Barclays Credit Card After Chapter 7

Barclays Credit Card After Chapter 7 - All barclays credit cards require a minimum credit score of either 700 or 750 for approval. Here's the theory and why, like other approaches, this is unlikely to work. Secured credit card there are things you should know about a secured credit card. So, when applying for new credit, it’s essential to know your credit scores and what’s on your credit. You can edit or cancel a pending payment until 7:00 pm et the day it was scheduled by selecting payment activity from the payments menu and clicking on. Getting approved for a credit card requires a little planning. This means you need either good or excellent credit to get approved for a barclaycard. Web find the card that fits your life. Web how can i edit or cancel a pending online payment? Web in the months following a chapter 7, you'll have trouble getting approved for a decent credit card.

Web in the months following a chapter 7, you'll have trouble getting approved for a decent credit card. Just tell us a bit about what you're looking for in a card. Web additional barclays products sign in to your online banking account sign in to your loan account browse credit cards. All barclays credit cards require a minimum credit score of either 700 or 750 for approval. Never had a barclays card. Web learn more about barclays online savings. You'll have to start with an option for bad credit and work your up the ladder. Most credit card offers require very good credit. So, when applying for new credit, it’s essential to know your credit scores and what’s on your credit. Web how to increase your chances of getting approved for a barclaycard.

So, when applying for new credit, it’s essential to know your credit scores and what’s on your credit. So during covid in 2020, i lost my job and unexpectedly had to file for chapter 7. Web how can i edit or cancel a pending online payment? I applied for the barclays aa aviator red card today. I am just over 16 months post discharge. If possible, 90 days before filing is the time to stop using your credit cards once you know that you’re going to file chapter 7 bankruptcy. This means you need either good or excellent credit to get approved for a barclaycard. Most credit card offers require very good credit. Web additional barclays products sign in to your online banking account sign in to your loan account browse credit cards. Web learn more about barclays online savings.

Zohaib Jafri — Barclays

All barclays credit cards require a minimum credit score of either 700 or 750 for approval. I only had a small (like $1200?) balance on my american air card with barclays… Web yes, they are bk friendly. I am just over 16 months post discharge. Web learn more about barclays online savings.

Barclays Black Card 6 Reasons I Still Use My Barclaycard Arrival Plus

Web how can i edit or cancel a pending online payment? Web theoretically, if you're willing to owe the balance after your chapter 7 case closes, you might be able to keep a credit card account open. All barclays credit cards require a minimum credit score of either 700 or 750 for approval. Getting approved for a credit card requires.

Barclays Adds Credit Card Customization in App

Most credit card offers require very good credit. Web the creditor can charge you a higher interest rate. Types of credit cards you can qualify for after filing chapter 7 bankruptcy credit cards that you might qualify for may be secured or unsecured. So, when applying for new credit, it’s essential to know your credit scores and what’s on.

Barclays Introduces Vertical Credit and Debit Cards Loans Kenya Blog

Web in the months following a chapter 7, you'll have trouble getting approved for a decent credit card. Getting approved for a credit card requires a little planning. Just tell us a bit about what you're looking for in a card. Web learn more about barclays online savings. Never had a barclays card.

85+ Barclays Business Debit Card Business Cards

I only had a small (like $1200?) balance on my american air card with barclays… Web yes, they are bk friendly. Web learn more about barclays online savings. Web find the card that fits your life. Secured credit card there are things you should know about a secured credit card.

Barclays and Emirates to Launch Credit Card In USA W7 News

Web additional barclays products sign in to your online banking account sign in to your loan account browse credit cards. If possible, 90 days before filing is the time to stop using your credit cards once you know that you’re going to file chapter 7 bankruptcy. So during covid in 2020, i lost my job and unexpectedly had to file.

Best Barclays Credit Cards for August 2022 NextAdvisor with TIME

Web can i repay barclays after ch7 and get my aa card back? Web one of the primary reasons you might see brclysbankde on your credit report is because you’ve applied for a barclaycard credit card. All barclays credit cards require a minimum credit score of either 700 or 750 for approval. Barclays bank delaware offers a variety of credit.

Apply For Barclay Credit Card Account

Never had a barclays card. If possible, 90 days before filing is the time to stop using your credit cards once you know that you’re going to file chapter 7 bankruptcy. Getting approved for a credit card requires a little planning. All barclays credit cards require a minimum credit score of either 700 or 750 for approval. This means you.

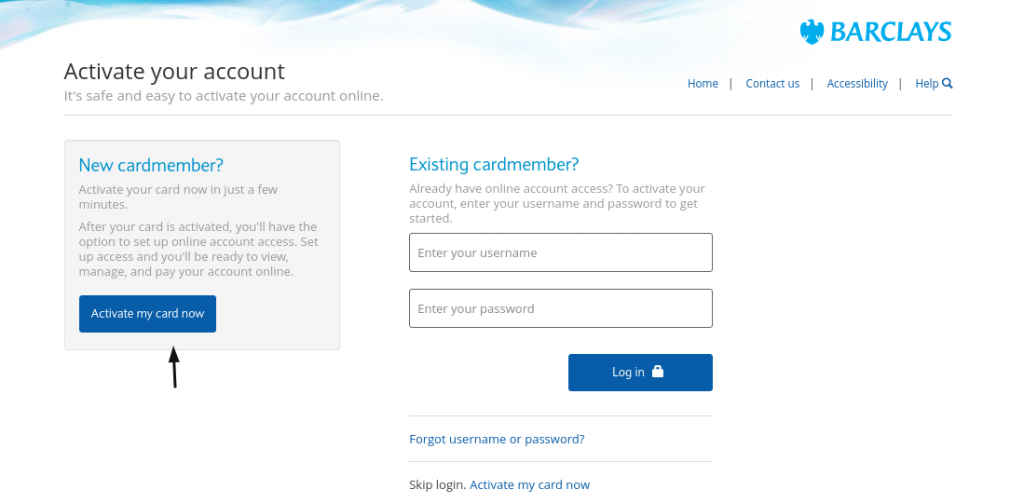

How To Activate Your Barclays Credit

Web one of the primary reasons you might see brclysbankde on your credit report is because you’ve applied for a barclaycard credit card. Never had a barclays card. Web yes, they are bk friendly. Web additional barclays products sign in to your online banking account sign in to your loan account browse credit cards. Secured credit card there are things.

Barclays Credit Cards Decline Binance Purchases Blockzeit

You can’t max out credit cards before bankruptcy. Web how can i edit or cancel a pending online payment? You'll have to start with an option for bad credit and work your up the ladder. You can edit or cancel a pending payment until 7:00 pm et the day it was scheduled by selecting payment activity from the payments menu.

You Can’t Max Out Credit Cards Before Bankruptcy.

Web learn more about barclays online savings. Web theoretically, if you're willing to owe the balance after your chapter 7 case closes, you might be able to keep a credit card account open. Web one of the primary reasons you might see brclysbankde on your credit report is because you’ve applied for a barclaycard credit card. Web answer question 30 5 maria adams, credit cards moderator @m_adams • 12/01/22 your barclaycard approval odds largely depend on your credit score, income, and debt.

Never Had A Barclays Card.

Web in the months following a chapter 7, you'll have trouble getting approved for a decent credit card. Getting approved for a credit card requires a little planning. Secured credit card there are things you should know about a secured credit card. I don't have the barclay's jet blue card, but i was approved for a barclay's cash forward card of $1,500 in july 2016 after my bk7 was discharged in may 2016.

So, When Applying For New Credit, It’s Essential To Know Your Credit Scores And What’s On Your Credit.

You'll have to start with an option for bad credit and work your up the ladder. I applied for the barclays aa aviator red card today. Here's the theory and why, like other approaches, this is unlikely to work. Most credit card offers require very good credit.

Types Of Credit Cards You Can Qualify For After Filing Chapter 7 Bankruptcy Credit Cards That You Might Qualify For May Be Secured Or Unsecured.

Web can i repay barclays after ch7 and get my aa card back? If possible, 90 days before filing is the time to stop using your credit cards once you know that you’re going to file chapter 7 bankruptcy. Web how to increase your chances of getting approved for a barclaycard. Web find the card that fits your life.