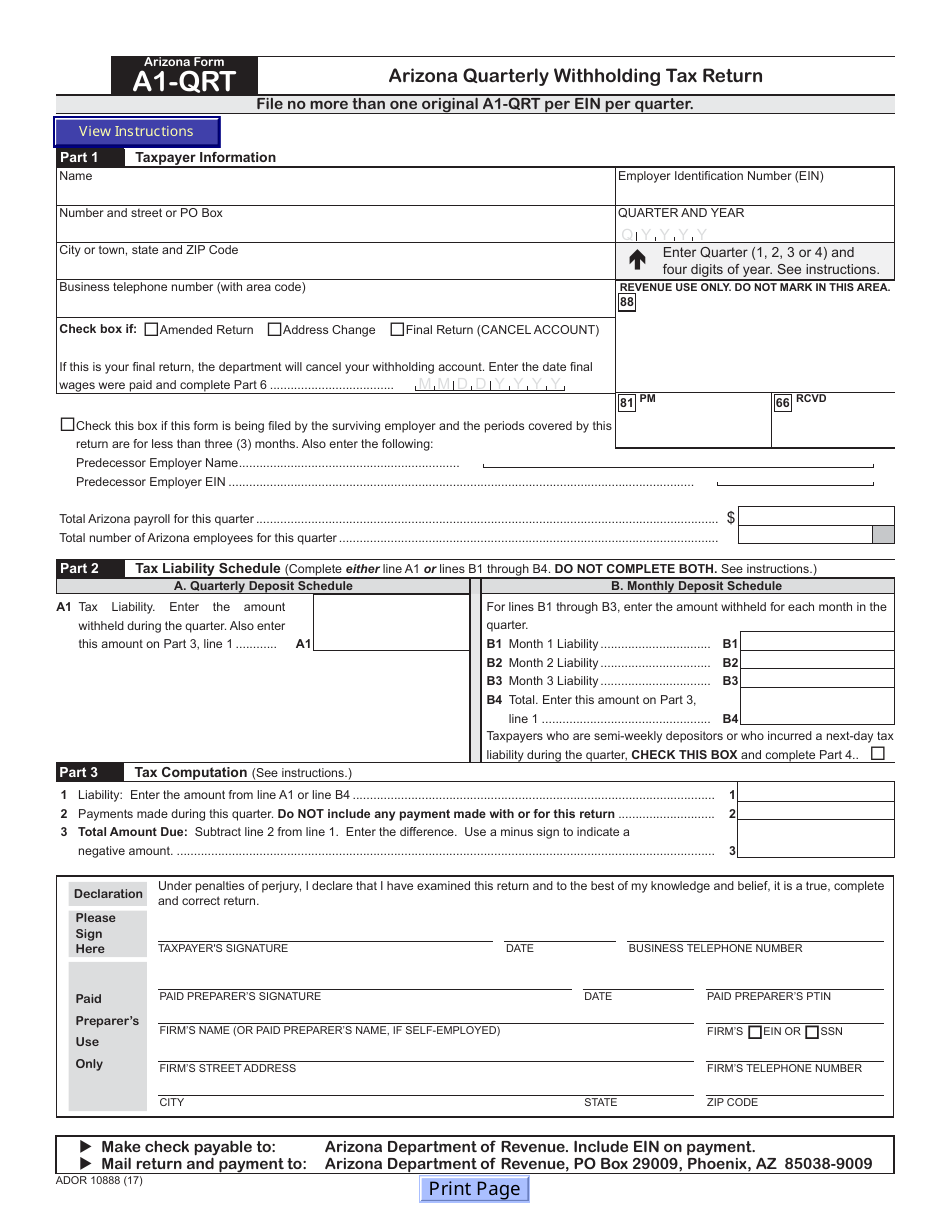

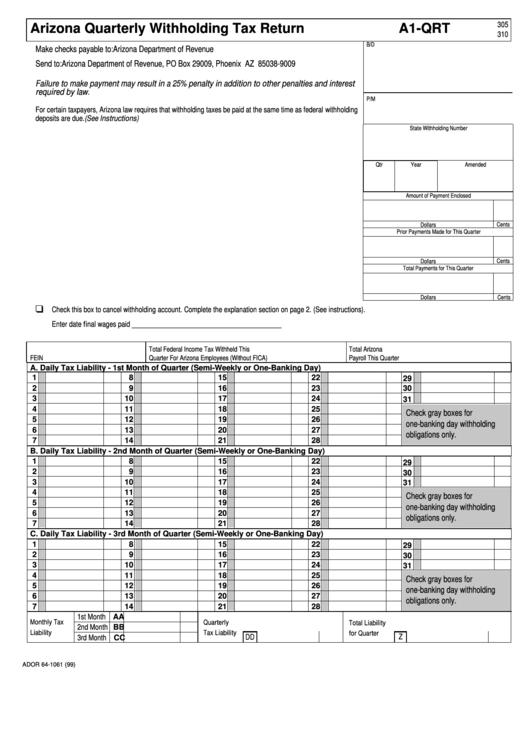

Arizona Form A1 Qrt

Arizona Form A1 Qrt - Payroll service providers registered with arizona can upload electronic files containing. Employers required to make more than one arizona withholding payment per calendar quarter, but not required to pay by. City or town, state and zip code business telephone number (with area code) check. Web arizona withholding reconciliation tax return. Web or try to claim refunds with this return. Web arizona quarterly withholding tax return. Complete, sign, print and send your tax documents easily with us legal forms. Web withholding transmittal of wage and tax statements. Download blank or fill out online in pdf format. The employer must remit the tax withheld to the department, based.

Complete, sign, print and send your tax documents easily with us legal forms. Used by employers to reconcile the amount (s) of arizona income tax withheld and deposited with the department of. The employer must remit the tax withheld to the department, based. Payroll service providers registered with arizona can upload electronic files containing. This form is for income earned in tax year 2022, with tax returns due in april. We last updated the arizona quarterly withholding tax return in august 2022, so this is the. Web edit arizona form a1 qrt 2021. Arizona quarterly withholding tax return:. Employers required to make more than one arizona withholding payment per calendar quarter, but not required to pay by. Complete, edit or print tax forms instantly.

Complete, edit or print tax forms instantly. Arizona quarterly withholding tax return:. Get ready for tax season deadlines by completing any required tax forms today. Download blank or fill out online in pdf format. Web arizona quarterly withholding tax return. Web edit arizona form a1 qrt 2021. Payroll service providers registered with arizona can upload electronic files containing. We last updated the arizona quarterly withholding tax return in august 2022, so this is the. Employers required to make more than one arizona withholding payment per calendar quarter, but not required to pay by. Complete, sign, print and send your tax documents easily with us legal forms.

Arizona Form A1QRT (ADOR10888) Download Fillable PDF or Fill Online

City or town, state and zip code business telephone number (with area code) check. Web edit arizona form a1 qrt 2021. Web arizona withholding reconciliation tax return. Download blank or fill out online in pdf format. Arizona quarterly withholding tax return:.

Arizona Form A1 QRT Fillable Az A1 Qrt Form Top Fill Out and Sign

City or town, state and zip code business telephone number (with area code) check. Payroll service providers registered with arizona can upload electronic files containing. Web or try to claim refunds with this return. Download blank or fill out online in pdf format. Used by employers to reconcile the amount (s) of arizona income tax withheld and deposited with the.

Arizona Employment Tax Forms MENPLOY

This form is for income earned in tax year 2022, with tax returns due in april. Web arizona quarterly withholding tax return. The employer must remit the tax withheld to the department, based. Arizona quarterly withholding tax return:. We last updated the arizona quarterly withholding tax return in august 2022, so this is the.

Fillable Online Arizona Form 140IA Arizona Department of Revenue Fax

Get ready for tax season deadlines by completing any required tax forms today. Web arizona quarterly withholding tax return. Complete, sign, print and send your tax documents easily with us legal forms. The employer must remit the tax withheld to the department, based. Download blank or fill out online in pdf format.

Arizona Tax Filings Requirements Efile 1099/W2 for the Arizona State

Used by employers to reconcile the amount (s) of arizona income tax withheld and deposited with the department of. Complete, edit or print tax forms instantly. Web edit arizona form a1 qrt 2021. Payroll service providers registered with arizona can upload electronic files containing. Web arizona quarterly withholding tax return.

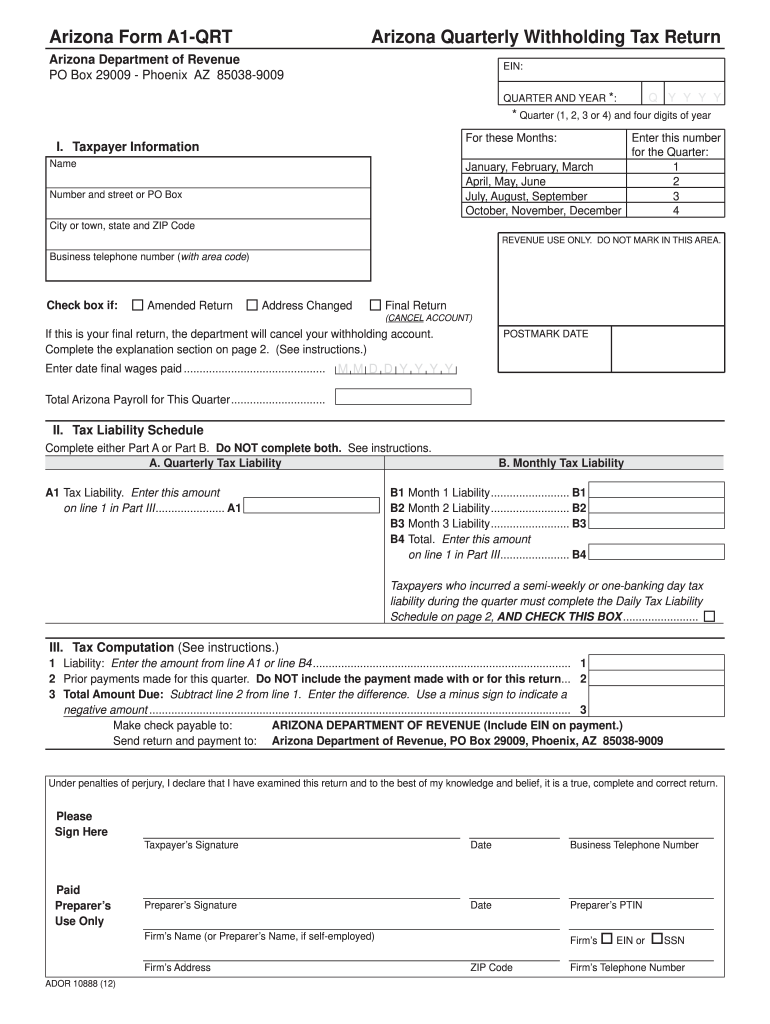

2012 Form AZ ADOR A1QRT Fill Online, Printable, Fillable, Blank

The employer must remit the tax withheld to the department, based. This form is for income earned in tax year 2022, with tax returns due in april. Complete, sign, print and send your tax documents easily with us legal forms. Web arizona quarterly withholding tax return. Employers required to make more than one arizona withholding payment per calendar quarter, but.

Form A1Qrt Arizona Quarterly Withholding Tax Return printable pdf

Get ready for tax season deadlines by completing any required tax forms today. Web edit arizona form a1 qrt 2021. Quickly add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your. Complete, sign, print and send your tax documents easily with us legal forms. Payroll service providers registered with arizona.

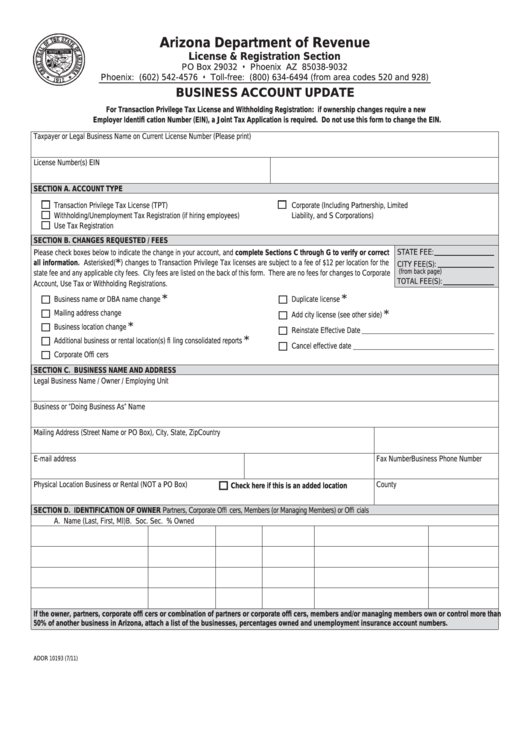

Fillable Arizona Form 10193 Business Account Update printable pdf

Complete, edit or print tax forms instantly. Payroll service providers registered with arizona can upload electronic files containing. Web edit arizona form a1 qrt 2021. Complete, sign, print and send your tax documents easily with us legal forms. Employers required to make more than one arizona withholding payment per calendar quarter, but not required to pay by.

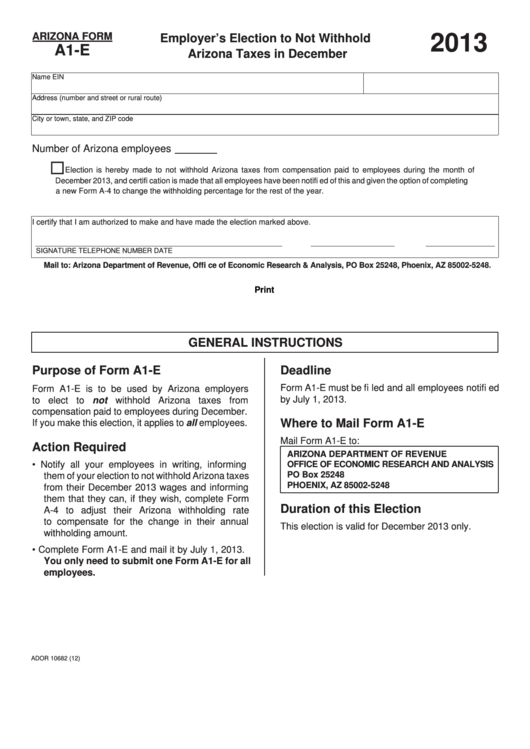

Fillable Arizona Form A1E Employer'S Election To Not Withhold

This form is for income earned in tax year 2022, with tax returns due in april. The employer must remit the tax withheld to the department, based. Complete, edit or print tax forms instantly. City or town, state and zip code business telephone number (with area code) check. Used by employers to reconcile the amount (s) of arizona income tax.

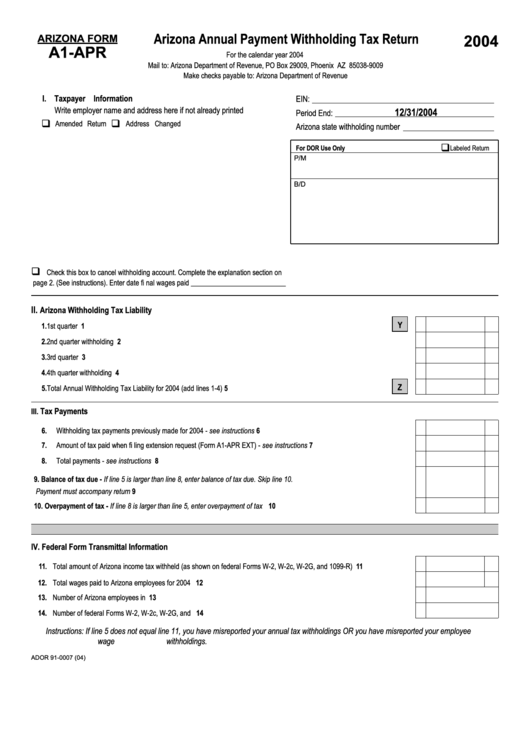

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

Get ready for tax season deadlines by completing any required tax forms today. Quickly add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your. Web arizona withholding reconciliation tax return. The employer must remit the tax withheld to the department, based. Employers required to make more than one arizona withholding.

Web Arizona Withholding Reconciliation Tax Return.

Web withholding transmittal of wage and tax statements. Quickly add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your. Web edit arizona form a1 qrt 2021. Download blank or fill out online in pdf format.

City Or Town, State And Zip Code Business Telephone Number (With Area Code) Check.

Used by employers to reconcile the amount (s) of arizona income tax withheld and deposited with the department of. Arizona quarterly withholding tax return:. Get ready for tax season deadlines by completing any required tax forms today. Complete, sign, print and send your tax documents easily with us legal forms.

The Employer Must Remit The Tax Withheld To The Department, Based.

Employers required to make more than one arizona withholding payment per calendar quarter, but not required to pay by. Payroll service providers registered with arizona can upload electronic files containing. We last updated the arizona quarterly withholding tax return in august 2022, so this is the. Web arizona quarterly withholding tax return.

Complete, Edit Or Print Tax Forms Instantly.

This form is for income earned in tax year 2022, with tax returns due in april. Web or try to claim refunds with this return.