Chapter 13 Bankruptcy Keep Car

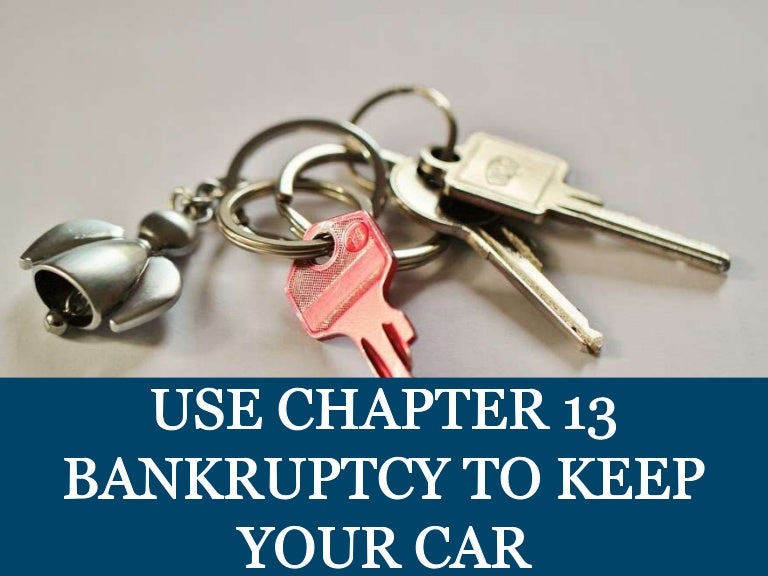

Chapter 13 Bankruptcy Keep Car - Web sometimes, one or more creditors fail to file a proof of claim within the time limit. If you have a lot of equity in your car you may not be able. Filing for bankruptcy under chapter 13 can give a debtor an opportunity to pay back missed payments on their car loan. If you need an auto loan, you may be wondering about where to find car dealers that deal. Learn how filing for chapter 13 bankruptcy can help you keep your vehicle from being repossessed and when you can use a cramdown to decrease the loan amount you'll need to pay. If your lender has repossessed but not yet sold your car, truck, van, minivan, motorcycle, suv, or some other motor vehicle, filing for chapter 13 bankruptcy could allow you to get your vehicle back. Chapter 13 allows a debtor to keep property and pay debts over time,. Web in a chapter 13 bankruptcy, filers are usually able to keep their property. Web tax refunds in chapter 13 bankruptcy. Web cars under chapter 13 bankruptcy law.

Web pros of switching to chapter 7. But in chapter 13, tax refunds based on income you earn while your bankruptcy. By cara o'neill , attorney you'll keep all of your property in chapter 13 , including cars because the chapter 13 repayment plan affords benefits that aren't available in chapter. In general, you get to keep your property, including cars, in chapter 13 bankruptcy. Web in a chapter 13 bankruptcy, filers are usually able to keep their property. You still have the car when. Here are some choices you and your attorney will consider. Your payments will become part of your chapter 13 bankruptcy plan. In chapter 13 bankruptcy, tax refunds based on income you earned before you filed bankruptcy are part of your estate, just like chapter 7. Learn how filing for chapter 13 bankruptcy can help you keep your vehicle from being repossessed and when you can use a cramdown to decrease the loan amount you'll need to pay.

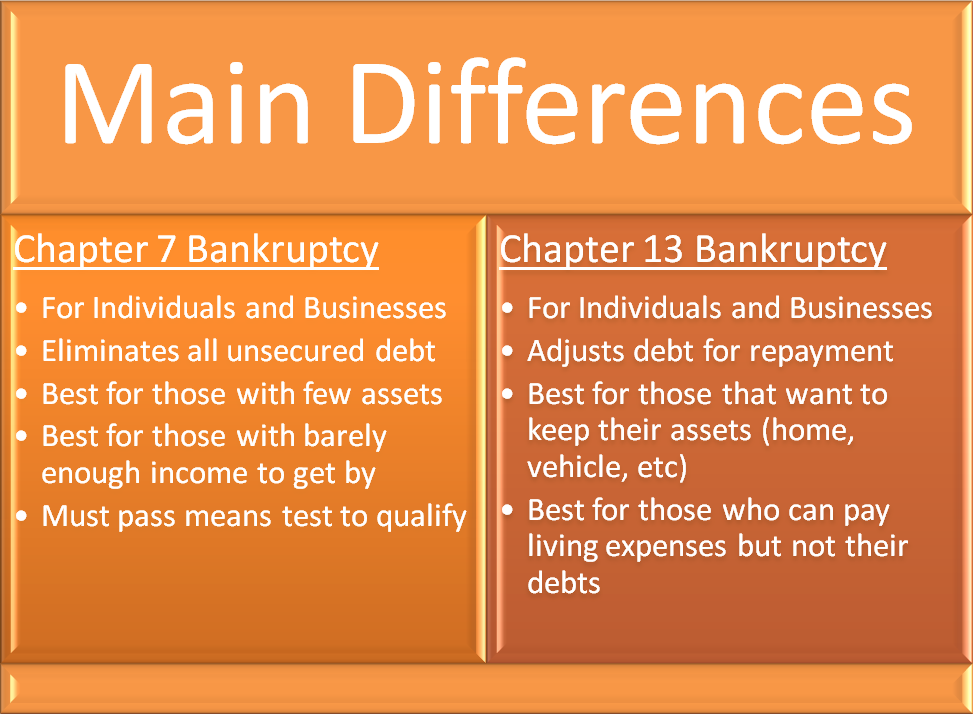

Web december 20, 2022. Web sometimes, one or more creditors fail to file a proof of claim within the time limit. Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Web pros of switching to chapter 7. Web you can use chapter 13 bankruptcy to repay many different types of debt, including car loans. Web everyone can keep their car in chapter 13 bankruptcy, even after falling behind on payments. Also, if you can qualify for a repayment plan and get caught up on. Web tax refunds in chapter 13 bankruptcy. You still have the car when. Web sometimes it isn't wise to keep your vehicle during chapter 13 bankruptcy.

Can I Keep My House and Car After a Bankruptcy Filing? CMC Law

Depending on how much you owe and how much your car is worth, you may benefit from achapter 13. Web in a chapter 13 bankruptcy, filers are usually able to keep their property. Also, if you can qualify for a repayment plan and get caught up on. If you’re filing for chapter 13 bankruptcy, you may keep your car if.

Using Chapter 13 Bankruptcy to Lower Your Car Interest Rate

If you need an auto loan, you may be wondering about where to find car dealers that deal. Here are some choices you and your attorney will consider. Web if you have a car loan, the amount you owe on it may be reduced in the chapter 13 bankruptcy process if you owe more on it than its current value..

Morestar » Blog Archive The Key Elements Of A Chapter 13 Bankruptcy Plan

Web december 20, 2022. These creditors will receive payments through your chapter 13. Web cars under chapter 13 bankruptcy law. Web chapter 13 offers benefits that can help you keep your car, such as not liquidating all your assets so you don’t lose everything. Web if you have a car loan, the amount you owe on it may be reduced.

Everything You Need to Know About Chapter 13 Bankruptcy

Web sometimes it isn't wise to keep your vehicle during chapter 13 bankruptcy. No matter if you file a chapter 7 or a chapter 13, dealing with a bankruptcy isn't easy. In chapter 13 bankruptcy, you'll stand a good chance of keeping your car. You still have the car when. Web pros of switching to chapter 7.

Chapter 13 Bankruptcy Keep Your Property & Repay Debts Over Time

Web december 20, 2022. Also, the size of your payments and the value of the car. If you need an auto loan, you may be wondering about where to find car dealers that deal. If your lender has repossessed but not yet sold your car, truck, van, minivan, motorcycle, suv, or some other motor vehicle, filing for chapter 13 bankruptcy.

Chapter 7 Bankruptcy vs Chapter 13 Bankruptcy Arizona Bankruptcy

Web if you have a car loan, the amount you owe on it may be reduced in the chapter 13 bankruptcy process if you owe more on it than its current value. No matter if you file a chapter 7 or a chapter 13, dealing with a bankruptcy isn't easy. Web what happens to your car, truck, van, motorcycle, or.

Use Chapter 13 Bankruptcy to keep your Car

Web whether you can keep two cars in a chapter 13 bankruptcy depends on a number of factors. Here's how the automatic stay protects you in two different repossession situations. In return, you must repay your creditors (in full or in part) through your chapter 13. Web if you have a car loan, the amount you owe on it may.

What Is Chapter 13 Bankruptcy and Is It Worth It? TheStreet

Web tax refunds in chapter 13 bankruptcy. By cara o'neill , attorney you'll keep all of your property in chapter 13 , including cars because the chapter 13 repayment plan affords benefits that aren't available in chapter. But in chapter 13, tax refunds based on income you earn while your bankruptcy. Here are some choices you and your attorney will.

How to Keep Your Car in Chapter 13 Bankruptcy CMC Law

It allows you to stop a repossession, catch up on your car payments, reduce your car loan and even give your car to the bank (lender) if you can’t make the payments on your car. They also might be able to reduce their debt on the loan. In chapter 13 bankruptcy, tax refunds based on income you earned before you.

Filing for Chapter 13 Bankruptcy in GA to Reduce Your Car Loan and

Depending on how much you owe and how much your car is worth, you may benefit from achapter 13. Here's how the automatic stay protects you in two different repossession situations. Web what happens to your car, truck, van, motorcycle, or another vehicle if you file for chapter 13 bankruptcy? No matter if you file a chapter 7 or a.

Web By Cara O'neill, Attorney Get Debt Relief Now.

If your lender has repossessed but not yet sold your car, truck, van, minivan, motorcycle, suv, or some other motor vehicle, filing for chapter 13 bankruptcy could allow you to get your vehicle back. We've helped 205 clients find attorneys today. Web in a chapter 13 bankruptcy, filers are usually able to keep their property. Discharging most unsecured debts such as credit card balances and medical debt, which saves money.

They Also Might Be Able To Reduce Their Debt On The Loan.

Here are some choices you and your attorney will consider. In chapter 13 bankruptcy, you'll stand a good chance of keeping your car. Web whether you can keep two cars in a chapter 13 bankruptcy depends on a number of factors. Web pros of switching to chapter 7.

Web Everyone Can Keep Their Car In Chapter 13 Bankruptcy, Even After Falling Behind On Payments.

In chapter 13 bankruptcy, tax refunds based on income you earned before you filed bankruptcy are part of your estate, just like chapter 7. Car loan cramdowns in bankruptcy. Learn how filing for chapter 13 bankruptcy can help you keep your vehicle from being repossessed and when you can use a cramdown to decrease the loan amount you'll need to pay. Web december 20, 2022.

In General, You Get To Keep Your Property, Including Cars, In Chapter 13 Bankruptcy.

Depending on how much you owe and how much your car is worth, you may benefit from achapter 13. A chapter 13 bankruptcy typically lasts from three to five years. Web by baran bulkat, attorney. Chapter 13 allows a debtor to keep property and pay debts over time,.