Chapter 13 100 Percent Plan

Chapter 13 100 Percent Plan - Under this chapter, debtors propose a repayment plan. Calculating a chapter 13 plan payment is somewhat complicated, so we've eliminated a few steps for simplicity. Web debtors whose plan is designed to pay off 100 percent of the outstanding debt may be able to exit bankruptcy earlier by making larger payments. 100 percent repayment plans are viable options for debtors in certain. You have now paid back ten percent of all you owe your creditors. Web pay 100% of the allowed claims filed in your case, or qualify for a hardship discharge to understand why your options for an early exit are limited, you need to know how this chapter works, including how your plan length and payment amounts get determined. So what if that percentage is 100%? To a significant degree, three factors will determine your chapter 13 plan type. It is required to pay back all secured. Web how to calculate chapter 13 plan payments.

A 100 % plan is a chapter 13 bankruptcy in which you develop a plan with your attorney and creditors to pay back your debt. Here's where you can find more priority debt categories (they're the same in chapters 7 and 13). Web many chapter 13 debtors pay only a small portion of their unsecured debts through the chapter 13 plan. Web generally in a projected 100% plan if less than all claims are timely filed and allowed it would result in an early discharge but would not change your plan payment. The best this article can do is provide a minimum monthly payment. Web how to calculate chapter 13 plan payments. Web chapter 13 bankruptcy: Is a chapter 13 bankruptcy still offer value? That's the monthly amount you'll pay. Web also, bankruptcy courts are likely to approve 100 percent repayment plans compared to ones that compensate fewer creditors.

“for the next 60 months,. Web paying 100% of your unsecured debt through a chapter 13 plan looks a lot different than paying 100% of the same debt directly. However, some pay all debt owed in what's called a 100% plan, or nothing in a zero percent plan. That plan in most cases is 5 years long, and it essentially says: Web calculating and proposing a feasible chapter 13 repayment plan is a complicated process that can't be explained with 100% accuracy in a short article. Web the answer is that even a 100% plan can save a debtor thousands of dollars over the 3 to 5 year life of the plan in the form of foregone interest, penalties and late fees. It enables individuals with regular income to develop a plan to repay all or part of their debts. The length of your plan Web also, bankruptcy courts are likely to approve 100 percent repayment plans compared to ones that compensate fewer creditors. Web many chapter 13 debtors pay only a small portion of their unsecured debts through the chapter 13 plan.

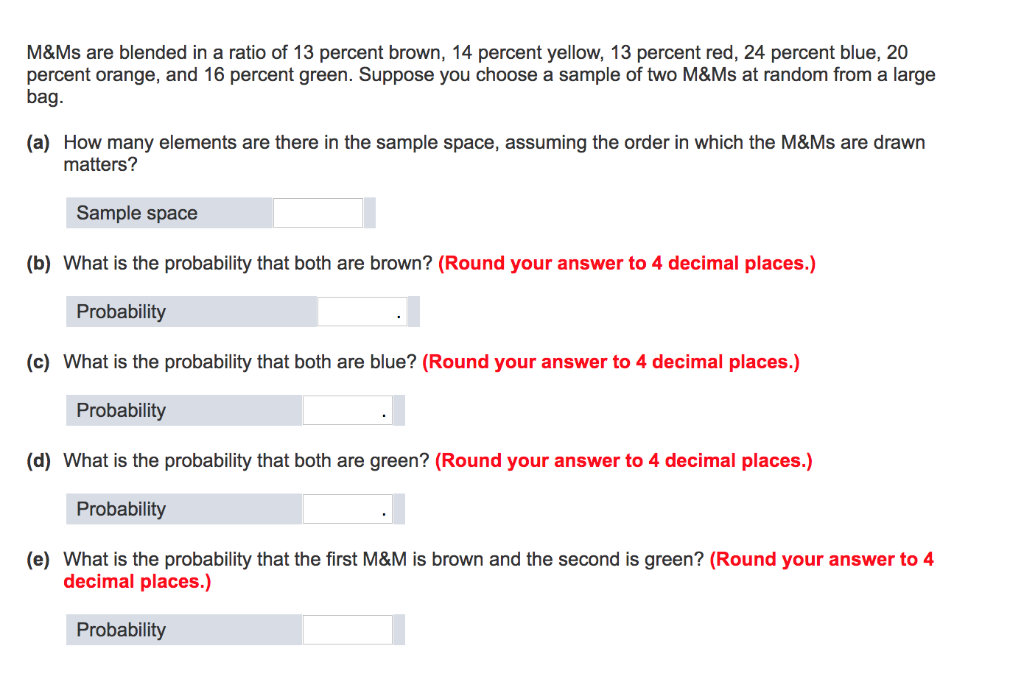

Solved M&Ms are blended in a ratio of 13 percent brown, 14

Web what is a chapter 13 100 percent bankruptcy plan? A 100 % plan is a chapter 13 bankruptcy in which you develop a plan with your attorney and creditors to pay back your debt. Web what is a 100% chapter 13 plan? 100 percent repayment plans are viable options for debtors in certain. Web paying less than 100% to.

COM 100 Chapter 13 YouTube

A 100 % plan is a chapter 13 bankruptcy in which you develop a plan with your attorney and creditors to pay back your debt. Learn more by reading unsecured debt in chapter 13… Web what is a 100% chapter 13 plan? Web in chapter 13 bankruptcy, you must devote all of your disposable income to your chapter 13 repayment.

Benefits of a part 13 100 percent Bundle

Web how to calculate chapter 13 plan payments. That's the monthly amount you'll pay. Web chapter 13 bankruptcy: Isn’t a 100% chapter 13 plan (as they are known) pretty. Unfortunately, your plan wasn’t 100 percent;

The 100 percent Plan YouTube

Web pay 100% of the allowed claims filed in your case, or qualify for a hardship discharge to understand why your options for an early exit are limited, you need to know how this chapter works, including how your plan length and payment amounts get determined. Web paying less than 100% to your unsecured creditors is considered a “composition plan”.

Selina Solutions Class 8 Concise Maths Chapter 7 Percent And Percentage

So what if that percentage is 100%? When you file a chapter 13 bankruptcy case, you present the court with a plan. Web also, bankruptcy courts are likely to approve 100 percent repayment plans compared to ones that compensate fewer creditors. The length of your plan Keep in mind that even if you can fund a chapter 13 plan.

Benefits of a part 13 100 percent Plan stjudescollege

Web also, bankruptcy courts are likely to approve 100 percent repayment plans compared to ones that compensate fewer creditors. It was only 10 percent. It enables individuals with regular income to develop a plan to repay all or part of their debts. Web pay 100% of the allowed claims filed in your case, or qualify for a hardship discharge to.

MEMORIZE Chapter 13

Web debtors whose plan is designed to pay off 100 percent of the outstanding debt may be able to exit bankruptcy earlier by making larger payments. That’s because, in a chapter 13 plan, 100% means 100% of the. That plan in most cases is 5 years long, and it essentially says: Is a chapter 13 bankruptcy still offer value? However,.

The 25 Plan Vantage Technology Consulting Group

It was only 10 percent. Calculating a chapter 13 plan payment is somewhat complicated, so we've eliminated a few steps for simplicity. Unfortunately, your plan wasn’t 100 percent; That's the monthly amount you'll pay. Web debtors whose plan is designed to pay off 100 percent of the outstanding debt may be able to exit bankruptcy earlier by making larger payments.

Top Ten Percent Plan in Texas IDRA

You pay back all secured debt (which is required in all chapter 13 cases) and 100%. Web what is a 100% chapter 13 plan? “for the next 60 months,. It was only 10 percent. Here's where you can find more priority debt categories (they're the same in chapters 7 and 13).

Benefits of a part 13 100 percent Plan stjudescollege

However, some pay all debt owed in what's called a 100% plan, or nothing in a zero percent plan. The length of your plan Web personal injury and wrongful death awards from driving under the influence, and. Web many chapter 13 debtors pay only a small portion of their unsecured debts through the chapter 13 plan. A 100 % plan.

That’s Because, In A Chapter 13 Plan, 100% Means 100% Of The.

It was only 10 percent. It is required to pay back all secured. It enables individuals with regular income to develop a plan to repay all or part of their debts. Web background a chapter 13 bankruptcy is also called a wage earner's plan.

You Have Now Paid Back Ten Percent Of All You Owe Your Creditors.

Isn’t a 100% chapter 13 plan (as they are known) pretty. The length of your plan Web what is a chapter 13 100 percent bankruptcy plan? Unfortunately, your plan wasn’t 100 percent;

A 100 % Plan Is A Chapter 13 Bankruptcy In Which You Develop A Plan With Your Attorney And Creditors To Pay Back Your Debt.

Web the hallmark of a chapter 13 bankruptcy case is the repayment plan you'll propose to the bankruptcy trustee, creditors, and the court. Calculating a chapter 13 repayment plan. Learn more by reading unsecured debt in chapter 13… You pay back all secured debt (which is required in all chapter 13 cases) and 100%.

Here's Where You Can Find More Priority Debt Categories (They're The Same In Chapters 7 And 13).

However, some pay all debt owed in what's called a 100% plan, or nothing in a zero percent plan. Web the answer is that even a 100% plan can save a debtor thousands of dollars over the 3 to 5 year life of the plan in the form of foregone interest, penalties and late fees. “for the next 60 months,. Your father gives you enough money to pay off the rest of your plan so that you can get out two years early.