Can You Sue A Chapter 7 Trustee

Can You Sue A Chapter 7 Trustee - Web the chapter 7 trustee collects assets of the debtor that are not exempt under the bankruptcy code, liquidates the assets, and distributes the proceeds to creditors. In chapter 7 cases, the debtor does not have an absolute right to a discharge. If, however, there is no exempt property, the trustee. Before submitting the report, the trustee should be confident that there are no legal issues that could cause the united states trustee. § 109(h) and § 707(a). I have a complaint about the trustee in my chapter 7, chapter 12, or chapter 13 case. Jan 11th, 2019 most chapter 7 bankruptcy cases move through the process smoothly, but that’s not to say missteps don’t happen. Web michael anderson september 12, 2019. Web chapter 7 trustees begin asking for the next year's tax returns as early as september each year. A chapter 7 trustee can sell your house.

For all cases filed between january and may the trustee. The chapter 7 trustee or the chapter 13 trustee must refer the matter to the united states trustee who may file a motion to dismiss based on 11 u.s.c. § 109(h) and § 707(a). Web does the debtor have the right to a discharge or can creditors object to the discharge? Web the chapter 7 trustee collects assets of the debtor that are not exempt under the bankruptcy code, liquidates the assets, and distributes the proceeds to creditors. They continue to alk about tax refunds through may. Web if you own nonexempt property, the bankruptcy trustee (the person who oversees your bankruptcy petition) can sell it and distribute the proceeds to your creditors. Web chapter 7 bankruptcy — also known as liquidation or straight bankruptcy — is a process in which you are able to ask a bankruptcy court to wipe out most of your debts so you can start over. An objection to the debtor's discharge may be filed by a creditor, by the trustee in the case, or by the u.s. Web if you're a business owner and you file a personal chapter 7 bankruptcy, you might be able to keep your business.

You'll lose the business if the chapter 7 trustee can sell. § 109(h) and § 707(a). However, if you want to keep an item of nonexempt property, there’s a good chance that the trustee will let you. Where do i file my complaint? Web you likely have no lawsuit against the trustee for liquidating property in a chapter 7 that is their job. Web once a chapter 7 case has been fully administered, it is time for the trustee to submit the final report to the united states trustee. The short answer is yes. Web to lodge a complaint against a private trustee in a chapter 7, 12 or 13 bankruptcy case, a consumer debtor may contact the u.s. Before submitting the report, the trustee should be confident that there are no legal issues that could cause the united states trustee. I have a complaint about the trustee in my chapter 7, chapter 12, or chapter 13 case.

Can You Sue a Trustee for Negligence? Lowthorp Richards

Web to lodge a complaint against a private trustee in a chapter 7, 12 or 13 bankruptcy case, a consumer debtor may contact the u.s. Web after you file for chapter 7 bankruptcy, a number of things will happen. Web chapter 7 trustees begin asking for the next year's tax returns as early as september each year. In chapter 7.

Chapter 13 Trustee Free of Charge Creative Commons Chalkboard image

Trustee program field office if you have a. If you have an immediate concern about this, please call a chapter 7 lawyer right now and get your free consultation to discuss the matter with a bankruptcy lawyer. For all cases filed between january and may the trustee. However, it may be possible to vacate the sale of the property if.

Can You Sue Someone If They Infect You With Coronavirus? News

For all cases filed between january and may the trustee. Web after you file for chapter 7 bankruptcy, a number of things will happen. Web chapter 7 trustees begin asking for the next year's tax returns as early as september each year. Jan 11th, 2019 most chapter 7 bankruptcy cases move through the process smoothly, but that’s not to say.

What Is the Trustee’s Role in a Chapter 7 Bankruptcy?

However, it may be possible to vacate the sale of the property if it didn't realize any money for the. § 109(h) and § 707(a). Web chapter 7 bankruptcy — also known as liquidation or straight bankruptcy — is a process in which you are able to ask a bankruptcy court to wipe out most of your debts so you.

Free of Charge Creative Commons chapter 7 trustee Image Highway Signs 3

In chapter 7 cases, the debtor does not have an absolute right to a discharge. Web once a chapter 7 case has been fully administered, it is time for the trustee to submit the final report to the united states trustee. The chapter 7 trustee or the chapter 13 trustee must refer the matter to the united states trustee who.

Duties of a Trustee Chuck Newland

If you have an immediate concern about this, please call a chapter 7 lawyer right now and get your free consultation to discuss the matter with a bankruptcy lawyer. They continue to alk about tax refunds through may. Web the chapter 7 trustee collects assets of the debtor that are not exempt under the bankruptcy code, liquidates the assets, and.

Chapter 7 Trustee Free of Charge Creative Commons Typewriter image

Where do i file my complaint? Web to lodge a complaint against a private trustee in a chapter 7, 12 or 13 bankruptcy case, a consumer debtor may contact the u.s. Before submitting the report, the trustee should be confident that there are no legal issues that could cause the united states trustee. They continue to alk about tax refunds.

Chapter 7 Trustee Highway Sign image

In chapter 7 cases, the debtor does not have an absolute right to a discharge. A simple way to avoid problems is to become familiar with issues the chapter 7 bankruptcy trustee will consider red flags. I have a complaint about the trustee in my chapter 7, chapter 12, or chapter 13 case. Web to receive the additional payment, eligible.

Chapter 13 Trustee Free of Charge Creative Commons Post it Note image

Jan 11th, 2019 most chapter 7 bankruptcy cases move through the process smoothly, but that’s not to say missteps don’t happen. Web if you're a business owner and you file a personal chapter 7 bankruptcy, you might be able to keep your business. For all cases filed between january and may the trustee. A simple way to avoid problems is.

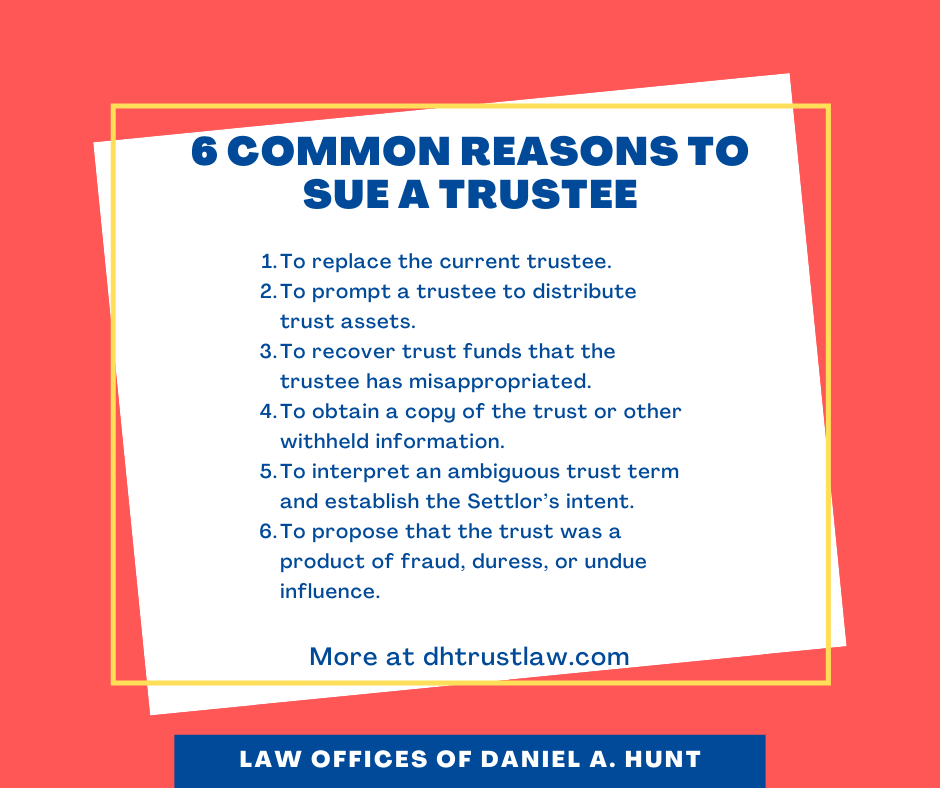

Why and How to Sue a Trustee • Law Offices of Daniel Hunt

The short answer is yes. For all cases filed between january and may the trustee. Web to be eligible to serve as a trustee in a chapter 7 case, a person must be: § 109(h) and § 707(a). In chapter 7 cases, the debtor does not have an absolute right to a discharge.

You May Contact The U.s.

I have a complaint about the trustee in my chapter 7, chapter 12, or chapter 13 case. In chapter 7 cases, the debtor does not have an absolute right to a discharge. Where do i file my complaint? Web chapter 7 trustees begin asking for the next year's tax returns as early as september each year.

Before Submitting The Report, The Trustee Should Be Confident That There Are No Legal Issues That Could Cause The United States Trustee.

Web to receive the additional payment, eligible chapter 7 trustees must certify they have rendered services pursuant to the regulations via the filing of a “trustee services rendered pursuant to 330 (e)”. Web if you're a business owner and you file a personal chapter 7 bankruptcy, you might be able to keep your business. However, it may be possible to vacate the sale of the property if it didn't realize any money for the. § 109(h) and § 707(a).

A Chapter 7 Trustee Can Sell Your House.

If, however, there is no exempt property, the trustee. Trustee program field office in his region. Web the chapter 7 trustee collects assets of the debtor that are not exempt under the bankruptcy code, liquidates the assets, and distributes the proceeds to creditors. 1) you will be assigned a bankruptcy trustee who will oversee your filing.

The Short Answer Is Yes.

Jan 11th, 2019 most chapter 7 bankruptcy cases move through the process smoothly, but that’s not to say missteps don’t happen. Web you likely have no lawsuit against the trustee for liquidating property in a chapter 7 that is their job. Web once a chapter 7 case has been fully administered, it is time for the trustee to submit the final report to the united states trustee. Web to be eligible to serve as a trustee in a chapter 7 case, a person must be: