Chapter 7 In Pennsylvania

Chapter 7 In Pennsylvania - The pennsylvania homestead exemption personal property exemptions other pennsylvania exemptions: In chapter 13 , your assets will determine how much you are required to pay to your unsecured creditors. It requires a debtor to give up property which exceeds certain limits called “exemptions”, so the property can be sold to pay creditors. Am i eligible for bankruptcy in pennsylvania? Having a high income does not always mean that you cannot file for chapter 7 bankruptcy in pennsylvania. It is crucial to understand how they are different, so that you are better able to select the best type of bankruptcy for you. Civil judgments from lawsuits (including personal injury) some taxes, including back federal, state, and local income taxes. Web chapter 7 statement of your current monthly income and means test calculation. The bankruptcy code sets forth a list of federal exemptions but also allows each state to. Web what are pennsylvania bankruptcy exemptions and why are they important in chapter 7 bankruptcy?

On the other hand, chapter. The bankruptcy code sets forth a list of federal exemptions but also allows each state to. Civil judgments from lawsuits (including personal injury) some taxes, including back federal, state, and local income taxes. Web with a few exceptions, chapter 7 eliminates debts, including: Am i eligible for bankruptcy in pennsylvania? It requires a debtor to give up property which exceeds certain limits called “exemptions”, so the property can be sold to pay creditors. Web do you qualify for chapter 7 bankruptcy in pennsylvania? Web july 9, 2021. Web chapter 7 is known as “straight” bankruptcy or “liquidation.”. Web in a chapter 7 bankruptcy you can wipe out all debts except:

Web in chapter 7 bankruptcy in pennsylvania, certain debts are dischargeable, meaning they can be eliminated or forgiven. Web chapter 7 was designed to get folks out of debt quickly and relatively easily. These debts include credit card debt, medical debt, personal. Web why pennsylvania bankruptcy exemptions are important in chapter 7 bankruptcy who can use the pennsylvania bankruptcy exemptions? Statement of exemption from presumption of abuse under § 707 (b) (2) statement of intention for individuals filing under. Web in a chapter 7 bankruptcy you wipe out your debts and get a “fresh start”. Pennsylvania bankruptcy exemptions real property exemptions: Web most people who file for bankruptcy in pennsylvania use either chapter 7 or chapter 13. Am i eligible for bankruptcy in pennsylvania? Chapter 7 bankruptcy liquidates the debtor’s assets and property, using the gains from this liquidation to pay off creditors.

The Midterm Elections, explained The Brown and White

Web do you qualify for chapter 7 bankruptcy in pennsylvania? Am i eligible for bankruptcy in pennsylvania? It is also commonly known as the “fresh start” type bankruptcy. Having a high income does not always mean that you cannot file for chapter 7 bankruptcy in pennsylvania. Civil judgments from lawsuits (including personal injury) some taxes, including back federal, state, and.

Top 10 things to see in Pennsylvania Getaway Couple

It requires a debtor to give up property which exceeds certain limits called “exemptions”, so the property can be sold to pay creditors. Fortunately, many people with fairly high incomes can qualify for chapter 7. On the other hand, chapter. Web july 9, 2021. Web with a few exceptions, chapter 7 eliminates debts, including:

Pennsylvania Chapter New Patriotic Party USA

It is also commonly known as the “fresh start” type bankruptcy. Statement of exemption from presumption of abuse under § 707 (b) (2) statement of intention for individuals filing under. Chapter 7 bankruptcy liquidates the debtor’s assets and property, using the gains from this liquidation to pay off creditors. Money owed for child support, alimony, fines, property settlements, criminal restitution,.

Pennsylvania NDWA & NDWAWe Dream in Black Chapter National Domestic

Web do you qualify for chapter 7 bankruptcy in pennsylvania? Web most people who file for bankruptcy in pennsylvania use either chapter 7 or chapter 13. Typically, the judge discharges most unsecured debts in as little as six months. It is also commonly known as the “fresh start” type bankruptcy. The bankruptcy code sets forth a list of federal exemptions.

History Alive, Chapter 7 Pennsylvania Colony YouTube

Having a high income does not always mean that you cannot file for chapter 7 bankruptcy in pennsylvania. Web chapter 7 is known as “straight” bankruptcy or “liquidation.”. It is also commonly known as the “fresh start” type bankruptcy. Web exceptions to the automatic stay in chapter 7 bankruptcies in pennsylvania while the stay offers robust legal protection, chapter 7.

THE BOOKE OF IOSHUA. (ORIGINAL 1611 KJV)

Web in a chapter 7 bankruptcy you can wipe out all debts except: Web july 9, 2021. It is crucial to understand how they are different, so that you are better able to select the best type of bankruptcy for you. Web chapter 7 statement of your current monthly income and means test calculation. Web what is the difference between.

Philadelphia Chapter Pennsylvania Railroad Technical & Historical Society

Web in chapter 7 bankruptcy in pennsylvania, certain debts are dischargeable, meaning they can be eliminated or forgiven. Web what is the difference between a chapter 7 and chapter 13 bankruptcy in pennsylvania? Am i eligible for bankruptcy in pennsylvania? Nonetheless, many people assume that they cannot file for bankruptcy if their income is high. Web chapter 7 statement of.

Central Pennsylvania Save Chapter Origins Animal Advocates of South

Web the chapter 7 bankruptcy means test can determine if a pennsylvania petitioner’s income level and expenses are eligible to file for a chapter 7 bankruptcy. Web what is the difference between a chapter 7 and chapter 13 bankruptcy in pennsylvania? Typically, the judge discharges most unsecured debts in as little as six months. Web why pennsylvania bankruptcy exemptions are.

7 Pennsylvania Ave, Camp Hill, PA 17011 MLS PACB120274 Coldwell Banker

It is also commonly known as the “fresh start” type bankruptcy. These debts include credit card debt, medical debt, personal. Statement of exemption from presumption of abuse under § 707 (b) (2) statement of intention for individuals filing under. Chapter 7 and chapter 13 bankruptcy filings differ in terms of procedure, eligibility, and timeframe. The formula is designed to prevent.

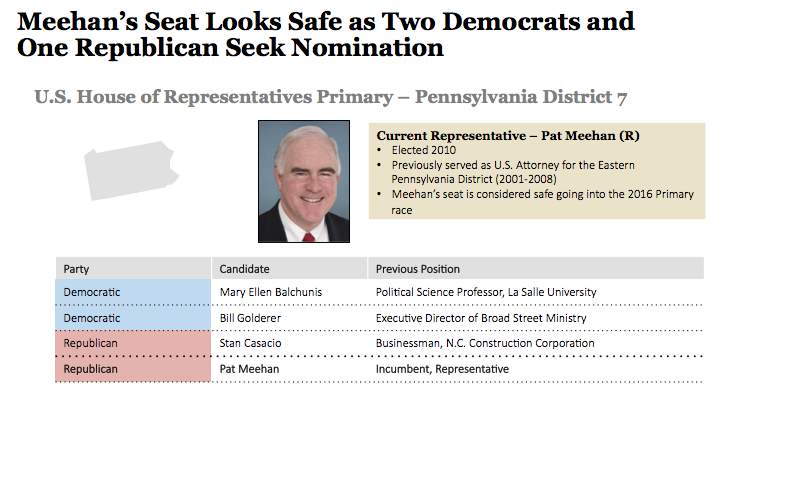

Pennsylvania District 7 Primary Race

Web most people who file for bankruptcy in pennsylvania use either chapter 7 or chapter 13. Web chapter 7 is the fastest and easiest way for debtors to obtain fresh starts. Chapter 7 bankruptcy liquidates the debtor’s assets and property, using the gains from this liquidation to pay off creditors. Web the chapter 7 bankruptcy means test can determine if.

Web The Chapter 7 Bankruptcy Means Test Can Determine If A Pennsylvania Petitioner’s Income Level And Expenses Are Eligible To File For A Chapter 7 Bankruptcy.

In chapter 13 , your assets will determine how much you are required to pay to your unsecured creditors. Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. Nonetheless, many people assume that they cannot file for bankruptcy if their income is high. Web in a chapter 7 bankruptcy you wipe out your debts and get a “fresh start”.

The Bankruptcy Code Sets Forth A List Of Federal Exemptions But Also Allows Each State To.

The formula is designed to prevent individuals from chapter 7. It is crucial to understand how they are different, so that you are better able to select the best type of bankruptcy for you. Web chapter 7 is the fastest and easiest way for debtors to obtain fresh starts. Web with a few exceptions, chapter 7 eliminates debts, including:

Web Why Pennsylvania Bankruptcy Exemptions Are Important In Chapter 7 Bankruptcy Who Can Use The Pennsylvania Bankruptcy Exemptions?

It requires a debtor to give up property which exceeds certain limits called “exemptions”, so the property can be sold to pay creditors. Civil judgments from lawsuits (including personal injury) some taxes, including back federal, state, and local income taxes. Web what is the difference between a chapter 7 and chapter 13 bankruptcy in pennsylvania? Web in chapter 7 bankruptcy in pennsylvania, certain debts are dischargeable, meaning they can be eliminated or forgiven.

Web Chapter 7 Statement Of Your Current Monthly Income And Means Test Calculation.

Chapter 7 bankruptcy liquidates the debtor’s assets and property, using the gains from this liquidation to pay off creditors. Web do you qualify for chapter 7 bankruptcy in pennsylvania? Typically, the judge discharges most unsecured debts in as little as six months. Chapter 7 and chapter 13 bankruptcy filings differ in terms of procedure, eligibility, and timeframe.