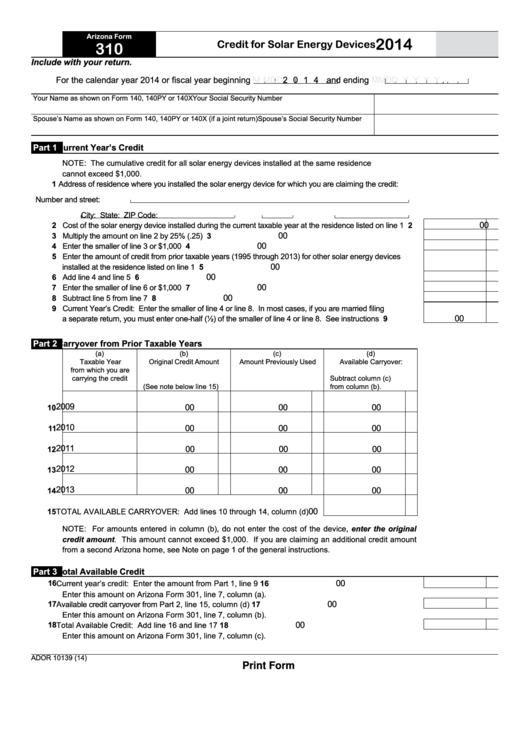

Az Form 310

Az Form 310 - Ad az recordkeeping log rule 310 & more fillable forms, register and subscribe now! Web start with arizona form 310 (2020 info used for reference), enter the value of the solar energy device(s) on line 2, 25% of that on line 3, and the limit of $1,000 on line 5. Web arizona form 310credit for solar energy devices include with your return. Web 26 rows 310 : Upload, modify or create forms. Upload, modify or create forms. Credit for solar energy devices: Web forms tax credits forms credit for solar energy devices credit for solar energy devices did you install solar panels on your house? Web 26 rows form number. Agricultural water conservation system credit:

Web march 16, 2022. Web arizona form 310 to be eligible for this credit, you must be an arizona resident who is not a dependent of another taxpayer. Web we last updated arizona form 310 in february 2023 from the arizona department of revenue. For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d y y y. We last updated the credit for solar energy credit in february 2023, so this is the latest version of form 310, fully updated for tax year 2022. Web arizona form 310 credit for solar energy devices 2022 include with your return. For the calendar year 2022 or fiscal year beginning mmdd2022 and ending mmd 2022 d y y y y. This form is for income earned in tax year 2022, with tax returns due in april. Upload, modify or create forms. The cumulative credit for all solar energy devices installed at the same residence cannot.

Web 26 rows form number. Web march 16, 2022. For the calendar year 2019 or fiscal year beginning mmd 2 0 1 9 and ending mmd d y y y y. Try it for free now! Web start with arizona form 310 (2020 info used for reference), enter the value of the solar energy device(s) on line 2, 25% of that on line 3, and the limit of $1,000 on line 5. Web 26 rows 310 : For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmd 2021 d y y y y. You can print other arizona tax forms here. Web arizona form 310 adjustments to income 13 articles business income (schedule c) 55 articles capital gains/losses 11 articles credits 41 articles education credits/deductions. The cumulative credit for all solar energy devices installed at the same residence cannot.

Fillable Arizona Form 310 Credit For Solar Energy Devices 2014

Upload, modify or create forms. Ad az recordkeeping log rule 310 & more fillable forms, register and subscribe now! Web start with arizona form 310 (2020 info used for reference), enter the value of the solar energy device(s) on line 2, 25% of that on line 3, and the limit of $1,000 on line 5. This form is for income.

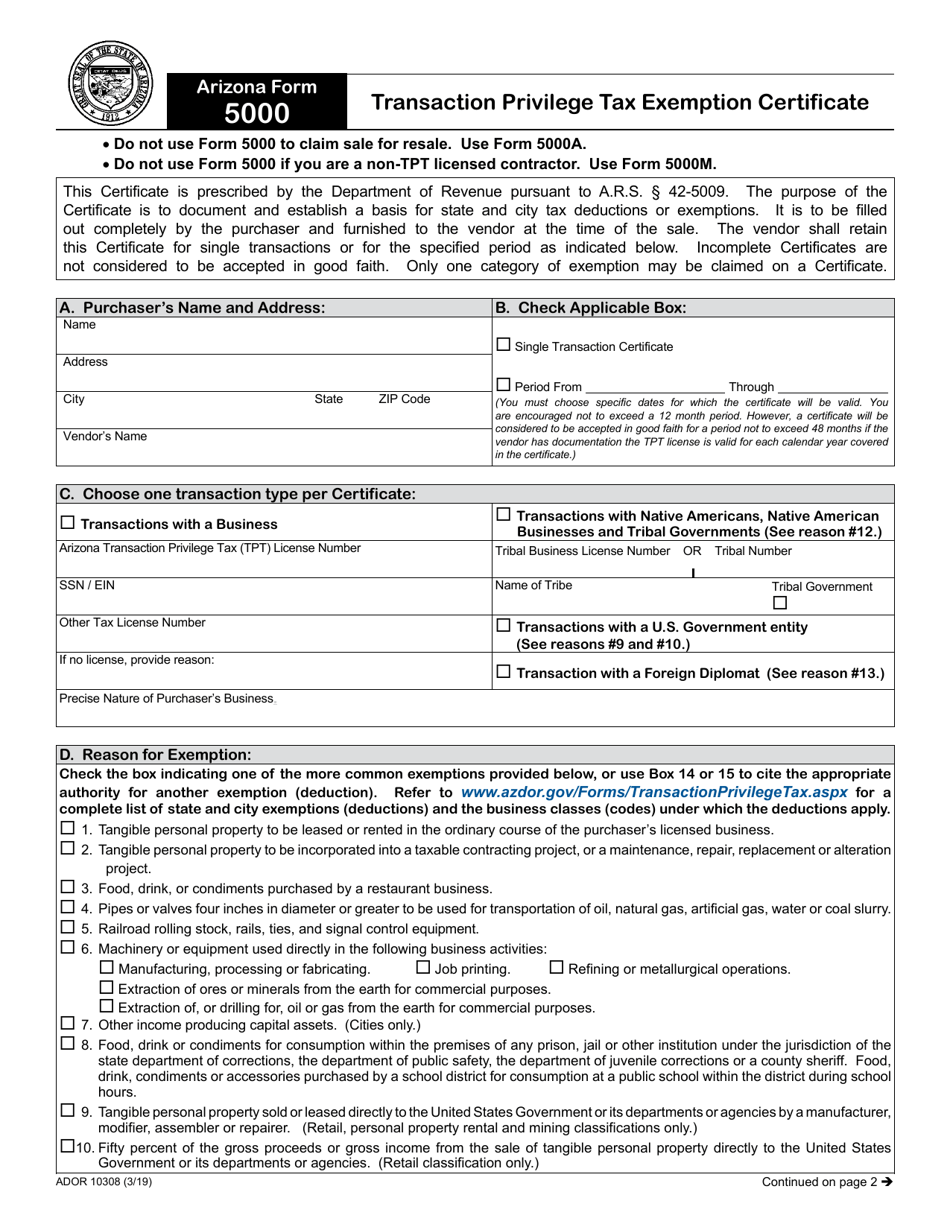

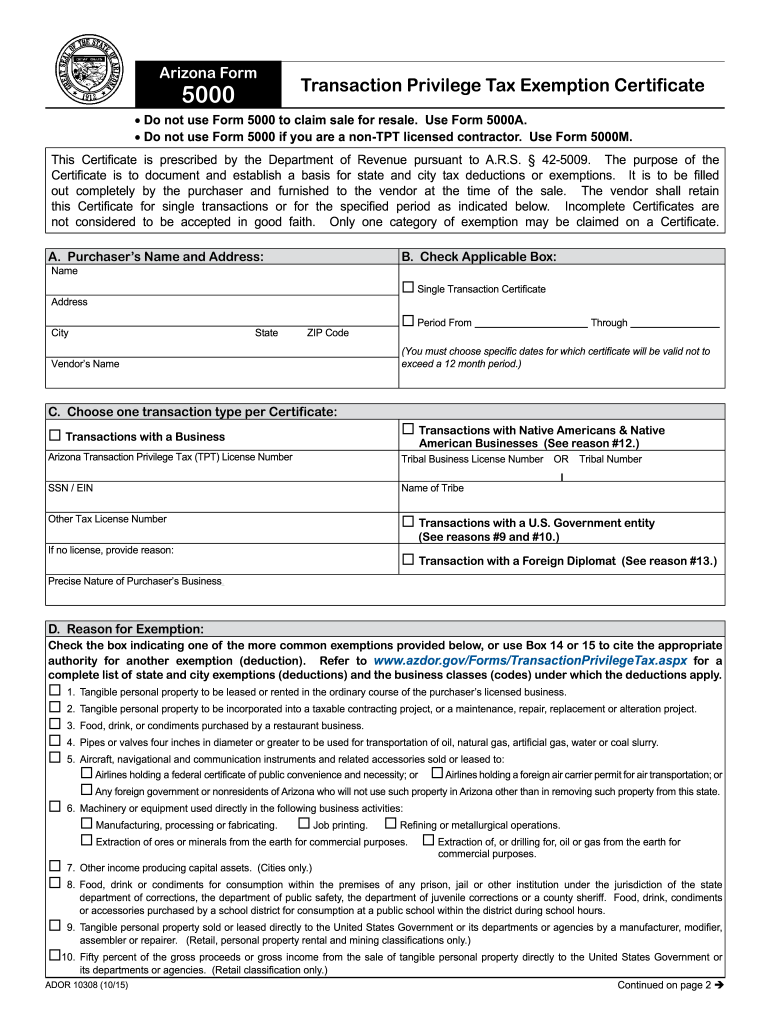

Arizona Form 5000 (ADOR10308) Download Fillable PDF or Fill Online

Solar energy device is a system or series of. Web 26 rows 310 : You can print other arizona tax forms here. Web arizona form 310 adjustments to income 13 articles business income (schedule c) 55 articles capital gains/losses 11 articles credits 41 articles education credits/deductions. Web arizona form 310 to be eligible for this credit, you must be an.

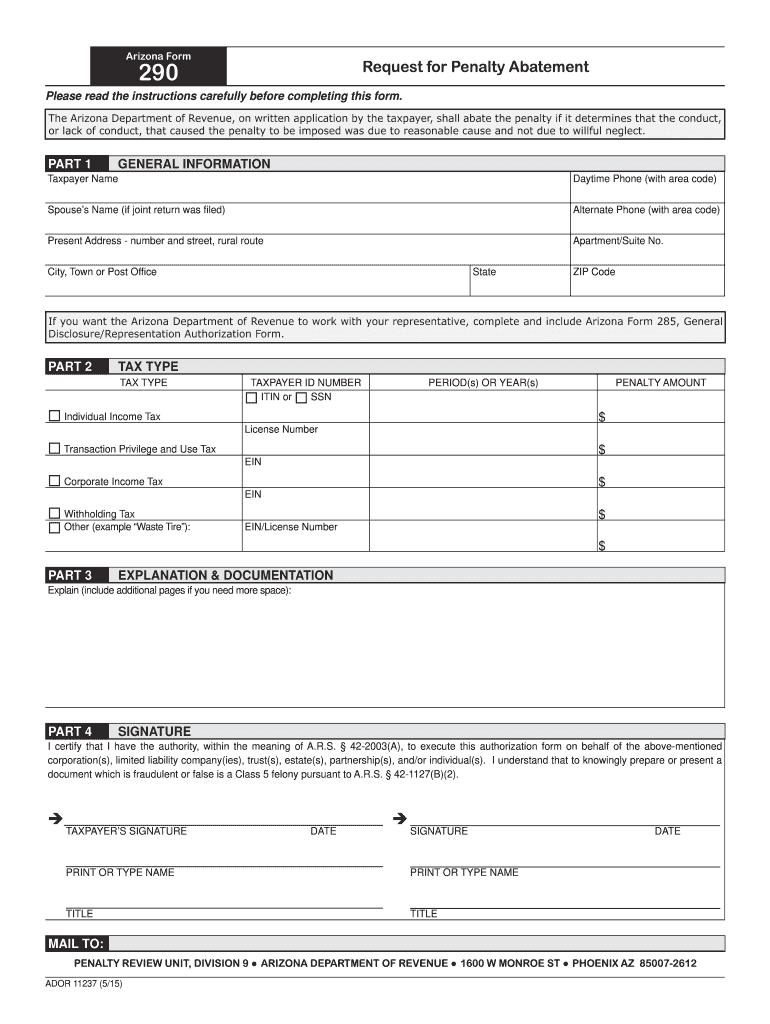

Form 290 Arizona Fill Online, Printable, Fillable, Blank pdfFiller

For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmd 2021 d y y y y. For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d y y y. The cumulative credit for all solar energy devices installed at the same residence cannot. Web.

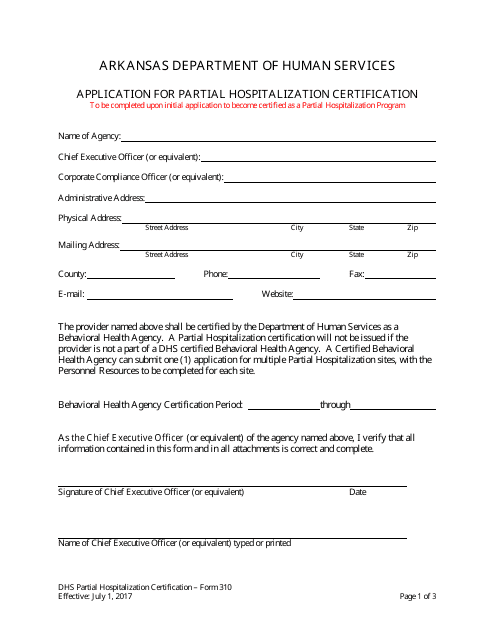

Form 310 Download Printable PDF or Fill Online Application for Partial

For the calendar year 2019 or fiscal year beginning mmd 2 0 1 9 and ending mmd d y y y y. Web arizona form 310 credit for solar energy devices 2021 part 1 current year’s credit note: Web arizona form 310credit for solar energy devices include with your return. Phoenix, az— homeowners who installed a solar energy device in.

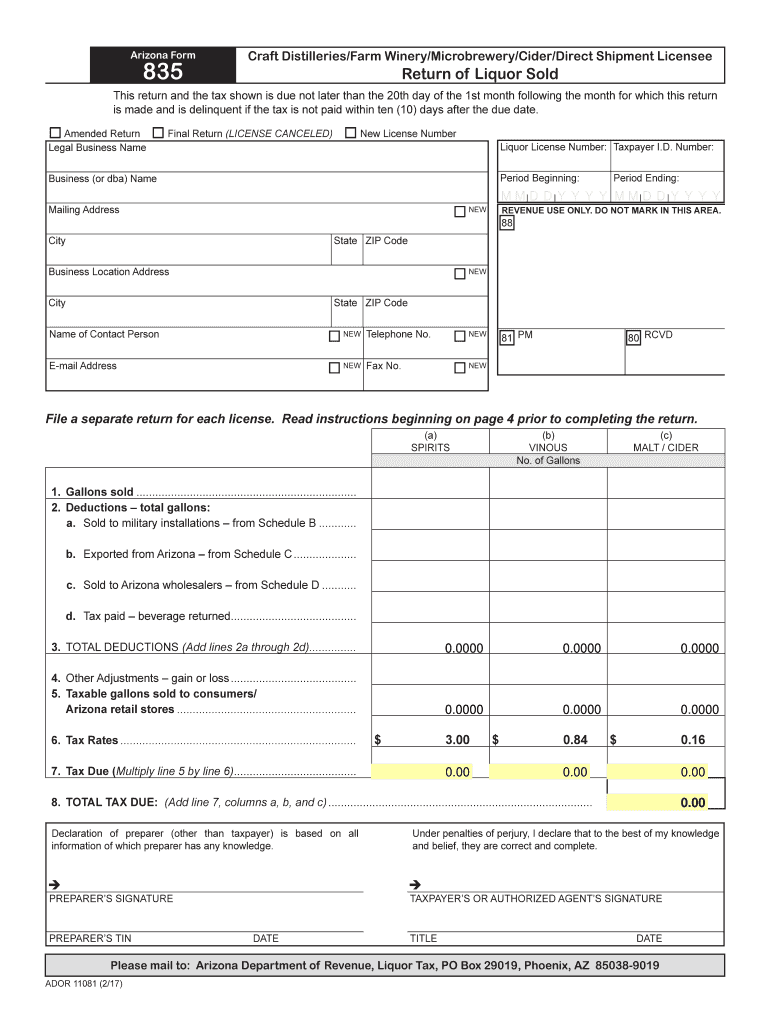

AZ Form 835 20172022 Fill out Tax Template Online US Legal Forms

Web 310credit for solar energy devices include with your return. We last updated the credit for solar energy credit in february 2023, so this is the latest version of form 310, fully updated for tax year 2022. Web arizona form 310 credit for solar energy devices 2022 include with your return. Web arizona form 310 adjustments to income 13 articles.

AZ Form 301, Nonrefundable Individual Tax Credits and Recapture

Try it for free now! Web arizona form 310 credit for solar energy devices 2022 include with your return. Ad az recordkeeping log rule 310 & more fillable forms, register and subscribe now! Web march 16, 2022. We last updated the credit for solar energy credit in february 2023, so this is the latest version of form 310, fully updated.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

The cumulative credit for all solar energy devices installed at the same residence cannot. This form is for income earned in tax year 2022, with tax returns due in april. Solar energy device is a system or series of. Web arizona form 310credit for solar energy devices include with your return. Web start with arizona form 310 (2020 info used.

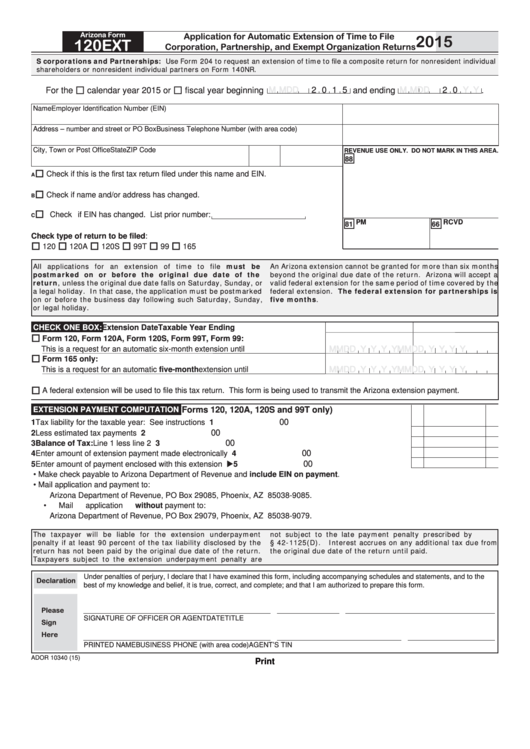

Fillable Arizona Form 120ext Application For Automatic Extension Of

Credit for solar energy devices: Web march 16, 2022. Ad az recordkeeping log rule 310 & more fillable forms, register and subscribe now! Web 26 rows form number. Web arizona form 310 credit for solar energy devices 2022 include with your return.

10A100 Form Fill Out and Sign Printable PDF Template signNow

Web arizona form 310 to be eligible for this credit, you must be an arizona resident who is not a dependent of another taxpayer. For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmd 2021 d y y y y. Solar energy device is a system or series of. Ad az recordkeeping log rule 310 & more.

2015 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank pdfFiller

Web arizona form 310credit for solar energy devices include with your return. For the calendar year 2019 or fiscal year beginning mmd 2 0 1 9 and ending mmd d y y y y. Web 26 rows form number. Web 26 rows 310 : Some users have reported that even though they do not choose the solar energy credit for.

Web 310Credit For Solar Energy Devices Include With Your Return.

Agricultural water conservation system credit: Web march 16, 2022. This form is for income earned in tax year 2022, with tax returns due in april. Phoenix, az— homeowners who installed a solar energy device in their residential home during 2021 are advised to submit form 310,.

Web Arizona Form 310 Adjustments To Income 13 Articles Business Income (Schedule C) 55 Articles Capital Gains/Losses 11 Articles Credits 41 Articles Education Credits/Deductions.

Web arizona form 310 credit for solar energy devices 2021 part 1 current year’s credit note: Web start with arizona form 310 (2020 info used for reference), enter the value of the solar energy device(s) on line 2, 25% of that on line 3, and the limit of $1,000 on line 5. Web forms tax credits forms credit for solar energy devices credit for solar energy devices did you install solar panels on your house? Application for bingo license packet.

Web 26 Rows 310 :

Some users have reported that even though they do not choose the solar energy credit for arizona, in the state review, they are asked to fill. We last updated the credit for solar energy credit in february 2023, so this is the latest version of form 310, fully updated for tax year 2022. Web arizona form 310credit for solar energy devices include with your return. Upload, modify or create forms.

Ad Az Recordkeeping Log Rule 310 & More Fillable Forms, Register And Subscribe Now!

Web arizona form 310 credit for solar energy devices 2019 include with your return. Upload, modify or create forms. For the calendar year 2022 or fiscal year beginning mmdd2022 and ending mmd 2022 d y y y y. For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmd 2021 d y y y y.