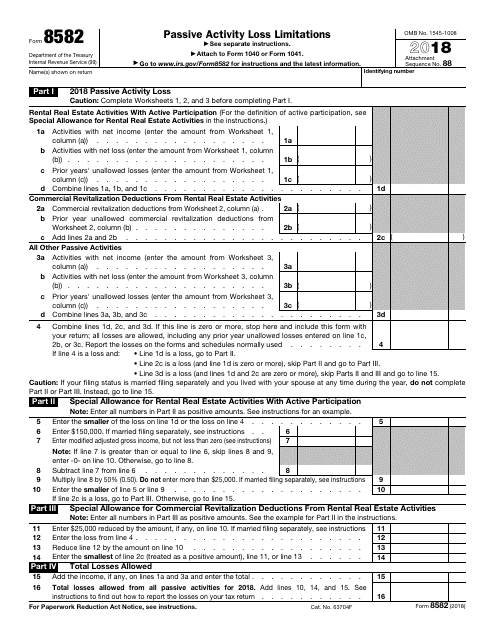

8582 Tax Form

8582 Tax Form - 858 name(s) shown on return identifying number Web about form 8582, passive activity loss limitations. Ad access irs tax forms. Go to www.irs.gov/form8582 for instructions and the latest information. If you actively participated in a passive rental real estate activity, you may be able to deduct up to $25,000 of loss from the activity from your nonpassive income. Web irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. Edit, sign and print tax forms on any device with uslegalforms. This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Noncorporate taxpayers use form 8582 to:

Go to www.irs.gov/form8582 for instructions and the latest information. A pal occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. Noncorporate taxpayers use form 8582 to: You can print other federal tax forms here. Complete, edit or print tax forms instantly. This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income. Tax law & stimulus updates. This article will walk you through what you need to know about irs form 8582, including: Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed pals. Web about form 8582, passive activity loss limitations.

Figure the amount of any passive activity loss (pal) for the current tax year. Go to www.irs.gov/form8582 for instructions and the latest information. Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Web turbotax live en español. Edit, sign and print tax forms on any device with uslegalforms. Web form 8582 department of the treasury internal revenue service passive activity loss limitations see separate instructions. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. 858 name(s) shown on return identifying number This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed pals.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Report the application of prior year unallowed pals. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. This article will walk you through what you need to know about irs form 8582, including: Web form 8582 is used by noncorporate taxpayers to figure the amount of any.

2B. Professor Patricia (Patty) Pâté is retired from

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Noncorporate taxpayers use form 8582 to: You can print other federal tax forms here. Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions.

IRS Form 8582 Download Fillable PDF or Fill Online Passive Activity

Noncorporate taxpayers use form 8582 to: Web form 8582 department of the treasury internal revenue service passive activity loss limitations see separate instructions. Web turbotax live en español. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. You can print other federal tax forms here. Edit, sign and print tax forms on any device with uslegalforms. 858 name(s) shown on return identifying number Figure the amount of any passive activity.

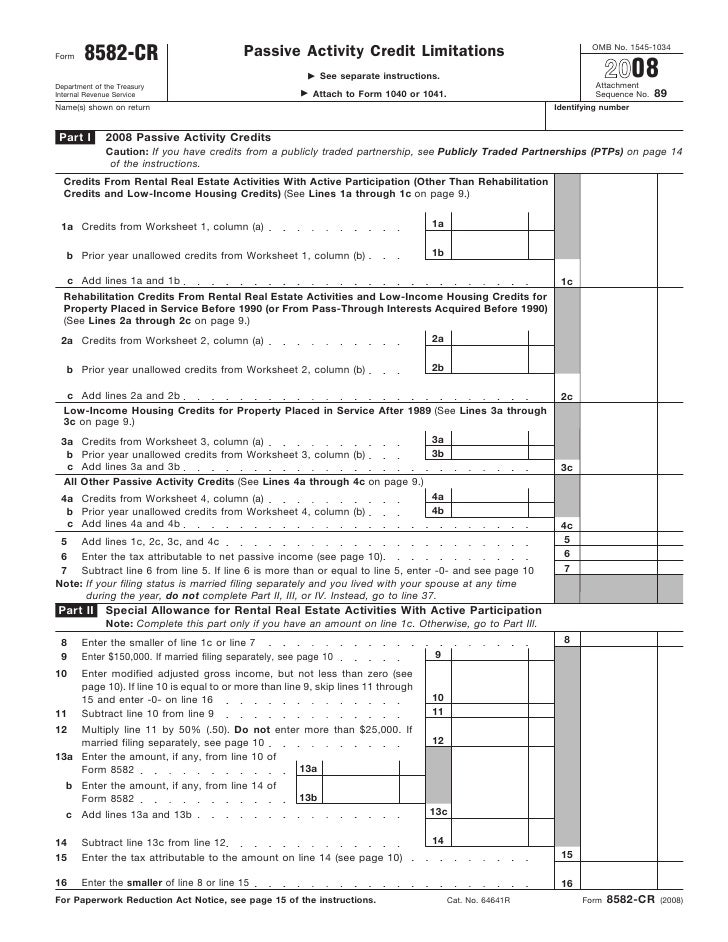

Form 8582CR Passive Activity Credit Limitations

A pal occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. Complete, edit or print tax forms instantly. Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. 858 name(s) shown on return identifying number Web irs form.

Instructions for Form 8582CR (12/2019) Internal Revenue Service

858 name(s) shown on return identifying number Tax law & stimulus updates. Web about form 8582, passive activity loss limitations. Noncorporate taxpayers use form 8582 to: Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed pals.

Instructions for Form 8582CR (01/2012) Internal Revenue Service

This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income. Noncorporate taxpayers use form 8582 to: 858 name(s) shown on return identifying number Go to www.irs.gov/form8582 for instructions and the latest information. This article will walk you through what you need to know about irs form 8582, including:

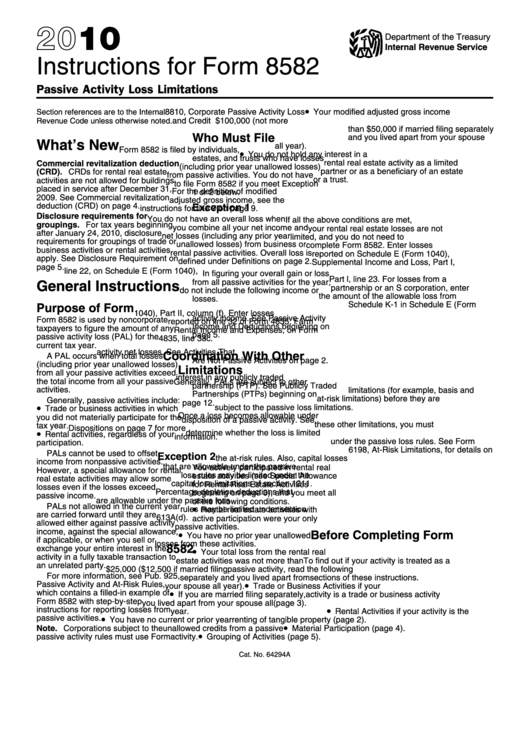

Instructions For Form 8582 2010 printable pdf download

A passive activity loss occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. Edit, sign and print tax forms on any device with uslegalforms. You can print other federal tax forms here. Report the application of prior year unallowed pals. 858 name(s) shown on return identifying.

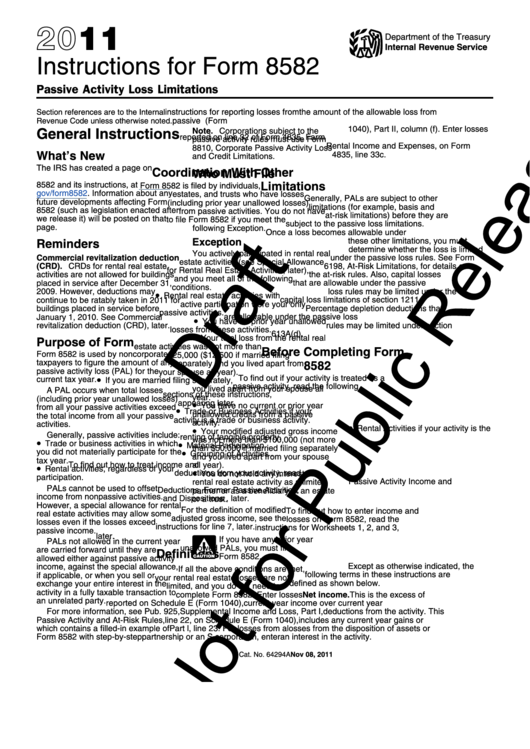

Instructions For Form 8582 Draft 2011 printable pdf download

A passive activity loss occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. Noncorporate taxpayers use form 8582 to: Complete, edit or print tax forms instantly. A pal occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

This article will walk you through what you need to know about irs form 8582, including: Ad access irs tax forms. Web irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. Complete, edit or print tax forms instantly. A passive activity loss occurs when total losses (including prior year unallowed losses).

If You Actively Participated In A Passive Rental Real Estate Activity, You May Be Able To Deduct Up To $25,000 Of Loss From The Activity From Your Nonpassive Income.

Edit, sign and print tax forms on any device with uslegalforms. This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income. A pal occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. Tax law & stimulus updates.

Web Form 8582 Is Used By Noncorporate Taxpayers To Figure The Amount Of Any Passive Activity Loss (Pal) For The Current Tax Year And To Report The Application Of Prior Year Unallowed Pals.

Complete, edit or print tax forms instantly. A passive activity loss occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. Web about form 8582, passive activity loss limitations. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022.

Noncorporate Taxpayers Use Form 8582 To:

Report the application of prior year unallowed pals. You can print other federal tax forms here. Go to www.irs.gov/form8582 for instructions and the latest information. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year.

This Article Will Walk You Through What You Need To Know About Irs Form 8582, Including:

858 name(s) shown on return identifying number Web turbotax live en español. Web form 8582 department of the treasury internal revenue service passive activity loss limitations see separate instructions. Figure the amount of any passive activity loss (pal) for the current tax year.