8915F-T Form

8915F-T Form - January 2022), please be advised that those. Web i still have a critical diagnostic today on march 20, 2023 for a 2022 individual tax return: For example, the form 1040 page is at. Department of the treasury internal. (january 2022) qualified disaster retirement plan distributions and repayments. Federal form 8915f (2020) is final, but the instructions are still in draft. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the amount of your qualified 2020 disaster distributions made for 2020 or 2021 and. Generally this will match the distribution that was taxable but if you took. Web almost every form and publication has a page on irs.gov with a friendly shortcut. (your answer won't affect the preparation of.

I go back to ensure. Generally this will match the distribution that was taxable but if you took. January 2022), please be advised that those. Web i still have a critical diagnostic today on march 20, 2023 for a 2022 individual tax return: Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the amount of your qualified 2020 disaster distributions made for 2020 or 2021 and. Web almost every form and publication has a page on irs.gov with a friendly shortcut. Federal form 8915f (2020) is final, but the instructions are still in draft. (your answer won't affect the preparation of. (january 2022) qualified disaster retirement plan distributions and repayments. Department of the treasury internal.

Department of the treasury internal. Federal form 8915f (2020) is final, but the instructions are still in draft. To report the 2021 cares act retirement plan distribution for 2020 that gave. January 2022), please be advised that those. (your answer won't affect the preparation of. (january 2022) qualified disaster retirement plan distributions and repayments. Web i still have a critical diagnostic today on march 20, 2023 for a 2022 individual tax return: Generally this will match the distribution that was taxable but if you took. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the amount of your qualified 2020 disaster distributions made for 2020 or 2021 and. Web almost every form and publication has a page on irs.gov with a friendly shortcut.

2022 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

Generally this will match the distribution that was taxable but if you took. Web i still have a critical diagnostic today on march 20, 2023 for a 2022 individual tax return: Federal form 8915f (2020) is final, but the instructions are still in draft. January 2022), please be advised that those. (your answer won't affect the preparation of.

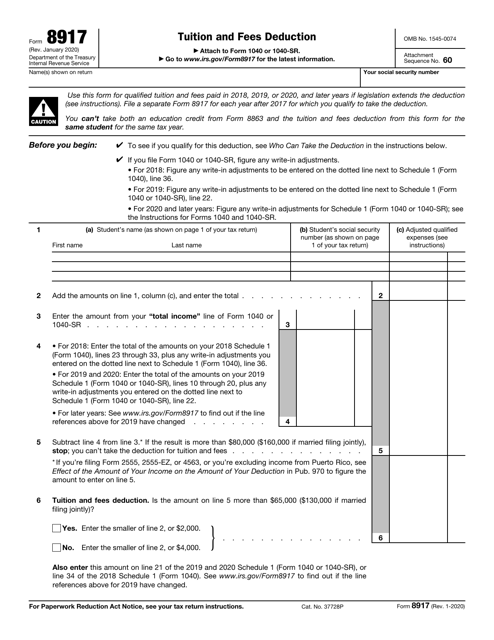

Irs Form 8917 Printable Printable Forms Free Online

(your answer won't affect the preparation of. Department of the treasury internal. Generally this will match the distribution that was taxable but if you took. I go back to ensure. Web i still have a critical diagnostic today on march 20, 2023 for a 2022 individual tax return:

Form 8915 Qualified Hurricane Retirement Plan Distributions and

I go back to ensure. To report the 2021 cares act retirement plan distribution for 2020 that gave. January 2022), please be advised that those. Generally this will match the distribution that was taxable but if you took. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the amount of your.

FORM 8915FT

Federal form 8915f (2020) is final, but the instructions are still in draft. I go back to ensure. Generally this will match the distribution that was taxable but if you took. Web almost every form and publication has a page on irs.gov with a friendly shortcut. January 2022), please be advised that those.

form 8915 e instructions turbotax Renita Wimberly

Department of the treasury internal. Federal form 8915f (2020) is final, but the instructions are still in draft. Web i still have a critical diagnostic today on march 20, 2023 for a 2022 individual tax return: I go back to ensure. January 2022), please be advised that those.

8915 F 2020 Coronavirus Distributions for 2021 Tax Returns YouTube

(january 2022) qualified disaster retirement plan distributions and repayments. Generally this will match the distribution that was taxable but if you took. Federal form 8915f (2020) is final, but the instructions are still in draft. Web almost every form and publication has a page on irs.gov with a friendly shortcut. For example, the form 1040 page is at.

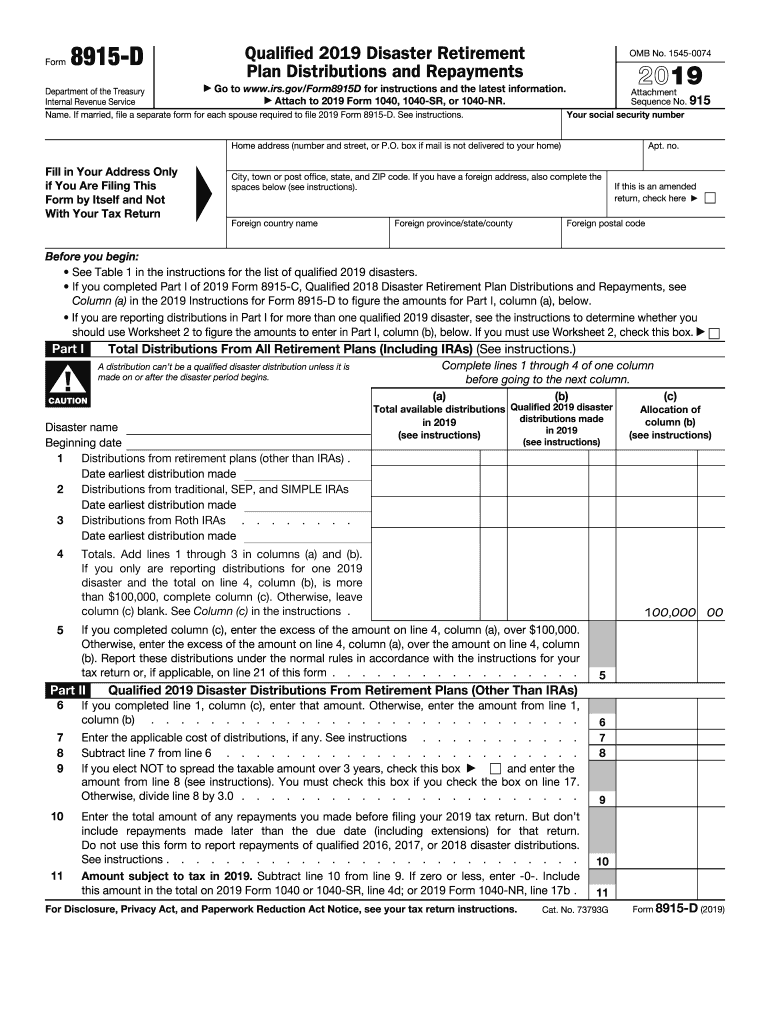

8915 D Form Fill Out and Sign Printable PDF Template signNow

(january 2022) qualified disaster retirement plan distributions and repayments. (your answer won't affect the preparation of. Generally this will match the distribution that was taxable but if you took. Department of the treasury internal. I go back to ensure.

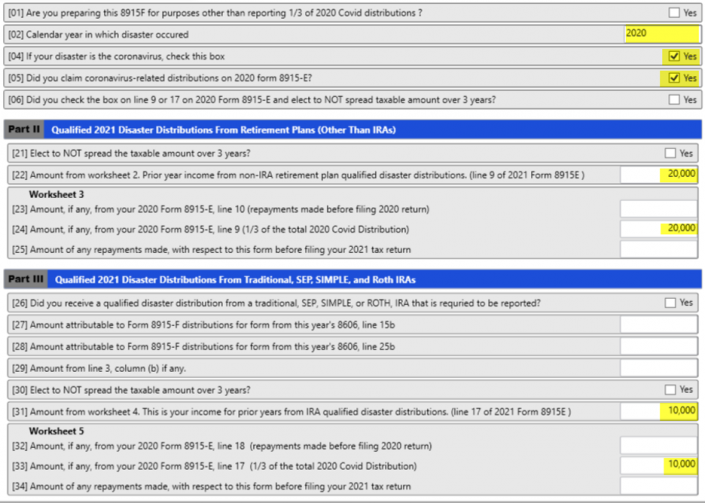

Basic 8915F Instructions for 2021 Taxware Systems

Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the amount of your qualified 2020 disaster distributions made for 2020 or 2021 and. Federal form 8915f (2020) is final, but the instructions are still in draft. For example, the form 1040 page is at. (your answer won't affect the preparation of..

'Forever' form 8915F issued by IRS for retirement distributions Newsday

Generally this will match the distribution that was taxable but if you took. For example, the form 1040 page is at. Web almost every form and publication has a page on irs.gov with a friendly shortcut. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the amount of your qualified 2020.

“Qualified disaster” declaration KPMG United States

Department of the treasury internal. To report the 2021 cares act retirement plan distribution for 2020 that gave. (january 2022) qualified disaster retirement plan distributions and repayments. I go back to ensure. Web i still have a critical diagnostic today on march 20, 2023 for a 2022 individual tax return:

Generally This Will Match The Distribution That Was Taxable But If You Took.

Web i still have a critical diagnostic today on march 20, 2023 for a 2022 individual tax return: For example, the form 1040 page is at. (january 2022) qualified disaster retirement plan distributions and repayments. I go back to ensure.

January 2022), Please Be Advised That Those.

Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the amount of your qualified 2020 disaster distributions made for 2020 or 2021 and. Department of the treasury internal. Federal form 8915f (2020) is final, but the instructions are still in draft. (your answer won't affect the preparation of.

Web Almost Every Form And Publication Has A Page On Irs.gov With A Friendly Shortcut.

To report the 2021 cares act retirement plan distribution for 2020 that gave.