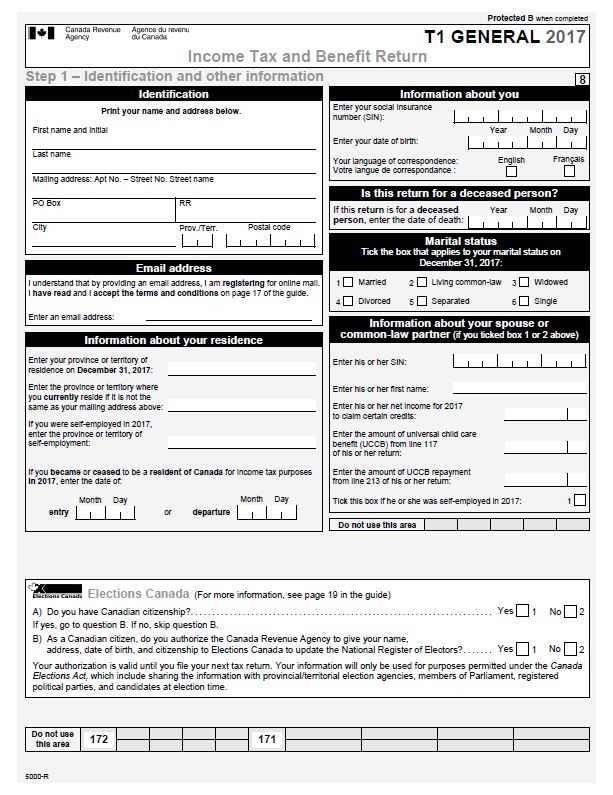

Canadian Td1 Form

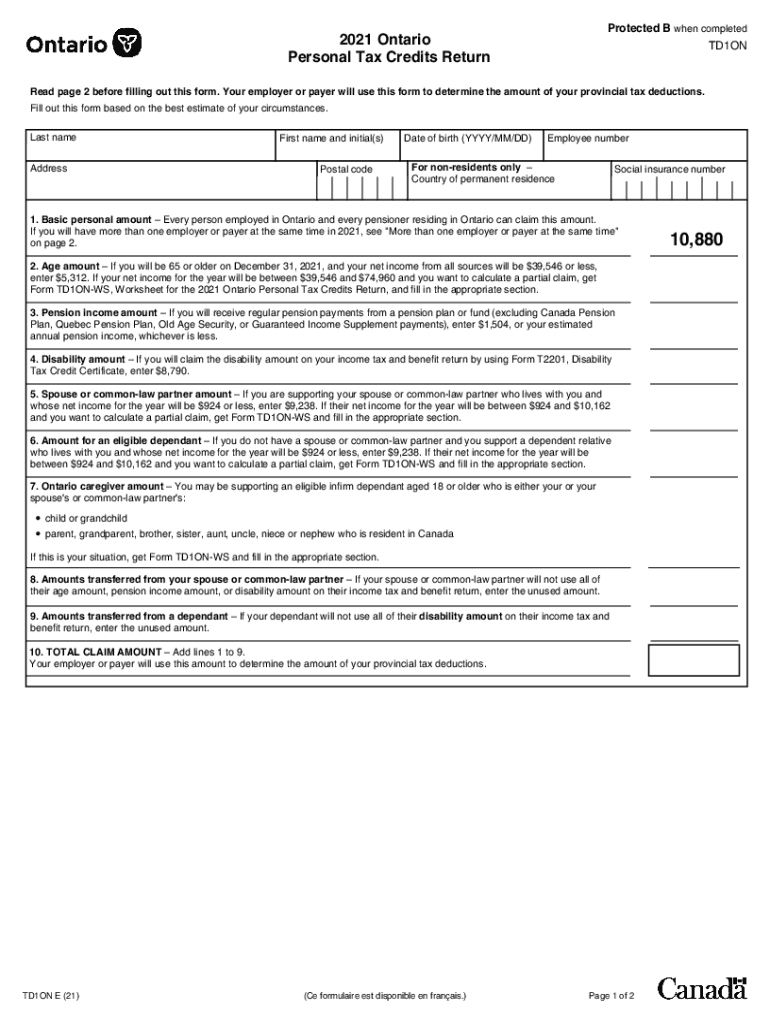

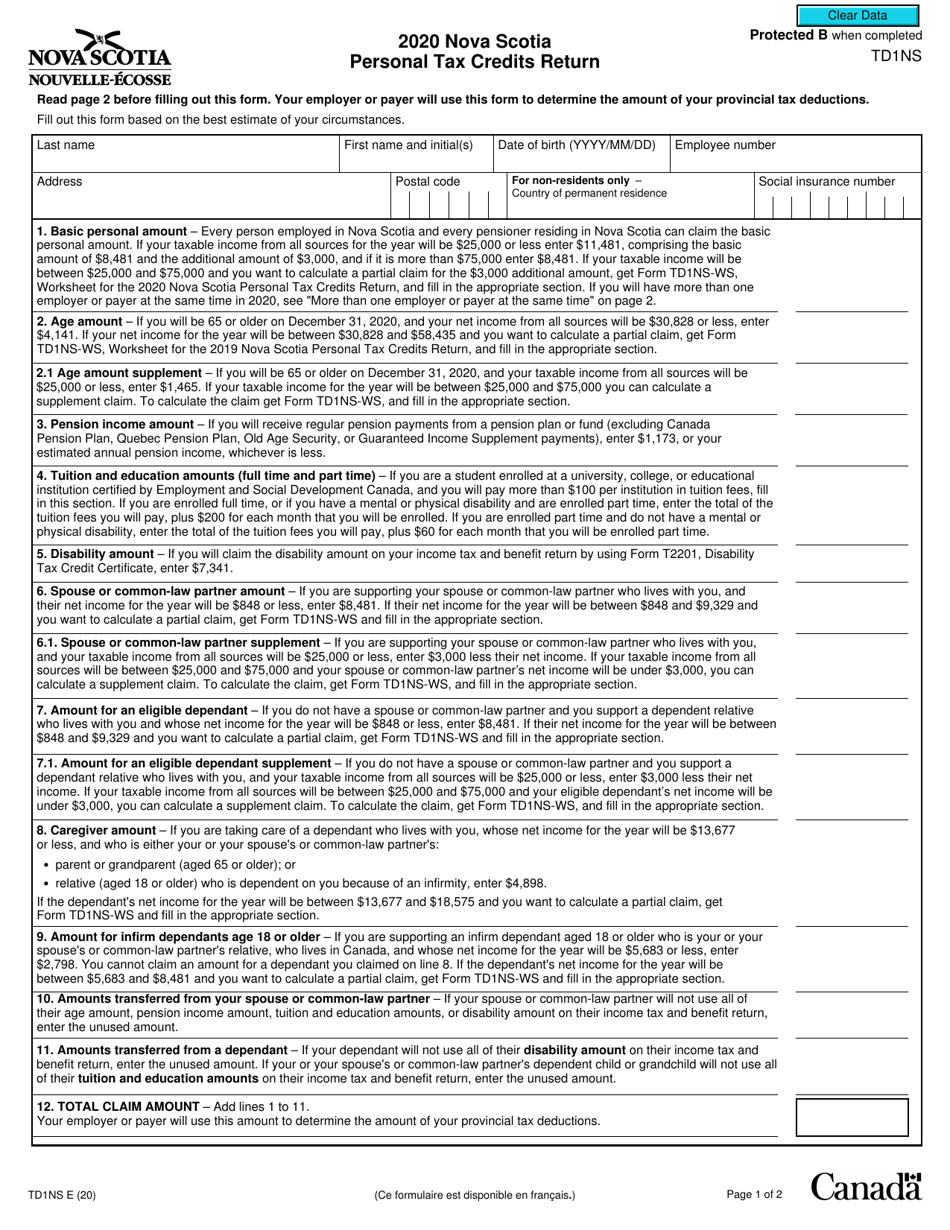

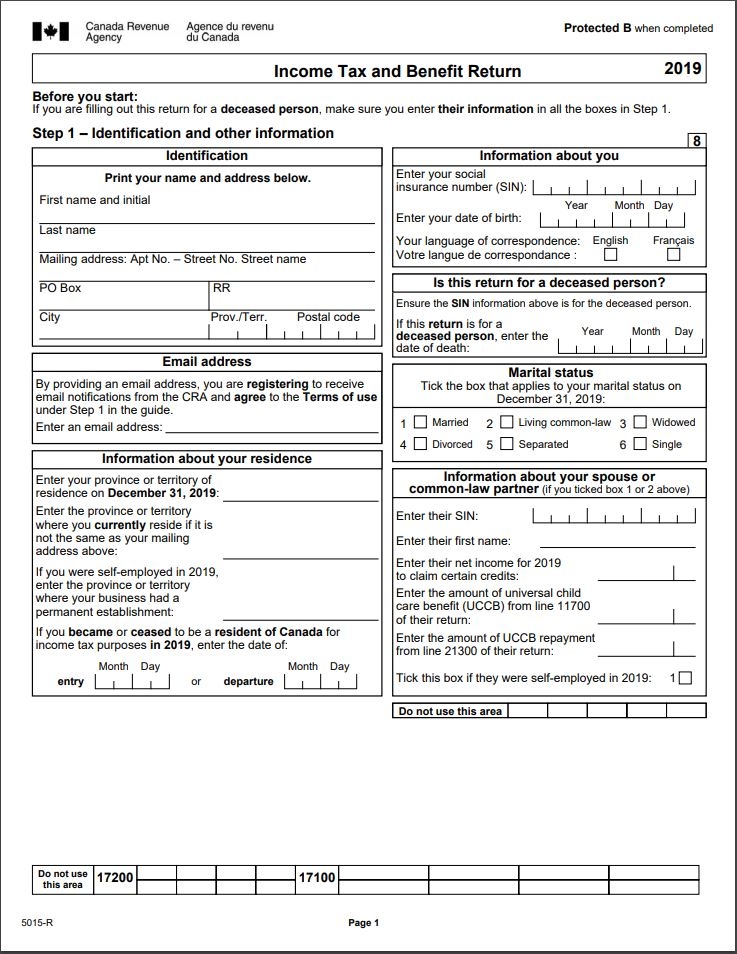

Canadian Td1 Form - The “basic personal amount” for 2021 is $13,808. Additional td1 forms apply to specific provinces. Employers collect these forms from their. Web the term “td1” refers to the national document that all employees resident in canada must complete. Web simply put, the td1 form gives the cra a means to accurately estimate how much a person will owe the government in taxes each fiscal year and make the required. Here is everything you need to know about the td1 form. Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online. If you are an employee, use the form td1 for your province or. Simply put, the purpose of the td1 form is to collect the correct amount of tax from each working person, and it is one of the most crucial tax. Employees and pensioners complete the federal form,.

Web create federal and provincial or territorial forms td1, following the instructions at electronic td1 form, and have your employees send them to you online. Form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. Web get the completed td1 forms. Here is everything you need to know about the td1 form. Web canada revenue agency provides employers with td1 personal tax credits return forms, both federal and provincial. The “basic personal amount” for 2021 is $13,808. Employers and pension payers are most likely to request you fill out. To know how much tax to deduct, each employee needs to. Web the td1 form is the more casual term for the canada revenue agency (cra) td1 personal tax credits returns form. Additional td1 forms apply to specific provinces.

Simply put, a td1, personal tax credits return, is a form that is necessary for. Simply put, the purpose of the td1 form is to collect the correct amount of tax from each working person, and it is one of the most crucial tax. The disability tax credit is $8.662. Here is everything you need to know about the td1 form. Web if your claim amount on line 13 is more than $13,229, you also have to fill out a provincial or territorial td1 form. The “basic personal amount” for 2021 is $13,808. Web the td1 form is the more casual term for the canada revenue agency (cra) td1 personal tax credits returns form. Employees and pensioners complete the federal form,. Web the term “td1” refers to the national document that all employees resident in canada must complete. Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online for best.

Your Bullsh*tFree Guide to Canadian Tax for Working Holidaymakers

To know how much tax to deduct, each employee needs to. Web your employer is required by law to ask you for some information about your particular tax situation, and that’s why they have asked you to complete a td1 form. Web the basic personal amount in 2022 is $14,398. Web td1 2021 personal tax credits return; Web the td1.

2021 Form Canada TD1ON Fill Online, Printable, Fillable, Blank pdfFiller

Web get the completed td1 forms. Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online for best. Web the td1 form is the more casual term for the canada revenue agency (cra) td1 personal tax credits returns form. These are labeled with extra. To.

Form TD1NS Download Fillable PDF or Fill Online Nova Scotia Personal

Web the td1 personal tax credits return is used to calculate the amount of income tax that will be deducted or withheld from your employment or pension income. Additional td1 forms apply to specific provinces. Web td1 2021 personal tax credits return; Td1ab 2021 alberta personal tax credits return;. Web canada revenue agency provides employers with td1 personal tax credits.

Free Electronic TD1BC Form TD1 British Columbia, Free Template from

Web january 6, 2023 tax credits! Web get the completed td1 forms. Web your employer is required by law to ask you for some information about your particular tax situation, and that’s why they have asked you to complete a td1 form. Here is everything you need to know about the td1 form. Simply put, the purpose of the td1.

Your Bullsh*tFree Guide to Canadian Tax for Working Holidaymakers

Web simply put, the td1 form gives the cra a means to accurately estimate how much a person will owe the government in taxes each fiscal year and make the required. Td1 forms for pay received; Web a td1 is simply a form used to calculate how much tax should be withheld from your payments. Web td1 personal tax credits.

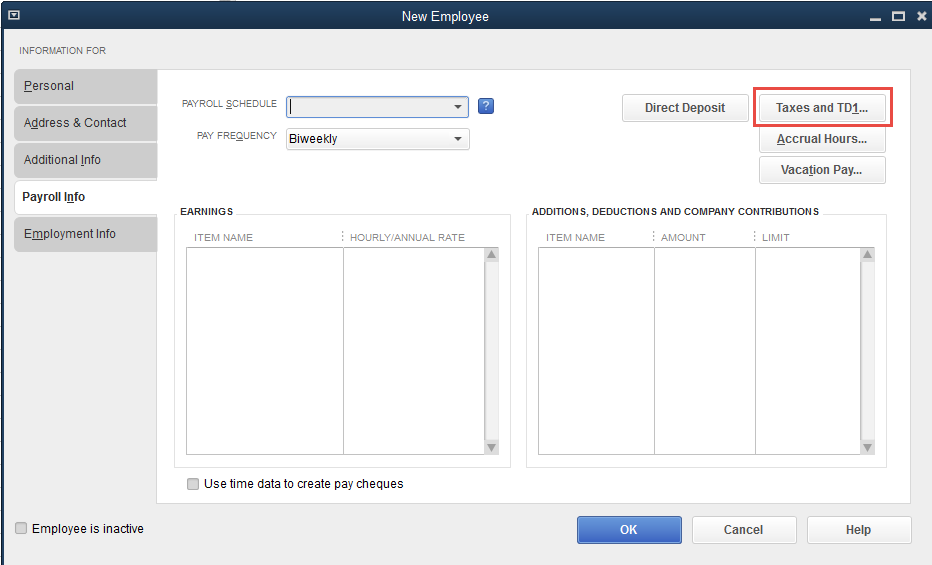

Changes to TD1 Basic Personal Amount calculation f... QuickBooks

Web the basic personal amount in 2022 is $14,398. Here is everything you need to know about the td1 form. Web create federal and provincial or territorial forms td1, following the instructions at electronic td1 form, and have your employees send them to you online. Simply put, a td1, personal tax credits return, is a form that is necessary for..

How to stop paying the Tax Man too much VazOxlade Toronto Star

Employers collect these forms from their. If you are an employee, use the form td1 for your province or. Web simply put, the td1 form gives the cra a means to accurately estimate how much a person will owe the government in taxes each fiscal year and make the required. Web january 6, 2023 tax credits! The disability tax credit.

Canadian provincial, territorial, and federal government aging policies

Web the td1 form is the more casual term for the canada revenue agency (cra) td1 personal tax credits returns form. Web get the completed td1 forms. Web create federal and provincial or territorial forms td1, following the instructions at electronic td1 form, and have your employees send them to you online. Web create federal and provincial or territorial forms.

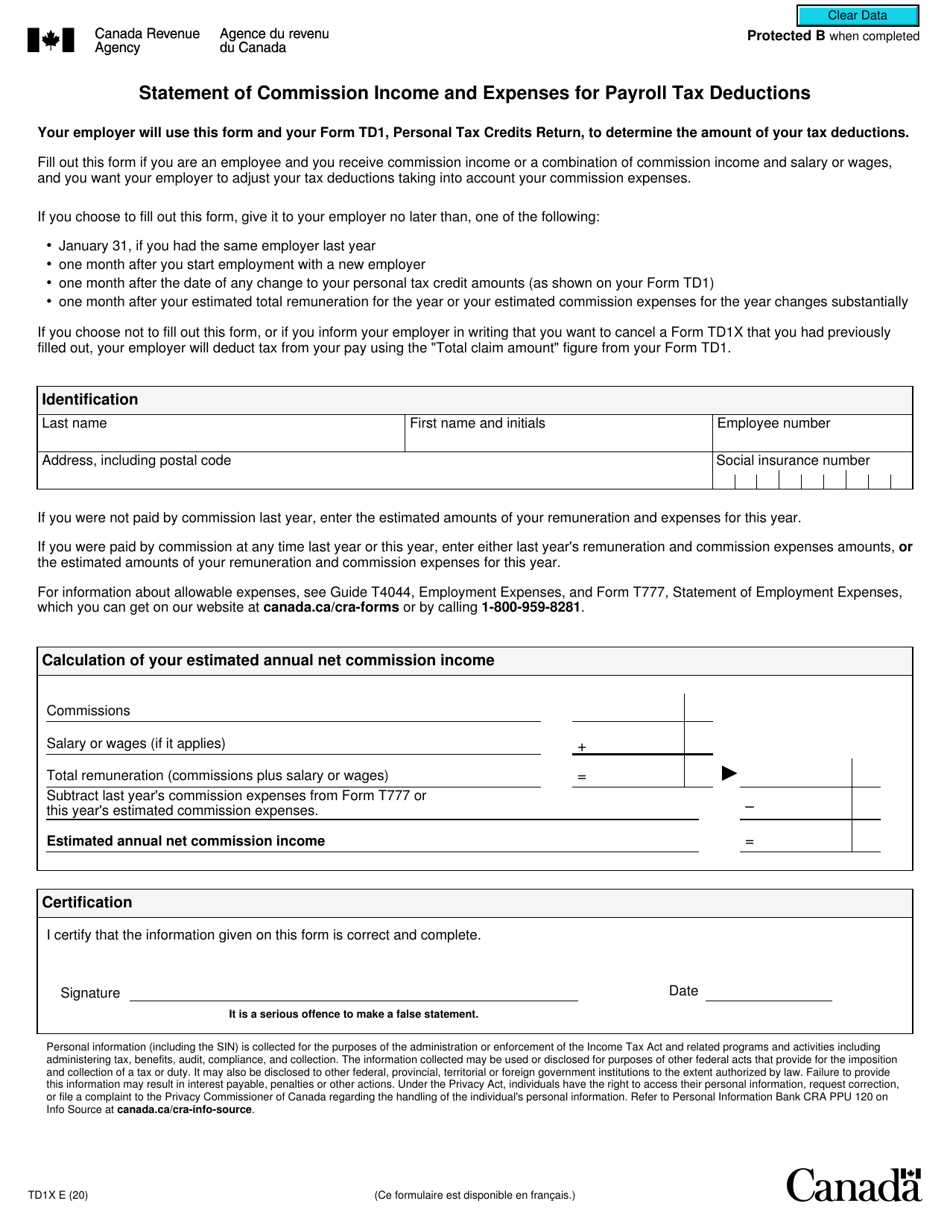

Form TD1X Download Fillable PDF or Fill Online Statement of Commission

The disability tax credit is $8.662. If you are an employee, use the form td1 for your province or. To reduce source deductions employees must submit a formal request by filling out the canada revenue agency’s form t1213. To know how much tax to deduct, each employee needs to. Additional td1 forms apply to specific provinces.

Fill Free fillable Government of Canada PDF forms

To reduce source deductions employees must submit a formal request by filling out the canada revenue agency’s form t1213. Web td1 personal tax credits return; Simply put, the purpose of the td1 form is to collect the correct amount of tax from each working person, and it is one of the most crucial tax. Web create federal and provincial or.

Web Create Federal And Provincial Or Territorial Forms Td1, Following The Instructions At Electronic Form Td1, And Have Your Employees Send Them To You Online For Best.

Td1ab 2021 alberta personal tax credits return;. Web canada revenue agency provides employers with td1 personal tax credits return forms, both federal and provincial. Employers collect these forms from their. Web get the completed td1 forms.

If You Are An Employee, Use The Form Td1 For Your Province Or.

Employers and pension payers are most likely to request you fill out. Web create federal and provincial or territorial forms td1, following the instructions at electronic td1 form, and have your employees send them to you online. Unfortunately, they aren’t magically calculated on your employee’s behalf. Web td1 2021 personal tax credits return;

The “Basic Personal Amount” For 2021 Is $13,808.

Web the tax allowances for 2021 are stipulated in the official td1 form. Web the basic personal amount in 2022 is $14,398. Web if your claim amount on line 13 is more than $13,229, you also have to fill out a provincial or territorial td1 form. Simply put, a td1, personal tax credits return, is a form that is necessary for.

Form Td1, Personal Tax Credits Return, Must Be Filled Out When Individuals Start A New Job Or They Want To Increase Income Tax Deductions.

To know how much tax to deduct, each employee needs to. Here is everything you need to know about the td1 form. Web the term “td1” refers to the national document that all employees resident in canada must complete. Web the td1 personal tax credits return is used to calculate the amount of income tax that will be deducted or withheld from your employment or pension income.