Blank Bank Reconciliation Form

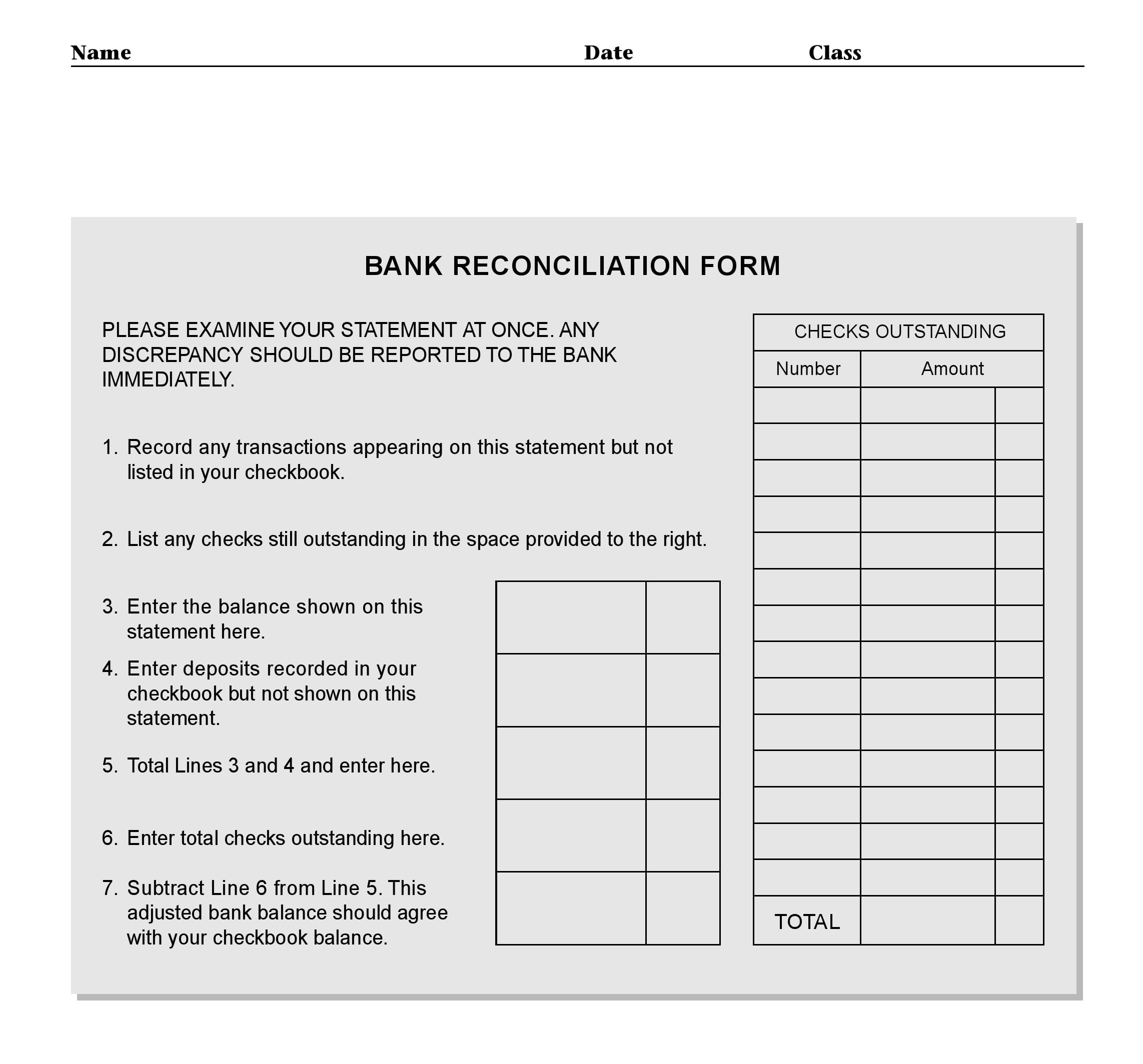

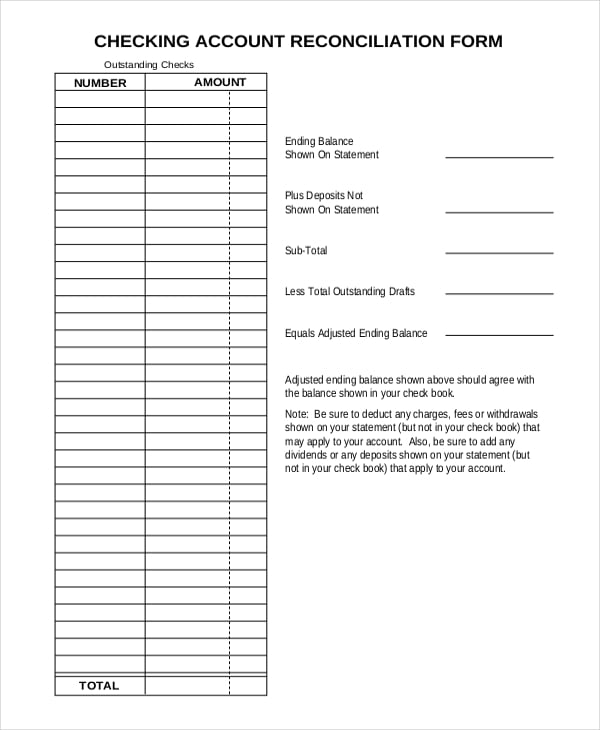

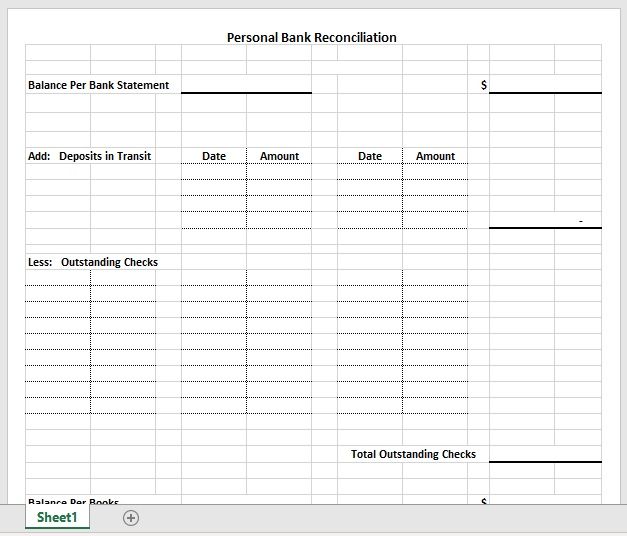

Blank Bank Reconciliation Form - A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Be sure to deduct any. Detecting errors such as double payments, missed payments, calculation errors etc. Reconciling the two accounts helps identify whether accounting changes are needed. You can customize all of the templates offered below for business use or for reconciling personal accounts. Your bank reconciliation form can be as simple or as detailed as you like. Spot fraudulent transactions and theft; A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. Enter your name and email in the form below and download the free template now!

For more financial management tools, download cash flow and other accounting templates. Spot fraudulent transactions and theft; Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Enter your name and email in the form below and download the free template now! Verify additions and subtractions above and in your check register; Be sure to deduct any. The total adjusted bank balance is written in the end. You can customize all of the templates offered below for business use or for reconciling personal accounts. Tracking and adding bank fees and penalties in the books; Web download the free template.

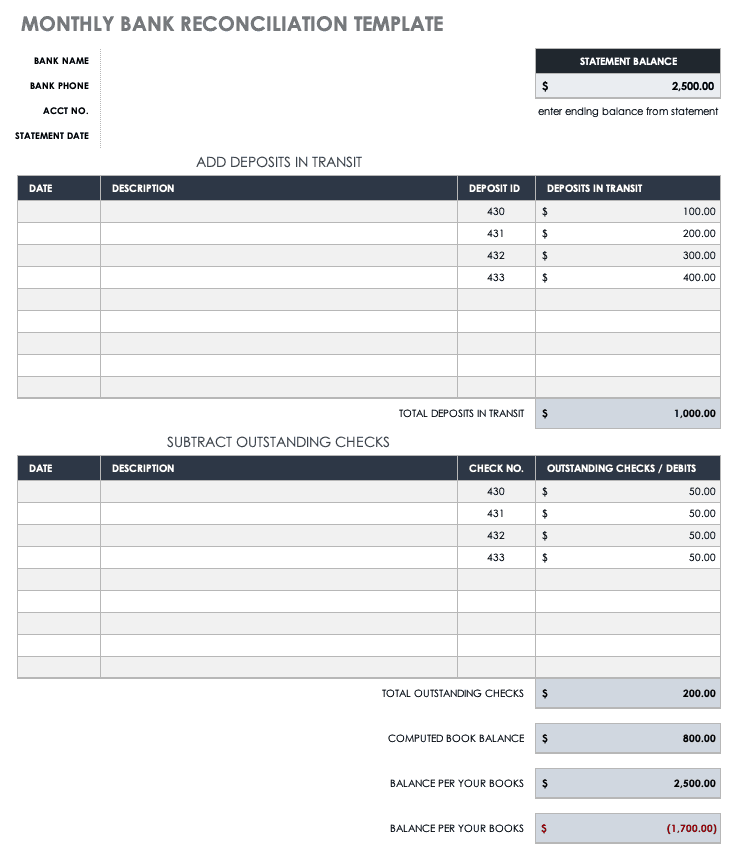

The total adjusted bank balance is written in the end. Web download the free template. For more financial management tools, download cash flow and other accounting templates. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Compare the dollar amounts of deposits listed on this statement with the deposit amounts recorded in your check register. Your bank reconciliation form can be as simple or as detailed as you like. In the case of personal bank accounts, like. Below is a good example of a simple reconciliation form. Web updated april 17, 2023 what is a bank reconciliation? Web the bank reconciliation process offers several advantages including:

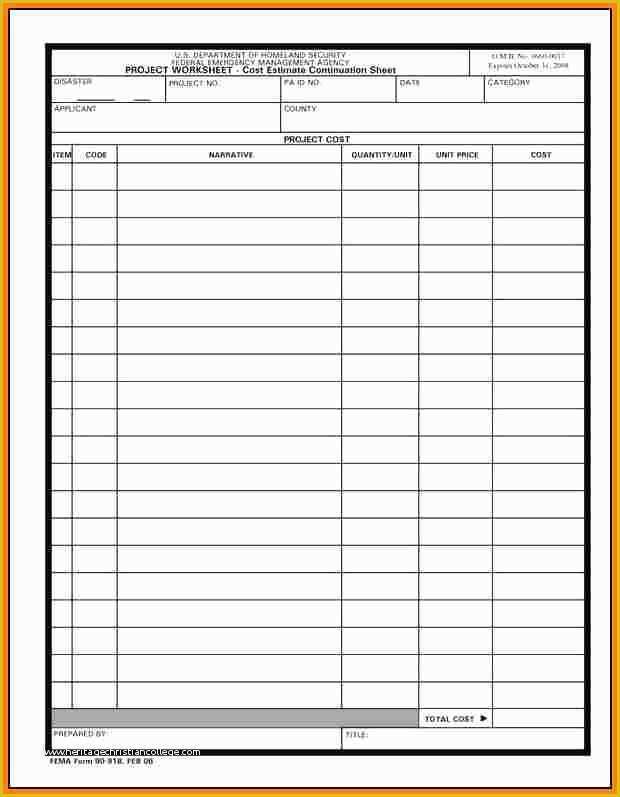

Bank Reconciliation Template Excel Free Download Of 5 Payroll

Enter your name and email in the form below and download the free template now! Web updated april 17, 2023 what is a bank reconciliation? Reconciling the two accounts helps identify whether accounting changes are needed. Compare the dollar amounts of checks listed on this statement with the check amounts listed in our check register; Spot fraudulent transactions and theft;

Bank Statement Reconciliation Template

Detecting errors such as double payments, missed payments, calculation errors etc. A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Below is a good example of a simple reconciliation form. A bank reconciliation statement is a document that compares the cash balance on a.

50+ Bank Reconciliation Examples & Templates [100 Free]

Web updated april 17, 2023 what is a bank reconciliation? A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Enter your name and email in the form below and download the free template now! It has three columns for add, less, and equal for.

50+ Bank Reconciliation Examples & Templates [100 Free]

Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. Detecting errors such as double payments, missed payments, calculation errors etc. Web if you do not balance 1. Web blank bank reconciliation form records the cash book and bank statement summary for the account. Keeping track of accounts.

Free Bank Reconciliation Form PDF Template Form Download

A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Web the bank reconciliation process offers several advantages including: Compare the dollar amounts of deposits listed on this statement with the deposit amounts recorded in your check register. Web if you do not balance 1..

Bank Statement Reconciliation Form Business Mentor

Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. What are the uses of this form? Web if you do not balance 1. You can customize all of the templates offered below for business use or for reconciling personal accounts. A bank reconciliation statement is a document that matches the cash balance on a company’s.

Bank Statement Template 28+ Free Word, PDF Document Downloads

For more financial management tools, download cash flow and other accounting templates. Web updated april 17, 2023 what is a bank reconciliation? Web blank bank reconciliation form records the cash book and bank statement summary for the account. Keeping track of accounts payable and receivables of the business; In the case of personal bank accounts, like.

20+ Free Bank Reconciliation Sheet Templates Printable Samples

Tracking and adding bank fees and penalties in the books; Web if you do not balance 1. Web updated april 17, 2023 what is a bank reconciliation? A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Verify additions and subtractions above and in your.

Free Account Reconciliation Templates Smartsheet

A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. The total adjusted bank balance is written in the end. Compare the dollar amounts of deposits listed on this statement with the deposit amounts recorded in your check register. Below is a good example of.

50+ Bank Reconciliation Examples & Templates [100 Free]

Reconciling the two accounts helps identify whether accounting changes are needed. What are the uses of this form? Tracking and adding bank fees and penalties in the books; Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Compare the dollar amounts of deposits listed on this statement with the deposit amounts recorded in your check.

Web Updated April 17, 2023 What Is A Bank Reconciliation?

Reconciling the two accounts helps identify whether accounting changes are needed. Detecting errors such as double payments, missed payments, calculation errors etc. Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. Be sure to deduct any.

You Can Customize All Of The Templates Offered Below For Business Use Or For Reconciling Personal Accounts.

For more financial management tools, download cash flow and other accounting templates. In the case of personal bank accounts, like. Enter your name and email in the form below and download the free template now! Compare the dollar amounts of checks listed on this statement with the check amounts listed in our check register;

Web The Bank Reconciliation Process Offers Several Advantages Including:

It has three columns for add, less, and equal for recording the different amounts. Below is a good example of a simple reconciliation form. Spot fraudulent transactions and theft; Web download the free template.

Web Save Time, Protect Financial Assets, And Increase Accuracy With Free Bank Reconciliation Templates.

Compare the dollar amounts of deposits listed on this statement with the deposit amounts recorded in your check register. Web if you do not balance 1. Your bank reconciliation form can be as simple or as detailed as you like. A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement.

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-20.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-37.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-34.jpg)