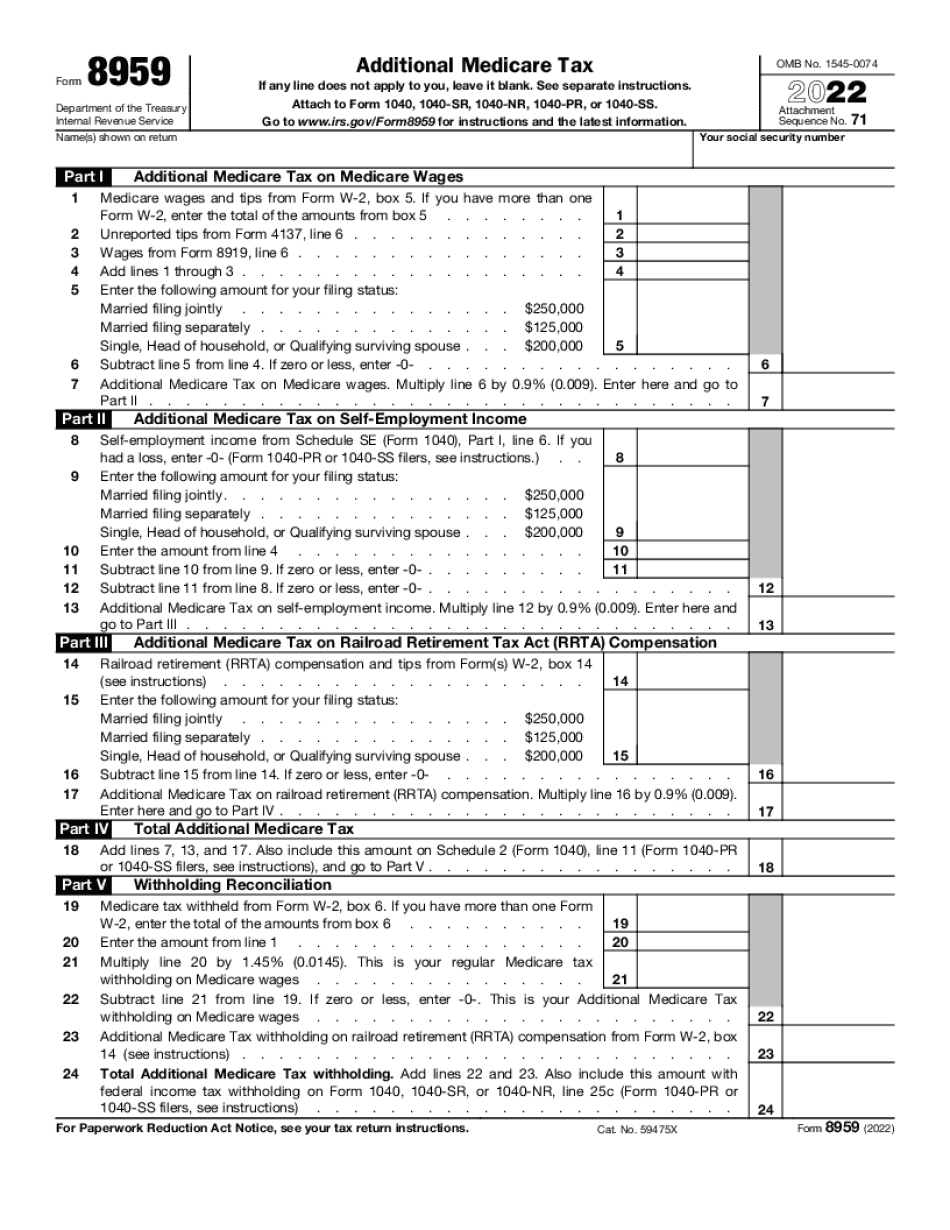

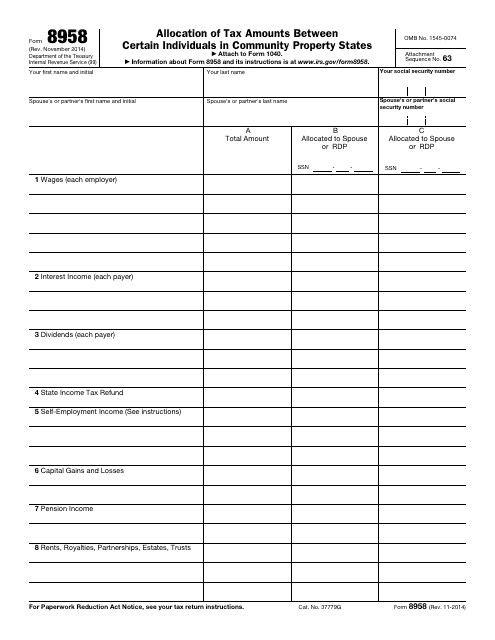

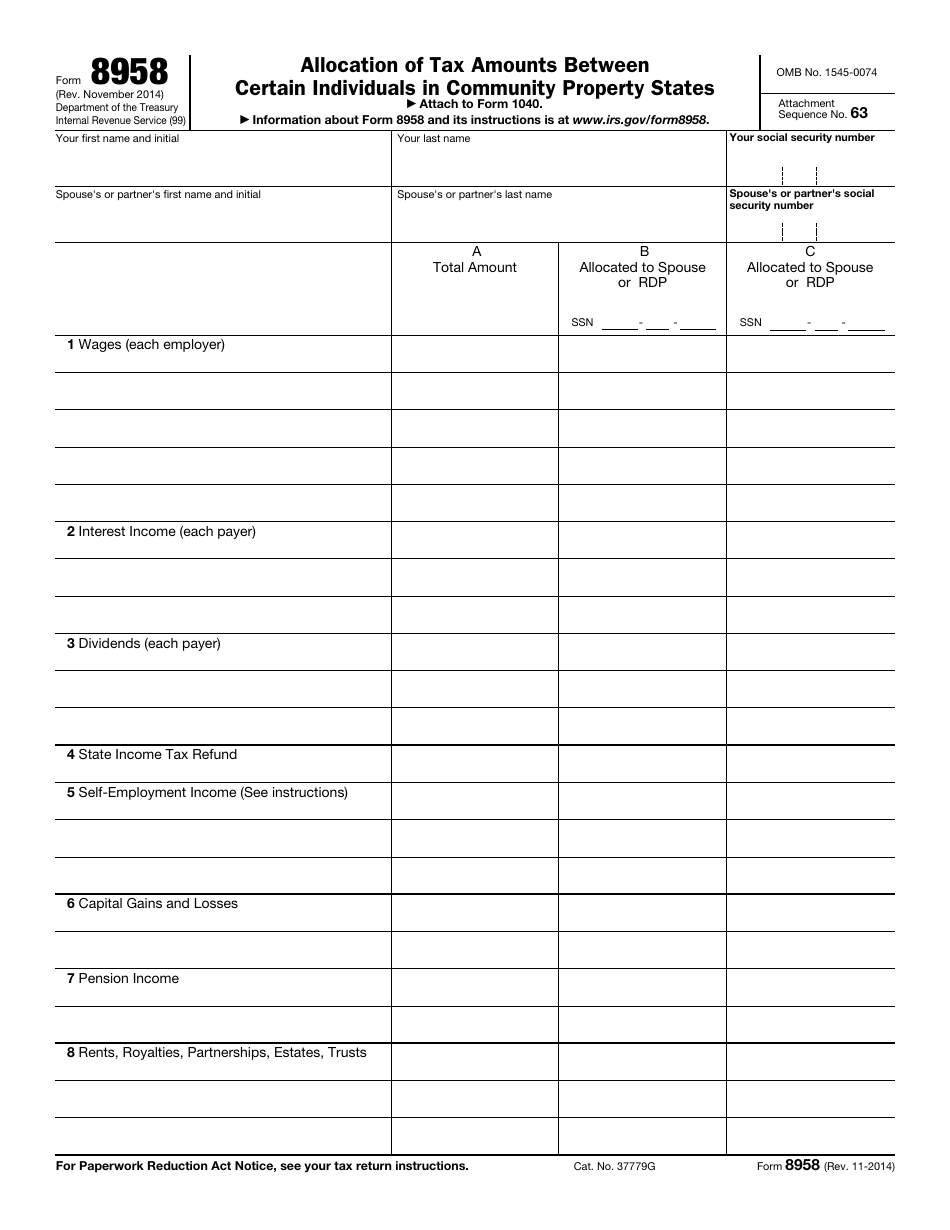

8958 Tax Form

8958 Tax Form - For some of the western states, the following addresses were previously used: Click the printer icon above the worksheet on the right side. The states of tennessee and south dakota have passed elective community property laws. Publication 555 discusses community property laws that. This publication does not address the federal tax. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web to generate form 8958, follow these steps: Web taxes deductions & credits skyecanyongator level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. I got married in nov.

Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web generating form 8958 community property and the mfj/mfs worksheet suppress form 8958 allocation of tax amounts between individuals in community property states. Enter amounts in the income allocation details subsection. Web form 8958 is a federal corporate income tax form. Web tennessee and south dakota. Web information about publication 555, community property, including recent updates and related forms. This publication does not address the federal tax. Web taxes deductions & credits skyecanyongator level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Publication 555 discusses community property laws that. For some of the western states, the following addresses were previously used:

Publication 555 discusses community property laws that. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. The states of tennessee and south dakota have passed elective community property laws. Go to screen 3.1, community property income allocation. Yes, loved it could be better no one. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. For some of the western states, the following addresses were previously used: This publication does not address the federal tax. Web to generate form 8958, follow these steps: I got married in nov.

Form 8958 instructions 2023 Fill online, Printable, Fillable Blank

Publication 555 discusses community property laws that. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web if your resident state is a community.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web information about publication 555, community property, including recent updates and related forms. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Click the.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Web to generate form 8958, follow these steps: Yes, loved it could be better no one. For some of the western states, the following addresses were previously used: Web information about publication 555, community property, including recent updates and related forms. Publication 555 discusses community property laws that.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

I got married in nov. Web form 8958 is a federal corporate income tax form. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. For.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

This publication does not address the federal tax. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Yes, loved it could be better no one. Web to generate form 8958, follow these steps: Go to screen 3.1, community property income allocation. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. For some of the western.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

For some of the western states, the following addresses were previously used: This publication does not address the federal tax. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web tennessee and south dakota. Enter amounts in the income allocation details subsection.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

I got married in nov. Web information about publication 555, community property, including recent updates and related forms. For some of the western states, the following addresses were previously used: Web form 8958 is a federal corporate income tax form. Web tennessee and south dakota.

Form 8958 Fill Out and Sign Printable PDF Template signNow

Click the printer icon above the worksheet on the right side. I got married in nov. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. For some of the western states, the following addresses were previously used: Web taxes deductions & credits skyecanyongator level 1 how to properly fill out form 8958 i moved to nevada in.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web generating form 8958 community property and the mfj/mfs worksheet suppress form 8958 allocation of tax amounts between individuals in community property states. I got married in nov. Yes, loved it could be better no one. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are.

Web Generating Form 8958 Community Property And The Mfj/Mfs Worksheet Suppress Form 8958 Allocation Of Tax Amounts Between Individuals In Community Property States.

Web tennessee and south dakota. Web taxes deductions & credits skyecanyongator level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Department of the treasury |. I got married in nov.

Web If Your Resident State Is A Community Property State, And You File A Federal Tax Return Separately From Your Spouse Or Registered Domestic Partner, Use Form 8958 To Report Half.

Enter amounts in the income allocation details subsection. Go to screen 3.1, community property income allocation. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. The states of tennessee and south dakota have passed elective community property laws.

Web Use This Form To Determine The Allocation Of Tax Amounts Between Married Filing Separate Spouses Or Registered Domestic Partners (Rdps) With Community Property.

Web form 8958 is a federal corporate income tax form. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web information about publication 555, community property, including recent updates and related forms.

California, Connecticut, District Of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia.

Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Publication 555 discusses community property laws that. For some of the western states, the following addresses were previously used: Yes, loved it could be better no one.