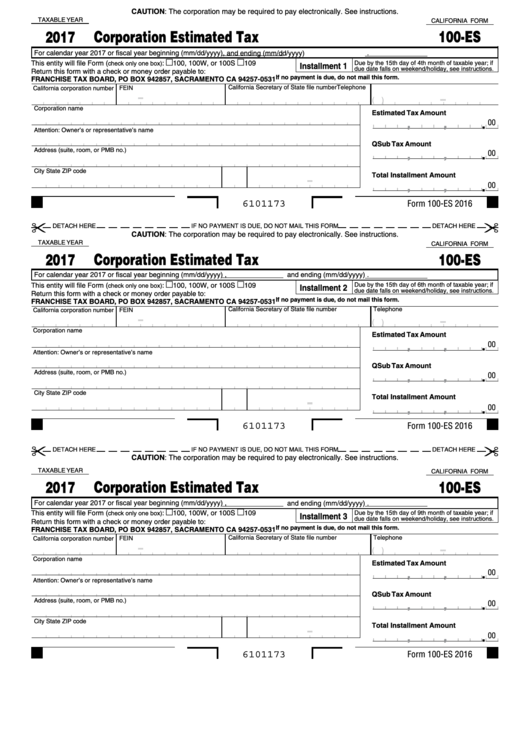

Ca Form 100 Es

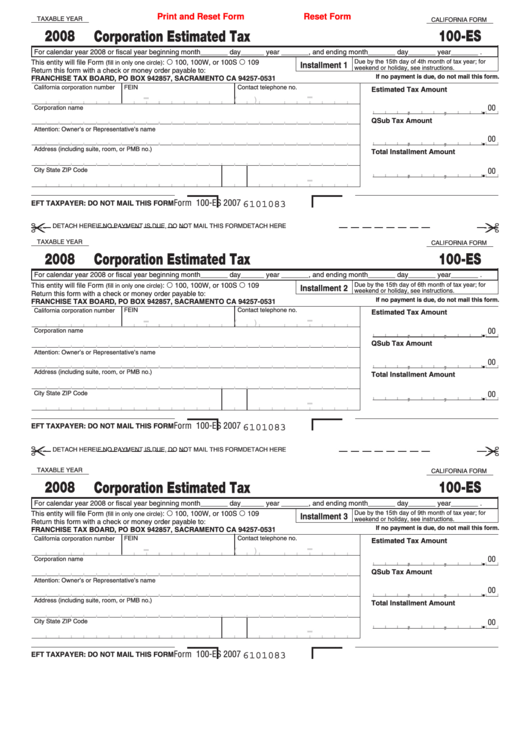

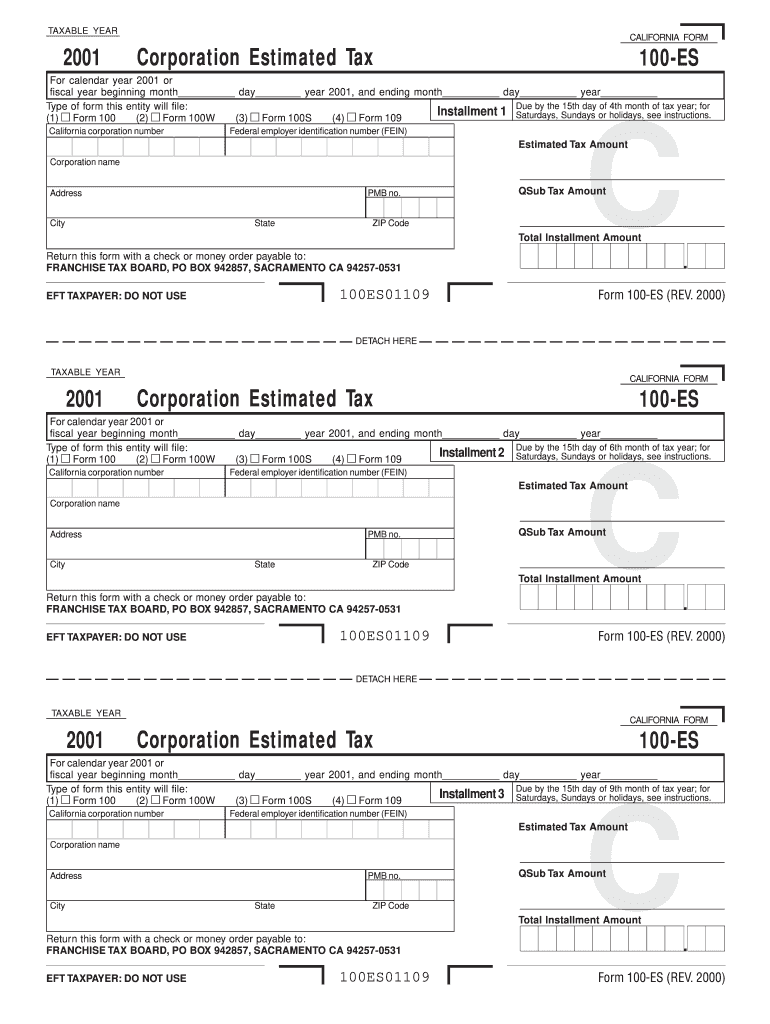

Ca Form 100 Es - 3601213form 100 2021 side 1. For calendar year 2023 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). Web select this payment type if you are filing an amended tax return (form 100x) with a balance due. This entity will file form (check only one box): 2021 california corporation franchise or income tax. Check only one box on form 100‑es to indicate if the estimate payment is for form 100, california corporation franchise or. Web determine the estimated tax requirement for california. Web estimated tax requirement for california. This entity will file form (check only one box):. 2022 s corporation income tax returns due and tax due (for calendar.

For calendar year 2020 or fiscal year beginning (mm/dd/yyyy) , for calendar year. For calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). Due by the 15th day of 4th month of taxable year; This entity will file form (check only one box): Due date falls on weekend/holiday, see instructions. Web determine the estimated tax requirement for california. Web select this payment type if you are filing an amended tax return (form 100x) with a balance due. Check only one box on form 100‑es to indicate if the estimate payment is for form 100, california corporation franchise or. Corporations are required to pay the following percentages of the estimated tax liability. 2022 s corporation income tax returns due and tax due (for calendar.

Due by the 15th day of 4th month of taxable year; Due date falls on weekend/holiday, see instructions. For calendar year 2017 or. Check only one box on form 100‑es to indicate if the estimate payment is for form 100, california corporation franchise or. Web determine the estimated tax requirement for california. This entity will file form (check only one box):. 3601213form 100 2021 side 1. You can download or print current or past. For calendar year 2020 or fiscal year beginning (mm/dd/yyyy) , for calendar year. Corporations are required to pay the following percentages of the estimated tax liability.

Fillable California Form 100 Es Corporate Esitimated Tax Franchise

Notice of proposed assessment (npa) payment select this payment type if you. Web select this payment type if you are filing an amended tax return (form 100x) with a balance due. Web estimated tax requirement for california. For calendar year 2017 or. For calendar year 2023 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy).

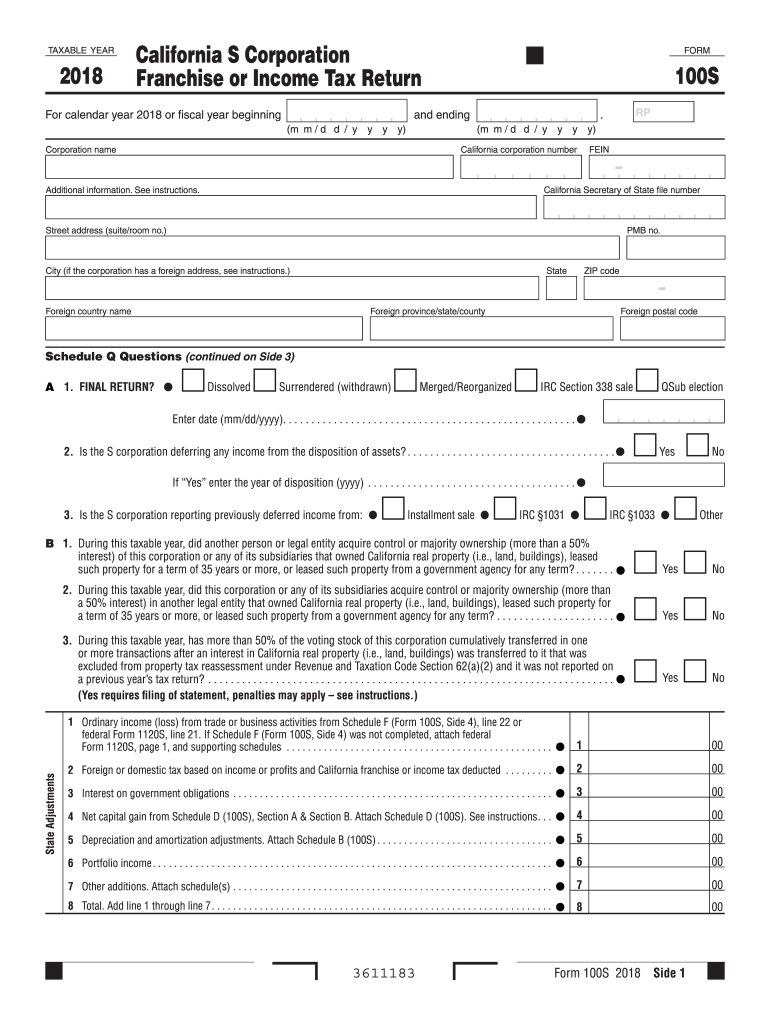

California Form 100s Instructions PDF Fill Out and Sign Printable PDF

Notice of proposed assessment (npa) payment select this payment type if you. 3601213form 100 2021 side 1. For calendar year 2017 or. This entity will file form (check only one box): 2021 california corporation franchise or income tax.

Ca Form 100 Es Fill Out and Sign Printable PDF Template signNow

3601213form 100 2021 side 1. Due by the 15th day of 4th month of taxable year; You can download or print current or past. This entity will file form (check only one box):. Web select this payment type if you are filing an amended tax return (form 100x) with a balance due.

Form 100 Es Fill Out and Sign Printable PDF Template signNow

Web determine the estimated tax requirement for california. For calendar year 2020 or fiscal year beginning (mm/dd/yyyy) , for calendar year. Web 2021 form 100 california corporation franchise or income tax return. Web select this payment type if you are filing an amended tax return (form 100x) with a balance due. Check only one box on form 100‑es to indicate.

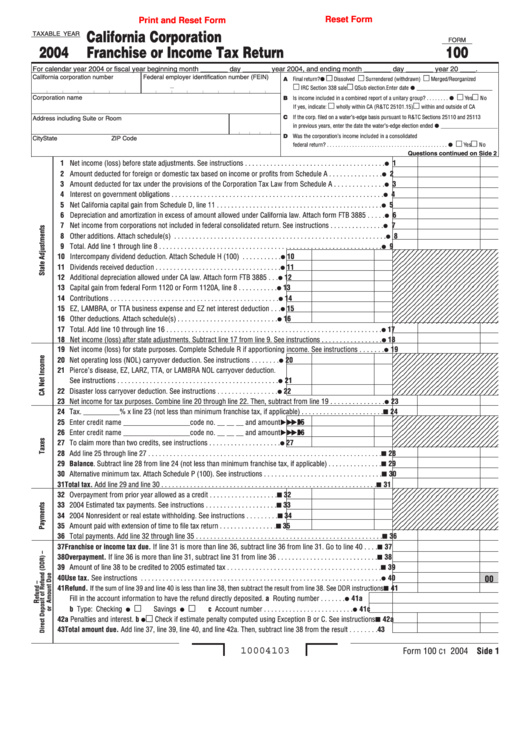

Fillable Form 100 California Corporation Franchise Or Tax

Due by the 15th day of 4th month of taxable year; Web 2021 form 100 california corporation franchise or income tax return. You can download or print current or past. For calendar year 2020 or fiscal year beginning (mm/dd/yyyy) , for calendar year. For calendar year 2023 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy).

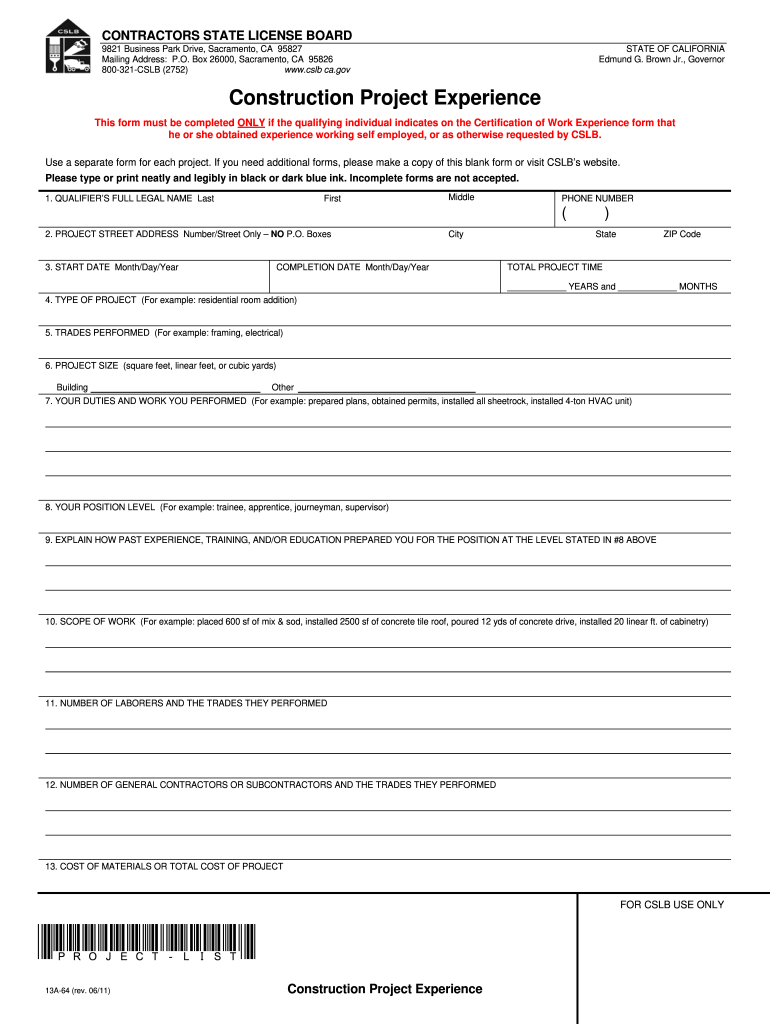

CA Form 13A64 2011 Fill and Sign Printable Template Online US

This entity will file form (check only one box): 2021 california corporation franchise or income tax. Web 2021 form 100 california corporation franchise or income tax return. Notice of proposed assessment (npa) payment select this payment type if you. Check only one box on form 100‑es to indicate if the estimate payment is for form 100, california corporation franchise or.

Fillable California Form 100Es Corporation Estimated Tax 2008

This entity will file form (check only one box): For calendar year 2023 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). This entity will file form (check only one box):. Web 2021 form 100 california corporation franchise or income tax return. You can download or print current or past.

Form 100ES California Franchise Tax Board ftb ca Fill out & sign

3601213form 100 2021 side 1. Notice of proposed assessment (npa) payment select this payment type if you. Due date falls on weekend/holiday, see instructions. Corporations are required to pay the following percentages of the estimated tax liability. 2021 california corporation franchise or income tax.

2016 Form 100Es Corporation Estimated Tax Edit, Fill, Sign Online

Web estimated tax requirement for california. You can download or print current or past. 3601213form 100 2021 side 1. Web determine the estimated tax requirement for california. 2021 california corporation franchise or income tax.

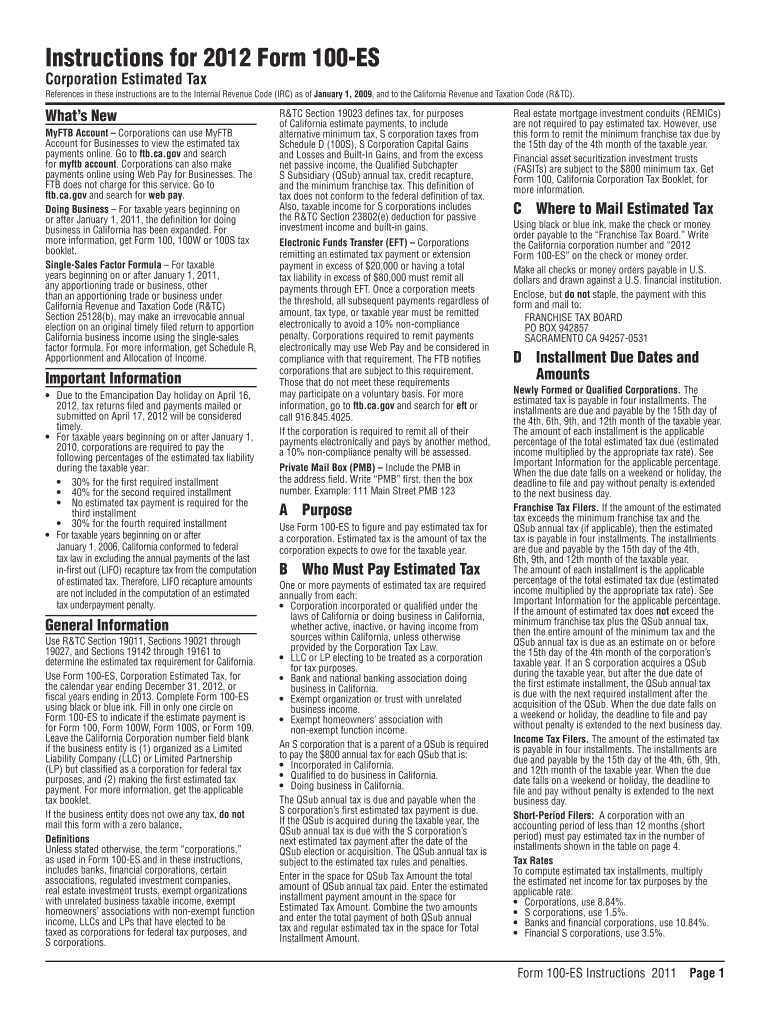

Instructions For Form 100Es Corporation Estimated Tax 2013

This entity will file form (check only one box): Corporations are required to pay the following percentages of the estimated tax liability. 3601213form 100 2021 side 1. For calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). 2022 s corporation income tax returns due and tax due (for calendar.

For Calendar Year 2023 Or Fiscal Year Beginning (Mm/Dd/Yyyy) , And Ending (Mm/Dd/Yyyy).

This entity will file form (check only one box): For calendar year 2017 or. Corporations are required to pay the following percentages of the estimated tax liability. Web select this payment type if you are filing an amended tax return (form 100x) with a balance due.

Web 2021 Form 100 California Corporation Franchise Or Income Tax Return.

3601213form 100 2021 side 1. Web estimated tax requirement for california. 2022 s corporation income tax returns due and tax due (for calendar. 2021 california corporation franchise or income tax.

Due Date Falls On Weekend/Holiday, See Instructions.

Notice of proposed assessment (npa) payment select this payment type if you. Check only one box on form 100‑es to indicate if the estimate payment is for form 100, california corporation franchise or. This entity will file form (check only one box): This entity will file form (check only one box):.

Web Determine The Estimated Tax Requirement For California.

Due by the 15th day of 4th month of taxable year; For calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). You can download or print current or past. For calendar year 2020 or fiscal year beginning (mm/dd/yyyy) , for calendar year.