Ct Conveyance Tax Form

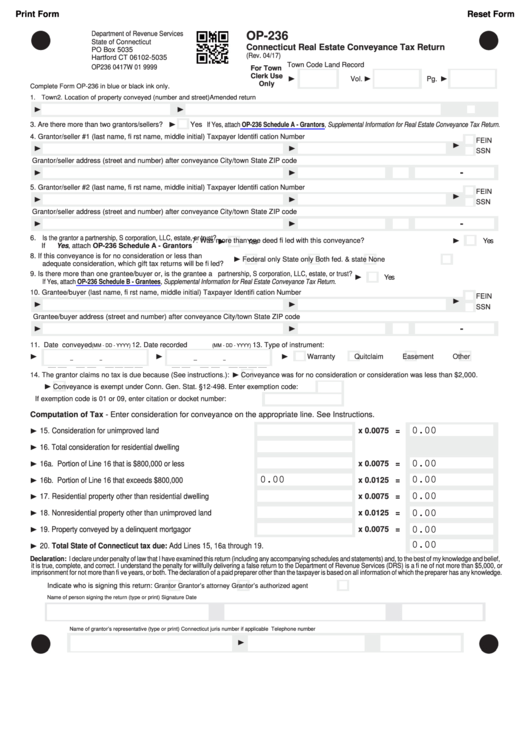

Ct Conveyance Tax Form - Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code Web connecticut real estate conveyance tax return (rev. Location of property conveyed (number and street) amended return 3. 04/17) for town town code clerk use only 2. The state conveyance tax is 0.75% of the sales price for properties with a sales price that is $800,000.00 or less. 04/17) for town clerk use only town code land record vol. Web connecticut real estate conveyance tax return (rev. Are there more than two grantors/sellers? Location of property conveyed (number and street) land record vol. Up to and including $800,000:

04/17) for town clerk use only town code land record vol. Web connecticut real estate conveyance tax return (rev. Web the marginal tax brackets for residential real property are as follows: Web connecticut real estate conveyance tax return (rev. Are there more than two grantors/sellers? The applicable state and municipal rates are added together to get the total tax rate for a particular property conveyance. A state tax and a municipal tax. Forms for state of connecticut/department of administrative services For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. Up to and including $800,000:

The state conveyance tax is 0.75% of the sales price for properties with a sales price that is $800,000.00 or less. Web connecticut real estate conveyance tax return (rev. More information, real estate conveyance tax: Web connecticut real estate conveyance tax return (rev. 04/17) for town clerk use only town code land record vol. Are there more than two grantors/sellers? A state tax and a municipal tax. Are there more than two grantors/sellers? 04/17) for town town code clerk use only 2. Up to and including $800,000:

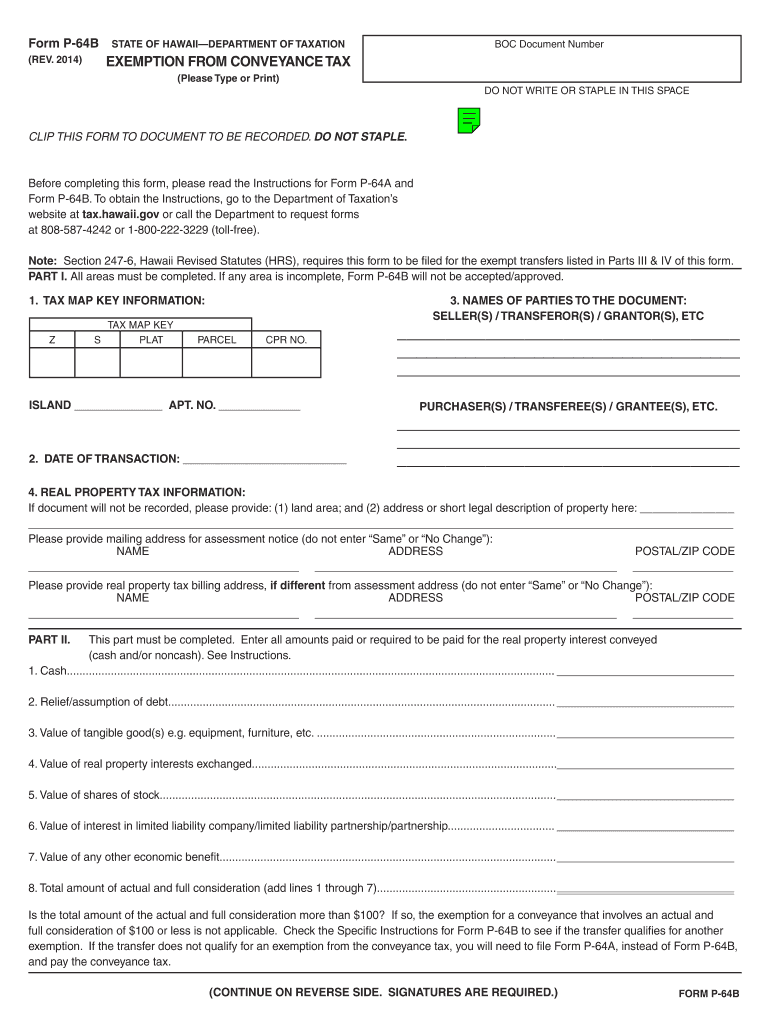

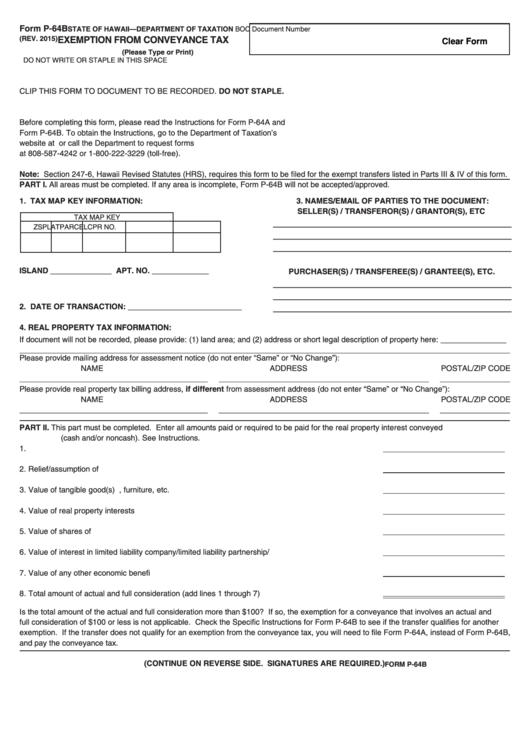

20192022 Form HI DoT P64A Fill Online, Printable, Fillable, Blank

Town connecticut real estate conveyance tax return (rev. The combined rate is applied to the property’s sales price. Up to and including $800,000: Location of property conveyed (number and street) amended return 3. Forms for state of connecticut/department of administrative services

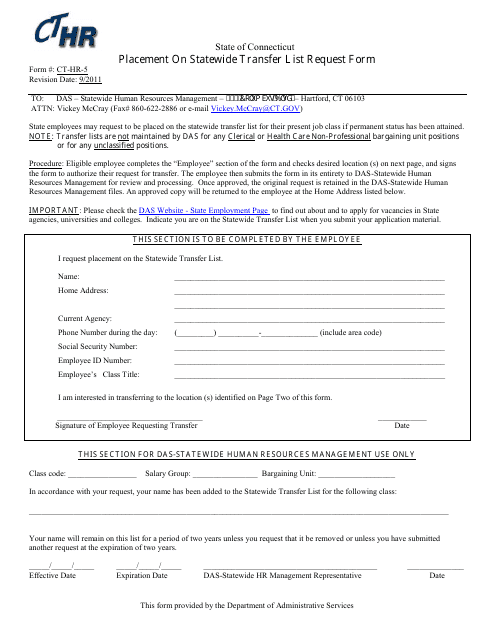

Form CTHR5 Download Fillable PDF or Fill Online Placement on

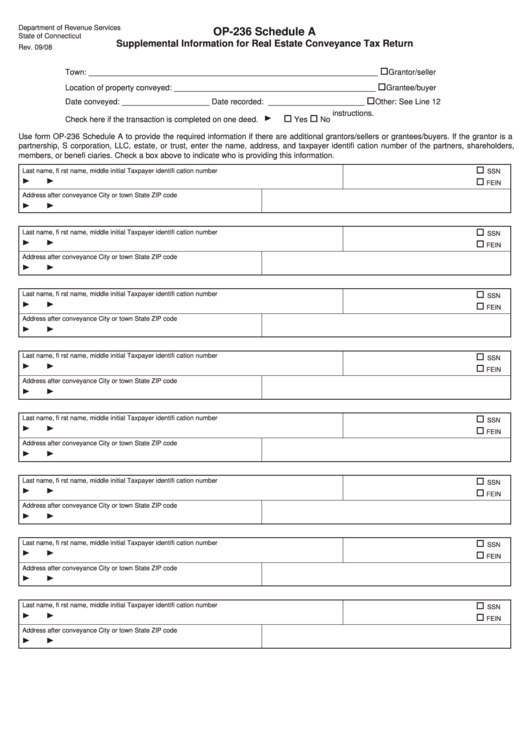

Web connecticut’s real estate conveyance tax the real estate conveyance tax has two parts: For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. More information, real estate conveyance tax: Are there more than two grantors/sellers? Web supplemental information for connecticut real.

P64B Fill Out and Sign Printable PDF Template signNow

Up to and including $800,000: Download this form and complete using adobe acrobat. Web supplemental information for connecticut real estate conveyance tax return (rev. Web connecticut real estate conveyance tax return (rev. More information, real estate conveyance tax:

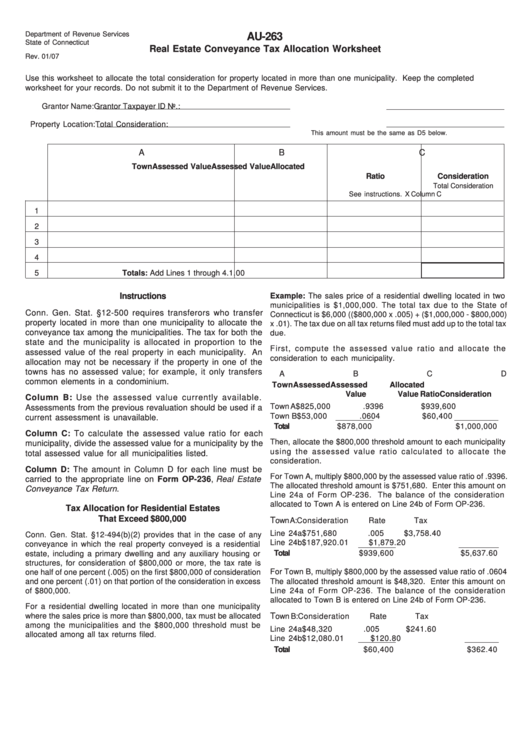

Form Au263 Real Estate Conveyance Tax Allocation Worksheet 2007

More information, real estate conveyance tax: Web supplemental information for connecticut real estate conveyance tax return (rev. 04/17) for town town code clerk use only 2. Location of property conveyed (number and street) amended return 3. If the grantee is a partnership,

Fillable Form P64b Exemption From Conveyance Tax printable pdf download

The applicable state and municipal rates are added together to get the total tax rate for a particular property conveyance. Yes if yes, attach 4. If the grantee is a partnership, Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code The state conveyance tax is 0.75% of.

Fillable Form Op236 Connecticut Real Estate Conveyance Tax Return

Town connecticut real estate conveyance tax return (rev. A state tax and a municipal tax. Location of property conveyed (number and street) land record vol. 04/17) for town clerk use only town code land record vol. Web supplemental information for connecticut real estate conveyance tax return (rev.

Deed of Reconveyance Form PDF Sample Templates Sample Templates

Download this form and complete using adobe acrobat. Web connecticut real estate conveyance tax return (rev. Town connecticut real estate conveyance tax return (rev. Web supplemental information for connecticut real estate conveyance tax return (rev. 04/17) for town clerk use only town code land record vol.

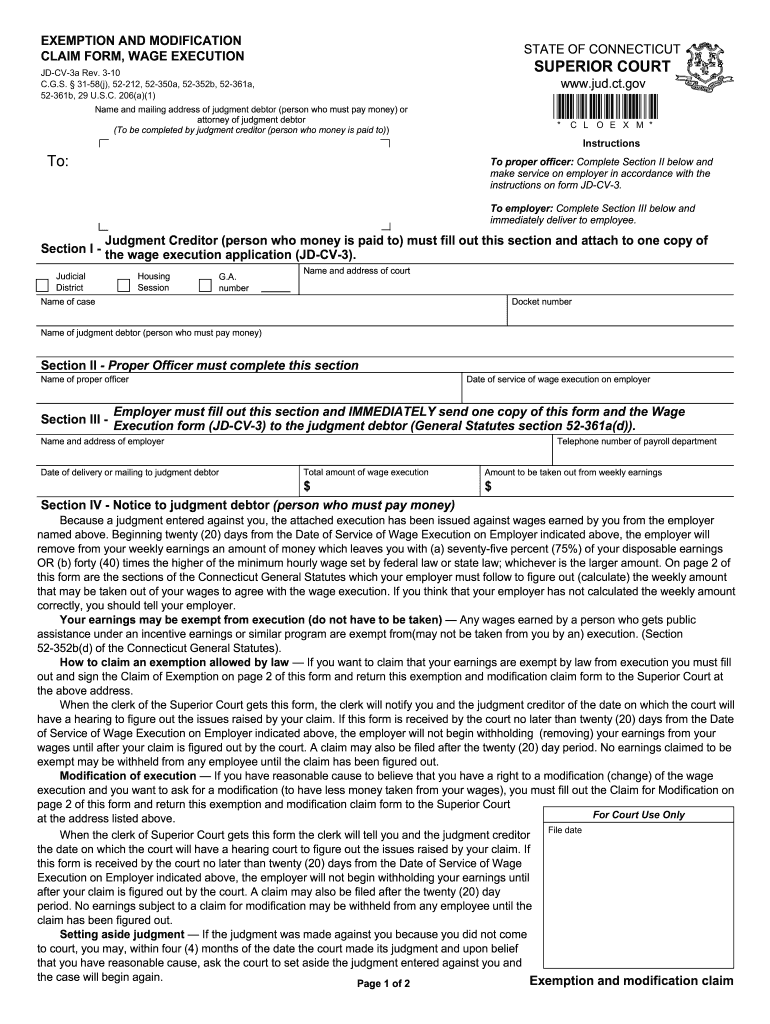

Ct Exemption and Modification Claim Form Fill Out and Sign Printable

04/17) for town town code clerk use only 2. Yes if yes, attach 4. If the grantee is a partnership, Are there more than two grantors/sellers? Location of property conveyed (number and street) amended return 3.

Schedule A (Form Op236) Supplemental Information For Real Estate

The state conveyance tax is 0.75% of the sales price for properties with a sales price that is $800,000.00 or less. Forms for state of connecticut/department of administrative services Location of property conveyed (number and street) amended return 3. Web connecticut real estate conveyance tax return (rev. Web supplemental information for connecticut real estate conveyance tax return (rev.

Ct Conveyance Tax Form Printable Form, Templates and Letter

Web connecticut’s real estate conveyance tax the real estate conveyance tax has two parts: 04/17) for town clerk use only town code land record vol. 04/17) for town town code clerk use only 2. If the grantee is a partnership, Web supplemental information for connecticut real estate conveyance tax return (rev.

04/17) For Town Town Code Clerk Use Only 2.

The combined rate is applied to the property’s sales price. Download this form and complete using adobe acrobat. Yes if yes, attach 4. Are there more than two grantors/sellers?

Web Connecticut’s Real Estate Conveyance Tax The Real Estate Conveyance Tax Has Two Parts:

Web the marginal tax brackets for residential real property are as follows: Are there more than two grantors/sellers? Location of property conveyed (number and street) amended return 3. Town connecticut real estate conveyance tax return (rev.

More Information, Real Estate Conveyance Tax:

Web supplemental information for connecticut real estate conveyance tax return (rev. A state tax and a municipal tax. Up to and including $800,000: Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code

Location Of Property Conveyed (Number And Street) Land Record Vol.

For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. Web connecticut real estate conveyance tax return (rev. The state conveyance tax is 0.75% of the sales price for properties with a sales price that is $800,000.00 or less. Web connecticut real estate conveyance tax return (rev.