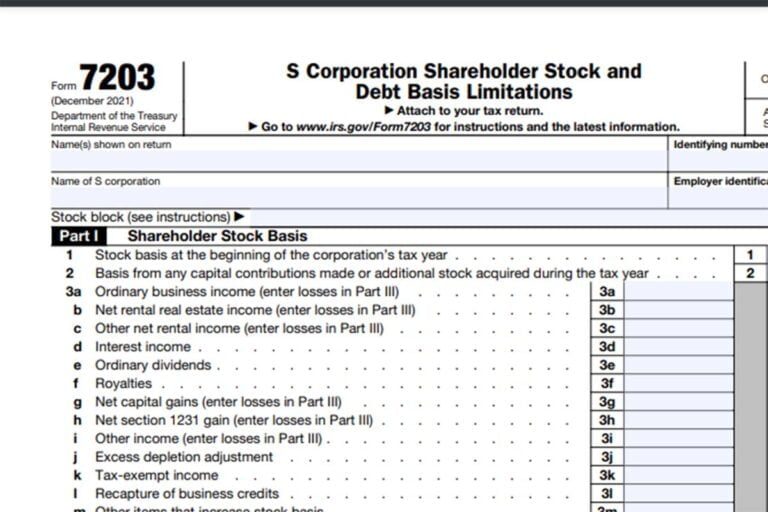

7203 Tax Form

7203 Tax Form - Employee's withholding certificate form 941; How do i clear ef messages 5486 and 5851? Web irs form 7203 is a tax form used to report the basis of your shares in an s corporation. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. To enter basis limitation info in the. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Web addresses for forms beginning with the number 7. Please note, the form 7203 is not required to. Web about form 7203, s corporation shareholder stock and debt basis limitations. Press f6 to bring up open forms.

Web form 7203 is generated for a 1040 return when: S corporation shareholders use form 7203 to figure the potential. Employee's withholding certificate form 941; Web 1 best answer julies expert alumni if you have an entry for distributions on line 16 d, you are required to complete form 7203, even if you believe the distributions. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Web form 7203 contains a detailed accounting of the shareholder’s basis in the corporation and replaces the requirement that the shareholder/taxpayer attach a basis. Press f6 to bring up open forms. Web the form 7203 represents the irs’ official reporting form to be used to track a shareholder’s basis in an s corporation. Employers engaged in a trade or business who.

How do i clear ef messages 5486 and 5851? The draft form includes a new item d. Use this address if you are not enclosing a payment use this. Web what is form 7203? This form helps you calculate the adjusted basis of your stock and debt. A taxpayer will need to. Employee's withholding certificate form 941; Employers engaged in a trade or business who. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web the form 7203 represents the irs’ official reporting form to be used to track a shareholder’s basis in an s corporation.

More Basis Disclosures This Year for S corporation Shareholders Need

Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. Web what is form 7203? Employers engaged in a trade or business who. Employee's withholding certificate form 941; S corporation shareholders use form 7203 to figure the potential.

SCorporation Shareholders May Need to File Form 7203

Web irs issues guidance for s corporation shareholders. Web what is form 7203? Web form 7203 contains a detailed accounting of the shareholder’s basis in the corporation and replaces the requirement that the shareholder/taxpayer attach a basis. This form helps you calculate the adjusted basis of your stock and debt. The irs changes for s corporations form 7203 was developed.

National Association of Tax Professionals Blog

Web about form 7203, s corporation shareholder stock and debt basis limitations. A taxpayer will need to. S corporation shareholders use form 7203 to figure the potential. Web form 7203 is generated for a 1040 return when: To enter basis limitation info in the.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web form 7203 is generated for a 1040 return when: Employee's withholding certificate form 941; December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. This form helps you calculate the adjusted basis of your stock and debt. Web addresses for forms beginning with the number 7.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

This form helps you calculate the adjusted basis of your stock and debt. Web what is form 7203? How do i clear ef messages 5486 and 5851? Press f6 to bring up open forms. Web 1 best answer julies expert alumni if you have an entry for distributions on line 16 d, you are required to complete form 7203, even.

IRS Proposes New Form 7203 for S Corporation Shareholders to Report

This form helps you calculate the adjusted basis of your stock and debt. Web the form 7203 represents the irs’ official reporting form to be used to track a shareholder’s basis in an s corporation. The draft form includes a new item d. Employee's withholding certificate form 941; Web addresses for forms beginning with the number 7.

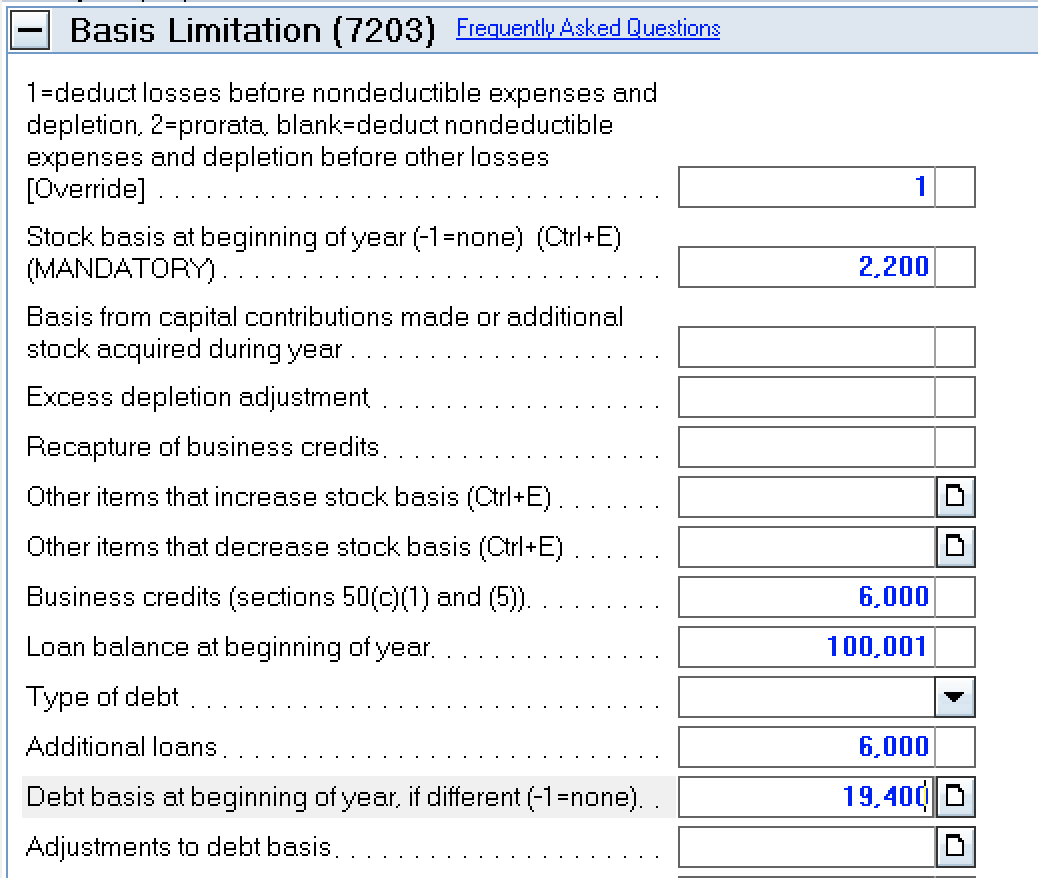

How to complete Form 7203 in Lacerte

This form helps you calculate the adjusted basis of your stock and debt. To enter basis limitation info in the. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Please note, the form 7203 is not required to. Employers engaged in a.

IRS Issues New Form 7203 for Farmers and Fishermen

Use this address if you are not enclosing a payment use this. How do i clear ef messages 5486 and 5851? Please note, the form 7203 is not required to. Employers engaged in a trade or business who. Web addresses for forms beginning with the number 7.

Peerless Turbotax Profit And Loss Statement Cvp

Employee's withholding certificate form 941; Please note, the form 7203 is not required to. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring.

National Association of Tax Professionals Blog

Web up to 10% cash back the draft form 7203 for tax year 2022 makes only two changes to the 2021 form: How do i clear ef messages 5486 and 5851? Web form 7203 contains a detailed accounting of the shareholder’s basis in the corporation and replaces the requirement that the shareholder/taxpayer attach a basis. Employers engaged in a trade.

Press F6 To Bring Up Open Forms.

Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. This form helps you calculate the adjusted basis of your stock and debt.

Web Up To 10% Cash Back The Draft Form 7203 For Tax Year 2022 Makes Only Two Changes To The 2021 Form:

Please note, the form 7203 is not required to. To enter basis limitation info in the. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Employers engaged in a trade or business who.

A Taxpayer Will Need To.

Web form 7203 contains a detailed accounting of the shareholder’s basis in the corporation and replaces the requirement that the shareholder/taxpayer attach a basis. Employee's withholding certificate form 941; The draft form includes a new item d. Web form 7203 is generated for a 1040 return when:

S Corporation Shareholders Use Form 7203 To Figure The Potential.

Use this address if you are not enclosing a payment use this. ( for a copy of a form, instruction, or publication) address to mail form to irs: Web what is form 7203? Web irs issues guidance for s corporation shareholders.