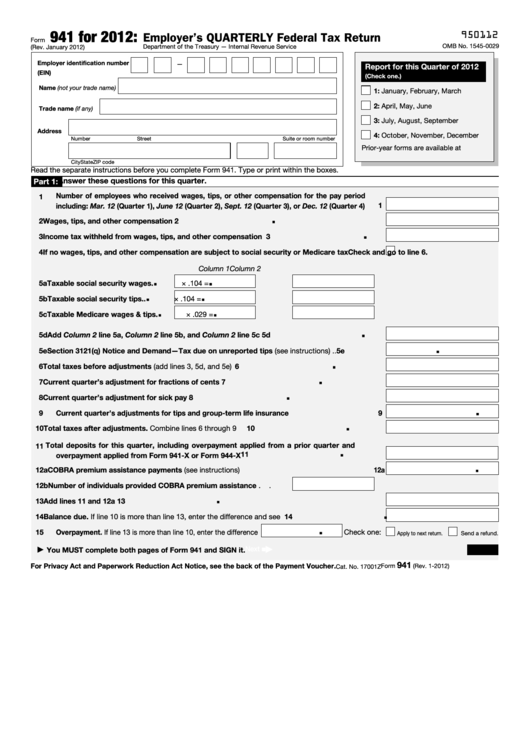

Can Federal Form 941 Be Filed Electronically

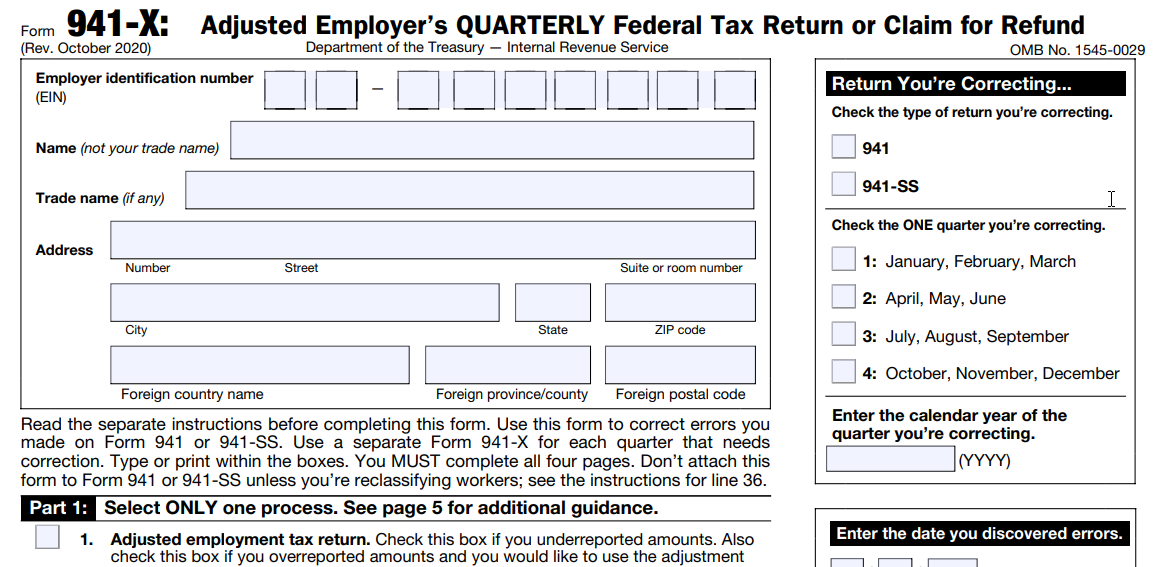

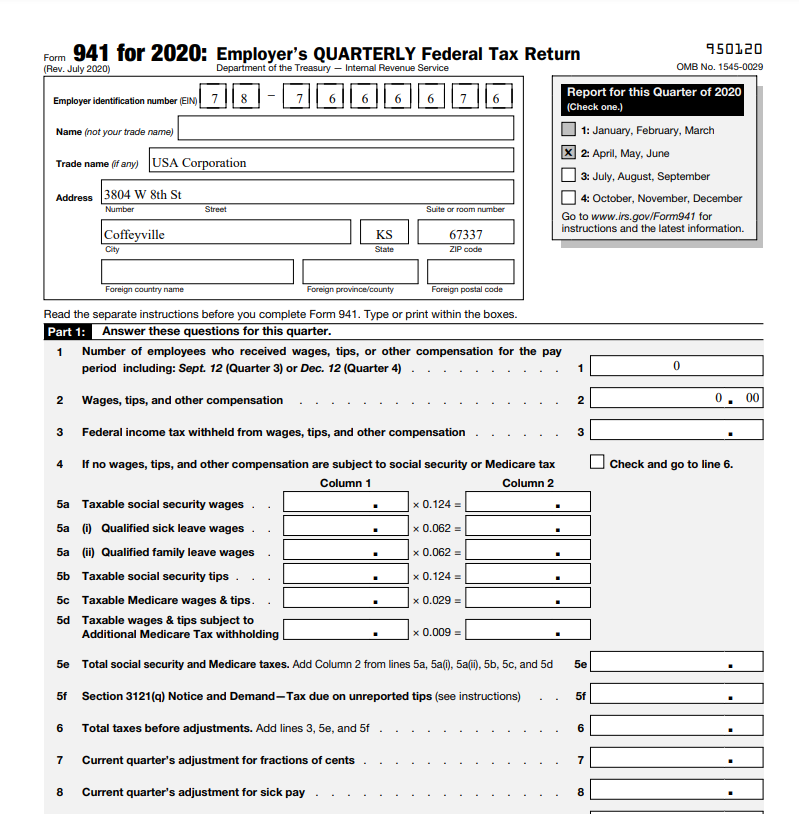

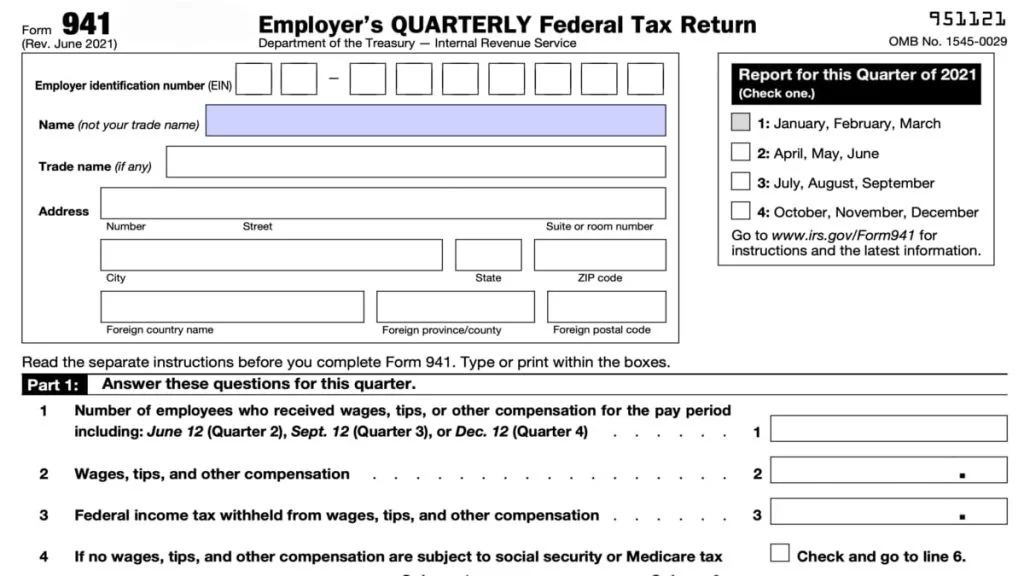

Can Federal Form 941 Be Filed Electronically - Web (see the updated form 941 mailing addresses starting on page 3.) at the same time, the irs encourages employers to consider filing their federal employment tax returns. You will have to use. Form 941 is used by employers. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile. Schedule r (form 941) is filed as an attachment to. Employers use this form to report income. Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. However, you cannot file forms directly with the irs. Web select federal form 941 from the list, then click edit.

Yes, you can file form 941 electronically. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule &. Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Those returns are processed in. Web mailing addresses for forms 941. For more information about a Web why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile. However, you cannot file forms directly with the irs. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return.

Those returns are processed in. Web cpeos must generally file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers, electronically. Web payroll tax returns. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web there are two options for filing form 941: Web eftps is ideal for making recurring payments such as estimated tax payments and federal tax deposits (ftds). Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Web mailing addresses for forms 941. Employers use this form to report income. For more information about a

For Now, IRS Okays ESignatures On Tax Forms That Can’t Be Filed

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web cpeos must generally file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers, electronically. Connecticut, delaware, district of columbia, georgia,. Ad file irs form 941 online in minutes. Web select federal form 941.

A The first quarter tax return needs to be filed for Prevosti Farms and

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Schedule r (form 941) is filed as an attachment to. Web payroll tax returns. Connecticut, delaware, district of columbia, georgia,. Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s.

941 Form 2023

Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Schedule r (form 941) is filed as an attachment to. For more information about.

Solved Required Complete Form 941 for Prevosti Farms and

However, you cannot file forms directly with the irs. Web cpeos must generally file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers, electronically. Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Web payroll tax returns. Those returns are processed in.

Form 941 Employer's Quarterly Federal Tax Return Definition

For more information about a Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Yes, you can file form 941 electronically. However, you cannot file forms directly with the irs. Web (see the updated form 941 mailing addresses starting on page 3.) at the same time, the irs encourages employers.

941 Employee Federal Tax Form 2023

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule &. Web select federal form 941 from the list, then click edit. Web eftps is ideal for making recurring payments such as.

How to fill out IRS Form 941 2019 PDF Expert

Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Employers use this form to report income. As of july 13, 2023,.

EFile Form 941 for 2022 File 941 Electronically at 4.95

Web mailing addresses for forms 941. Web payroll tax returns. Web (see the updated form 941 mailing addresses starting on page 3.) at the same time, the irs encourages employers to consider filing their federal employment tax returns. Web cpeos must generally file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers, electronically. As of.

IRS Form 941 Schedule B 2023

Web cpeos must generally file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers, electronically. Web why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter.

What is Federal Form 941 for employers? How to Download Form 941 Using

Web eftps is ideal for making recurring payments such as estimated tax payments and federal tax deposits (ftds). As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web (see the updated form 941 mailing addresses starting on page 3.) at the same time, the irs encourages employers to consider filing their federal.

Web Ein, “Form 941,” And The Tax Period (“1St Quarter 2023,” “2Nd Quarter 2023,” “3Rd Quarter 2023,” Or “4Th Quarter 2023”) On Your Check Or Money Order.

Those returns are processed in. Web select federal form 941 from the list, then click edit. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web payroll tax returns.

For More Information About A

Form 941 is used by employers. Employers use this form to report income. You will have to use. Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s.

Yes, You Can File Form 941 Electronically.

Connecticut, delaware, district of columbia, georgia,. Web why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile. Web there are two options for filing form 941: Ad file irs form 941 online in minutes.

Web Eftps Is Ideal For Making Recurring Payments Such As Estimated Tax Payments And Federal Tax Deposits (Ftds).

1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule &. Web (see the updated form 941 mailing addresses starting on page 3.) at the same time, the irs encourages employers to consider filing their federal employment tax returns. However, you cannot file forms directly with the irs. Schedule r (form 941) is filed as an attachment to.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)