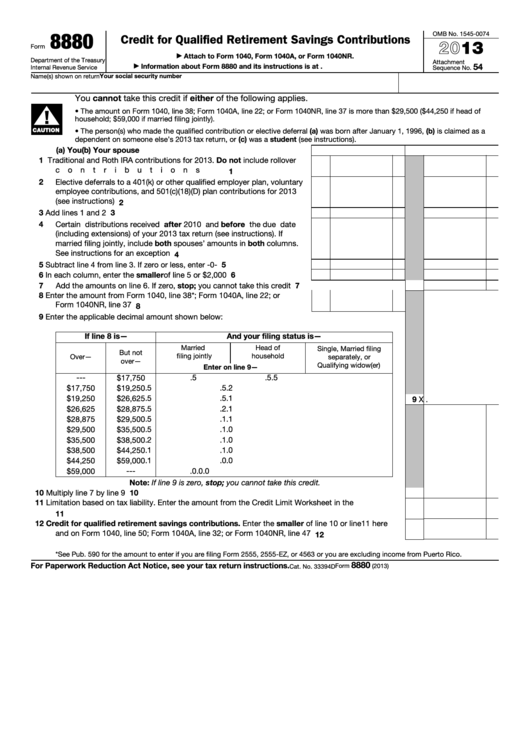

Credit For Qualified Retirement Savings Contributions Form 8880

Credit For Qualified Retirement Savings Contributions Form 8880 - If line 9 is zero, stop; Web contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan), or (d) contributions to a 501(c)(18)(d) plan. Web how do i claim the credit? Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Enter the amount from the credit limit worksheet in. The credit was designed to promote saving for retirement among. Depending on your adjusted gross income. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan), or (d) contributions to a 501(c)(18)(d) plan. You can’t take this credit.

Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. This tax credit can apply to. You were a student if. Web contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan), or (d) contributions to a 501(c)(18)(d) plan. Enter the amount from the credit limit worksheet in. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. If line 9 is zero, stop; Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of the return. The credit was designed to promote saving for retirement among. Ad edit, sign and print tax forms on any device with signnow.

Web how do i claim the credit? This tax credit can apply to. Ad edit, sign and print tax forms on any device with signnow. Web see form 8880, credit for qualified retirement savings contributions, for more information. You're not eligible for the credit if your adjusted gross income exceeds a certain amount. The credit was designed to promote saving for retirement among. Web form 8880 (2008) page 2 general instructions purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the. Web these two factors will determine the maximum credit you can take. Depending on your adjusted gross income. Enter the amount from the credit limit worksheet in.

Credit Limit Worksheet Form 8880

Web form 8880 is a united states internal revenue service tax form used to apply for tax credits for qualified retirement savings contributions. Web contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan), or (d) contributions to a 501(c)(18)(d) plan. Get ready for tax season deadlines by completing any required tax forms.

USA Retirement Savings Contributions Tax Credit Freelance Lifestyle

Web form 8880 allows you to claim the retirement savings contributions credit, also known as the saver’s credit. You were a student if. This tax credit can apply to. If line 9 is zero, stop; • a contribution to a.

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

Web • if the taxpayer seems to qualify for the credit, be sure to visit the form 8880 entry screen in the credits menu and address any necessary questions there. You were a student if. Get ready for tax season deadlines by completing any required tax forms today. This credit can be claimed in addition to any. Web form 8880,.

Fillable Form 8880 Credit For Qualified Retirement Savings

Web depending on your agi, you could receive a tax credit of 10%, 20%, or 50% of the first $2,000 ($4,000 for joint filers) that you contribute to eligible retirement accounts. The credit was designed to promote saving for retirement among. • a contribution to a. Ad edit, sign and print tax forms on any device with signnow. Web information.

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

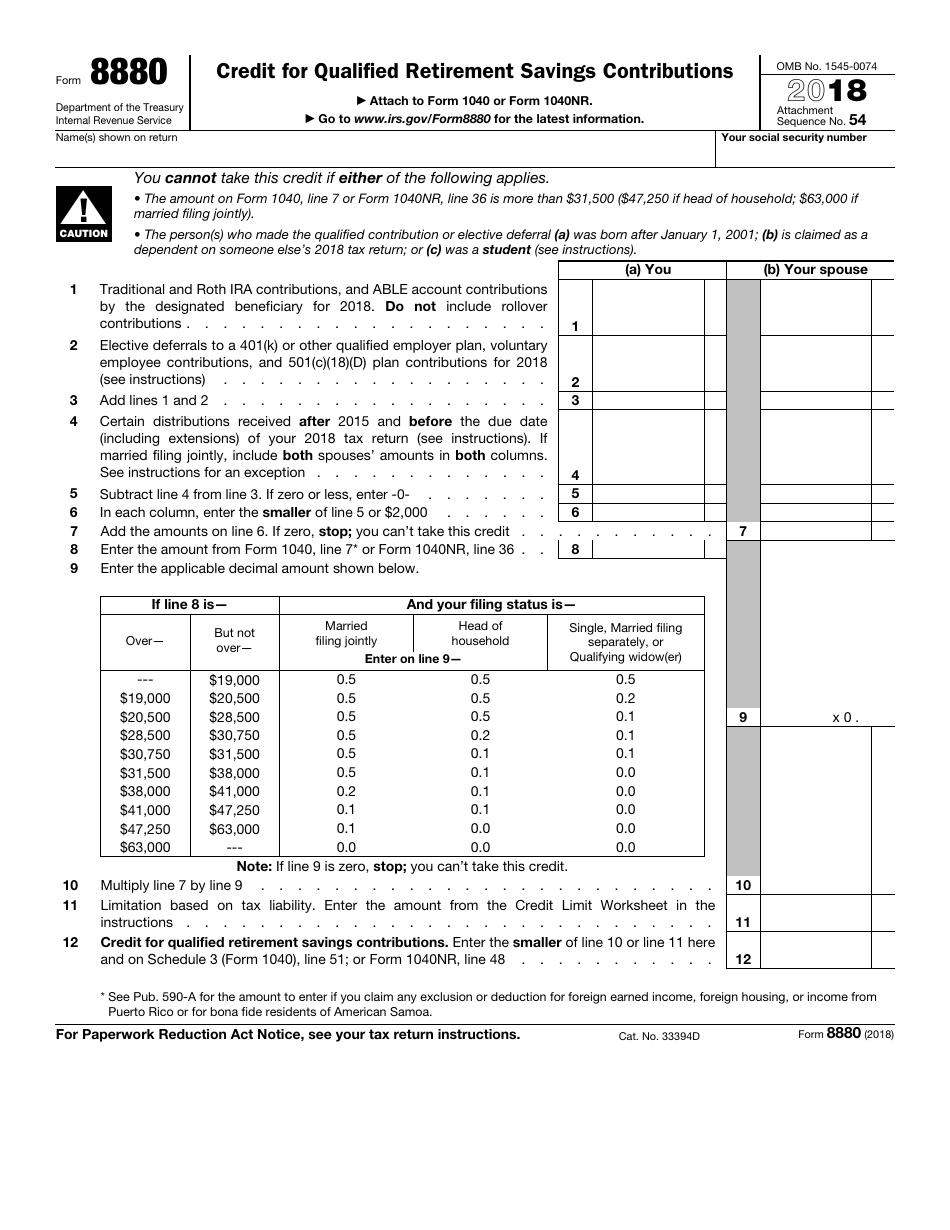

Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. 10 multiply line 7 by line 9.10 11 limitation based on tax liability. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web form 8880 allows you to.

Form 8880 Credit for Qualified Retirement Savings Contributions

Web depending on your agi, you could receive a tax credit of 10%, 20%, or 50% of the first $2,000 ($4,000 for joint filers) that you contribute to eligible retirement accounts. Enter the amount from the credit limit worksheet in. Web form 8880 allows you to claim the retirement savings contributions credit, also known as the saver’s credit. 10 multiply.

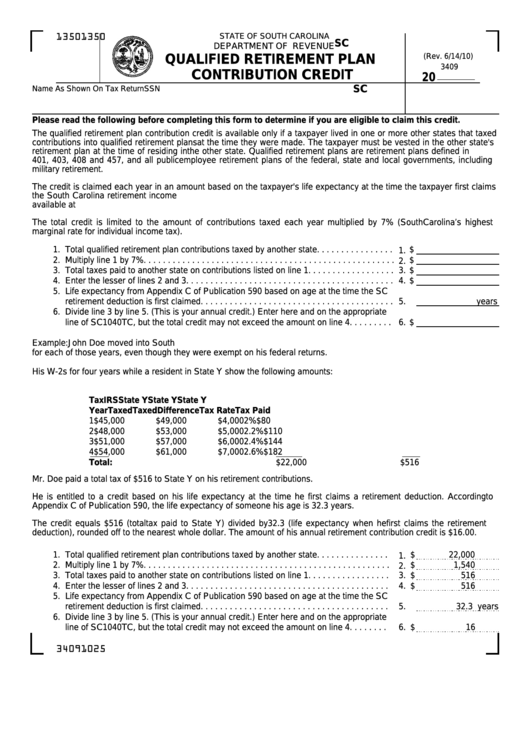

Form Sc Sch.tc29 Qualified Retirement Plan Contribution Credit

The credit was designed to promote saving for retirement among. Depending on your adjusted gross income. Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. Web form 8880 allows you to claim the retirement savings contributions credit, also known as the saver’s credit. Get ready for tax season deadlines by.

Business Concept about Form 8880 Credit for Qualified Retirement

10 multiply line 7 by line 9.10 11 limitation based on tax liability. Web how do i claim the credit? Web employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan), or (d) contributions to a 501(c)(18)(d) plan. Web contributions to a qualified retirement plan as defined in section 4974(c) (including the.

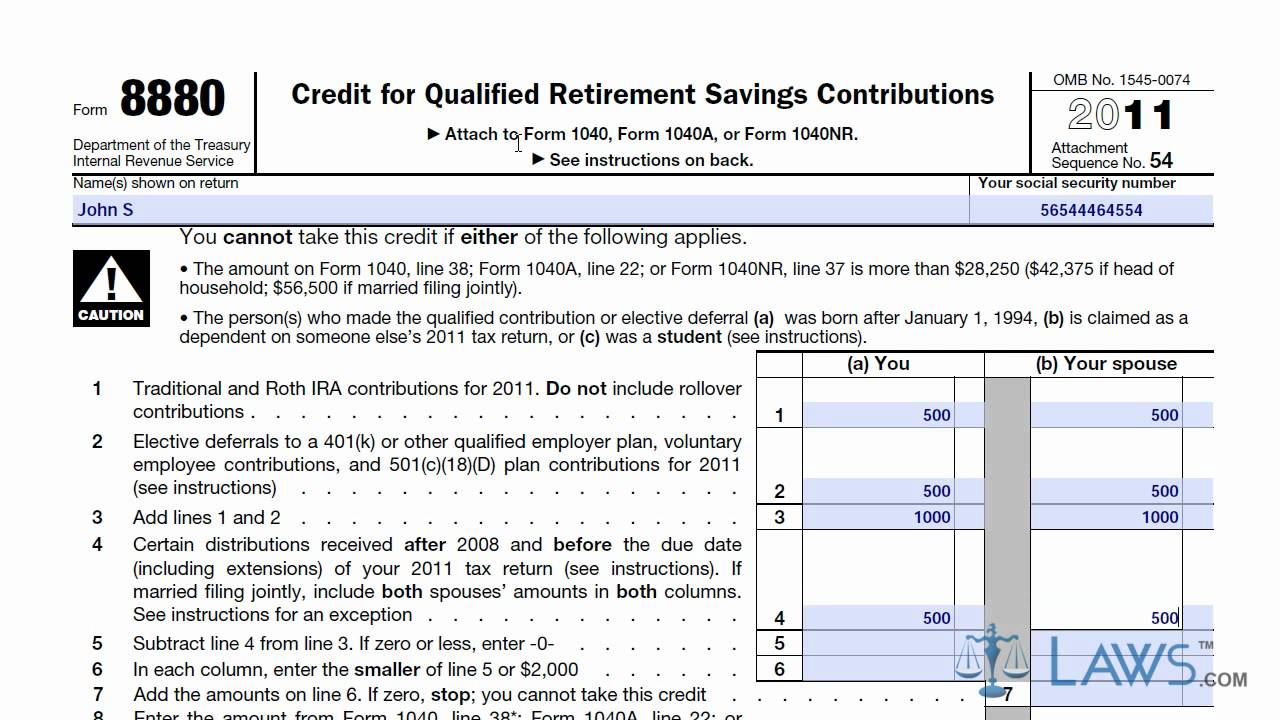

Learn How to Fill the Form 8880 Credit for Qualified Retirement Savings

Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. Web you cannot take this credit if either of the following applies. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in.

IRS Form 8880 Download Fillable PDF or Fill Online Credit for Qualified

Web form 8880 is a united states internal revenue service tax form used to apply for tax credits for qualified retirement savings contributions. You were a student if. Get ready for tax season deadlines by completing any required tax forms today. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web employee contributions to a qualified.

Enter The Amount From The Credit Limit Worksheet In.

The credit was designed to promote saving for retirement among. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Web depending on your agi, you could receive a tax credit of 10%, 20%, or 50% of the first $2,000 ($4,000 for joint filers) that you contribute to eligible retirement accounts. This tax credit can apply to.

Web How Do I Claim The Credit?

• a contribution to a. You can’t take this credit. Web • if the taxpayer seems to qualify for the credit, be sure to visit the form 8880 entry screen in the credits menu and address any necessary questions there. Web these two factors will determine the maximum credit you can take.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

You're not eligible for the credit if your adjusted gross income exceeds a certain amount. Web employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan), or (d) contributions to a 501(c)(18)(d) plan. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web plans that qualify are listed on form 8880.

Web Form 8880 Allows You To Claim The Retirement Savings Contributions Credit, Also Known As The Saver’s Credit.

Web form 8880 is a united states internal revenue service tax form used to apply for tax credits for qualified retirement savings contributions. If line 9 is zero, stop; Depending on your adjusted gross income. Web federal credit for qualified retirement savings contributions form 8880 pdf form content report error it appears you don't have a pdf plugin for this browser.

:max_bytes(150000):strip_icc()/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)