Cost To Form A Trust

Cost To Form A Trust - Web clauses in the trust; Assuming you decide you want a revocable living trust, how much should you expect to pay? A quick call to the local branch of a national bank can get. The cost of amending a trust. Web the cost of setting up a trust by lda is cheaper than the cost of setting up a trust by an attorney. Web updated on december 19, 2022 fact checked by rebecca mcclay in this article wills, trusts, and your estate plan what does it cost? The expense of creating a trust varies. Do i need a lawyer for a revocable. Web the cheapest accounts require just a couple hundred dollars in fees and less than $100 as an initial deposit. Web up to 25% cash back how much does a living trust cost?

Web how much does it cost to set up a trust? Web 35 minutes agothe world's two biggest rare earths companies outside of china are facing challenges turning rock from their mines into the building blocks for magnets used across. The cost of amending a trust. Web examples of trust costs in a sentence. Web a strong estate plan starts with life insurance. This means fees for living. Whether you want to learn how to set up a trust or have recently. Web up to 25% cash back how much does a living trust cost? The cost of setting up a trust depends on many factors, including the type of trust you want to set up, the assets you. The decision between a will and a living trust is the most typical option you have when creating an.

Web how much does a living trust cost? Web creating a simple trust could cost less than $100 through a digital service. It varies from $700 to $1000 for individuals and $9000 to $1,300 for married. The cost of setting up a trust depends on many factors, including the type of trust you want to set up, the assets you. Web if you hire an attorney to build your trust, you’ll likely pay more than $1,000, and fees will be higher for couples. And fees vary by state. Web examples of trust costs in a sentence. With a charitable trust, the grantor(creator of the trust) transfers control of assets into a trust. July 25, 2023 at 4:22 p.m. Web a strong estate plan starts with life insurance.

How much does it cost to form a family trust? Harbour & Associates

Having a lawyer create a trust for larger or more complicated estates could cost you. Web the cost of setting up a trust by lda is cheaper than the cost of setting up a trust by an attorney. But because you have to transfer ownership of your property, which comes with. In the absence of fraud or manifest error, the.

Remittance and Cost of Trust. It is widely known that the fees for

Ad avoid probate and save time for your loved ones by creating your how much to set up a trust. Web the average cost for an attorney to create a trust is between $1,000 and $1,500. The decision between a will and a living trust is the most typical option you have when creating an. Web updated on december 19,.

Will With Testamentary Trust Form Template in Google Docs, Word

Web setting up a trust is one way for people to manage their assets both throughout their life and after their death. Web how much does it cost to set up a trust? Web if you hire an attorney to build your trust, you’ll likely pay more than $1,000, and fees will be higher for couples. Web updated on december.

'In Blockchain we Trust'.. But, What is the COST of Trust? Published

Web creating a simple trust could cost less than $100 through a digital service. The cost of setting up a trust depends on many factors, including the type of trust you want to set up, the assets you. Having a lawyer create a trust for larger or more complicated estates could cost you. Sign and notarize the form. Web how.

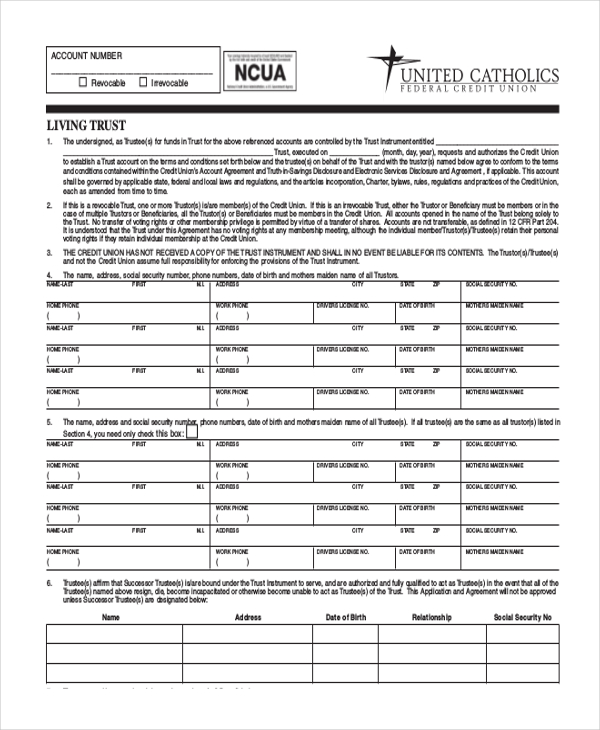

FREE 10+ Sample Living Trust Form Templates in PDF Word

If a couple is creating a trust, that cost may range from $1,200 to $1,500. And fees vary by state. With a charitable trust, the grantor(creator of the trust) transfers control of assets into a trust. Ad avoid probate and save time for your loved ones by creating your how much to set up a trust. Web updated on december.

FREE 10+ Sample Living Trust Form Templates in PDF Word

Sign and notarize the form. The cost of setting up a trust depends on many factors, including the type of trust you want to set up, the assets you. With a charitable trust, the grantor(creator of the trust) transfers control of assets into a trust. Web 35 minutes agothe world's two biggest rare earths companies outside of china are facing.

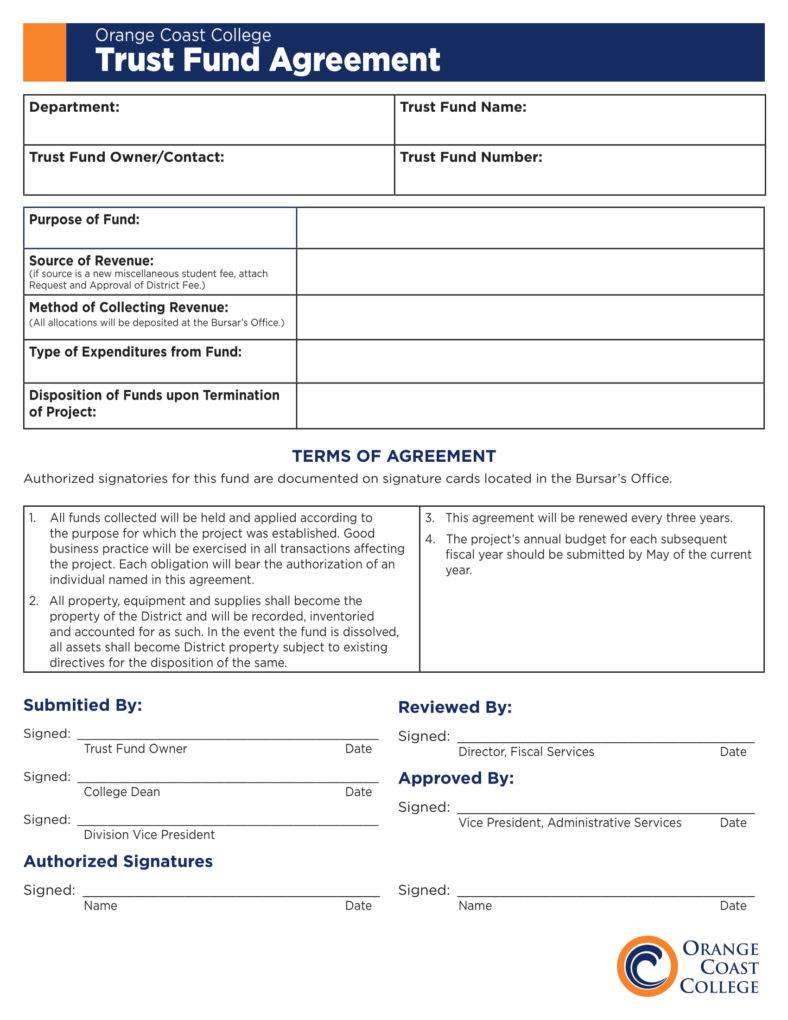

18+ Trust Agreement Templates PDF, Word Free & Premium Templates

The cost of amending a trust. Web the cheapest accounts require just a couple hundred dollars in fees and less than $100 as an initial deposit. Web the trust amendment form should identify the differences by section or paragraph number. Web if you hire an attorney to build your trust, you’ll likely pay more than $1,000, and fees will be.

FREE 16+ Sample Will and Trust Forms in PDF MS Word

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Having a lawyer create a trust for larger or more complicated estates could cost you. And fees vary by state. Web how much does a living trust cost? With a charitable trust, the grantor(creator of the trust) transfers control of assets into a trust.

Free Printable Will And Trust Forms Free Printable

Web examples of trust costs in a sentence. Web updated on december 19, 2022 fact checked by rebecca mcclay in this article wills, trusts, and your estate plan what does it cost? Web the cost of setting up a trust by lda is cheaper than the cost of setting up a trust by an attorney. Web 35 minutes agothe world's.

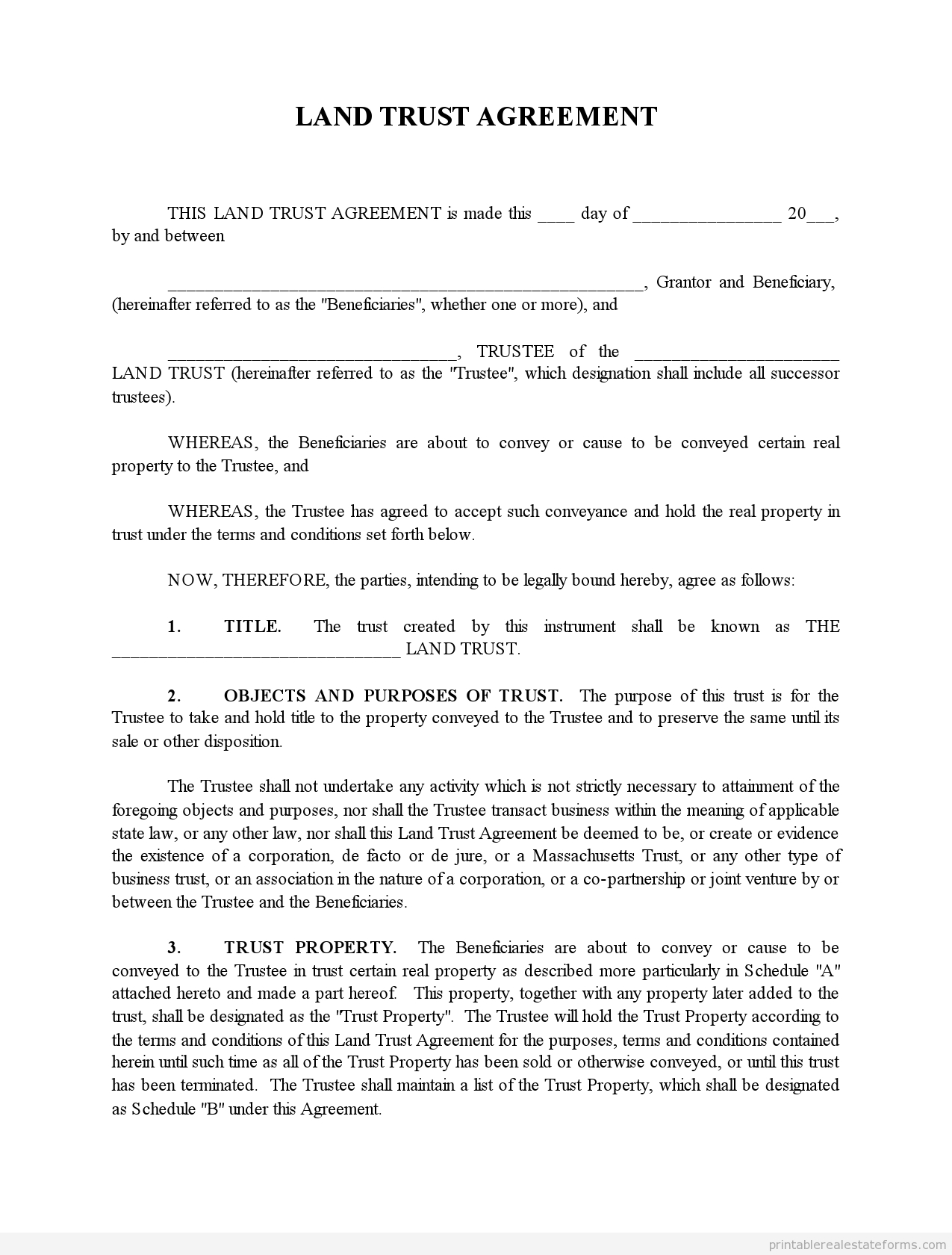

Real Estate Trust Agreement Forms (FREE PRINTABLE WORD)

The cost of amending a trust. If you are willing to do it yourself, it. Web setting up a trust is one way for people to manage their assets both throughout their life and after their death. The cost of setting up a trust depends on many factors, including the type of trust you want to set up, the assets.

A Quick Call To The Local Branch Of A National Bank Can Get.

Web clauses in the trust; Web starting in 2024, an $8 etias application will be required for u.s. Web creating a simple trust could cost less than $100 through a digital service. Web 35 minutes agothe world's two biggest rare earths companies outside of china are facing challenges turning rock from their mines into the building blocks for magnets used across.

In The Absence Of Fraud Or Manifest Error, The Estimated Final Trust Costs For Each Segment And The Total Estimated Final Trust Costs.

Web up to 25% cash back how much does a living trust cost? Assuming you decide you want a revocable living trust, how much should you expect to pay? Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web the cheapest accounts require just a couple hundred dollars in fees and less than $100 as an initial deposit.

Difference Between The Cost Of A Living Trust And A Will.

The cost of setting up a trust depends on many factors, including the type of trust you want to set up, the assets you. If you are willing to do it yourself, it. It varies from $700 to $1000 for individuals and $9000 to $1,300 for married. Do i need a lawyer for a revocable.

Having A Lawyer Create A Trust For Larger Or More Complicated Estates Could Cost You.

Web a strong estate plan starts with life insurance. With a charitable trust, the grantor(creator of the trust) transfers control of assets into a trust. And fees vary by state. Web the most common choice you have when setting up an estate plan is the choice between a will and a living trust.