Can An Llc File For Chapter 11

Can An Llc File For Chapter 11 - Web the chapter 11 filing would cover rite aid’s more than $3.3 billion debt load and pending legal allegations that it oversupplied prescription painkillers, the newspaper reported. Web filing a chapter 11 bankruptcy if the llc members want the business to continue operating despite the debts, filing for a chapter 11 can be an option. Under chapter 11, the firm's management oversees daily operations. However, the debtor has only 300 days to propose a chapter 11 plan in small business cases. Although they cannot discharge their debts in a chapter 7, they can under certain circumstances in a chapter 11. Chapter 11 is highly complex and the odds of successfully re organizing are not good unless you have experienced counsel. Consolidate your debt to save with one lower monthly payment. Businesses going through this type of bankruptcy are past the stage of reorganization and must sell off assets to. Web a corporation or llc has two options for filing bankruptcy: Web despite statutory certainty governing the formation and operation of llcs and the contractual flexibility permitted in operating agreements governing the llc and its membership interests, the bankruptcy code (11.

See if you qualify to save monthly on your debt. Web the chapter 11 filing would cover rite aid’s more than $3.3 billion debt load and pending legal allegations that it oversupplied prescription painkillers, the newspaper reported. Individuals may also file under chapter 7 or chapter 11. Compare top 5 consolidation options. And whether the llc can. Web chapter 11 is the only bankruptcy option, however, for a small business seeking to restructure and continue in operation if it is owned by a partnership, limited liability company, or corporation. Web generally, there is no deadline for filing a chapter 11 plan unless set by the bankruptcy court. Web despite statutory certainty governing the formation and operation of llcs and the contractual flexibility permitted in operating agreements governing the llc and its membership interests, the bankruptcy code (11. Partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Web often times our business bankruptcy lawyers receive calls from clients in dire financial straits asking whether a limited liability company (llc) can file for chapter 11 bankruptcy here in.

Llc and bankruptcy is a combination that points to the need for bankruptcy protection, which can offer a sense of relief when your limited liability company (llc) cannot pay its debts. Chapter 11 is highly complex and the odds of successfully re organizing are not good unless you have experienced counsel. However, the company directs significant. Web chapter 7 bankruptcy is sometimes called “liquidation” bankruptcy. Web the chapter 11 filing would cover rite aid’s more than $3.3 billion debt load and pending legal allegations that it oversupplied prescription painkillers, the newspaper reported. Web if the llc is a corporation, normal corporate tax rules will apply to the llc and it should file a form 1120, u.s. (chapter 13, the other reorganization bankruptcy, can. The 1120 is the c corporation income tax return, and. Consolidate your debt to save with one lower monthly payment. Get the tax answers you need.

the boy scouts of america filed for bankruptcy protection early today

Web despite statutory certainty governing the formation and operation of llcs and the contractual flexibility permitted in operating agreements governing the llc and its membership interests, the bankruptcy code (11. However, the debtor has only 300 days to propose a chapter 11 plan in small business cases. Web is an llc eligible for a business bankruptcy under chapter 11 bankruptcy.

28+ Chapter 7 Bankruptcy Texas ChaniceLeonel

Web if the llc is a corporation, normal corporate tax rules will apply to the llc and it should file a form 1120, u.s. In a business chapter 7 bankruptcy, the business is closed, all assets are liquidated by the bankruptcy trustee,. Such a plan often allows the debtor in possession to liquidate the business under more economically advantageous circumstances.

RI Bankruptcy Lawyer John Simonian Can I Refinance My Mortgage If I

Web no, a corporation or llc cannot represent itself in a chapter 11 proceeding you must have counsel. Partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Such a plan often allows the debtor in possession to liquidate the business under more economically advantageous circumstances than a chapter. Web failure to file returns and/or.

Rental Information How to Prevent Evictions During COVID19 Nicklin

The 1120 is the c corporation income tax return, and. Web despite statutory certainty governing the formation and operation of llcs and the contractual flexibility permitted in operating agreements governing the llc and its membership interests, the bankruptcy code (11. Web generally, there is no deadline for filing a chapter 11 plan unless set by the bankruptcy court. Web evergrande.

Ghost Ship Landlord, Surviving Victims Negotiate Civil Settlement

Businesses going through this type of bankruptcy are past the stage of reorganization and must sell off assets to. Web if the llc is a corporation, normal corporate tax rules will apply to the llc and it should file a form 1120, u.s. Web often times our business bankruptcy lawyers receive calls from clients in dire financial straits asking whether.

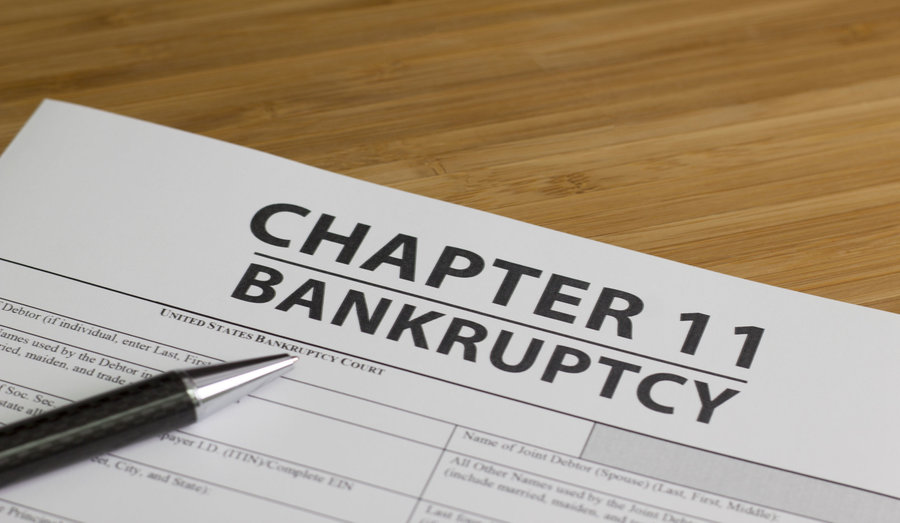

Chapter 11 Cramdown of Secured Debts Steiner Law Group, LLC

Web evergrande has said creditors may be able to vote this month on a restructuring, with possible approval by hong kong and british virgin islands courts in the first week of september. A chapter 11 bankruptcy will allow the business to. And whether the llc can. (chapter 13, the other reorganization bankruptcy, can. Web despite statutory certainty governing the formation.

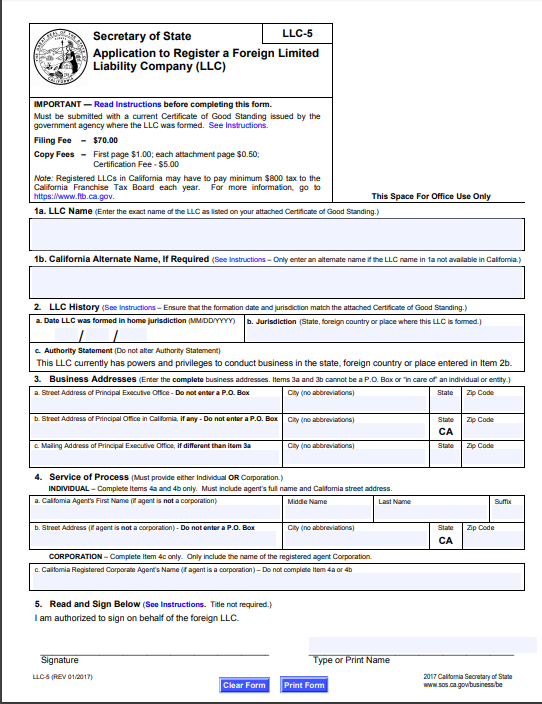

file an llc california California Secretary of State Expedited Filing

And whether the llc can. However, the company directs significant. A chapter 11 bankruptcy will allow the business to. Web the chapter 11 filing would cover rite aid’s more than $3.3 billion debt load and pending legal allegations that it oversupplied prescription painkillers, the newspaper reported. Consolidate your debt to save with one lower monthly payment.

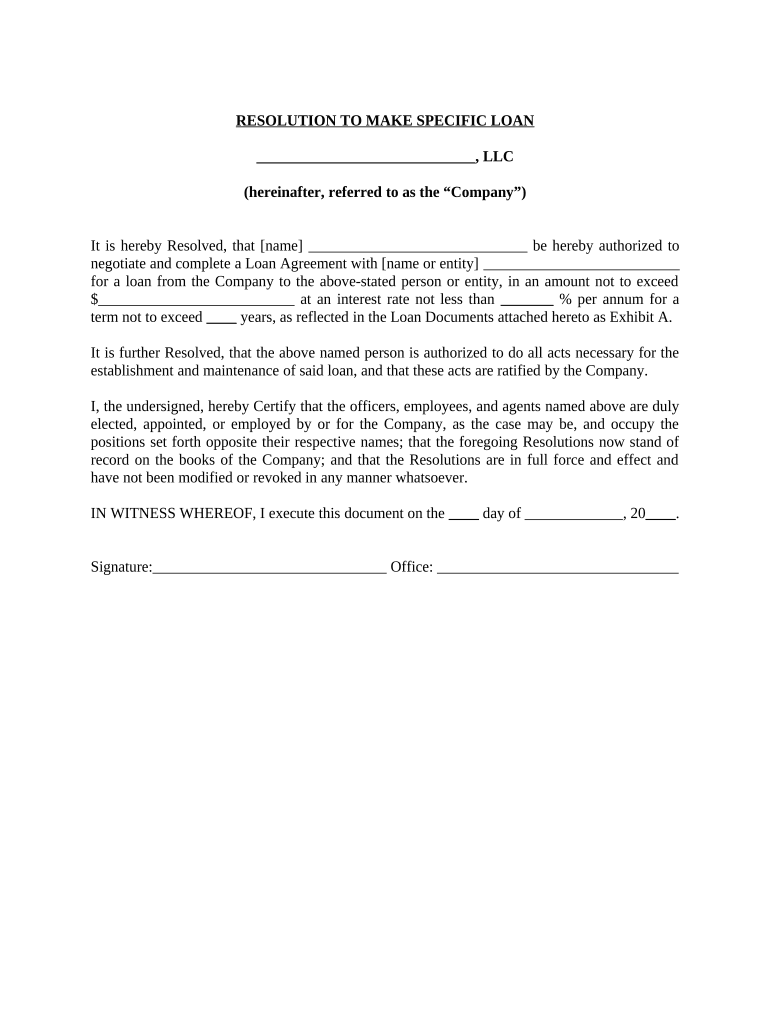

Resolution Llc Members Form Fill Out and Sign Printable PDF Template

Partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Llc and bankruptcy is a combination that points to the need for bankruptcy protection, which can offer a sense of relief when your limited liability company (llc) cannot pay its debts. Get the tax answers you need. Individuals may also file under chapter 7 or.

Remington Preparing to Declare Bankruptcy RedTea News

Web failure to file returns and/or pay current taxes during your bankruptcy may result in your case being dismissed. And whether the llc can. However, the company directs significant. Compare top 5 consolidation options. Although they cannot discharge their debts in a chapter 7, they can under certain circumstances in a chapter 11.

IMG_3355 Because We Can, LLC is a Design Build Studio loca… Flickr

Chapter 11 is highly complex and the odds of successfully re organizing are not good unless you have experienced counsel. See if you qualify to save monthly on your debt. Web if the llc is a corporation, normal corporate tax rules will apply to the llc and it should file a form 1120, u.s. Web a corporation or llc has.

Compare Top 5 Consolidation Options.

However, the debtor has only 300 days to propose a chapter 11 plan in small business cases. Partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. See if you qualify to save monthly on your debt. Businesses going through this type of bankruptcy are past the stage of reorganization and must sell off assets to.

Web A Corporation Or Llc Has Two Options For Filing Bankruptcy:

Web if the llc is a corporation, normal corporate tax rules will apply to the llc and it should file a form 1120, u.s. A case filed under chapter 11 of the bankruptcy code is frequently referred to as a “reorganization.”. Web no, a corporation or llc cannot represent itself in a chapter 11 proceeding you must have counsel. Web generally, there is no deadline for filing a chapter 11 plan unless set by the bankruptcy court.

Llc And Bankruptcy Is A Combination That Points To The Need For Bankruptcy Protection, Which Can Offer A Sense Of Relief When Your Limited Liability Company (Llc) Cannot Pay Its Debts.

Individuals may also file under chapter 7 or chapter 11. The good thing about llc. (chapter 13, the other reorganization bankruptcy, can. Find out what tax credits you might qualify for, and other tax savings opportunities.

Web Corporations Or Llc’s Can File Either Chapter 7 Bankruptcy Or Chapter 11 Bankruptcy, But Not Chapter 13 Bankruptcy.

Web often times our business bankruptcy lawyers receive calls from clients in dire financial straits asking whether a limited liability company (llc) can file for chapter 11 bankruptcy here in. Web in a chapter 11 case, a liquidating plan is permissible. And whether the llc can. In a business chapter 7 bankruptcy, the business is closed, all assets are liquidated by the bankruptcy trustee,.