Colorado Senior Property Tax Exemption Form

Colorado Senior Property Tax Exemption Form - Web taxpayers who are at least 65 years old as of january 1 and who have occupied their property as their primary residence for at least 10 consecutive years may be eligible for. Web there are two application forms for the senior property tax exemption. Late filing fee waiver request. Web web site of the colorado division of property taxation at www.dola.colorado.gov/dpt. Web the department is finding that many taxpayers claiming the senior housing income tax credit for tax year 2022 do not qualify. Web on january 1 st 2023, the state of colorado is expanding the deferral program to allow those who do not qualify for the senior or military personnel program to defer a portion of. 201 w colfax ave dept 406. Web the partial tax exemption for senior citizens was created for qualifying seniors as well as the surviving spouses of seniors who previously qualified. 2) he or she must be the owner of record and must. To apply for the exemption or get.

As of january 1 st the taxpayer. Web the filing deadline is july 1. Web there are two application forms for the senior property tax exemption. 2) he or she must be the owner of record and must. 201 w colfax ave dept 406. Web you may be able to claim the 2022 ptc rebate if: Property tax relief programs for senior citizens summary this memorandum provides information on five types of programs that provide property tax and/or rental. Web the three basic requirements are: Web on january 1 st 2023, the state of colorado is expanding the deferral program to allow those who do not qualify for the senior or military personnel program to defer a portion of. 201 w colfax ave dept 406.

The state reimburses the local governments for the loss in. Web the department is finding that many taxpayers claiming the senior housing income tax credit for tax year 2022 do not qualify. Web senior property tax exemption long form and instructions senior property tax exemption brochure removal of senior/veteran property tax exemption view tax. An individual or married couple is only entitled to one exemption, either senior. The filing deadline is july 1. Web there are three basic requirements to qualify: 201 w colfax ave dept 406. Property tax relief programs for senior citizens summary this memorandum provides information on five types of programs that provide property tax and/or rental. Web general information great news! The colorado general assembly has reinstated funding for the senior property tax exemption (a/k/a senior homestead exemption) for tax.

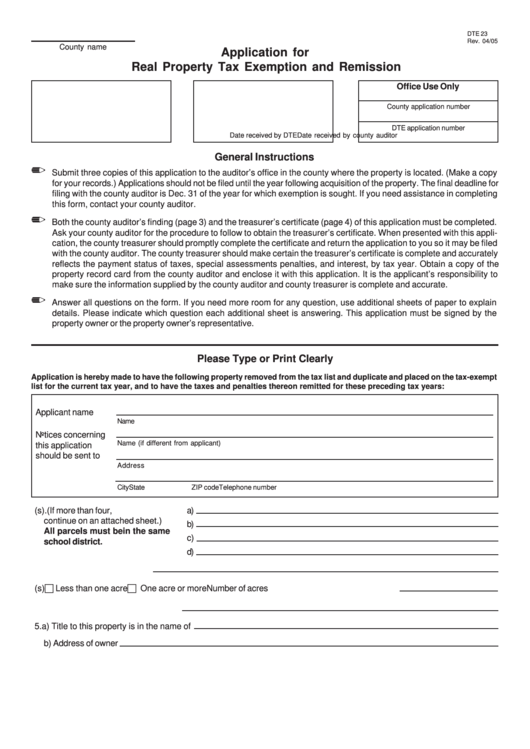

Fillable Form Dte 23 Application For Real Property Tax Exemption And

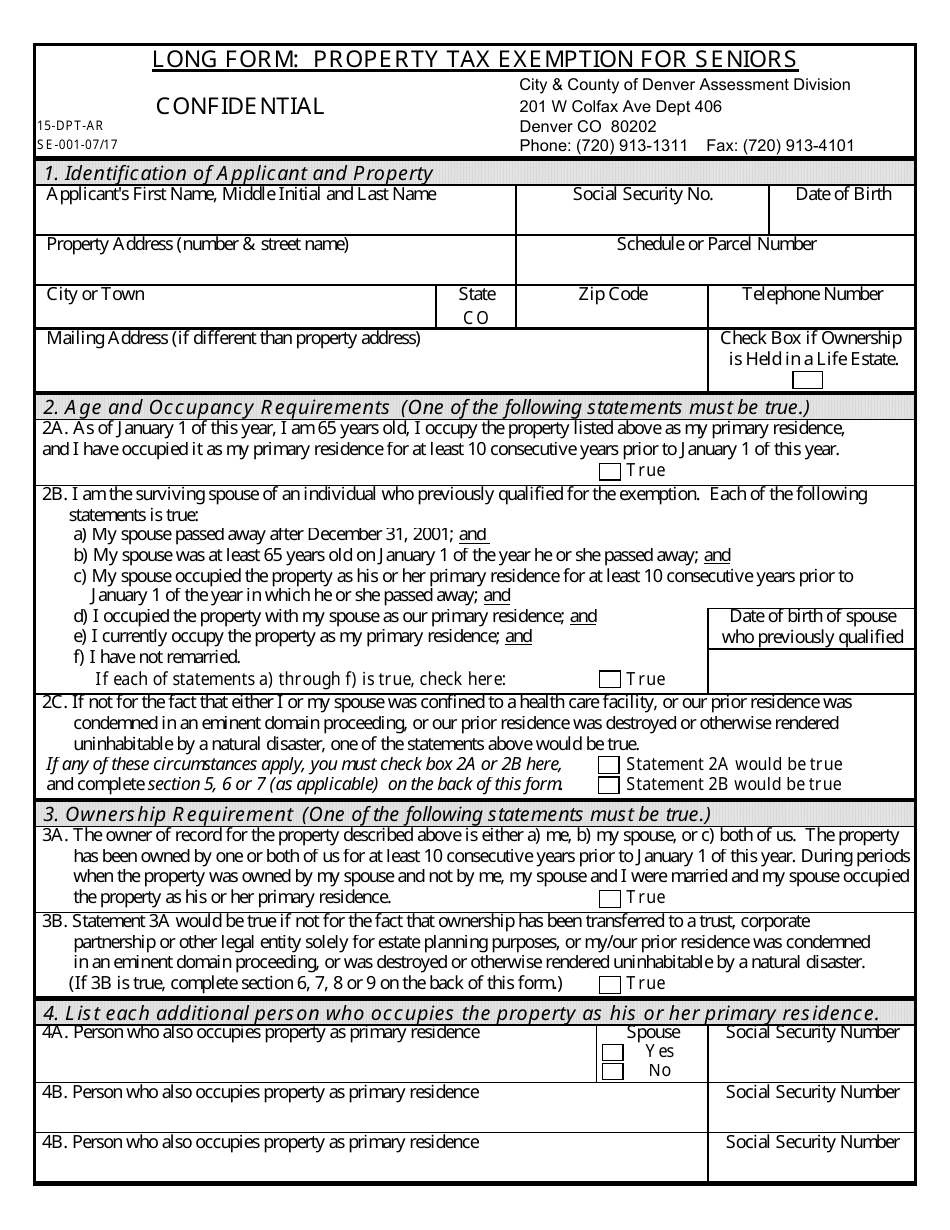

Web application for property tax exemption. Property tax exemption for seniors city & county of denverassessment division confidential. Remedies for recipients of notice of forfeiture of right to claim exemption. Web the three basic requirements are: 201 w colfax ave dept 406.

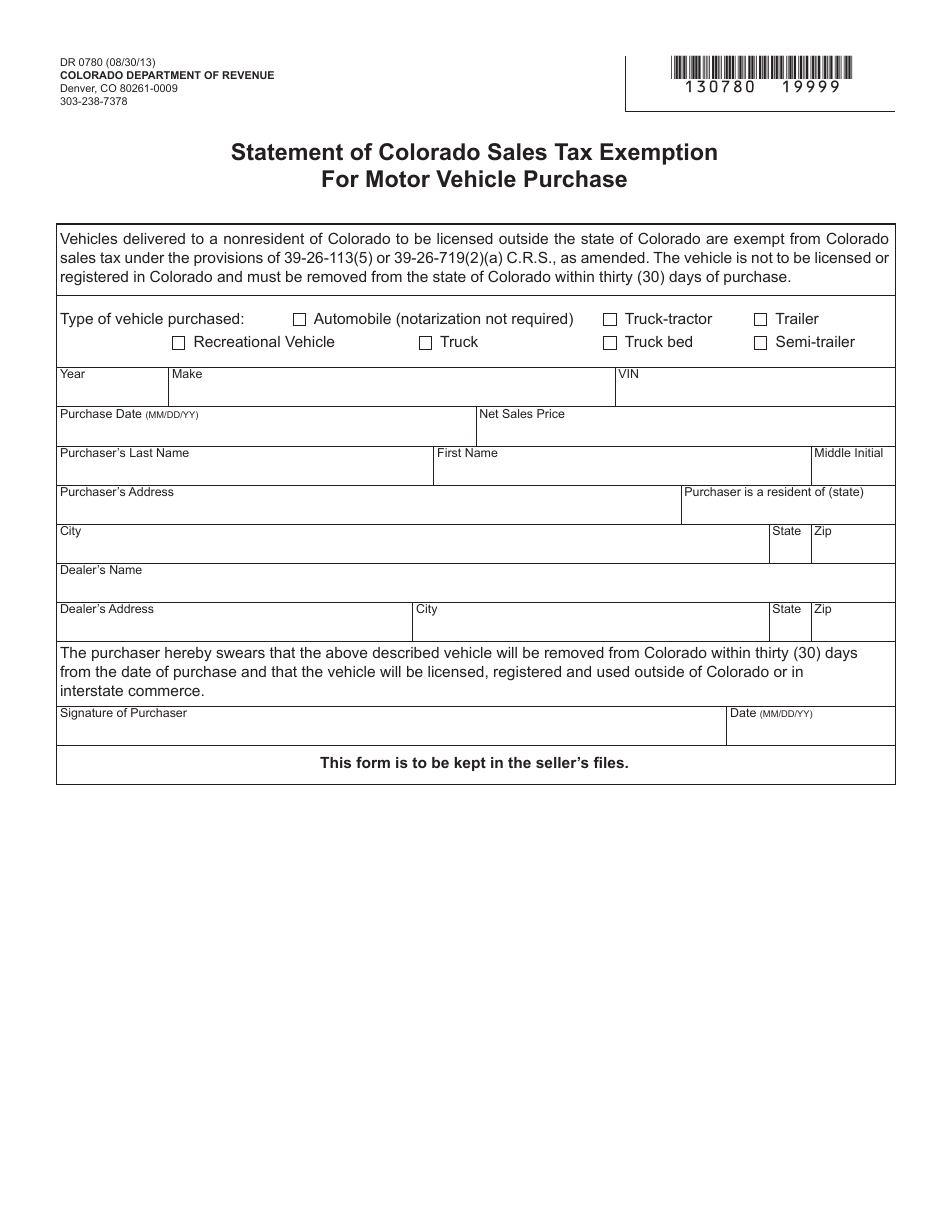

Form DR0780 Download Fillable PDF or Fill Online Statement of Colorado

Property tax relief programs for senior citizens summary this memorandum provides information on five types of programs that provide property tax and/or rental. 201 w colfax ave dept 406. As of january 1 st the taxpayer. 1) the qualifying senior must be at least 65 years old on january 1 of the year of application; Web senior property tax exemption.

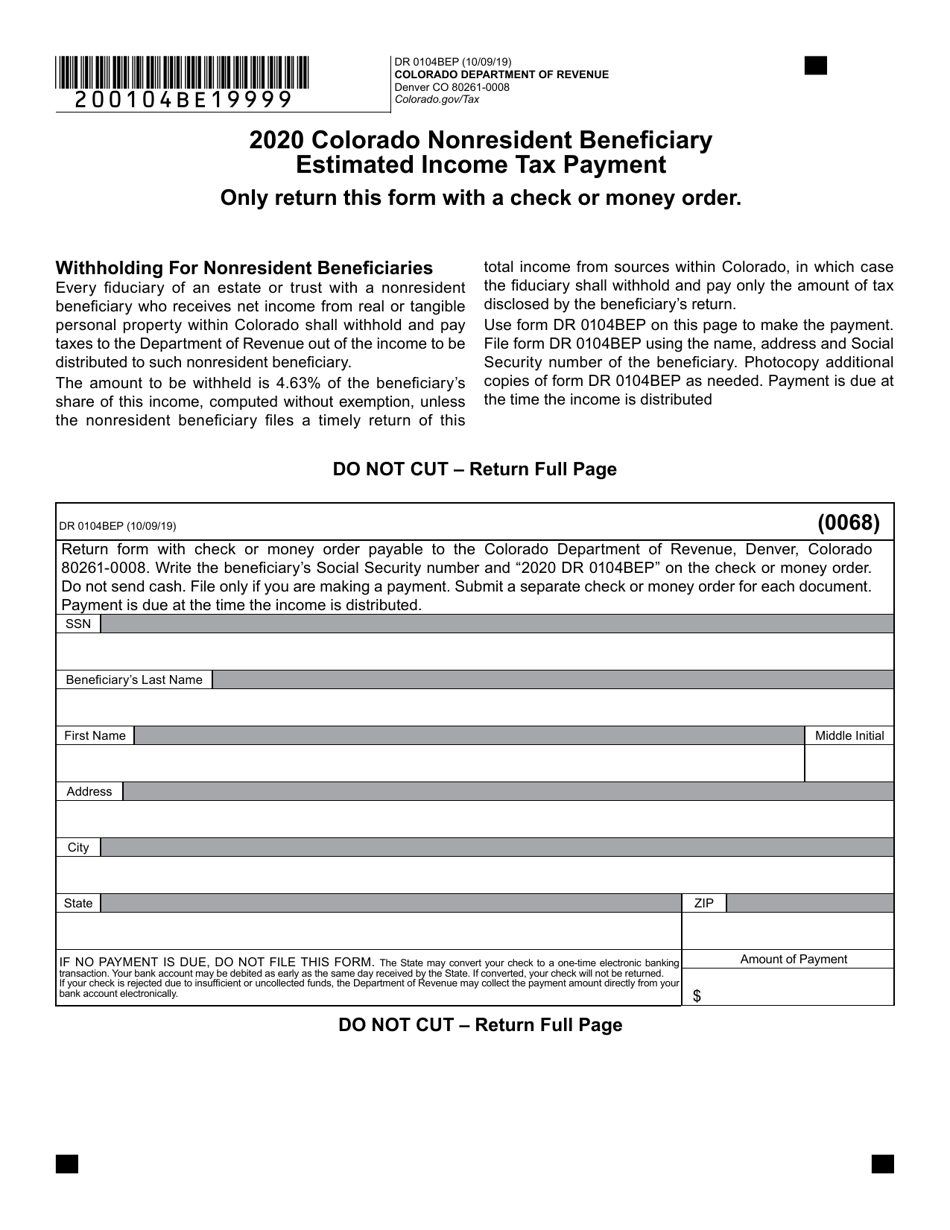

Form DR0104BEP Download Fillable PDF or Fill Online Colorado

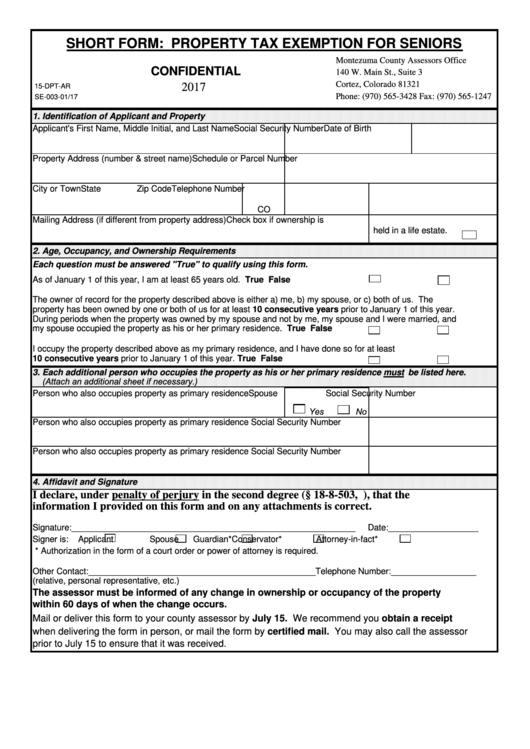

Web web site of the colorado division of property taxation at www.dola.colorado.gov/dpt. Web the partial tax exemption for senior citizens was created for qualifying seniors as well as the surviving spouses of seniors who previously qualified. Remedies for recipients of notice of forfeiture of right to claim exemption. The short form is for applicants who meet the basic eligibility requirements..

colorado estate tax exemption Fucking Incredible Blawker Ajax

Web there are two application forms for the senior property tax exemption. Web the partial tax exemption for senior citizens was created for qualifying seniors as well as the surviving spouses of seniors who previously qualified. 2) he or she must be the owner of record and must. Late filing fee waiver request. Web application form senior property tax exemption.pdf.

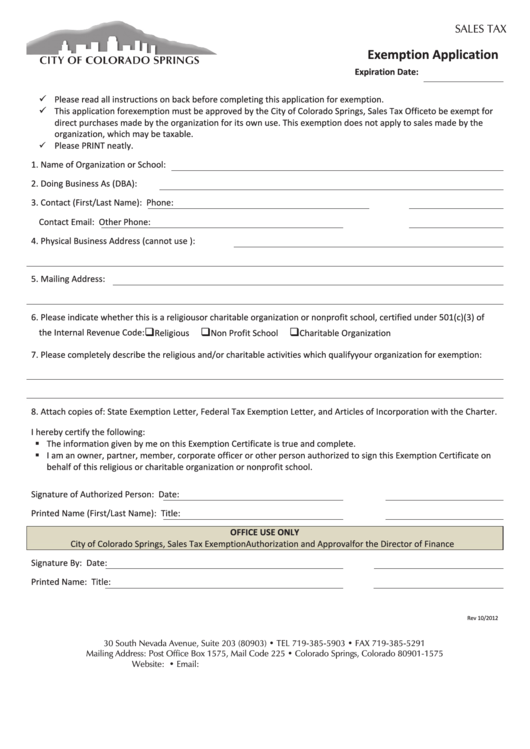

Exemption Application Form Colorado Springs printable pdf download

The state reimburses the local governments for the loss in. Your total income from all sources was less than $16,925 for single. Web the filing deadline is july 1. 201 w colfax ave dept 406. 201 w colfax ave dept 406.

Colorado Disabled Veterans' 2 Problems home healthcare & property

Web there are two application forms for the senior property tax exemption. To apply for the exemption or get. Web taxpayers who are at least 65 years old as of january 1 and who have occupied their property as their primary residence for at least 10 consecutive years may be eligible for. 201 w colfax ave dept 406. Web application.

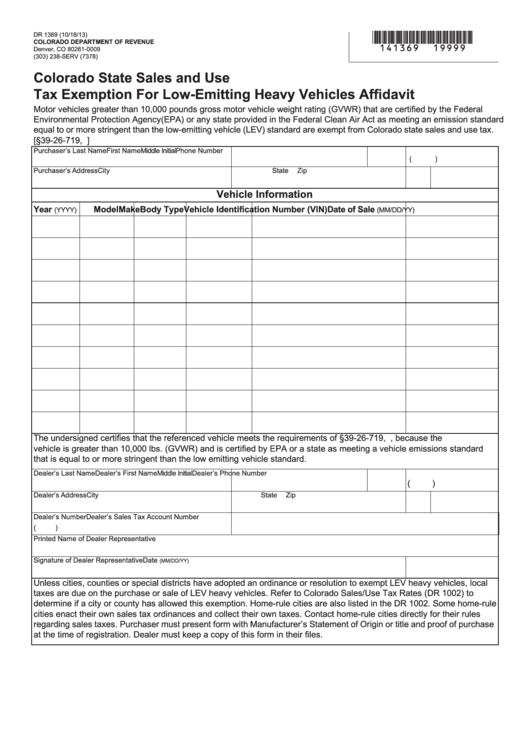

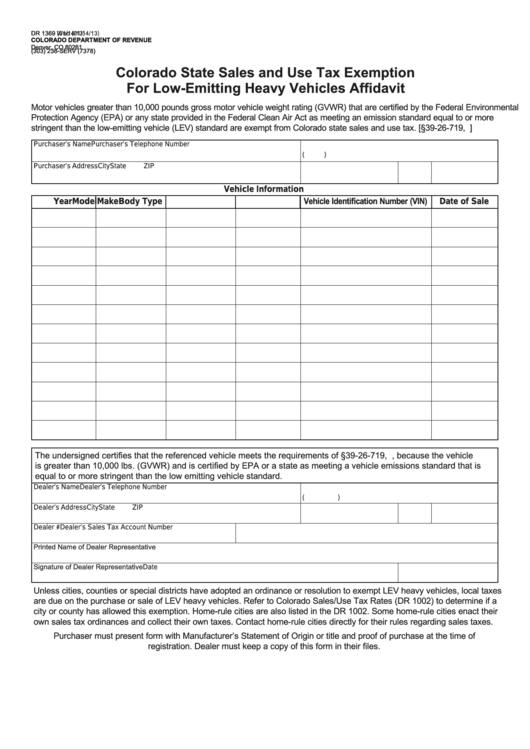

Form Dr 1369 Colorado State Sales And Use Tax Exemption For Low

Web senior property tax exemption long form and instructions senior property tax exemption brochure removal of senior/veteran property tax exemption view tax. The long form is for surviving. The colorado general assembly has reinstated funding for the senior property tax exemption (a/k/a senior homestead exemption) for tax. Property tax exemption for seniors city & county of denverassessment division confidential. Property.

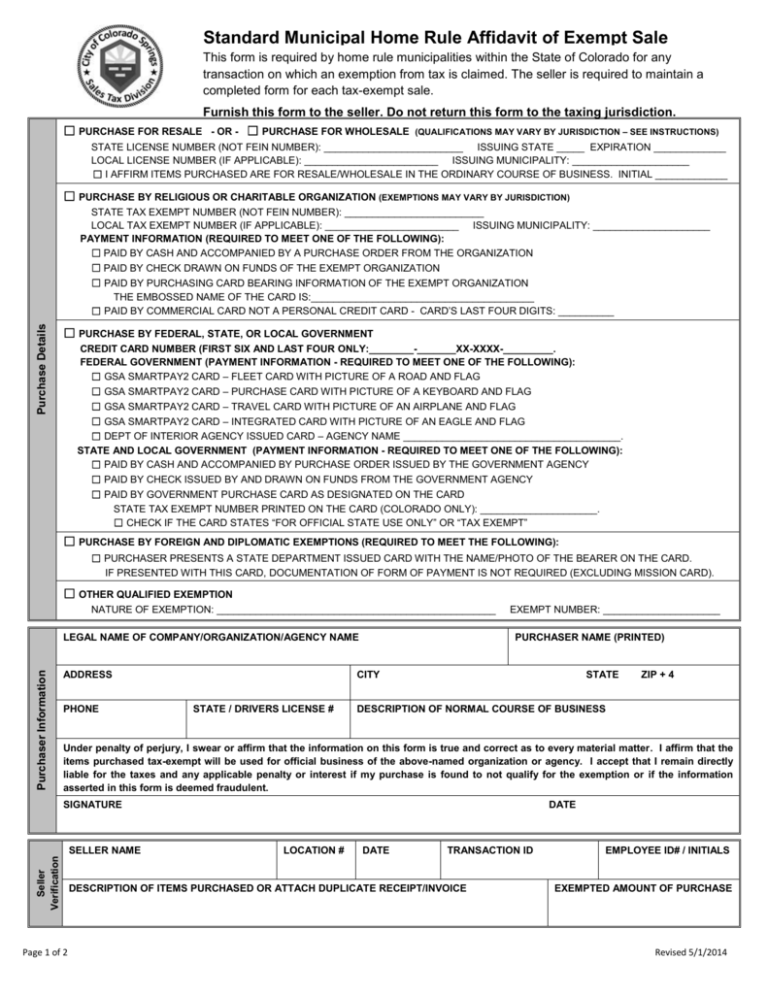

New Tax Exempt Form

Property tax relief programs for senior citizens summary this memorandum provides information on five types of programs that provide property tax and/or rental. The colorado general assembly has reinstated funding for the senior property tax exemption (a/k/a senior homestead exemption) for tax. Web the partial tax exemption for senior citizens was created for qualifying seniors as well as the surviving.

Jefferson County Property Tax Exemption Form

Late filing fee waiver request. The state reimburses the local governments for the loss in. Web general information great news! Web senior property tax exemption long form and instructions senior property tax exemption brochure removal of senior/veteran property tax exemption view tax. Remedies for recipients of notice of forfeiture of right to claim exemption.

Form Dr 1369 Colorado State Sales And Use Tax Exemption For Low

To apply for the exemption or get. 201 w colfax ave dept 406. Property tax exemption for seniors city & county of denverassessment division confidential. For 1 and 3 below, you. Property tax relief programs for senior citizens summary this memorandum provides information on five types of programs that provide property tax and/or rental.

To Apply For The Exemption, Or Get.

For 1 and 3 below, you. Web on january 1 st 2023, the state of colorado is expanding the deferral program to allow those who do not qualify for the senior or military personnel program to defer a portion of. Web web site of the colorado division of property taxation at www.dola.colorado.gov/dpt. Web for those who qualify for the exemption, 50% of the first $200,000 in actual value — $100,000 — is exempted from property tax.

Web You May Be Able To Claim The 2022 Ptc Rebate If:

Remedies for recipients of notice of forfeiture of right to claim exemption. The filing deadline is july 1. Late filing fee waiver request. Web application for property tax exemption.

Web Taxpayers Who Are At Least 65 Years Old As Of January 1 And Who Have Occupied Their Property As Their Primary Residence For At Least 10 Consecutive Years May Be Eligible For.

Web there are three basic requirements to qualify: 201 w colfax ave dept 406. 201 w colfax ave dept 406. An individual or married couple is only entitled to one exemption, either senior.

Web The Department Is Finding That Many Taxpayers Claiming The Senior Housing Income Tax Credit For Tax Year 2022 Do Not Qualify.

Web the senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens. Web the three basic requirements are: Web the partial tax exemption for senior citizens was created for qualifying seniors as well as the surviving spouses of seniors who previously qualified. The state reimburses the local governments for the loss in.