Can Form 1310 Be Filed Electronically

Can Form 1310 Be Filed Electronically - Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Depending on how the questions are answered on the 1310, it is possible to efile with the 1310 in. Complete, edit or print tax forms instantly. Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations: Answer the questions based on the decedent’s situation. Web depending on the circumstances, form 1310 can be filed electronically. If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics and. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. In care of addresseeelectronic filing information worksheet.

If paper filed, also include the taxpayer’s date of death across. Date now extended to october 31, 2023, for using electronic signatures,. Web yes, it can. Complete, edit or print tax forms instantly. Web the irs has set specific electronic filing guidelines for form 1310. Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Web depending on the circumstances, form 1310 can be filed electronically. In care of addresseeelectronic filing information worksheet. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310.

If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics and. You just need to attach a copy of the court certificate. In care of addresseeelectronic filing information worksheet. Get ready for tax season deadlines by completing any required tax forms today. Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations: If the return is not able to be e. Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. Get ready for tax season deadlines by completing any required tax forms today. From within your taxact return ( online or desktop), click federal. Depending on how the questions are answered on the 1310, it is possible to efile with the 1310 in.

EFiling Forms W2 and 1099MISC

Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Ad access irs.

Form 1065 Instructions 2020 2021 IRS Forms Zrivo

To access form 1310 in the. Date now extended to october 31, 2023, for using electronic signatures,. Depending on the circumstances, a return that includes form 1310 may or may not be able to be filed electronically. Web yes, it can. You can prepare the form and then mail it in to the same irs service center as the decedent's.

Filing 20686047 Electronically Filed 11/18/2014 114328 AM

Complete, edit or print tax forms instantly. If paper filed, also include the taxpayer’s date of death across. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. From within your taxact return ( online or desktop), click federal. Date now extended to october 31,.

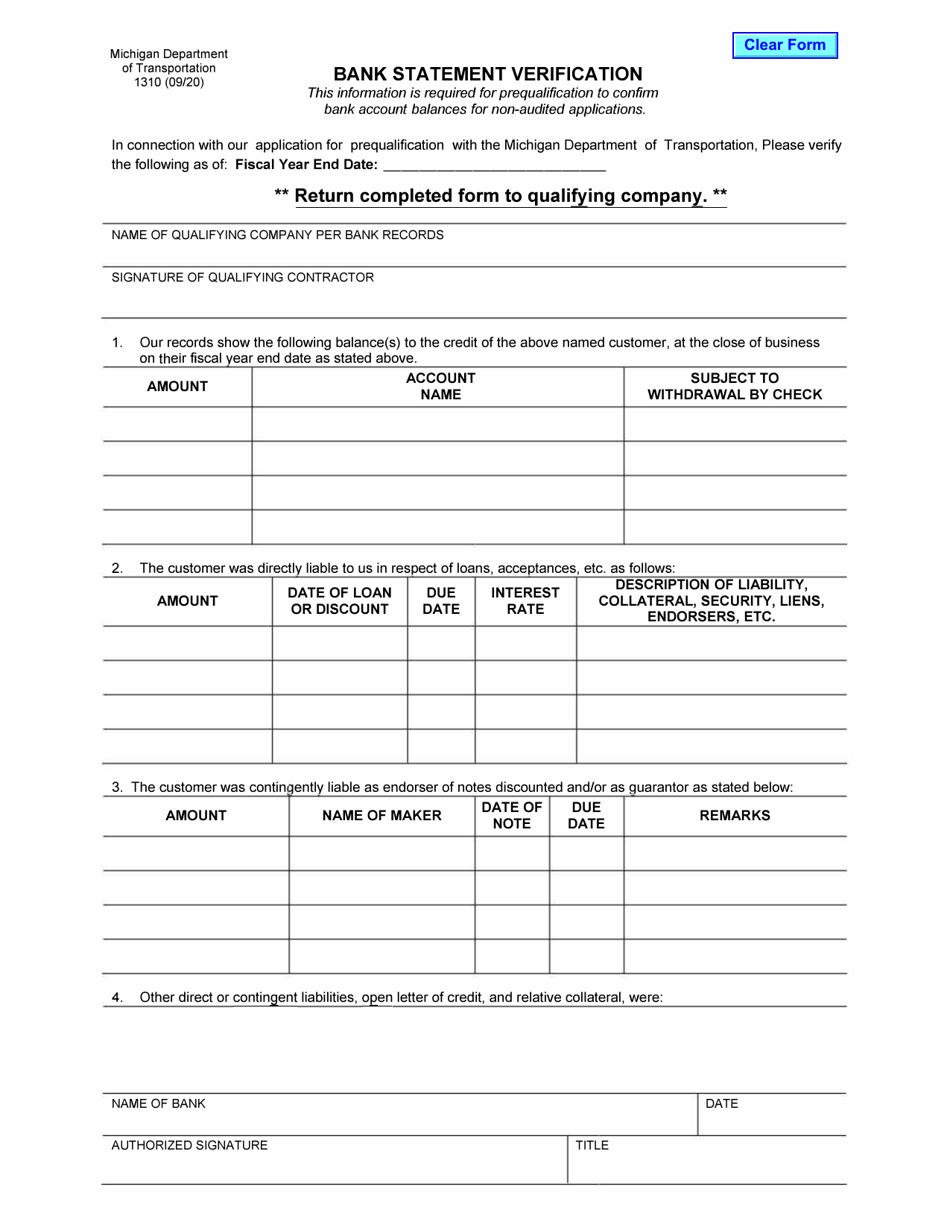

Form 1310 Download Fillable PDF or Fill Online Bank Statement

If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics and. Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations: For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. Depending on.

Which IRS Form Can Be Filed Electronically?

In care of addresseeelectronic filing information worksheet. If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics and. If paper filed, also include the taxpayer’s date of death across. If the return is not able to be e. You can prepare the form and then mail it in to the same.

Irs Form 1310 Printable 2020 2021 Blank Sample to Fill out Online

Web yes, it can. Date now extended to october 31, 2023, for using electronic signatures,. Complete, edit or print tax forms instantly. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web 9 rows the irs has set specific electronic.

Courtesy Copy Original Filed Electronically Stock Stamp HC Brands

Get ready for tax season deadlines by completing any required tax forms today. Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Answer the questions based on the decedent’s situation. To access form 1310 in the. Web the irs has set specific electronic filing guidelines for form 1310.

Form 1310 Edit, Fill, Sign Online Handypdf

Date now extended to october 31, 2023, for using electronic signatures,. If paper filed, also include the taxpayer’s date of death across. Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. Ad access irs tax forms. To access form 1310 in the.

Fill Free fillable Statement of Person Claiming Refund Due a Deceased

Get ready for tax season deadlines by completing any required tax forms today. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. You just need to attach a copy of the court certificate. Web the final return of a deceased taxpayer may be eligible for electronic filing in the.

What are the Different Types of State Court Records?

Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Web the irs has set specific electronic filing guidelines for form 1310. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. For form 1310 to be generated, the date of death field on screen 1 must be.

Web Yes, You Can File Irs Form 1310 In Turbotax To Claim The Tax Refund For A Decedent Return (A Return Filed On The Behalf Of A Deceased Taxpayer).

For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. In care of addresseeelectronic filing information worksheet. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. Answer the questions based on the decedent’s situation.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web if you aren't filing a joint return as the surviving spouse and a personal representative hasn't been appointed, file the return and attach form 1310. Web the irs has set specific electronic filing guidelines for form 1310. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. To access form 1310 in the.

If The Return Is Not Able To Be E.

If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics and. Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations: Ad access irs tax forms. Depending on the circumstances, a return that includes form 1310 may or may not be able to be filed electronically.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Depending on how the questions are answered on the 1310, it is possible to efile with the 1310 in. From within your taxact return ( online or desktop), click federal. Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. You just need to attach a copy of the court certificate.

/171358289-filing-electronically-56a0a44a3df78cafdaa38873.jpg)