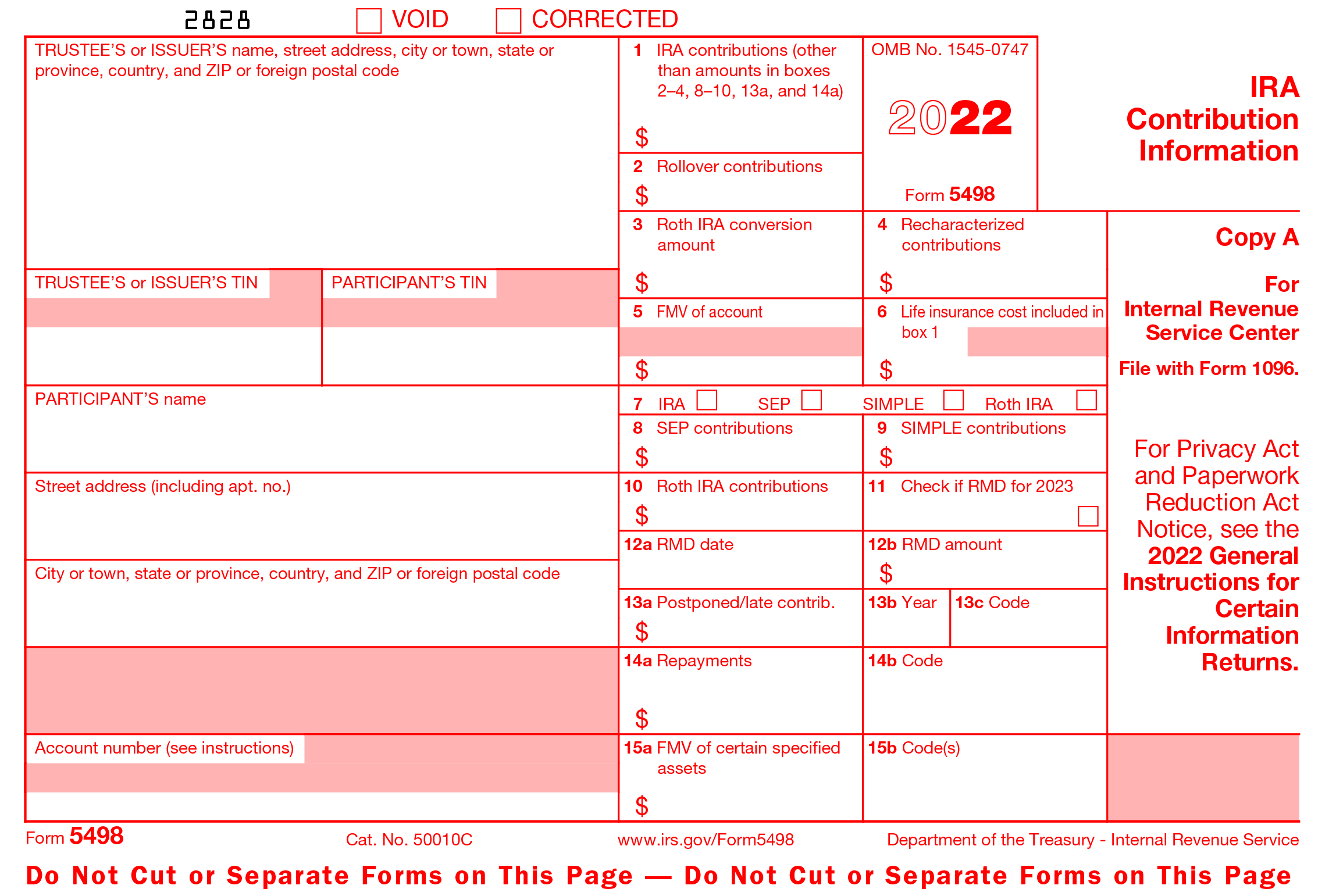

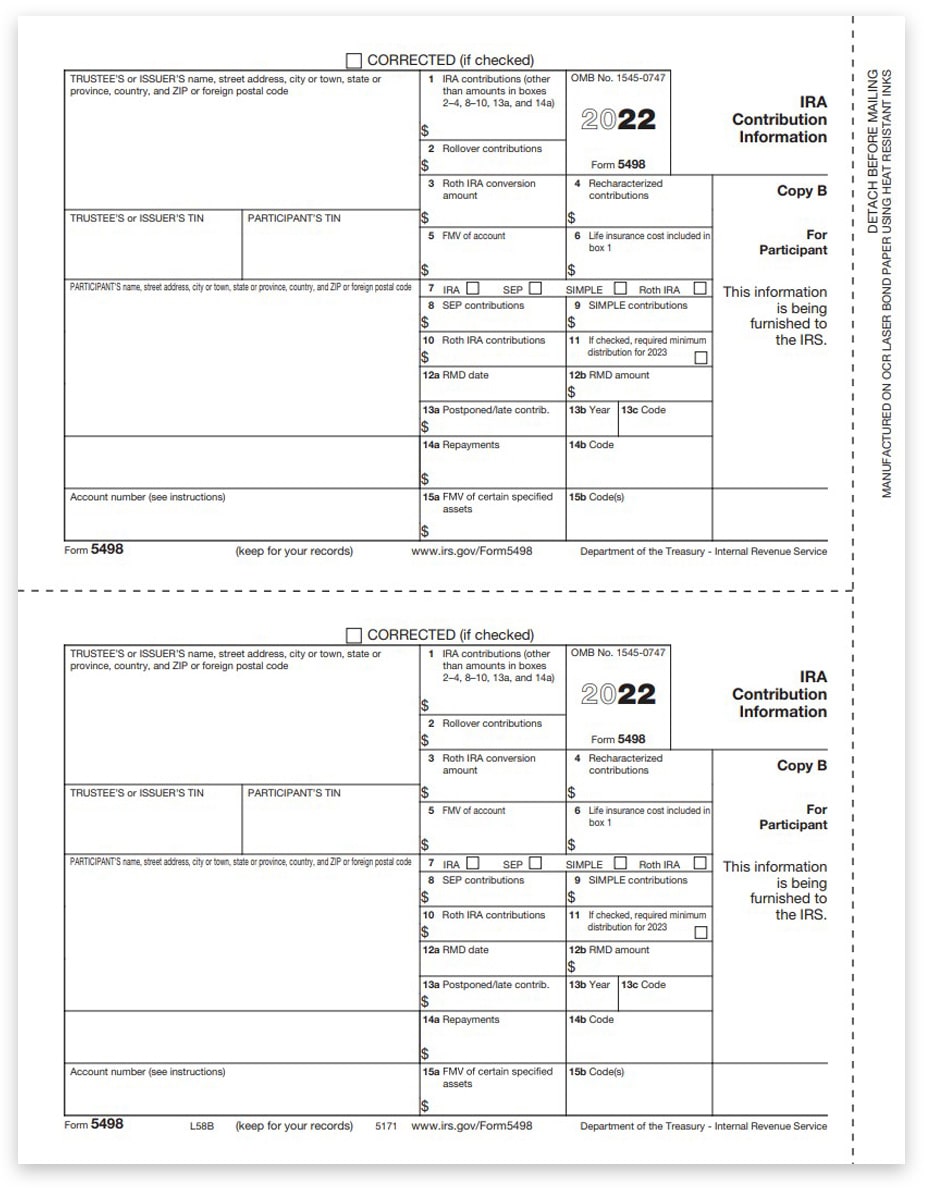

5498 Tax Form 2022

5498 Tax Form 2022 - It is not necessary to file a form 5498 for each investment under one plan. The institution that manages your ira is required to report all contributions you make to the account during the tax year on the form. An ira includes all investments under one ira plan. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including a deemed ira under section 408(q). For information about iras, see pubs. Department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. The irs uses the information on form 5498 to substantiate your contributions. (the 2022 general instructions for certain information returns, which relate to these and certain other information returns, have not yet been released.) When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Getting form 5498 after tax day may seem behind schedule, but there’s good reason for it.

An ira includes all investments under one ira plan. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including a deemed ira under section 408(q). Department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Getting form 5498 after tax day may seem behind schedule, but there’s good reason for it. It is not necessary to file a form 5498 for each investment under one plan. The institution that manages your ira is required to report all contributions you make to the account during the tax year on the form. For information about iras, see pubs. It also is one of several reasons why you may receive form 5498—an ira contribution tax form. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. (the 2022 general instructions for certain information returns, which relate to these and certain other information returns, have not yet been released.)

The irs uses the information on form 5498 to substantiate your contributions. It also is one of several reasons why you may receive form 5498—an ira contribution tax form. (the 2022 general instructions for certain information returns, which relate to these and certain other information returns, have not yet been released.) For information about iras, see pubs. It is not necessary to file a form 5498 for each investment under one plan. Web april 20, 2021 contributing to your ira means you’re putting savings toward your retirement. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including a deemed ira under section 408(q). Department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Getting form 5498 after tax day may seem behind schedule, but there’s good reason for it. The institution that manages your ira is required to report all contributions you make to the account during the tax year on the form.

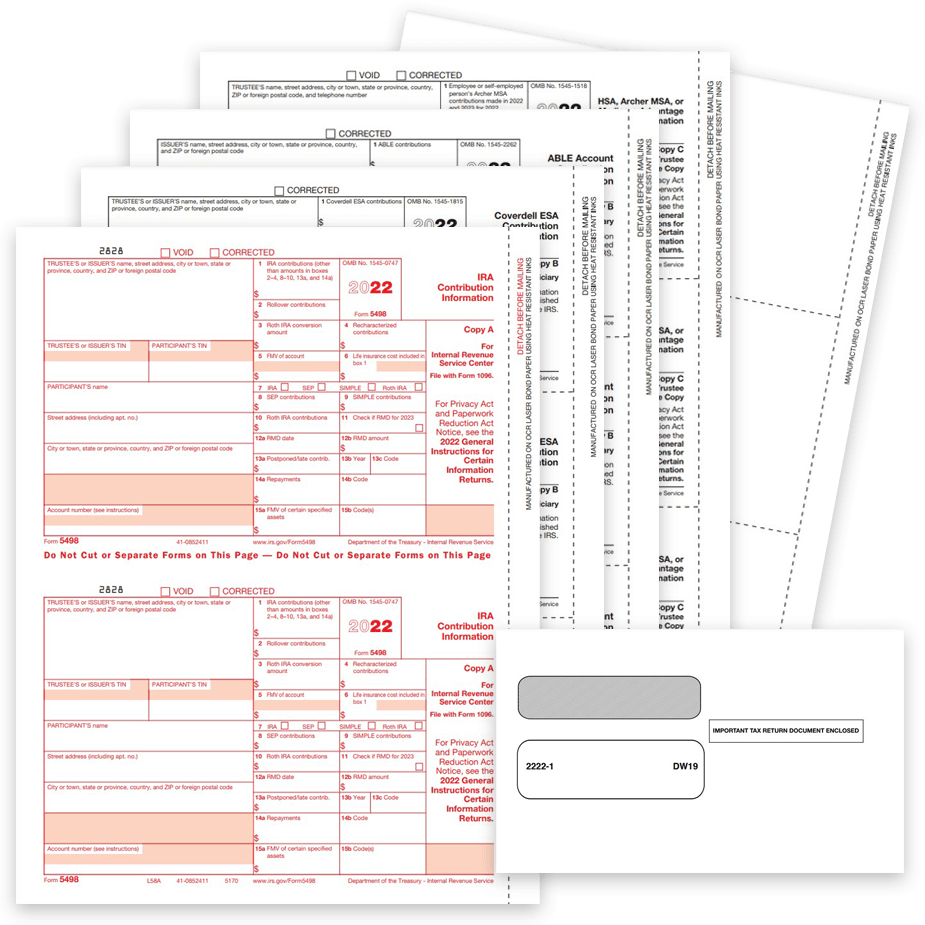

5498 Tax Forms for IRA Contributions, Participant Copy B

Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including a deemed ira under section 408(q). Web april 20, 2021 contributing to your ira means you’re putting savings toward your retirement. The institution that manages your ira is required to report.

The Purpose of IRS Form 5498

It is not necessary to file a form 5498 for each investment under one plan. It also is one of several reasons why you may receive form 5498—an ira contribution tax form. Getting form 5498 after tax day may seem behind schedule, but there’s good reason for it. An ira includes all investments under one ira plan. The institution that.

Form 5498 Fill Out and Sign Printable PDF Template signNow

The institution that manages your ira is required to report all contributions you make to the account during the tax year on the form. Web april 20, 2021 contributing to your ira means you’re putting savings toward your retirement. Getting form 5498 after tax day may seem behind schedule, but there’s good reason for it. It is not necessary to.

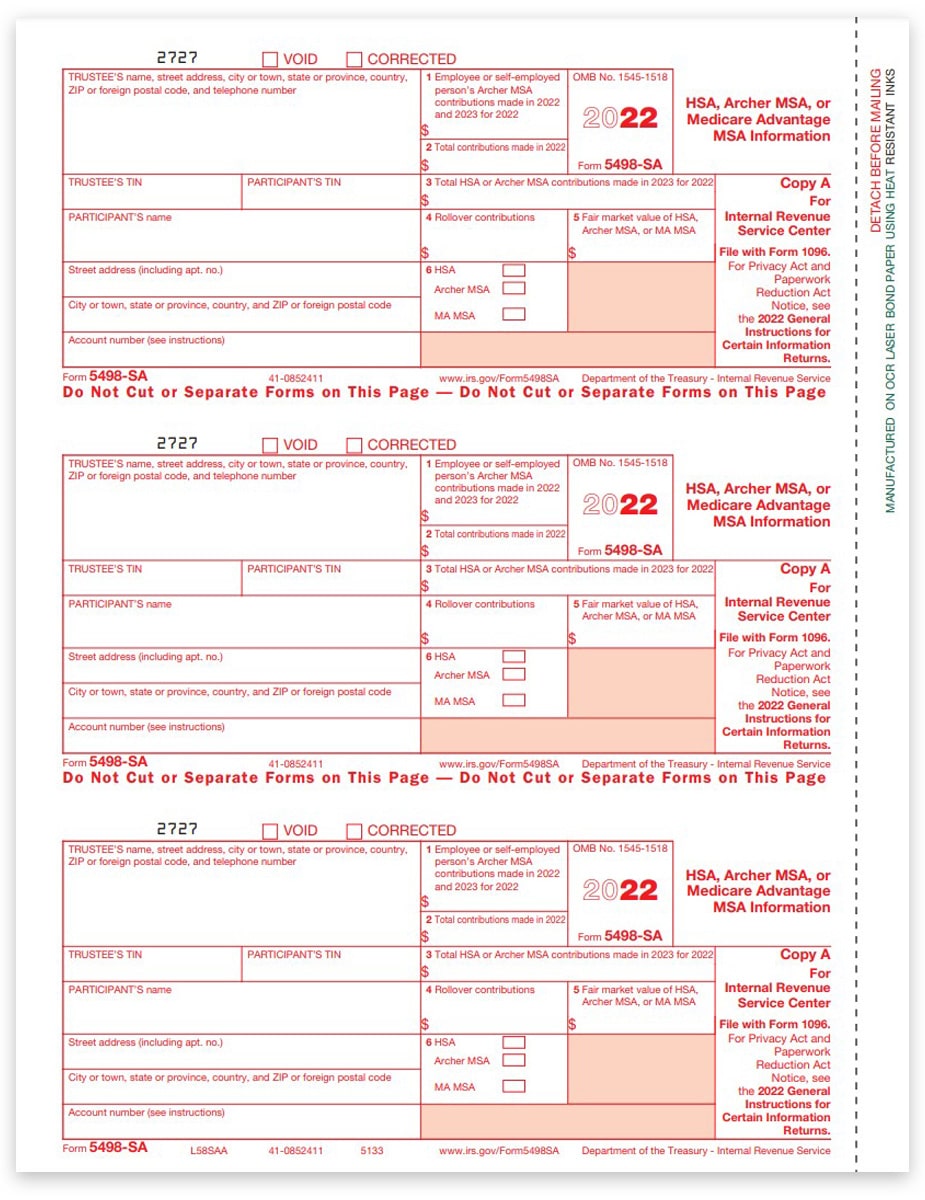

5498SA Tax Forms, IRS Copy A for HSA / MSA DiscountTaxForms

The irs uses the information on form 5498 to substantiate your contributions. For information about iras, see pubs. Department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any.

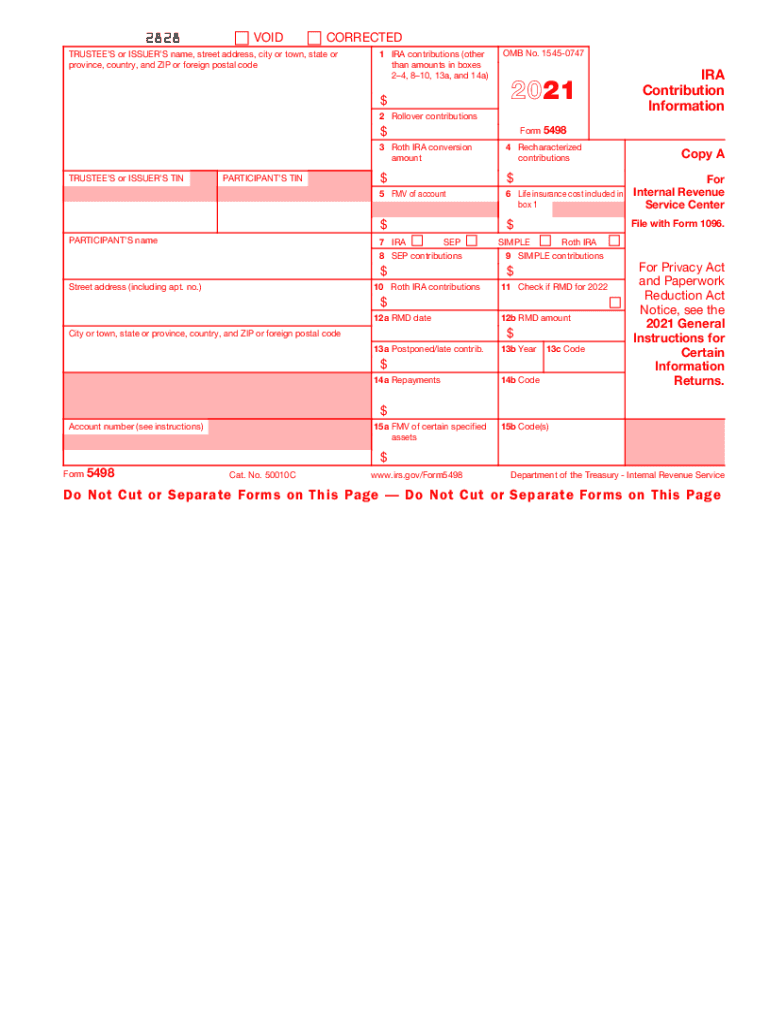

5498 Form 2021

When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. The irs uses the information on form 5498 to substantiate your contributions. It is not necessary to file a form 5498 for each investment under one plan. Getting form 5498 after tax day may seem behind schedule, but there’s good reason.

2016 Form IRS 5498SA Fill Online, Printable, Fillable, Blank PDFfiller

Getting form 5498 after tax day may seem behind schedule, but there’s good reason for it. An ira includes all investments under one ira plan. It also is one of several reasons why you may receive form 5498—an ira contribution tax form. (the 2022 general instructions for certain information returns, which relate to these and certain other information returns, have.

5498 Software to Create, Print & EFile IRS Form 5498

It also is one of several reasons why you may receive form 5498—an ira contribution tax form. The irs uses the information on form 5498 to substantiate your contributions. (the 2022 general instructions for certain information returns, which relate to these and certain other information returns, have not yet been released.) The institution that manages your ira is required to.

Fillable Form 5498SA (2022) Edit, Sign & Download in PDF PDFRun

For information about iras, see pubs. The institution that manages your ira is required to report all contributions you make to the account during the tax year on the form. It also is one of several reasons why you may receive form 5498—an ira contribution tax form. Web file form 5498, ira contribution information, with the irs by may 31,.

What Banks & Financial Institutions should know about Form 5498?

It is not necessary to file a form 5498 for each investment under one plan. Department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web april 20, 2021 contributing to your ira means you’re putting savings toward your retirement. An ira includes all investments under one ira plan. The irs uses.

5498 Tax Forms and Envelopes for 2022

Department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. An ira includes all investments under one ira plan. (the 2022 general instructions for certain information returns, which relate to these and certain other information returns, have not yet been released.) When you save for retirement with an individual retirement arrangement (ira),.

It Also Is One Of Several Reasons Why You May Receive Form 5498—An Ira Contribution Tax Form.

Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including a deemed ira under section 408(q). The institution that manages your ira is required to report all contributions you make to the account during the tax year on the form. It is not necessary to file a form 5498 for each investment under one plan. An ira includes all investments under one ira plan.

When You Save For Retirement With An Individual Retirement Arrangement (Ira), You Probably Receive A Form 5498 Each Year.

For information about iras, see pubs. Department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. (the 2022 general instructions for certain information returns, which relate to these and certain other information returns, have not yet been released.) Getting form 5498 after tax day may seem behind schedule, but there’s good reason for it.

Web April 20, 2021 Contributing To Your Ira Means You’re Putting Savings Toward Your Retirement.

The irs uses the information on form 5498 to substantiate your contributions.

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)