Balance Sheet With Negative Equity

Balance Sheet With Negative Equity - It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. Web negative shareholders' equity also has a place in the balance sheets of the business world. This situation usually happens when the company has incurred losses over a continuous period such that. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. Here are some common reasons for negative shareholders' equity:. In balance sheets, negative equity refers to the company's liability exceeding its assets. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets.

This situation usually happens when the company has incurred losses over a continuous period such that. In balance sheets, negative equity refers to the company's liability exceeding its assets. Here are some common reasons for negative shareholders' equity:. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. Web negative shareholders' equity also has a place in the balance sheets of the business world. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets.

Here are some common reasons for negative shareholders' equity:. This situation usually happens when the company has incurred losses over a continuous period such that. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. Web negative shareholders' equity also has a place in the balance sheets of the business world. In balance sheets, negative equity refers to the company's liability exceeding its assets. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported.

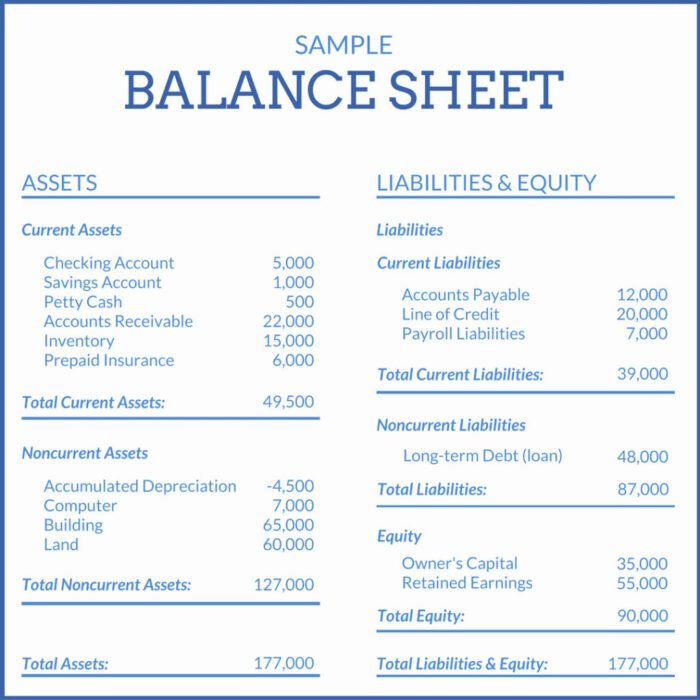

Balance sheet definition and meaning Market Business News

Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. Web on the other hand, negative equity refers to the.

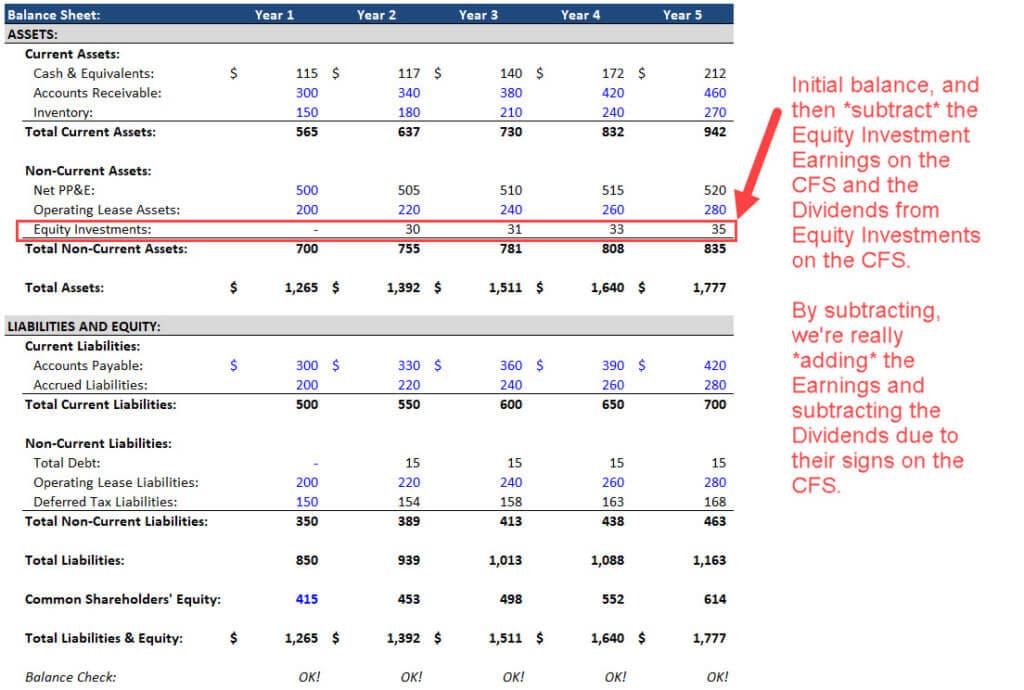

Dividend Recap LBO Tutorial With Excel Examples

This situation usually happens when the company has incurred losses over a continuous period such that. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. Here are some common reasons for negative shareholders'.

Equity Method of Accounting Excel, Video, and Full Examples

This situation usually happens when the company has incurred losses over a continuous period such that. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. In balance sheets, negative equity refers to the.

Dividend Recap LBO Tutorial With Excel Examples

Web negative shareholders' equity also has a place in the balance sheets of the business world. Here are some common reasons for negative shareholders' equity:. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s. This situation usually happens when the company has incurred losses over a continuous period such that. Web on the.

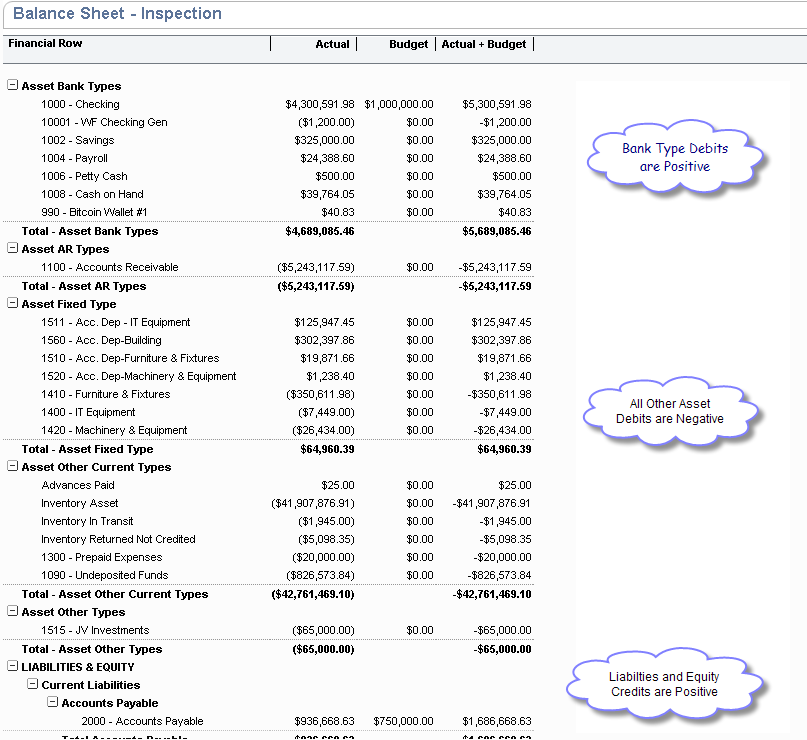

Smart Netsuite Trial Balance Financial Highlights Example

Here are some common reasons for negative shareholders' equity:. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. In balance sheets, negative equity refers to the company's liability exceeding its assets. Web a negative balance.

The Importance of an Accurate Balance Sheet Basis 365 Accounting

Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. This situation usually happens when the company has incurred losses over a continuous period such that. Web negative shareholders' equity also has a place in the balance sheets of the business world. Here are some common reasons for negative shareholders' equity:. In balance sheets,.

Negative Shareholders Equity Examples Buyback Losses

Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. In balance sheets, negative equity refers to the company's liability exceeding its assets. Web negative shareholders' equity also has a place in the balance sheets of the business world. It happens when the company’s liabilities exceed its assets, and in more financial terms, the.

Javier Blas on Twitter "The crisis at Biosev (the Brazilian sugar

In balance sheets, negative equity refers to the company's liability exceeding its assets. Web negative shareholders' equity also has a place in the balance sheets of the business world. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income.

Understanding Negative Balances in Your Financial Statements Fortiviti

This situation usually happens when the company has incurred losses over a continuous period such that. Web negative shareholders' equity also has a place in the balance sheets of the business world. Here are some common reasons for negative shareholders' equity:. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. In balance sheets,.

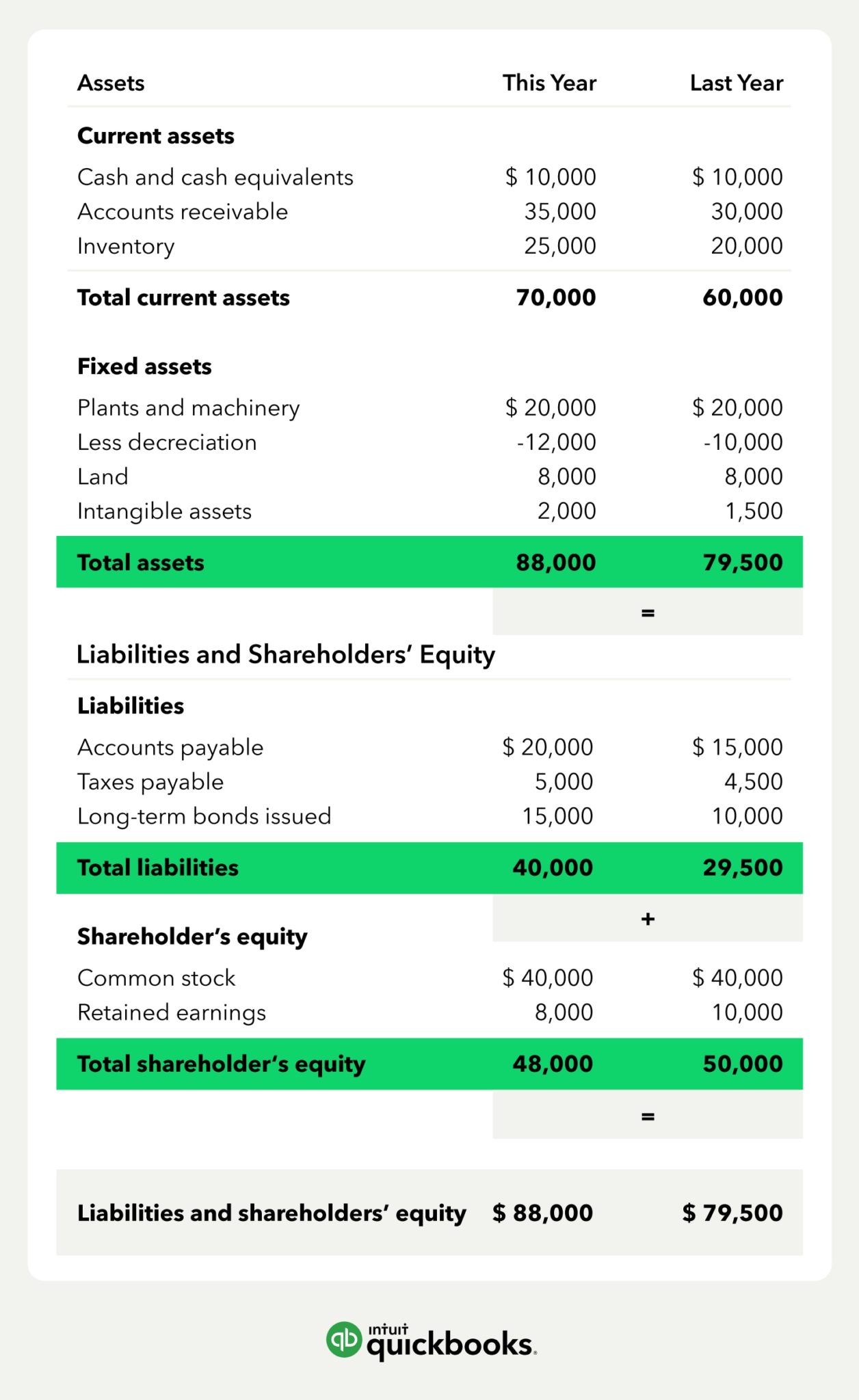

Stockholders' Equity What It Is, How To Calculate It, Examples

Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. This situation usually happens when the company has incurred losses over a continuous period such that. In balance sheets, negative equity refers to the company's liability exceeding its assets. Web negative shareholders' equity also has a place in the balance.

Web If The Current Year's Net Income Is Reported As A Separate Line In The Owner's Equity Or Stockholders' Equity Sections Of The Balance Sheet, A Negative Amount Of Net Income Must Be Reported.

Here are some common reasons for negative shareholders' equity:. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. In balance sheets, negative equity refers to the company's liability exceeding its assets. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet.

Web Negative Shareholders' Equity Also Has A Place In The Balance Sheets Of The Business World.

This situation usually happens when the company has incurred losses over a continuous period such that. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)