540 2Ez Tax Form

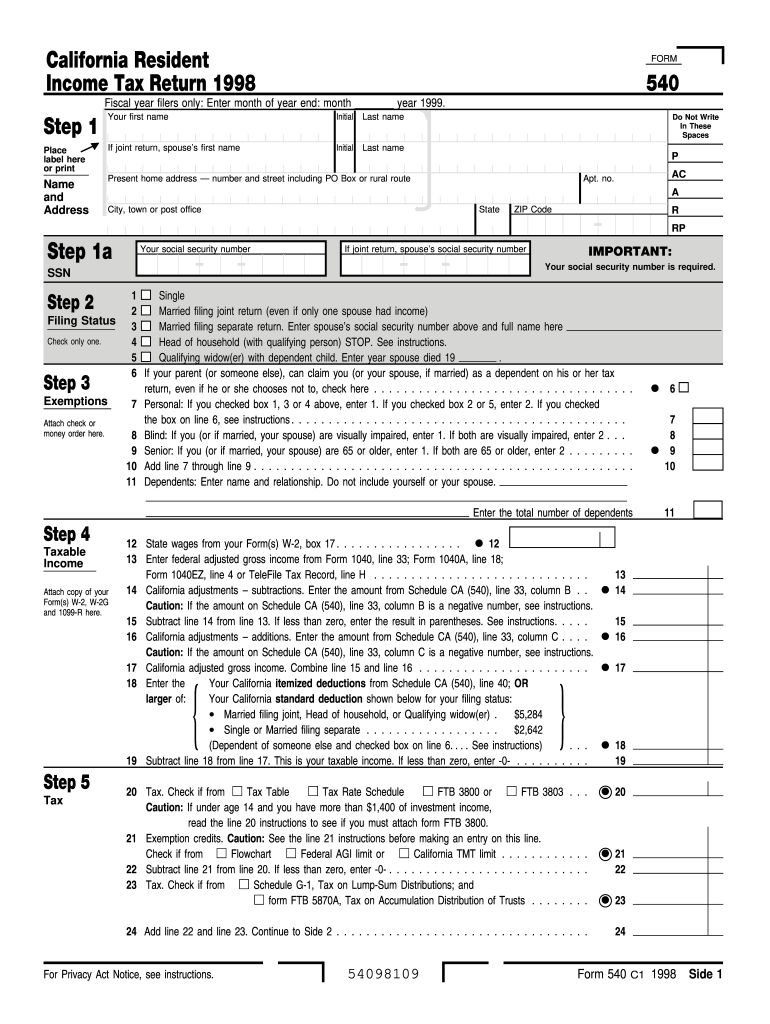

540 2Ez Tax Form - View and download up to seven years of past returns in turbotax online. Web qualifying surviving spouse/rdp with dependent child. This form is for income earned in tax year 2022, with tax returns due in april. This calculator does not figure tax for. See the table on page 4. Use this address if you are not enclosing a payment use this. California resident income tax return created date:. Code amount 400 401 403 405 406 407 408 410 413 422 423 424 425 431 438 439 440. How do i file an irs extension (form 4868) in. This form is for income earned in tax year 2022, with tax returns due in april.

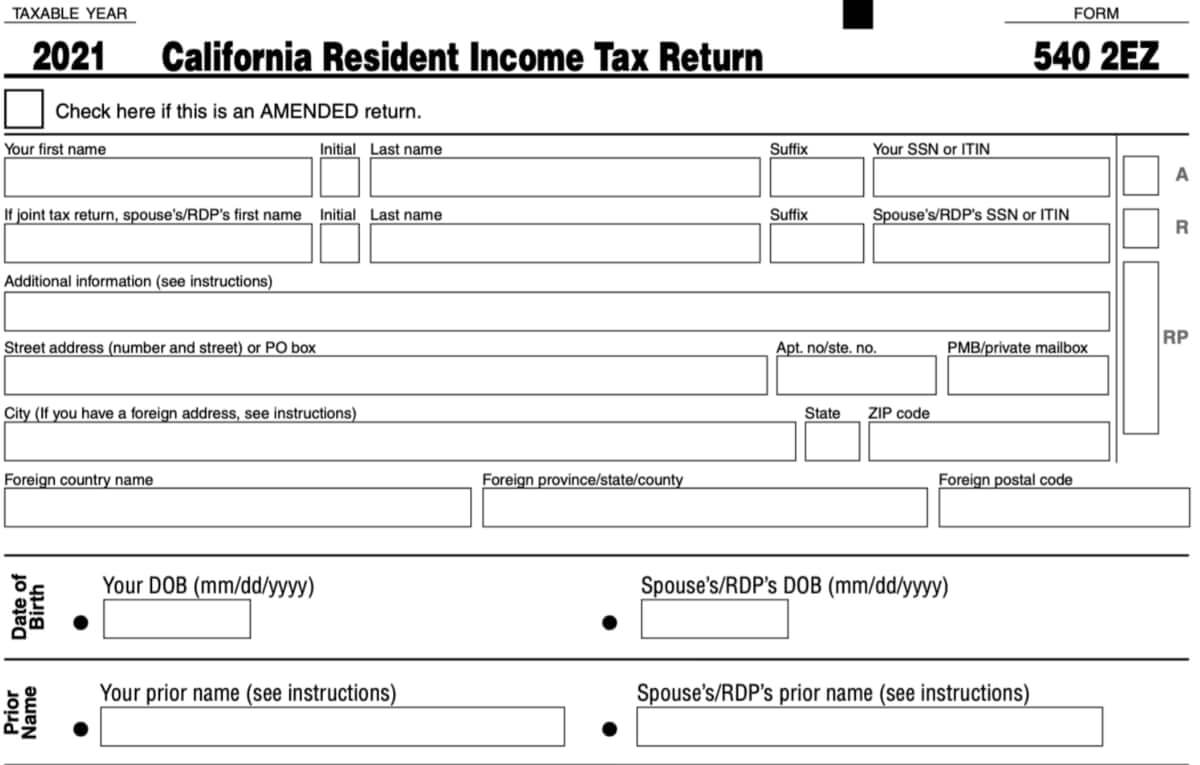

This form is for income earned in tax year 2022, with tax returns due in april. Use this address if you are not enclosing a payment use this. This form is for income earned in tax year 2022, with tax returns due in april. Web form 540 2ez tax booklet 2020 this table gives you credit of $4,601 for your standard deduction, $124 for your personal exemption credit, and $383 for each dependent. Web qualifying surviving spouse/rdp with dependent child. Web things you need to know before you complete. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. * california taxable income enter line 19 of 2022 form 540 or form 540nr. How do i file an irs extension (form 4868) in. Web form 540 2ez 2021side 3.

Web form 540 2ez tax booklet 2020 this table gives you credit of $4,601 for your standard deduction, $124 for your personal exemption credit, and $383 for each dependent. Web things you need to know before you complete. Terms and conditions may vary. Use this address if you are not enclosing a payment use this. View and download up to seven years of past returns in turbotax online. This form is for income earned in tax year 2022, with tax returns due in april. See the table on page 4. * california taxable income enter line 19 of 2022 form 540 or form 540nr. This calculator does not figure tax for. Web qualifying surviving spouse/rdp with dependent child.

CA 540 2EZ Tax Booklet 2001 Fill and Sign Printable Template Online

Terms and conditions may vary. How do i file an irs extension (form 4868) in. Web qualifying surviving spouse/rdp with dependent child. View and download up to seven years of past returns in turbotax online. Web things you need to know before you complete.

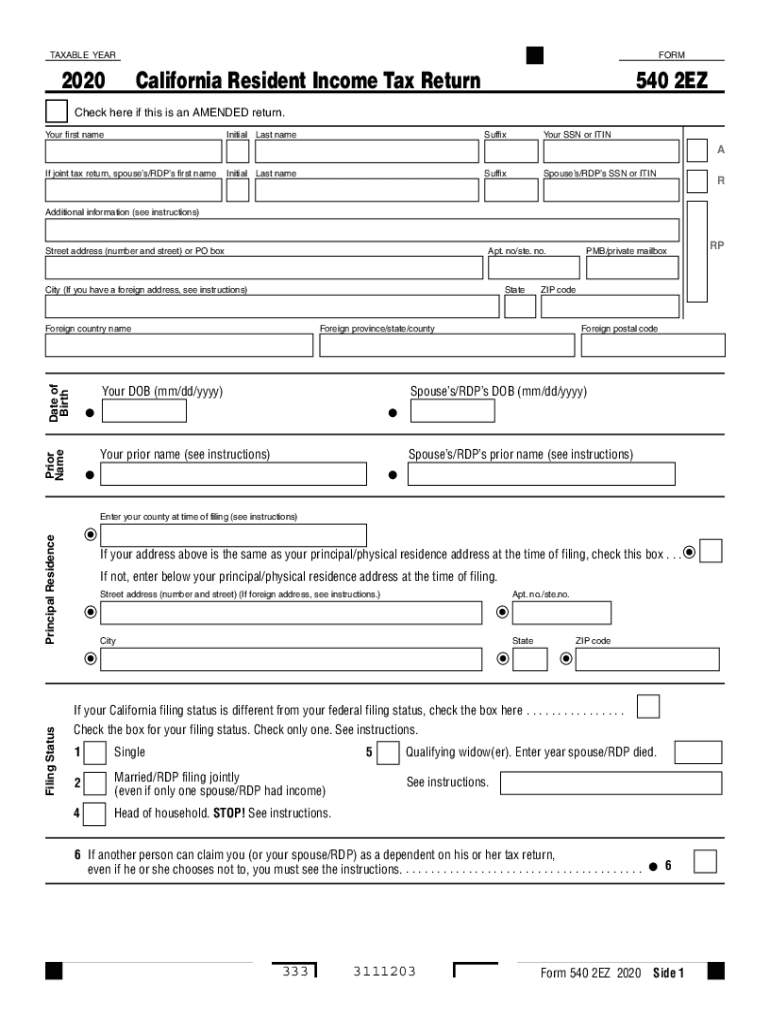

CA FTB 540 2EZ 2020 Fill out Tax Template Online US Legal Forms

Code amount 400 401 403 405 406 407 408 410 413 422 423 424 425 431 438 439 440. Web make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the irs through 10/31/2025. How do i file an irs extension (form 4868) in. Web form 540 2ez tax.

Form 5402EZ California 2022 2023 State And Local Taxes Zrivo

California resident income tax return created date:. * california taxable income enter line 19 of 2022 form 540 or form 540nr. View and download up to seven years of past returns in turbotax online. How do i file an irs extension (form 4868) in. Web qualifying surviving spouse/rdp with dependent child.

Form 540 California Resident Tax Return Fill Out and Sign

See the table on page 4. * california taxable income enter line 19 of 2022 form 540 or form 540nr. View and download up to seven years of past returns in turbotax online. This form is for income earned in tax year 2022, with tax returns due in april. Web most taxpayers are required to file a yearly income tax.

Form 540 2EZ Download Fillable PDF or Fill Online California Resident

Web things you need to know before you complete. Code amount 400 401 403 405 406 407 408 410 413 422 423 424 425 431 438 439 440. Web form 540 2ez tax booklet 2020 this table gives you credit of $4,601 for your standard deduction, $124 for your personal exemption credit, and $383 for each dependent. See the table.

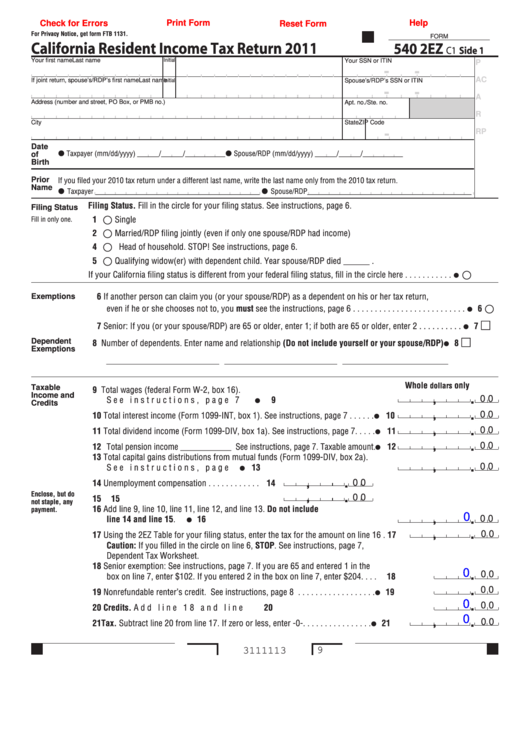

Fillable Form 540 2ez California Resident Tax Return 2011

Code amount 400 401 403 405 406 407 408 410 413 422 423 424 425 431 438 439 440. * california taxable income enter line 19 of 2022 form 540 or form 540nr. Use this address if you are not enclosing a payment use this. This form is for income earned in tax year 2022, with tax returns due in.

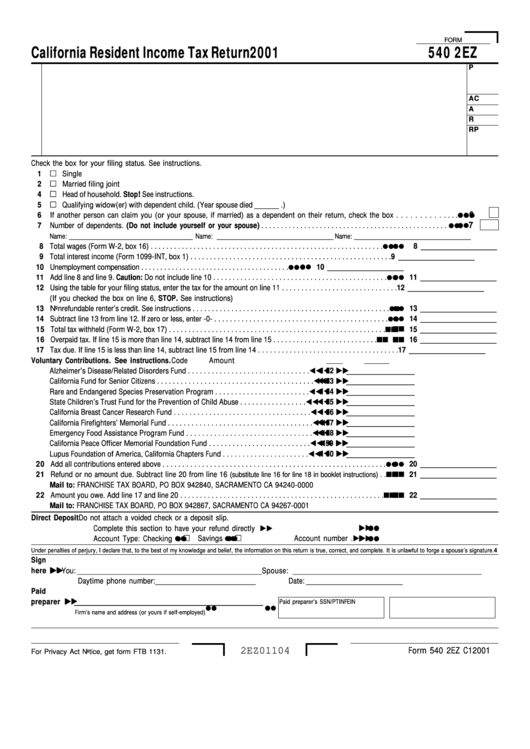

Form 540 2ez California Resident Tax Return 2001 printable

California resident income tax return created date:. Web form 540 2ez 2021side 3. Code amount 400 401 403 405 406 407 408 410 413 422 423 424 425 431 438 439 440. Web things you need to know before you complete. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue.

20202022 Form CA 540 2EZ Tax Booklet Fill Online, Printable, Fillable

Web things you need to know before you complete. Code amount 400 401 403 405 406 407 408 410 413 422 423 424 425 431 438 439 440. This form is for income earned in tax year 2022, with tax returns due in april. View and download up to seven years of past returns in turbotax online. See the table.

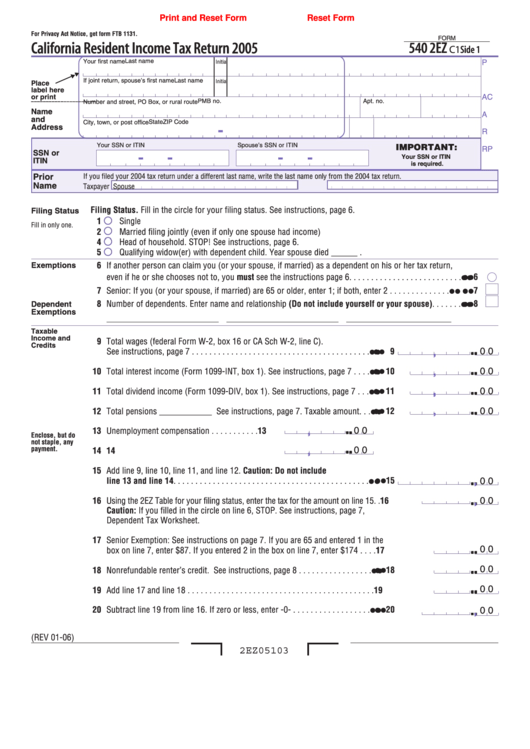

Fillable Form 540 2ez California Resident Tax Return 2005

California resident income tax return created date:. Web form 540 2ez 2021side 3. Web 2020 form 540 2ez california resident income tax return author: Web make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the irs through 10/31/2025. This calculator does not figure tax for.

2014 Form 540 2Ez California Resident Tax Return Edit, Fill

See the table on page 4. This form is for income earned in tax year 2022, with tax returns due in april. * california taxable income enter line 19 of 2022 form 540 or form 540nr. Web 2020 form 540 2ez california resident income tax return author: Web things you need to know before you complete.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the irs through 10/31/2025. Use this address if you are not enclosing a payment use this. This form is for income earned in tax year 2022, with tax returns due in april. Terms and conditions may vary.

How Do I File An Irs Extension (Form 4868) In.

Code amount 400 401 403 405 406 407 408 410 413 422 423 424 425 431 438 439 440. Web form 540 2ez tax booklet 2020 this table gives you credit of $4,601 for your standard deduction, $124 for your personal exemption credit, and $383 for each dependent. Web 2020 form 540 2ez california resident income tax return author: View and download up to seven years of past returns in turbotax online.

This Calculator Does Not Figure Tax For.

* california taxable income enter line 19 of 2022 form 540 or form 540nr. Web qualifying surviving spouse/rdp with dependent child. See the table on page 4. California resident income tax return created date:.

Web Things You Need To Know Before You Complete.

Determine if you qualify to use form 540 2ez. Web form 540 2ez 2021side 3. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.