in dc but are a resident of another state, you are not subject to dc income tax.

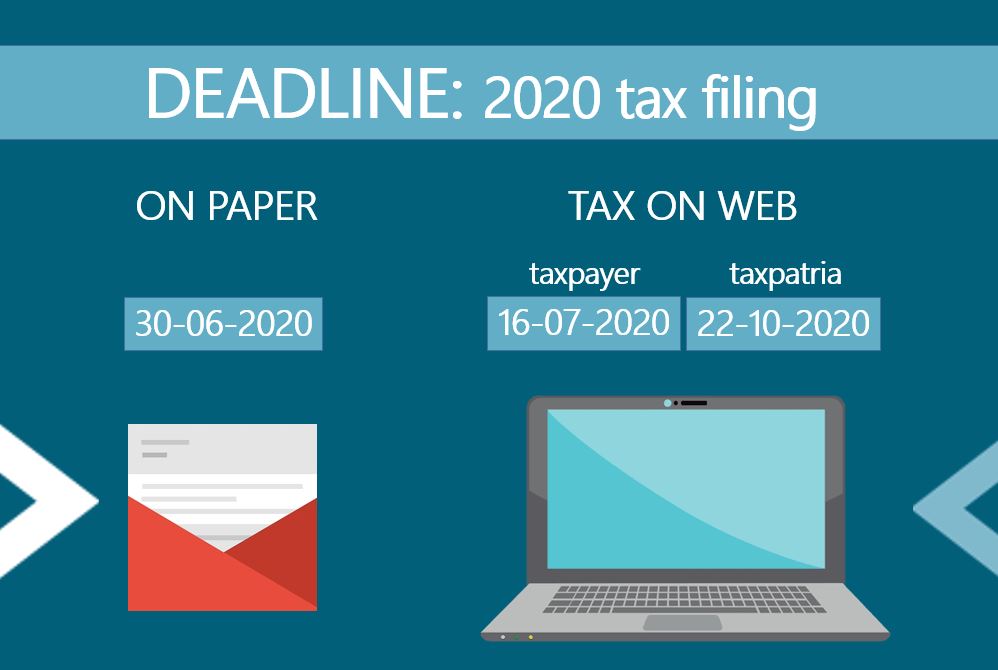

Fillable Form 20002X NonResident Amended Personal Tax

Sales and use tax forms. Web filing status / standard deduction: 4% of the taxable income. Details concerning the various taxes used by the district are presented in this. If the due date for filing a.

Virginia State Tax Form 2019 joehdesign

Irs use only—do not write or. Print in capital letters using black ink. Although we can’t respond individually to each comment. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021. Details concerning the various taxes used by the district are presented in this.

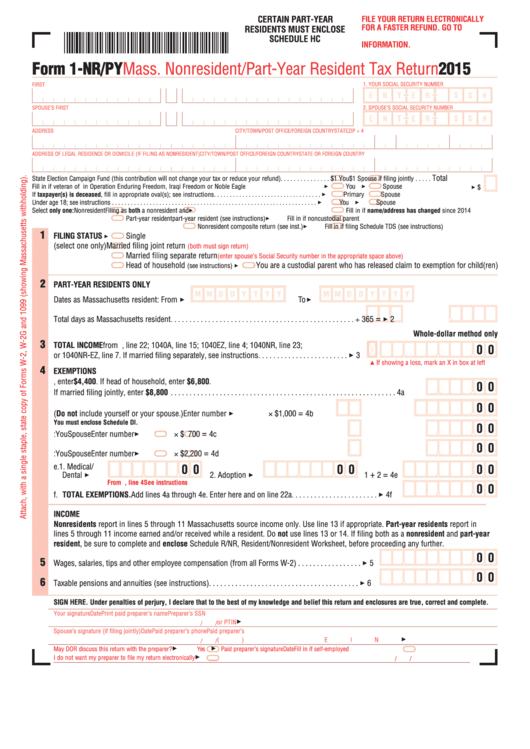

Form 1Nr/py Mass. Nonresident/partYear Resident Tax Return 2015

Nonresident alien income tax return. Web nonresidents are not required to file a dc return. 4% of the taxable income. You can download or print. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021.

Sales And Use Tax Forms.

Web nonresidents are not required to file a dc return. File with employer when requested. Details concerning the various taxes used by the district are presented in this. Commonwealth signature signature under penalties of law,.

You Can Download Or Print.

If the taxable income is: Taxpayers who used this form in. Irs use only—do not write or. Nonresident alien income tax return.

Web Individual Income Tax Forms 2023 Tax Filing Season(Tax Year 2022) Due To Production Delays, Paper Forms/Booklets For The District Of Columbia 2022 Individual Income Tax (D.

The tax rates for tax years beginning after 12/31/2021 are: Web filing status / standard deduction: Print in capital letters using black ink. 4% of the taxable income.

Although We Can’t Respond Individually To Each Comment.

Web the internal revenue service, tax forms and publications, 1111 constitution ave. If the due date for filing a. Web rates for tax year 2022. If you work in dc but are a resident of another state, you are not subject to dc income tax.