5471 Form Instructions

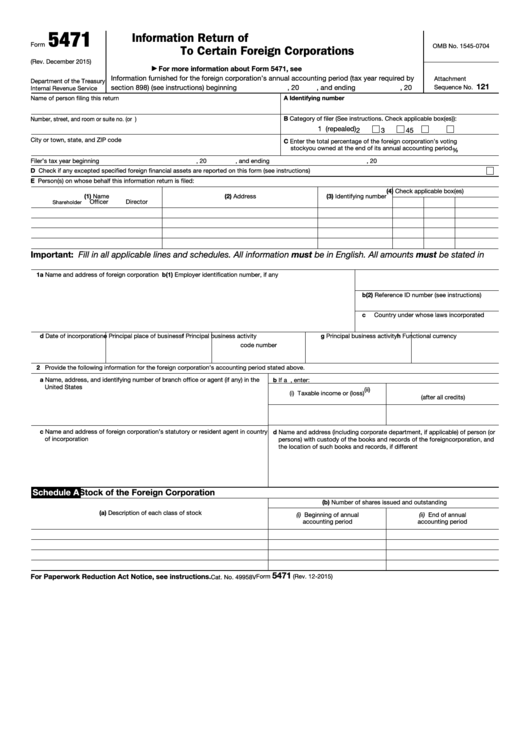

5471 Form Instructions - Name of person filing this return. Web instructions for form 5471(rev. And the december 2012 revision of separate schedule o.) information return of u.s. The irs is therefore able to prevent people from hiding foreign assets. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Other documents that will be necessary for form 5471 include: Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. Item c—percentage of voting stock owned; Web to file form 5471, you’ll need to provide your us shareholder identification details and your foreign corporation’s address. Web this class is designed to help accountants with minimal experience with form 5471 gain a better understanding of how to complete this form.

Go to the section, miscellaneous forms, and then go to the screen, information of u.s. For instructions and the latest information. The december 2020 revision of separate schedules j, p, q, and r; Section 898 specified foreign corporation (sfc). January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Other documents that will be necessary for form 5471 include: December 2021) department of the treasury internal revenue service. Persons with respect to certain foreign corporations Our instructor chaya siegfried will detail the changes to form 5471 and explain the purpose for each section of the form and how best to complete it. Web instructions for form 5471(rev.

Persons with respect to certain foreign corporations. Web to generate form 5471: Web instructions for form 5471(rev. Our instructor chaya siegfried will detail the changes to form 5471 and explain the purpose for each section of the form and how best to complete it. Other documents that will be necessary for form 5471 include: Web instructions for form 5471(rev. Item c—percentage of voting stock owned; Name of person filing this return. And the december 2012 revision of separate schedule o.) information return of u.s. The december 2020 revision of separate schedules j, p, q, and r;

Fillable Form 5471 Information Return Of U.s. Persons With Respect To

The december 2018 revision of schedule m; And the december 2012 revision of separate schedule o.) information return of u.s. Name of person filing this return. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; December 2021) department of the treasury internal revenue service.

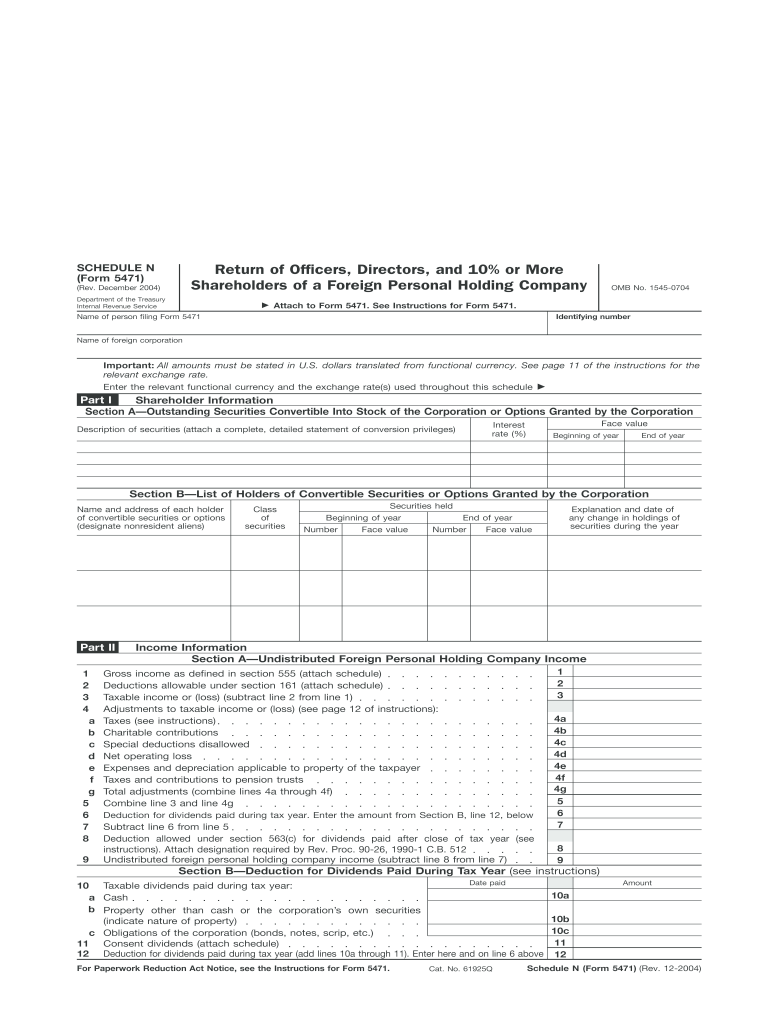

5471 Schedule N Fill Out and Sign Printable PDF Template signNow

Web instructions for form 5471(rev. Persons with respect to certain foreign corporations. December 2021) department of the treasury internal revenue service. Section 898 specified foreign corporation (sfc). Persons with respect to certain foreign corporations

IRS Form 5471 Filing Instructions for Green Card Holders and US

Item c—percentage of voting stock owned; Web form 5471 provides the irs with a record of us citizens and residents who have ownership in foreign corporations. Web to generate form 5471: The december 2020 revision of separate schedules j, p, q, and r; For instructions and the latest information.

CPA Worldwide Tax Service PC Just another WordPress site Chandler, AZ

Web to file form 5471, you’ll need to provide your us shareholder identification details and your foreign corporation’s address. Section 898 specified foreign corporation (sfc). The irs is therefore able to prevent people from hiding foreign assets. This is available in the following tax types: Web form 5471 provides the irs with a record of us citizens and residents who.

2012 form 5471 instructions Fill out & sign online DocHub

Item c—percentage of voting stock owned; Persons with respect to certain foreign corporations. The december 2020 revision of separate schedules j, p, q, and r; Web instructions for form 5471(rev. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r;

Download Instructions for IRS Form 5471 Information Return of U.S

For instructions and the latest information. And the december 2012 revision of separate schedule o.) information return of u.s. And the december 2012 revision of separate schedule o.) December 2021) department of the treasury internal revenue service. Web this class is designed to help accountants with minimal experience with form 5471 gain a better understanding of how to complete this.

Fill Free fillable F5471 Form 5471 (Rev. December 2019) PDF form

Other documents that will be necessary for form 5471 include: And the december 2012 revision of separate schedule o.) For instructions and the latest information. Section 898 specified foreign corporation (sfc). And the december 2012 revision of separate schedule o.) information return of u.s.

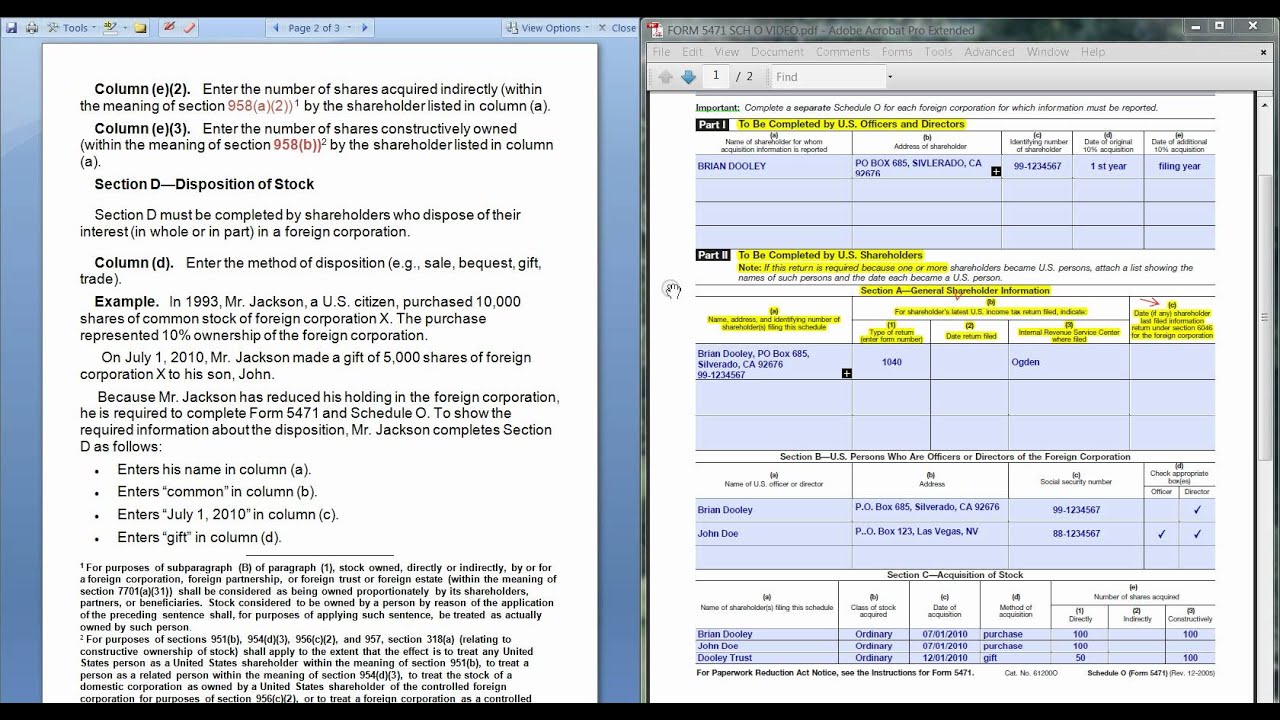

FORM 5471 SCHEDULE O CONTROLLED FOREIGN CORPORATION.avi YouTube

This is available in the following tax types: January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; The december 2020 revision of separate schedules j, p, q, and r; The december 2018 revision of schedule m; Shareholder of certain foreign corporations foreign corporation’s that file form 5471 use.

IRS Form 5471 Reporting for U.S. Shareholders of Foreign Companies

Persons with respect to certain foreign corporations Name of person filing this return. This is available in the following tax types: The december 2018 revision of schedule m; And the december 2012 revision of separate schedule o.) information return of u.s.

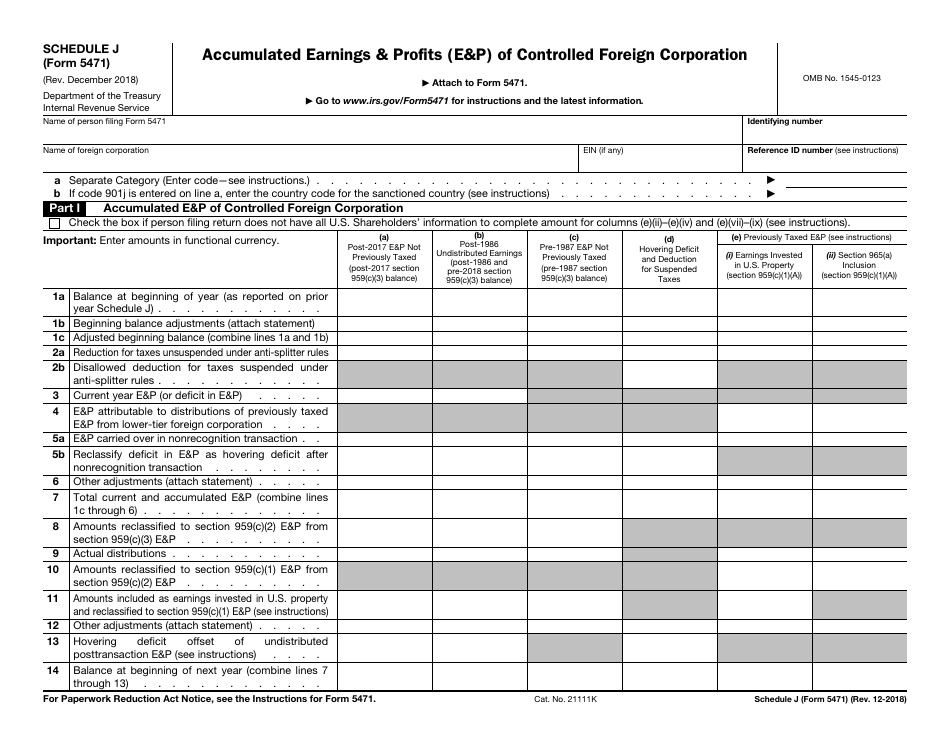

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

Web instructions for form 5471(rev. The irs is therefore able to prevent people from hiding foreign assets. Persons with respect to certain foreign corporations. Our instructor chaya siegfried will detail the changes to form 5471 and explain the purpose for each section of the form and how best to complete it. Section 898 specified foreign corporation (sfc).

And The December 2012 Revision Of Separate Schedule O.)

The december 2018 revision of schedule m; Web to file form 5471, you’ll need to provide your us shareholder identification details and your foreign corporation’s address. And the december 2012 revision of separate schedule o.) information return of u.s. Go to the section, miscellaneous forms, and then go to the screen, information of u.s.

Item C—Percentage Of Voting Stock Owned;

Information furnished for the foreign corporation’s annual accounting period (tax year required by Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. Our instructor chaya siegfried will detail the changes to form 5471 and explain the purpose for each section of the form and how best to complete it. December 2021) department of the treasury internal revenue service.

Web Form 5471 Provides The Irs With A Record Of Us Citizens And Residents Who Have Ownership In Foreign Corporations.

Web to generate form 5471: Web instructions for form 5471(rev. Persons with respect to certain foreign corporations. The irs is therefore able to prevent people from hiding foreign assets.

For Instructions And The Latest Information.

Web corrections to form 5471; Section 898 specified foreign corporation (sfc). Name of person filing this return. Other documents that will be necessary for form 5471 include: