Alabama State Tax Exemption Form

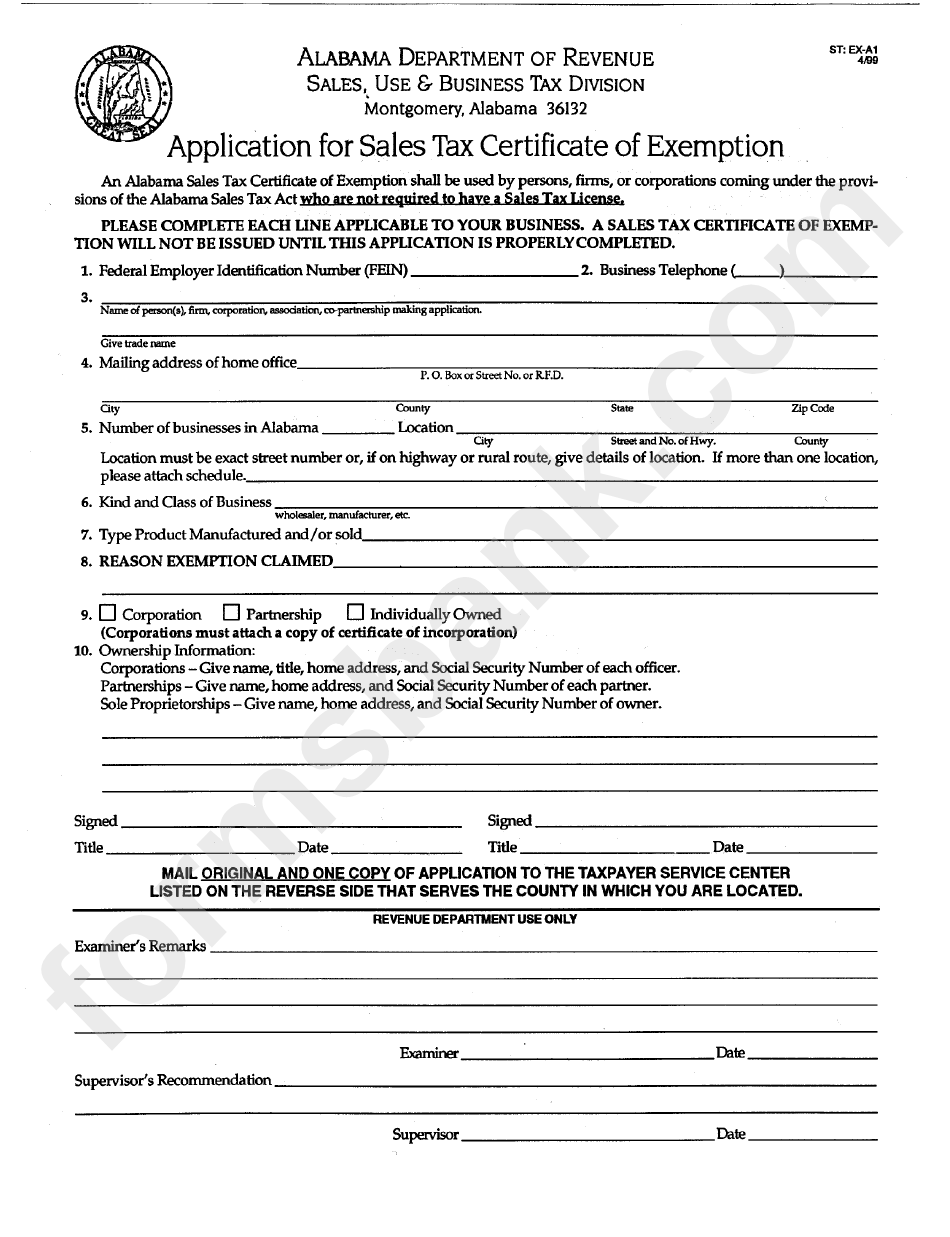

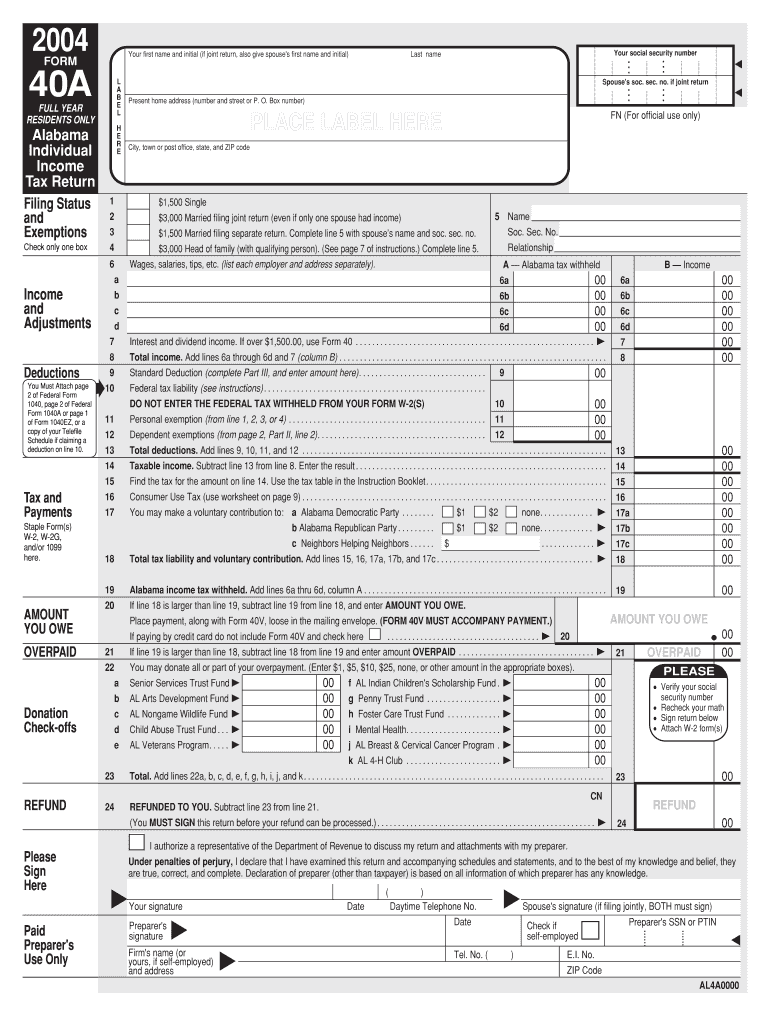

Alabama State Tax Exemption Form - Taxformfinder provides printable pdf copies of. Web taxpayers using the married filing jointly and head of family filing statuses are entitled to a $3,000 personal exemption. Web an alabama sales tax certificate of exemption shall be used by persons, firms, or corporations coming under the provisions of the alabama sales tax act who are not. Web alabama has a state income tax that ranges between 2% and 5% , which is administered by the alabama department of revenue. Edit your alabama ste 1 online. Web the alabama legislature gave final approval today to a bill to exempt from the state income tax up to $6,000 in taxable retirement income for people 65 and older. Web some common items which are considered to be exempt are: Web access information and directory of city, county, and state tax rates for sellers use tax. Prescription drugs, gasoline and motor oil items, seeds which are intended for planting purposes. Web if you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim ''exempt'' from alabama withholding tax.

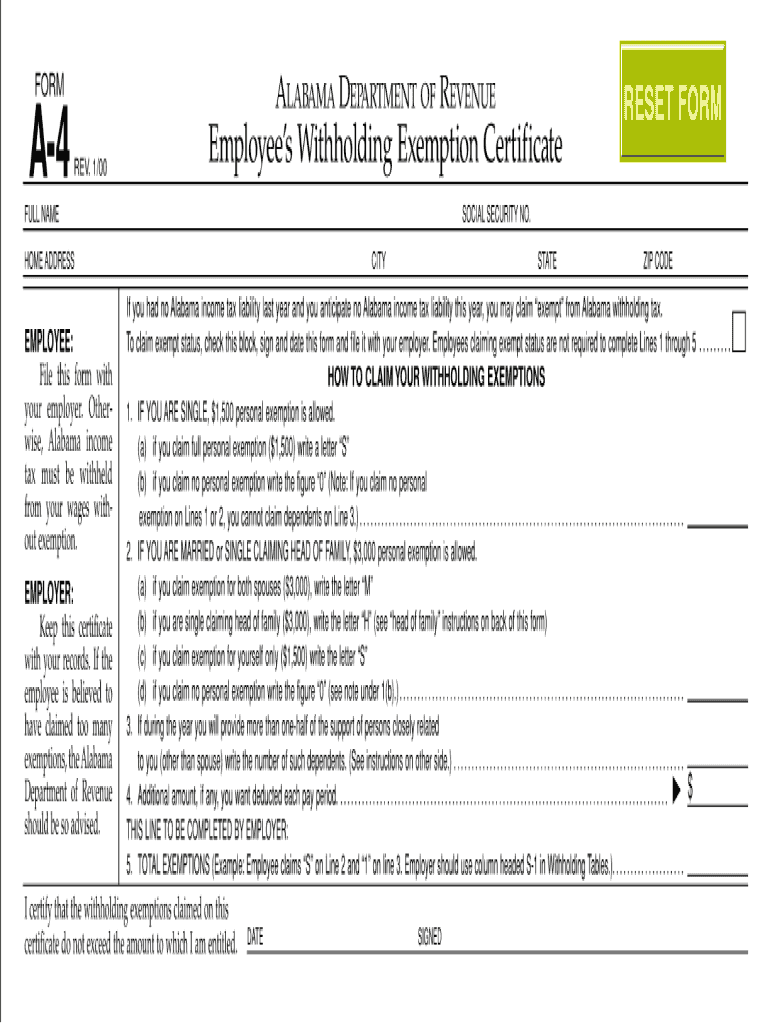

Web homeaddress city state zipcode howto claimyour withholding exemptions. Taxformfinder provides printable pdf copies of. Sales, use & business tax division. Web alabama has a state income tax that ranges between 2% and 5% , which is administered by the alabama department of revenue. Web the alabama legislature gave final approval today to a bill to exempt from the state income tax up to $6,000 in taxable retirement income for people 65 and older. Sales & use tax rates; Web some common items which are considered to be exempt are: Web no do i need a form? Web an alabama sales tax certificate of exemption shall be used by persons, firms, or corporations coming under the provisions of the alabama sales tax act who are not. Web the application for sales and use tax certificate of exemption is available from:

Part year residents are entitled to the full exemption amount. Web if you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim ''exempt'' from alabama withholding tax. Sales & use tax rates; Easily fill out pdf blank, edit, and sign them. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web send alabama state sales and use tax certificate of exemption form ste 1 via email, link, or fax. Web taxpayers using the married filing jointly and head of family filing statuses are entitled to a $3,000 personal exemption. Web access information and directory of city, county, and state tax rates for sellers use tax. Web some common items which are considered to be exempt are: Sales, use & business tax division.

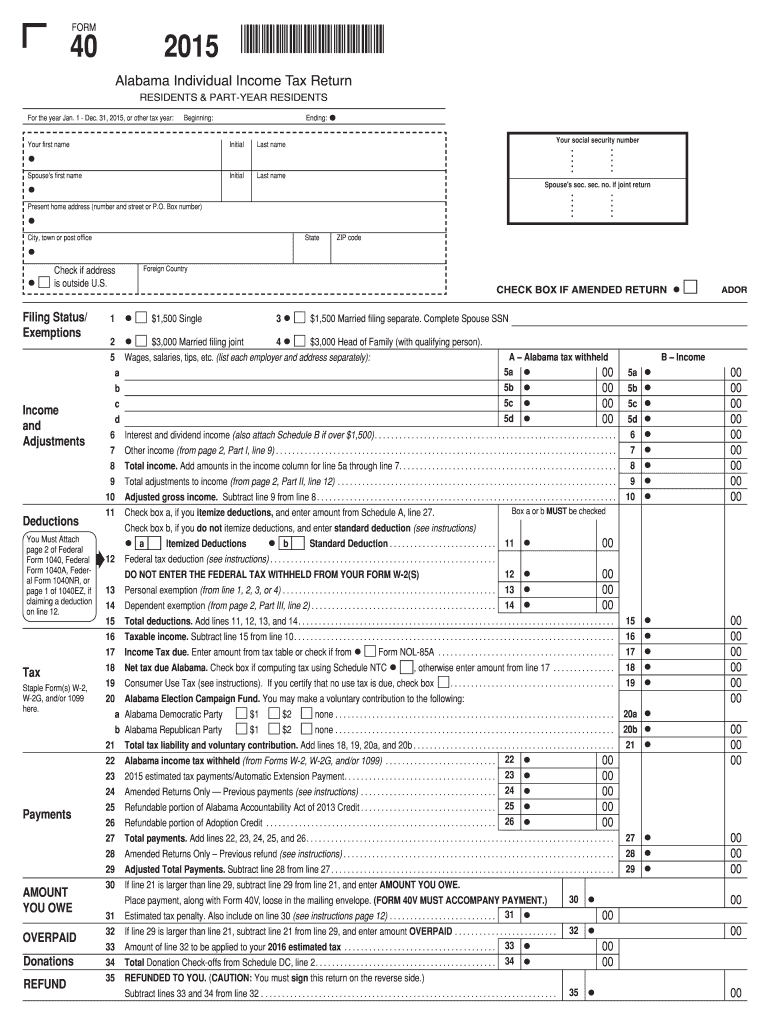

Alabama Form 40 Fill Out and Sign Printable PDF Template signNow

Web taxpayers using the married filing jointly and head of family filing statuses are entitled to a $3,000 personal exemption. Web the application for sales and use tax certificate of exemption is available from: Web alabama has a state income tax that ranges between 2% and 5% , which is administered by the alabama department of revenue. Web admin rules.

GENCO Marketplace Reseller Terms and Tax Licenses

You can also download it, export it or print it out. Web taxpayers using the married filing jointly and head of family filing statuses are entitled to a $3,000 personal exemption. Who do i contact if i have questions? Part year residents are entitled to the full exemption amount. Web alabama has a state income tax that ranges between 2%.

Application For Sales Tax Certificate Of Exemption Alabama Department

Taxformfinder provides printable pdf copies of. Web no do i need a form? You can also download it, export it or print it out. Web the alabama legislature gave final approval today to a bill to exempt from the state income tax up to $6,000 in taxable retirement income for people 65 and older. Web complete alabama state sales and.

Alabama A4 App

Sales & use tax rates; Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Sales, use & business tax division. For other alabama sales tax exemption certificates, go here. Web taxpayers using the married filing jointly and head.

2013 AZ ADEQ Out of State Exemption Form Fill Online, Printable

Sales & use tax rates; Web admin rules >. Web some common items which are considered to be exempt are: Sales, use & business tax division. Web to provide proof of sales tax exemption to vendors, we provide a copy of the university’s sales tax exemption form, which includes our state sales tax registration #6300 00080.

Alabama Ste 1 Fill Out and Sign Printable PDF Template signNow

Web you can download a pdf of the alabama streamlined sales tax certificate of exemption (form sst) on this page. Edit your alabama ste 1 online. Easily fill out pdf blank, edit, and sign them. Sales, use & business tax division. Web homeaddress city state zipcode howto claimyour withholding exemptions.

Form 40 Alabama Fill Out and Sign Printable PDF Template signNow

Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web if you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim ''exempt'' from alabama withholding tax..

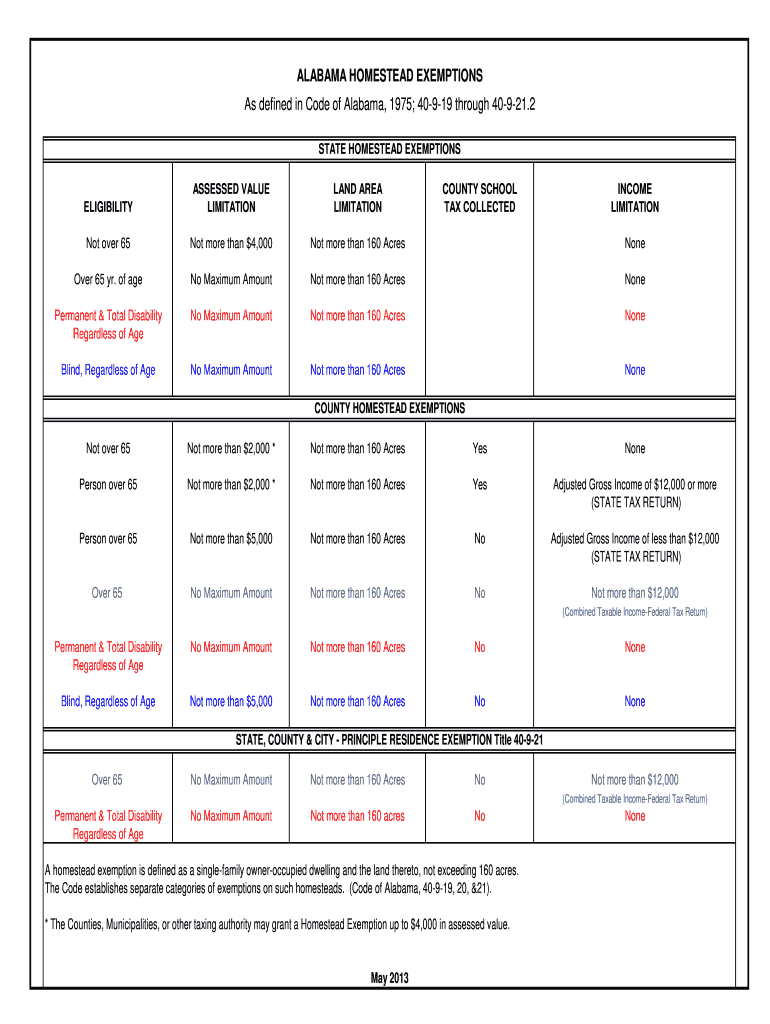

Alabama Homestead Exemption Fill Online, Printable, Fillable, Blank

Web no do i need a form? For other alabama sales tax exemption certificates, go here. Web homeaddress city state zipcode howto claimyour withholding exemptions. Web the application for sales and use tax certificate of exemption is available from: Web taxpayers using the married filing jointly and head of family filing statuses are entitled to a $3,000 personal exemption.

State Of Alabama Tax Refund Calendar Free Calendar Template

Edit your alabama ste 1 online. Web the application for sales and use tax certificate of exemption is available from: Web to provide proof of sales tax exemption to vendors, we provide a copy of the university’s sales tax exemption form, which includes our state sales tax registration #6300 00080. Web an alabama sales tax certificate of exemption shall be.

2000 Form AL DoR A4 Fill Online, Printable, Fillable, Blank PDFfiller

Edit your alabama ste 1 online. Web access information and directory of city, county, and state tax rates for sellers use tax. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Prescription drugs, gasoline and motor oil items,.

Web If You Had No Alabama Income Tax Liability Last Year And You Anticipate No Alabama Income Tax Liability This Year, You May Claim ''Exempt'' From Alabama Withholding Tax.

Web homeaddress city state zipcode howto claimyour withholding exemptions. Sales, use & business tax division. Web an alabama sales tax certificate of exemption shall be used by persons, firms, or corporations coming under the provisions of the alabama sales tax act who are not. Web you can download a pdf of the alabama streamlined sales tax certificate of exemption (form sst) on this page.

Web No Do I Need A Form?

Easily fill out pdf blank, edit, and sign them. Web send alabama state sales and use tax certificate of exemption form ste 1 via email, link, or fax. Web complete alabama state sales and use tax certificate of exemption form ste 1 2020 online with us legal forms. For other alabama sales tax exemption certificates, go here.

Sales & Use Tax Rates;

Edit your alabama ste 1 online. Web some common items which are considered to be exempt are: You can also download it, export it or print it out. Part year residents are entitled to the full exemption amount.

Web Admin Rules >.

Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web to provide proof of sales tax exemption to vendors, we provide a copy of the university’s sales tax exemption form, which includes our state sales tax registration #6300 00080. Prescription drugs, gasoline and motor oil items, seeds which are intended for planting purposes. Web taxpayers using the married filing jointly and head of family filing statuses are entitled to a $3,000 personal exemption.