Arizona Form 309 Instructions

Arizona Form 309 Instructions - Please see arizona form 309 instructions or income tax ruling (itr). More about the arizona form 309 tax credit we last. You also claiming a credit for more than one state or country,. Web arizona form 309 credit for taxes paid to another state or country for forms 140, 140nr, 140py and 140x 2022 include with your return. Its purpose is to calculate the income subject to tax by both arizona and another state to. Web arizona form 309credit for taxes paid to another state or country2017 include with your return. Arizona credit for taxes paid to another state or country (form 309) form 309 is used to claim credit in arizona for taxes paid to another state or country. A separate form must be filed for each state or country for which a credit is. Web home check return error: Web arizona and another state or country on the same income.

Web form 309 is an arizona individual income tax form. Web page 5 of the instructions for a list of state abbreviations. A separate form must be filed for each state or country for which a credit is. Official form 309 is used to give notice to creditors, equity security holders, and other interested parties of the filing of the bankruptcy case, the time, date,. Per the az form 309 instructions: Web what is a form 309? Its purpose is to calculate the income subject to tax by both arizona and another state to. Complete this form only if you. Web arizona form 301, nonrefundable individual tax credits and recapture, and include form 301 and form(s) 309 with your tax return to claim this credit. Arizona credit for taxes paid to another state or country (form 309) form 309 is used to claim credit in arizona for taxes paid to another state or country.

9 enter the amount of personal exemption claimed on arizona form 140, page 1, line 18 plus the amount. Web page 5 of the instructions for a list of state abbreviations. Web form 309 is an arizona individual income tax form. Web we last updated the credit for taxes paid to another state or country in february 2023, so this is the latest version of form 309, fully updated for tax year 2022. Web the tips below will help you complete az form 309 easily and quickly: Web arizona form 309credit for taxes paid to another state or country2020 include with your return. A separate form must be filed for each state or country for which a credit is. Web arizona form 309credit for taxes paid to another state or country2014 include with your return. Web arizona form 309credit for taxes paid to another state or country2017 include with your return. A separate form must be filed for each state or country for which a credit is.

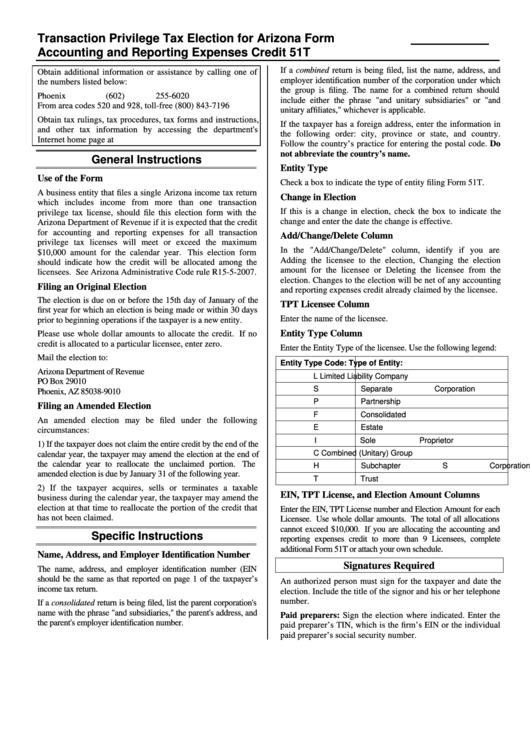

Instructions For Arizona Form 51t printable pdf download

Web arizona form 309credit for taxes paid to another state or country2020 include with your return. Enter the smaller of the amount entered on line 3 or line 4 5 $ 00 $ 00 6 total income subject to tax in both. Official form 309 is used to give notice to creditors, equity security holders, and other interested parties of.

Arizona 4.23 Annual Report Form Download Fillable PDF Templateroller

Web we last updated the credit for taxes paid to another state or country in february 2023, so this is the latest version of form 309, fully updated for tax year 2022. A separate form must be filed for each state or country for which a credit is. Arizona credit for taxes paid to another state or country (form 309).

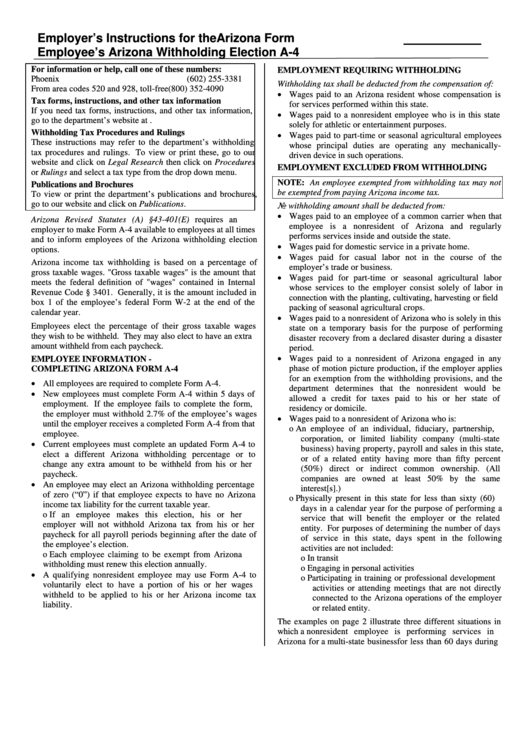

Arizona Form A4 Employer'S Instructions For The Employee'S Arizona

Official form 309 is used to give notice to creditors, equity security holders, and other interested parties of the filing of the bankruptcy case, the time, date,. Enter the smaller of the amount entered on line 3 or line 4 5 $ 00 $ 00 6 total income subject to tax in both. A separate form must be filed for.

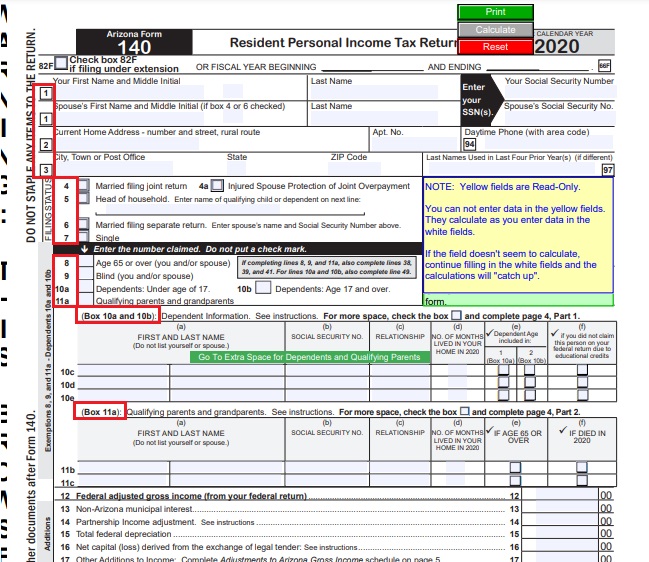

Instructions and Download of Arizona Form 140 Unemployment Gov

Web arizona form 309credit for taxes paid to another state or country2014 include with your return. Web home check return error: Web arizona form 309credit for taxes paid to another state or country2020 include with your return. Arizona credit for taxes paid to another state or country (form 309) form 309 is used to claim credit in arizona for taxes.

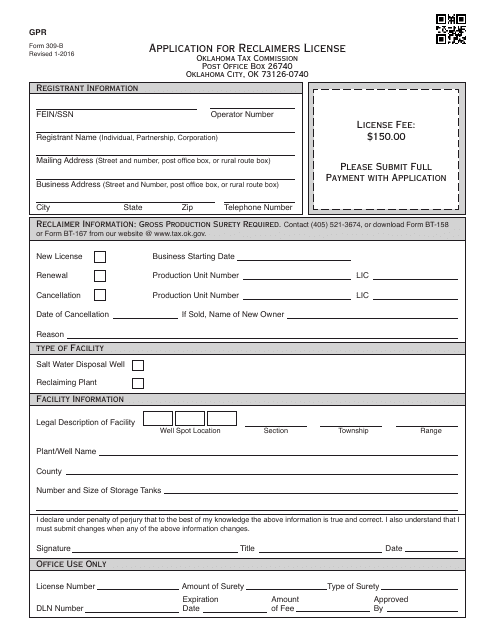

OTC Form 309B Download Printable PDF or Fill Online Application for

Web arizona form 309 credit for taxes paid to another state or country for forms 140, 140nr, 140py and 140x 2022 include with your return. Web arizona form 309credit for taxes paid to another state or country2020 include with your return. Web form 309 is an arizona individual income tax form. Enter the smaller of the amount entered on line.

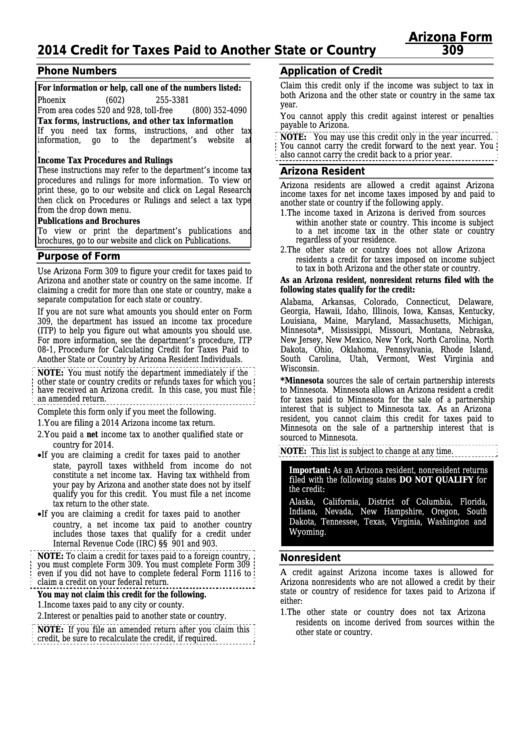

Arizona Form 309 Instructions Credit For Taxes Paid To Another State

Official form 309 is used to give notice to creditors, equity security holders, and other interested parties of the filing of the bankruptcy case, the time, date,. Web arizona form 301, nonrefundable individual tax credits and recapture, and include form 301 and form(s) 309 with your tax return to claim this credit. 9 enter the amount of personal exemption claimed.

Instructions and Download of Arizona Form 140 Unemployment Gov

Web those individuals taxed on income earned in another state and in arizona may earn a credit for taxes paid. A separate form must be filed for each state or country for which a credit is. Web arizona form 301, nonrefundable individual tax credits and recapture, and include form 301 and form(s) 309 with your tax return to claim this.

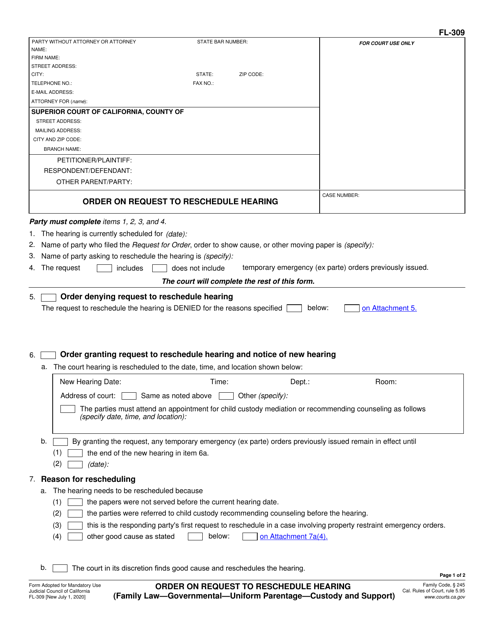

Form FL309 Download Fillable PDF or Fill Online Order on Request to

Web arizona form 309credit for taxes paid to another state or country2017 include with your return. Web form 309 is an arizona individual income tax form. A separate form must be filed for each. Web page 5 of the instructions for a list of state abbreviations. Web 24 rows a nonrefundable individual tax credit against income tax imposed.

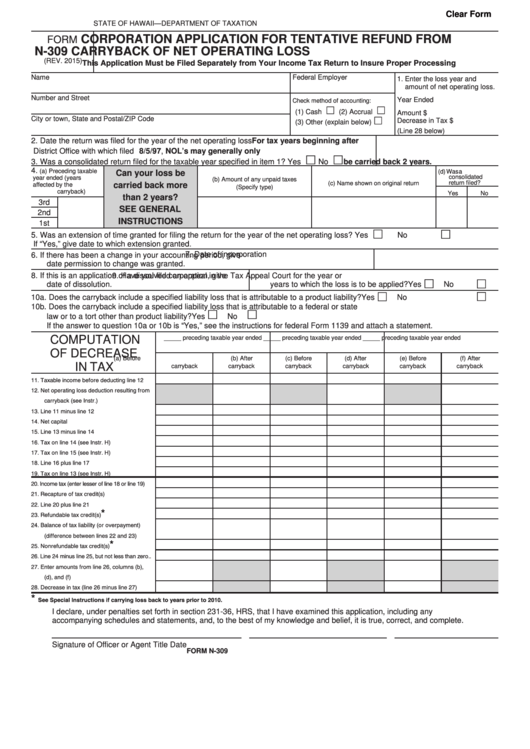

Fillable Form N309 Corporation Application For Tentative Refund From

Please see arizona form 309 instructions or income tax ruling (itr). Web arizona form 309credit for taxes paid to another state or country2020 include with your return. Arizona credit for taxes paid to another state or country (form 309) form 309 is used to claim credit in arizona for taxes paid to another state or country. Web arizona form 309credit.

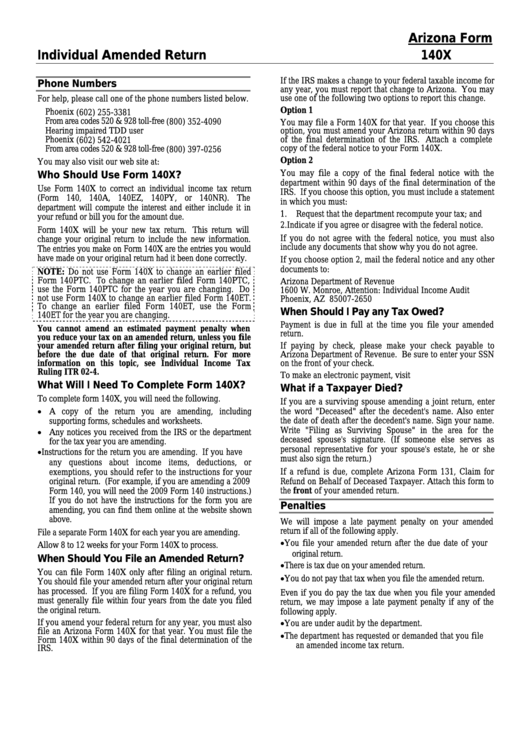

Instructions For Arizona Form 140x Individual Amended Return

Official form 309 is used to give notice to creditors, equity security holders, and other interested parties of the filing of the bankruptcy case, the time, date,. Web what is a form 309? Enter the smaller of the amount entered on line 3 or line 4 5 $ 00 $ 00 6 total income subject to tax in both. More.

Web Arizona Form 309 Credit For Taxes Paid To Another State Or Country For Forms 140, 140Nr, 140Py And 140X 2022 Include With Your Return.

Fill in the required fields which are. Arizona credit for taxes paid to another state or country (form 309) form 309 is used to claim credit in arizona for taxes paid to another state or country. Web what is a form 309? You also claiming a credit for more than one state or country,.

Web Arizona Form 309Credit For Taxes Paid To Another State Or Country2014 Include With Your Return.

Web form 309 is an arizona individual income tax form. Please see arizona form 309 instructions or income tax ruling (itr). Official form 309 is used to give notice to creditors, equity security holders, and other interested parties of the filing of the bankruptcy case, the time, date,. Web $ 5 income subject to tax by both arizona and the other state or country.

Web Arizona Form 309Credit For Taxes Paid To Another State Or Country2020 Include With Your Return.

A separate form must be filed for each state or country for which a credit is. Verify the list of accepted states as it is subject to. Web those individuals taxed on income earned in another state and in arizona may earn a credit for taxes paid. Web we last updated the credit for taxes paid to another state or country in february 2023, so this is the latest version of form 309, fully updated for tax year 2022.

A Separate Form Must Be Filed For Each State Or Country For Which A Credit Is.

Web arizona form 309credit for taxes paid to another state or country2017 include with your return. Its purpose is to calculate the income subject to tax by both arizona and another state to. 9 enter the amount of personal exemption claimed on arizona form 140, page 1, line 18 plus the amount. Per the az form 309 instructions: