941 Annual Reconciliation Form

941 Annual Reconciliation Form - Some small employers are eligible to file an annual form 944 pdf. October, november, december go to www.irs.gov/form941 for instructions and the latest. If these forms are not in balance, penalties from the irs and/or ssa could result. Compare those figures with the totals reported on all four 941s for the year. Form 941 asks for the total amount of. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name. 2022 withholding income tax payment and filing due dates. Web quick guide on how to complete ohio it 941 annual reconciliation of income tax withheld. Compare the data on the payroll register with your 941 for the quarterly period. Web annual reconciliation is required.

Ad just import, validate, & file. Use forms for the calendar. Fix discrepancies as soon as you. Web generally, employers are required to file forms 941 quarterly. Download your updated document, export it to the cloud, print it from the editor, or share it with other participants using a shareable link. Run a report that shows annual payroll amounts. Gather information needed to complete form 941. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. If these forms are not in balance, penalties from the irs and/or ssa could result. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name.

Fix discrepancies as soon as you. Gather information needed to complete form 941. Form 941 asks for the total amount of. Web the internal revenue service would like to share the benefits of completing a payroll reconciliation prior to filing your final form 941, employer's quarterly tax return or. Explore filing plans for single businesses or 3rd parties filing for multiple businesses. Compare those figures with the totals reported on all four 941s for the year. If these forms are not in balance, penalties from the irs and/or ssa could result. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Compare those figures with the totals reported on all four 941s for the year. Instead, employers in the u.s.

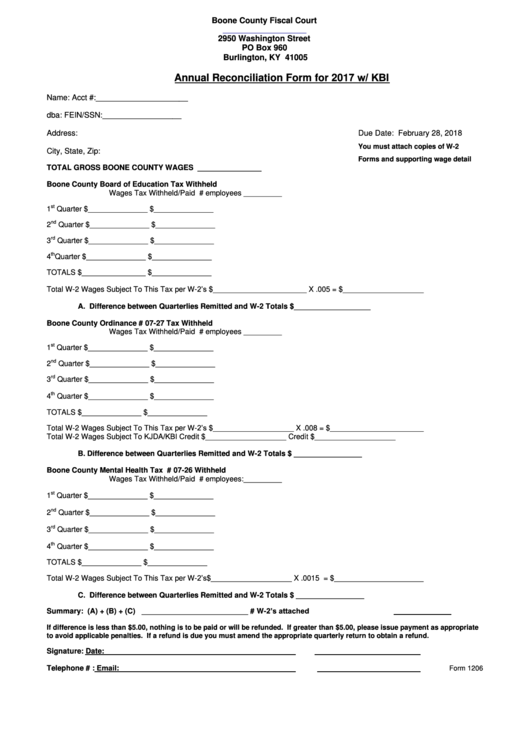

Fillable Form 1206 Annual Reconciliation Form W/ Kbi 2017 printable

Instead, employers in the u.s. Complete, edit or print tax forms instantly. Web annual reconciliation is required. Forget about scanning and printing out forms. If these forms are not in balance, penalties from the irs and/or ssa could result.

Form TC941D Download Fillable PDF or Fill Online Discrepancy Report

Run a report that shows annual payroll amounts. 2022 withholding income tax payment and filing due dates. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name. Run a report that shows annual payroll amounts. See the box to the right.

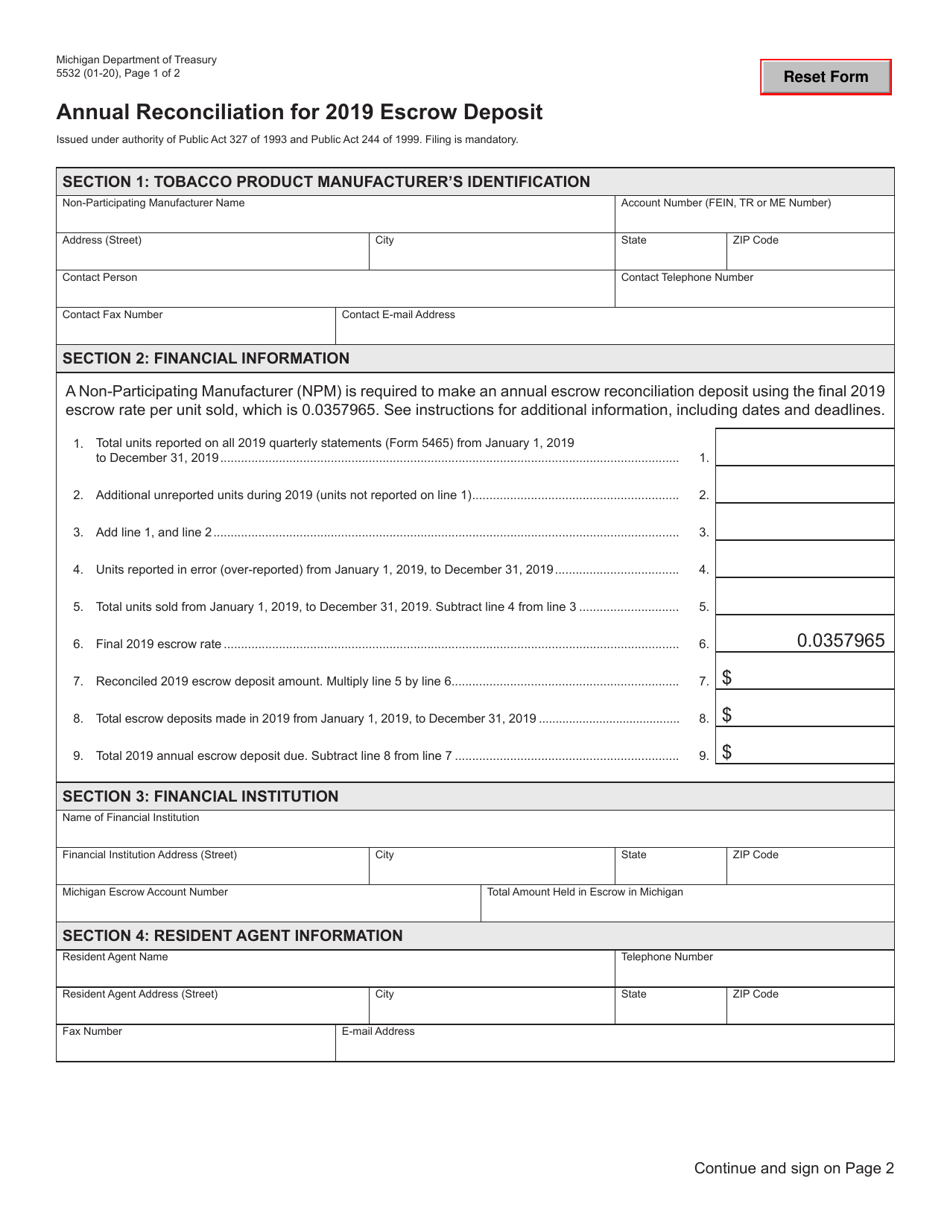

Form 5532 Download Fillable PDF or Fill Online Annual Reconciliation

If these forms are not in balance, penalties from the irs and/or ssa could result. Ad just import, validate, & file. Web get the form 941 annual tax accomplished. To the ohio department of. Run a report that shows annual payroll amounts.

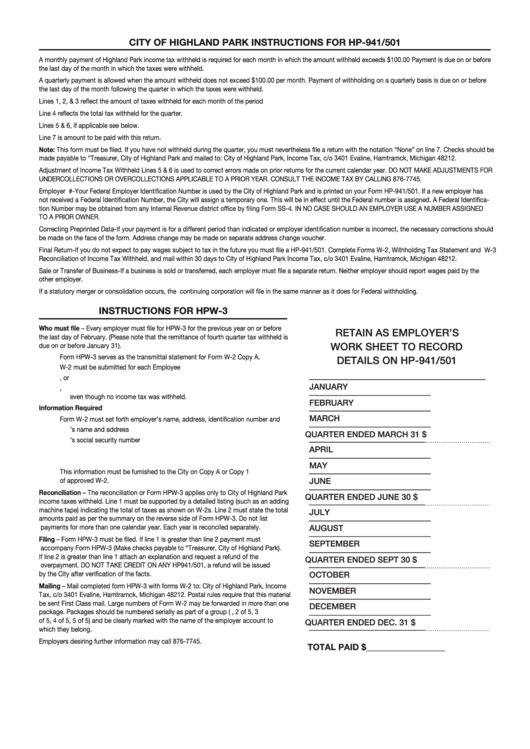

Instructions For Form Hp941/501/form Hpw3 Highland Park Tax

Run a report that shows annual payroll amounts. October, november, december go to www.irs.gov/form941 for instructions and the latest. Web the internal revenue service would like to share the benefits of completing a payroll reconciliation prior to filing your final form 941, employer's quarterly tax return or. Web annual reconciliation is required. Download your updated document, export it to the.

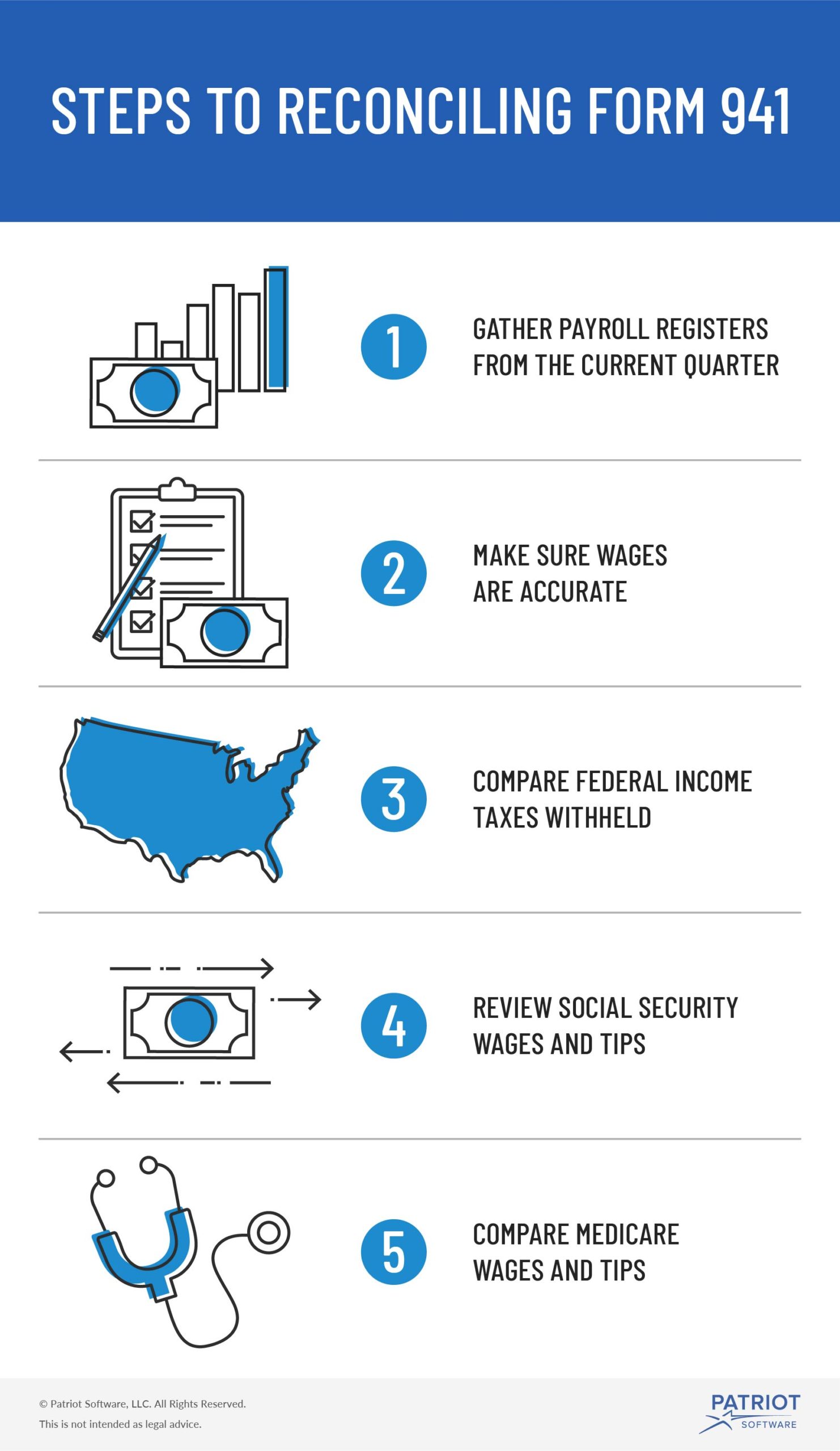

What to Know About Form 941 Reconciliation Steps, Due Dates, & More

Use our detailed instructions to fill out and. Web get the form 941 annual tax accomplished. Web the internal revenue service would like to share the benefits of completing a payroll reconciliation prior to filing your final form 941, employer's quarterly tax return or. Web annual reconciliation is required. Ad just import, validate, & file.

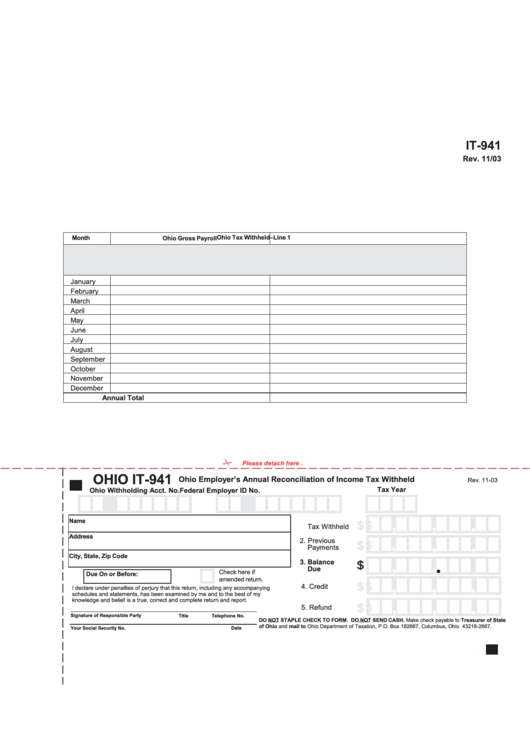

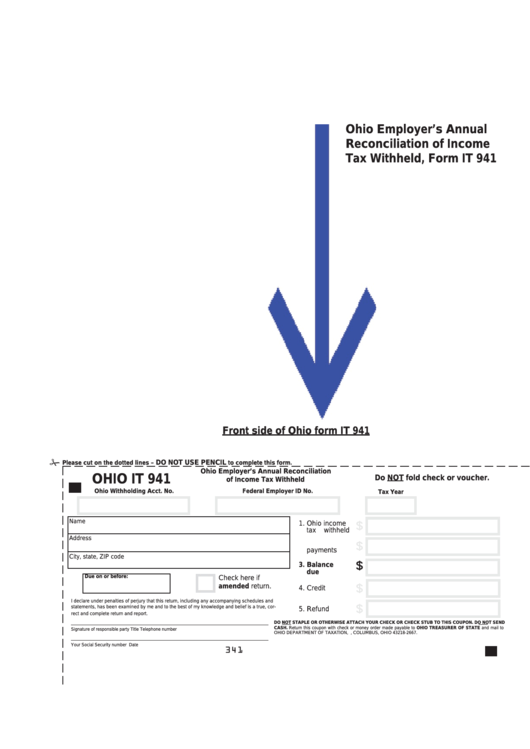

Form It941 Employer'S Annual Reconciliation Of Tax Withheld

Web quick guide on how to complete ohio it 941 annual reconciliation of income tax withheld. Use our detailed instructions to fill out and. Web get the form 941 annual tax accomplished. 2022 withholding income tax payment and filing due dates. Web the internal revenue service would like to share the benefits of completing a payroll reconciliation prior to filing.

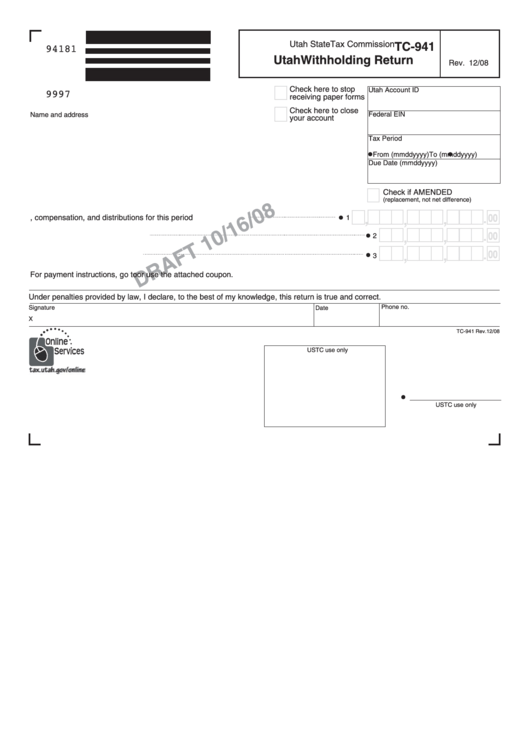

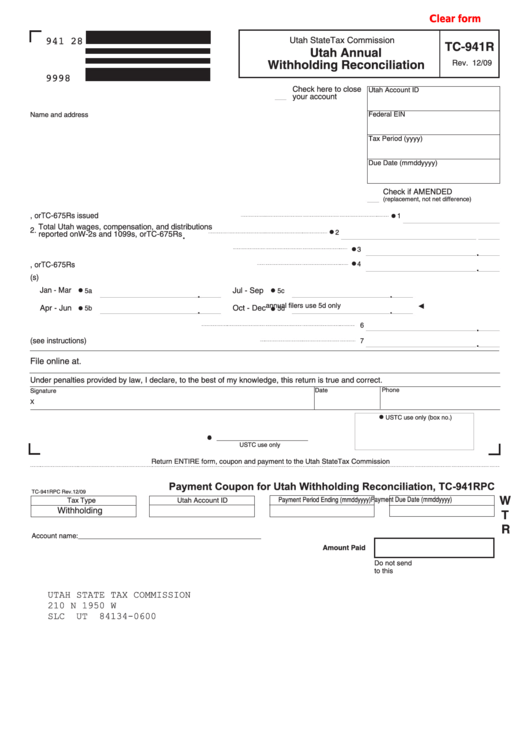

Form Tc941 Draft Utah Withholding Return, Form Tc941r Utah Annual

Run a report that shows annual payroll amounts. However, some small employers (those whose annual liability for social security, medicare, and. Web generally, employers are required to file forms 941 quarterly. Compare those figures with the totals reported on all four 941s for the year. Complete, edit or print tax forms instantly.

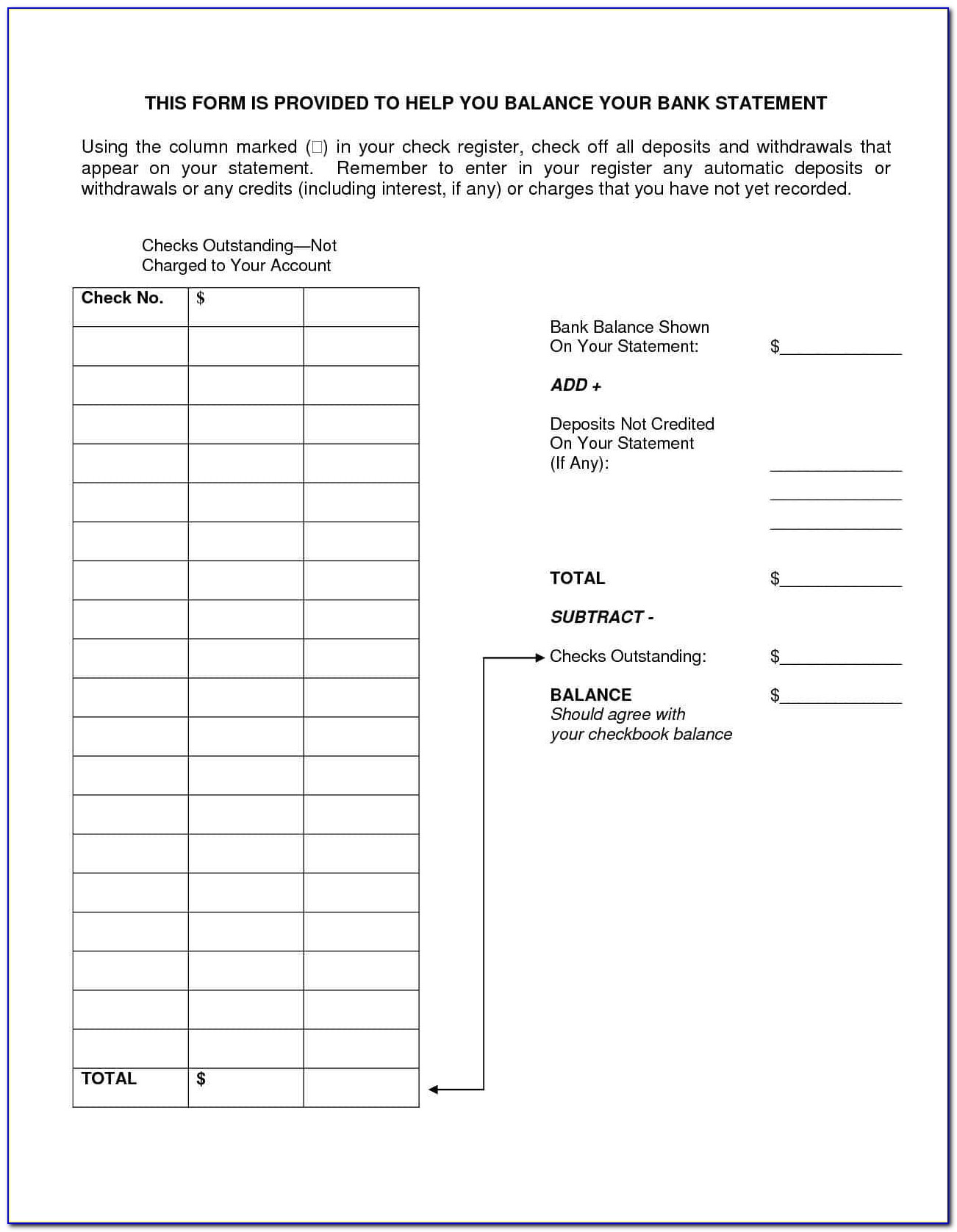

Daily Cash Reconciliation Excel Template

Run a report that shows annual payroll amounts. If these forms are not in balance, penalties from the irs and/or ssa could result. Web quick guide on how to complete ohio it 941 annual reconciliation of income tax withheld. Web get the form 941 annual tax accomplished. Compare those figures with the totals reported on all four 941s for the.

Fillable Form Tc941r Utah Annual Withholding Reconciliation

Some small employers are eligible to file an annual form 944 pdf. Ad get ready for tax season deadlines by completing any required tax forms today. Run a report that shows annual payroll amounts. Instead, employers in the u.s. If these forms are not in balance, penalties from the irs and/or ssa could result.

Fillable Ohio Form It 941 Ohio Employer'S Annual Reconciliation Of

Run a report that shows annual payroll amounts. Instead, employers in the u.s. Web annual reconciliation is required. October, november, december go to www.irs.gov/form941 for instructions and the latest. Form 941 asks for the total amount of.

Run A Report That Shows Annual Payroll Amounts.

If these forms are not in balance, penalties from the irs and/or ssa could result. Fix discrepancies as soon as you. Use our detailed instructions to fill out and. Some small employers are eligible to file an annual form 944 pdf.

Run A Payroll Register For The Quarter.

Web the internal revenue service would like to share the benefits of completing a payroll reconciliation prior to filing your final form 941, employer's quarterly tax return or. Web quick guide on how to complete ohio it 941 annual reconciliation of income tax withheld. Form 941 is used by employers. Instead, employers in the u.s.

Use Forms For The Calendar.

Compare those figures with the totals reported on all four 941s for the year. Web annual reconciliation is required. Compare those figures with the totals reported on all four 941s for the year. Ad get ready for tax season deadlines by completing any required tax forms today.

Download Your Updated Document, Export It To The Cloud, Print It From The Editor, Or Share It With Other Participants Using A Shareable Link.

Explore filing plans for single businesses or 3rd parties filing for multiple businesses. Form 941 asks for the total amount of. Web get the form 941 annual tax accomplished. However, some small employers (those whose annual liability for social security, medicare, and.