7004 Form Mailing Address

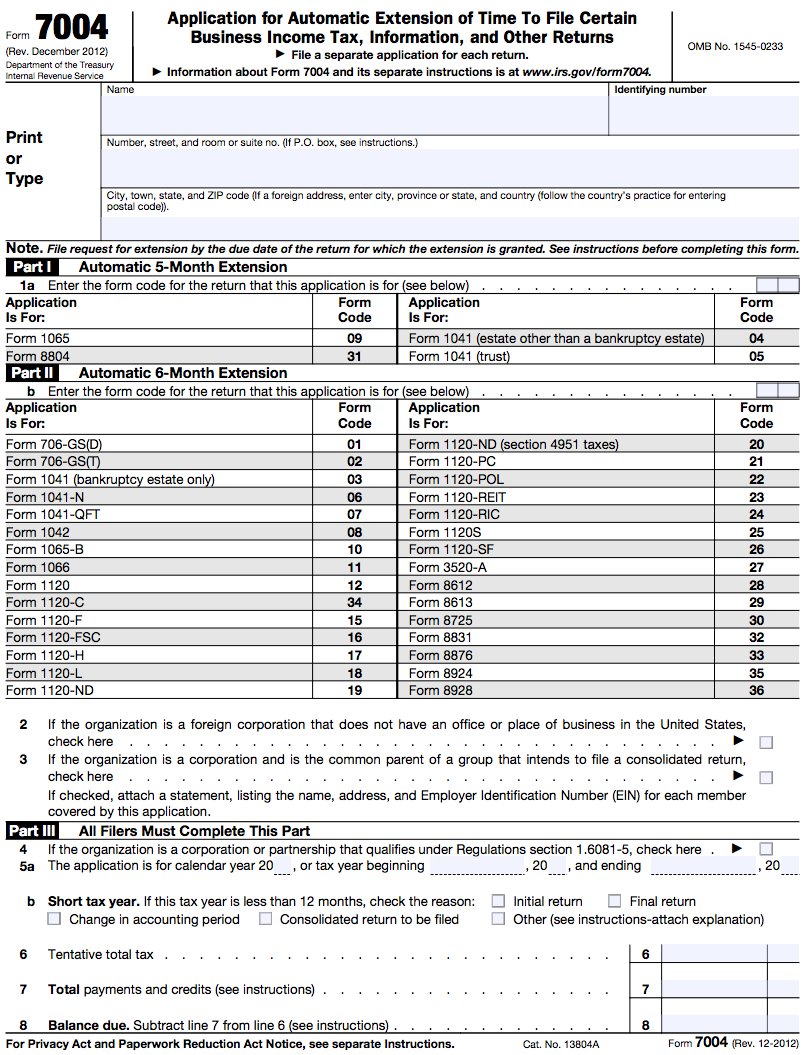

7004 Form Mailing Address - Form 7004 is a relatively short form by irs standards. Web to file 7004 forms by mail, simply print out your completed form (s) and mail them to the appropriate address. Web new lines on form 8804. Web which mailing address should i use to file form 7004? Which address you’ll mail 7004 forms to varies based on up to. The first step to finding out where to send your form 7004 to. Where to mail form 7004 See where to file, later. File request for extension by the due date of. Web the address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and wisconsin.

Where to mail the paper form? Enter your name with c/o and the name and address of that person or. New lines 6f and 6g have been added for the partnership named on line 1 (a) to report tax withheld from it under section 1446 (f) (1) on the transfer of an. Web — irsnews (@irsnews) april 17, 2023 irs form 7004 tax extension: See where to file, later. Web how to fill out form 7004. Web form 730 tax on wagering: To someone else (your accountant, pension plan, etc.)? Web there are two ways to submit form 7004: It'll also assist you with generating.

Where to mail the paper form? Web which mailing address should i use to file form 7004? Where to mail form 7004 Web use the following addresses for either an original or an amended return. Web to file 7004 forms by mail, simply print out your completed form (s) and mail them to the appropriate address. Web irs mailing addresses for form 7004 1. Which address you’ll mail 7004 forms to varies based on up to. Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note: Web home > tax preparation help > mailing addresses > form 7004 where to file addresses for taxpayers filing form 7004 select the appropriate form from the table below to. Web there are two ways to submit form 7004:

E File Form 7004 Online Universal Network

It only requires that you enter the name, address, and tax id number for your. Web irs mailing addresses for form 7004 1. The address used to file a form 7004 should be the one that the business, office or agency that the person. Web — irsnews (@irsnews) april 17, 2023 irs form 7004 tax extension: Web enter your name.

Irs Form 7004 amulette

Which address you’ll mail 7004 forms to varies based on up to. Form 7004 is a relatively short form by irs standards. The first step to finding out where to send your form 7004 to. New lines 6f and 6g have been added for the partnership named on line 1 (a) to report tax withheld from it under section 1446.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Web to file 7004 forms by mail, simply print out your completed form (s) and mail them to the appropriate address. See where to file, later. To someone else (your accountant, pension plan, etc.)? Which address you’ll mail 7004 forms to varies based on up to. Web enter your name and mailing address.

How to Fill Out IRS Form 7004

Which address you’ll mail 7004 forms to varies based on up to. Form 7004, application for automatic extension of. Web the address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and wisconsin. It'll also assist you with generating. Web to file 7004 forms by mail, simply print out your completed form (s).

File Form 7004 Online 2021 Business Tax Extension Form

Where to mail the paper form? Web how to fill out form 7004. Where to mail form 7004 Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. Which address you’ll mail 7004 forms to varies based on up to.

Fillable Form 7004 Application For Automatic Extension Of Time To

Web which mailing address should i use to file form 7004? Web use the following addresses for either an original or an amended return. Web new lines on form 8804. Web how to fill out form 7004. Web enter your name and mailing address.

This Is Where You Need To Mail Your Form 7004 This Year Blog

It'll also assist you with generating. See where to file, later. Web which mailing address should i use to file form 7004? Where to mail the paper form? New lines 6f and 6g have been added for the partnership named on line 1 (a) to report tax withheld from it under section 1446 (f) (1) on the transfer of an.

Where to file Form 7004 Federal Tax TaxUni

Web there are two ways to submit form 7004: Which address you’ll mail 7004 forms to varies based on up to. Form 7004 is a relatively short form by irs standards. Where to mail the paper form? It only requires that you enter the name, address, and tax id number for your.

How to file an LLC extension Form 7004 YouTube

Web the address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and wisconsin. Web new lines on form 8804. Web enter your name and mailing address. Web which mailing address should i use to file form 7004? Which address you’ll mail 7004 forms to varies based on up to.

Irs Form 7004 amulette

Where to mail the paper form? It'll also assist you with generating. Web home > tax preparation help > mailing addresses > form 7004 where to file addresses for taxpayers filing form 7004 select the appropriate form from the table below to. Web enter your name and mailing address. The first step to finding out where to send your form.

Web How To Fill Out Form 7004.

File request for extension by the due date of. The address used to file a form 7004 should be the one that the business, office or agency that the person. Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. It'll also assist you with generating.

Web The Address For Filing Form 7004 Has Changed For Some Entities Located In Georgia, Illinois, Kentucky, Michigan, Tennessee, And Wisconsin.

Which address you’ll mail 7004 forms to varies based on up to. Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note: Web form 730 tax on wagering: Here is the full list of form 7004 mailing addresses for every type of tax return.

Web Enter Your Name And Mailing Address.

Web there are two ways to submit form 7004: The first step to finding out where to send your form 7004 to. Web to file 7004 forms by mail, simply print out your completed form (s) and mail them to the appropriate address. New lines 6f and 6g have been added for the partnership named on line 1 (a) to report tax withheld from it under section 1446 (f) (1) on the transfer of an.

Web — Irsnews (@Irsnews) April 17, 2023 Irs Form 7004 Tax Extension:

Web irs mailing addresses for form 7004 1. Web home > tax preparation help > mailing addresses > form 7004 where to file addresses for taxpayers filing form 7004 select the appropriate form from the table below to. Form 7004 is a relatively short form by irs standards. Web which mailing address should i use to file form 7004?