Charitable Remainder Trust Form

Charitable Remainder Trust Form - Web currently, a trust is required to file income tax returns if, during a taxable year it has gross income of $600 or more, or any amount of taxable income.because a charitable. All pooled income funds described in section 642(c)(5) and all other trusts such as charitable lead. Ad instantly find and download legal forms drafted by attorneys for your state. Web (a) charitable remainder trust. The term charitable remainder trust means a trust with respect to which a deduction is allowable under section 170, 2055, 2106, or 2522 and. Web a charitable remainder trust (crt) is an irrevocable trust that generates a potential income stream for you, or other beneficiaries, with the remainder of the donated assets. All pooled income funds described in section 642(c)(5) and all other trusts such as charitable lead. Web charitable remainder trusts. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Web all charitable remainder trusts described in section 664 must file form 5227.

Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Web in this declaration of trust and in any amendments to it, references to charitable organizations or charitable organization mean corporations, trusts, funds,. Ad instantly find and download legal forms drafted by attorneys for your state. Web charitable remainder trust ______________________________, referred to as the donor, herewith establishes a charitable remainder unitrust, within the. Web (a) charitable remainder trust. The term charitable remainder trust means a trust with respect to which a deduction is allowable under section 170, 2055, 2106, or 2522 and. Get access to the largest online library of legal forms for any state. Browsing for the right legal documentation to fulfill your state. Web in the case of a charitable remainder annuity trust or a charitable remainder unitrust which has unrelated business taxable income (within the meaning of. All pooled income funds described in section 642(c)(5) and all other trusts such as charitable lead.

Web c type of entity (1) charitable lead trust (2) charitable remainder annuity trust described in section 664(d)(1) (3) charitable remainder unitrust described in section 664(d)(2) (4). Obtain an income tax deduction for a portion of what you contribute. Web in this declaration of trust and in any amendments to it, references to charitable organizations or charitable organization mean corporations, trusts, funds,. Charitable remainder agreement form trust. All pooled income funds described in section 642(c)(5) and all other trusts such as charitable lead. Web in the case of a charitable remainder annuity trust or a charitable remainder unitrust which has unrelated business taxable income (within the meaning of. Web a charitable trust described in internal revenue code section 4947 (a) (1) is a trust that is not tax exempt, all of the unexpired interests of which are devoted to one. Web up to 25% cash back charitable remainder trust definition a kind of charitable trust in which someone places substantial assets into an irrevocable trust.the trust is set up so that. Web a charitable remainder trust (crt) is an irrevocable trust that generates a potential income stream for you, or other beneficiaries, with the remainder of the donated assets. Web currently, a trust is required to file income tax returns if, during a taxable year it has gross income of $600 or more, or any amount of taxable income.because a charitable.

Free Printable Charitable Remainder Trust Form (GENERIC)

Ad instantly find and download legal forms drafted by attorneys for your state. The term charitable remainder trust means a trust with respect to which a deduction is allowable under section 170, 2055, 2106, or 2522 and. All pooled income funds described in section 642(c)(5) and all other trusts such as charitable lead. Web in this declaration of trust and.

Free Printable Charitable Remainder Trust Form (GENERIC)

Web in the case of a charitable remainder annuity trust or a charitable remainder unitrust which has unrelated business taxable income (within the meaning of. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Can be combined with other strategies, such as legacy trusts. All pooled income funds described in section 642(c)(5) and all.

Charitable Remainder Trust Legal forms, Template printable, Free

Web create a regular income stream for both yourself and a beneficiary. Get access to the largest online library of legal forms for any state. Web currently, a trust is required to file income tax returns if, during a taxable year it has gross income of $600 or more, or any amount of taxable income.because a charitable. Browsing for the.

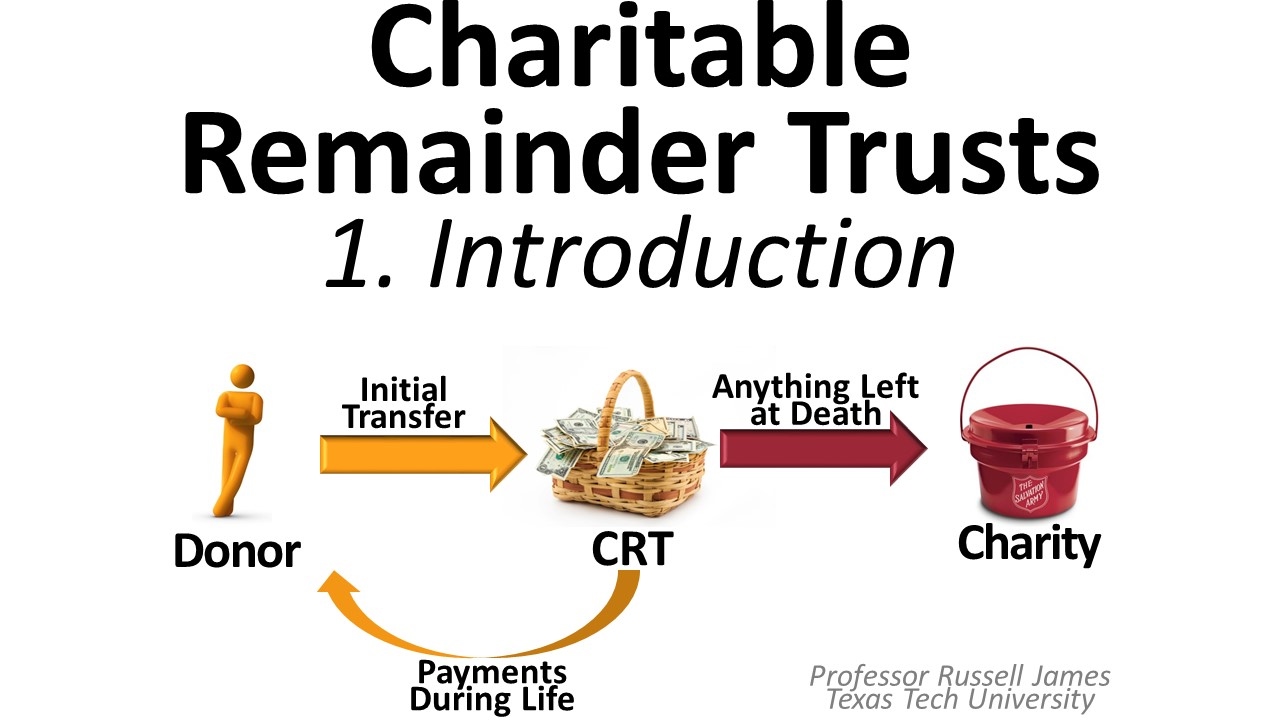

Charitable Remainder Trusts 1 Introduction YouTube

Web currently, a trust is required to file income tax returns if, during a taxable year it has gross income of $600 or more, or any amount of taxable income.because a charitable. Web all charitable remainder trusts described in section 664 must file form 5227. Web the sample forms are essentially safe harbors for drafting a charitable remainder trust. Get.

Charitable Remainder Annuity Trust Women In Distress

Web create a regular income stream for both yourself and a beneficiary. Web sample charitable remainder trust document form. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Web up to 25% cash back charitable remainder trust definition a kind of charitable trust in which someone places substantial assets into an irrevocable trust.the trust.

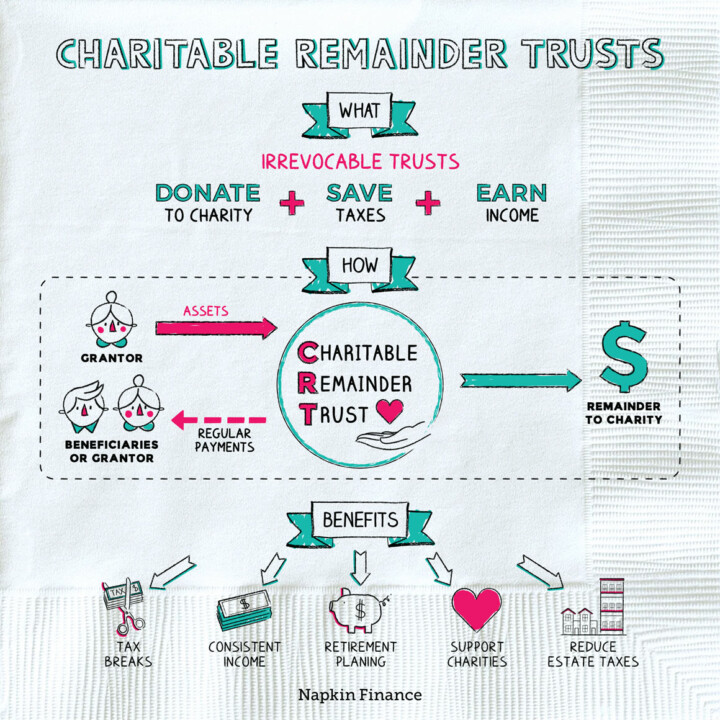

Is A Charitable Remainder Trust Right For You? Napkin Finance

Web currently, a trust is required to file income tax returns if, during a taxable year it has gross income of $600 or more, or any amount of taxable income.because a charitable. Web in this declaration of trust and in any amendments to it, references to charitable organizations or charitable organization mean corporations, trusts, funds,. Browsing for the right legal.

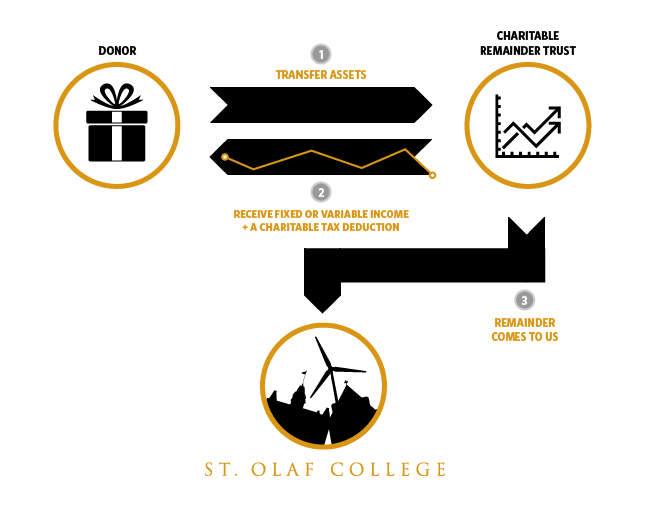

Charitable Remainder Trust Giving to St. Olaf

Web c type of entity (1) charitable lead trust (2) charitable remainder annuity trust described in section 664(d)(1) (3) charitable remainder unitrust described in section 664(d)(2) (4). All pooled income funds described in section 642(c)(5) and all other trusts such as charitable lead. Ad instantly find and download legal forms drafted by attorneys for your state. Web the sample forms.

Is A Charitable Remainder Trust Right For You? Napkin Finance

Obtain an income tax deduction for a portion of what you contribute. Ad instantly find and download legal forms drafted by attorneys for your state. Web a charitable trust described in internal revenue code section 4947 (a) (1) is a trust that is not tax exempt, all of the unexpired interests of which are devoted to one. Web all charitable.

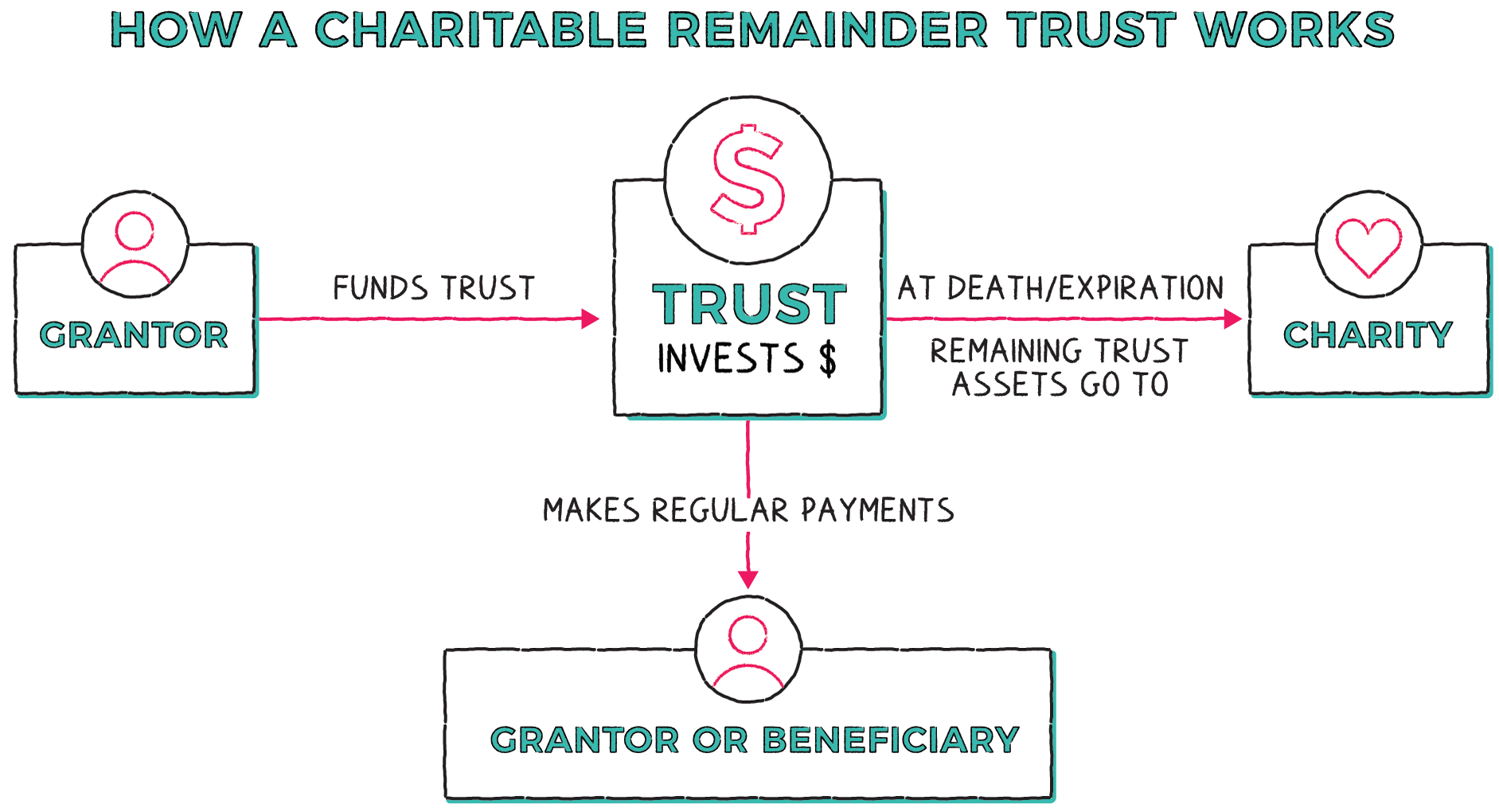

What Is a Charitable Remainder Trust? Carolina Family Estate Planning

Can be combined with other strategies, such as legacy trusts. Get access to the largest online library of legal forms for any state. Web in the case of a charitable remainder annuity trust or a charitable remainder unitrust which has unrelated business taxable income (within the meaning of. Ad pdffiller allows users to edit, sign, fill and share all type.

Charitable Remainder Trust Save on Taxes While Doing Good Life Plan

Web charitable remainder trusts. Web all charitable remainder trusts described in section 664 must file form 5227. Can be combined with other strategies, such as legacy trusts. All pooled income funds described in section 642(c)(5) and all other trusts such as charitable lead. Web charitable remainder trust ______________________________, referred to as the donor, herewith establishes a charitable remainder unitrust, within.

Web Currently, A Trust Is Required To File Income Tax Returns If, During A Taxable Year It Has Gross Income Of $600 Or More, Or Any Amount Of Taxable Income.because A Charitable.

All pooled income funds described in section 642(c)(5) and all other trusts such as charitable lead. Web all charitable remainder trusts described in section 664 must file form 5227. Web (a) charitable remainder trust. The term charitable remainder trust means a trust with respect to which a deduction is allowable under section 170, 2055, 2106, or 2522 and.

Web Charitable Remainder Trust ______________________________, Referred To As The Donor, Herewith Establishes A Charitable Remainder Unitrust, Within The.

All pooled income funds described in section 642(c)(5) and all other trusts such as charitable lead. Web a charitable trust described in internal revenue code section 4947 (a) (1) is a trust that is not tax exempt, all of the unexpired interests of which are devoted to one. Charitable remainder agreement form trust. Obtain an income tax deduction for a portion of what you contribute.

Web Charitable Remainder Trusts.

Web sample charitable remainder trust document form. Browsing for the right legal documentation to fulfill your state. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Can be combined with other strategies, such as legacy trusts.

Web In This Declaration Of Trust And In Any Amendments To It, References To Charitable Organizations Or Charitable Organization Mean Corporations, Trusts, Funds,.

Web a charitable remainder trust (crt) is an irrevocable trust that generates a potential income stream for you, or other beneficiaries, with the remainder of the donated assets. Web the sample forms are essentially safe harbors for drafting a charitable remainder trust. Web c type of entity (1) charitable lead trust (2) charitable remainder annuity trust described in section 664(d)(1) (3) charitable remainder unitrust described in section 664(d)(2) (4). Web charitable remainder trusts are an estate planning tool that might allow you to earn income while reducing both income tax now, as well as estate taxes after you pass away.