403B Tax Form

403B Tax Form - 2021 403(b) 457(b) plan administrators. It’s a path and a destination. Web what is a 403 (b) plan? Plans based on iras (sep, simple ira) do not offer loans. Web retirement options to help make a lasting financial plan. Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. Web employer sponsored retirement plans such as 403(b), simple ira, and sep iras. Build the future you want. Web if you have met the qualifications for a distribution and are electing to roll the proceeds directly into an individual retirement account, 403(b) or other qualified plan account,. 1) your organization isn’t eligible to sponsor a 403 (b) plan.

Web to a 403(b) with the same employer or requesting a direct rollover to a 403(b) with a different employer with another custodian, please complete our 403(b) transfer form. Web what is a 403 (b) plan? 2021 403(b) 457(b) plan administrators. Web educators make equitable the #1 choice for 403(b) plans since 1859, equitable has helped people build and secure their financial futures. To determine if a plan offers. Ad oppenheimerfunds & more fillable forms, register and subscribe now! 2021 403(b) plan summary information. Web if you have met the qualifications for a distribution and are electing to roll the proceeds directly into an individual retirement account, 403(b) or other qualified plan account,. Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. 1) your organization isn’t eligible to sponsor a 403 (b) plan.

The irs commonly finds mistakes in 403(b) plans. Build the future you want. Web 403(b) plan it’s important to know the tax rules that apply to a 403(b) plan to help you get the maximum benefit from your plan. 2021 403(b) plan summary information. Web employer sponsored retirement plans such as 403(b), simple ira, and sep iras. 1) your organization isn’t eligible to sponsor a 403 (b) plan. Our 403(b) plan is designed to meet the. It’s a path and a destination. Web the internal revenue service (irs) expanded its individually designed determination letter program to include 403(b) retirement plans in november 2022,. Web retirement options to help make a lasting financial plan.

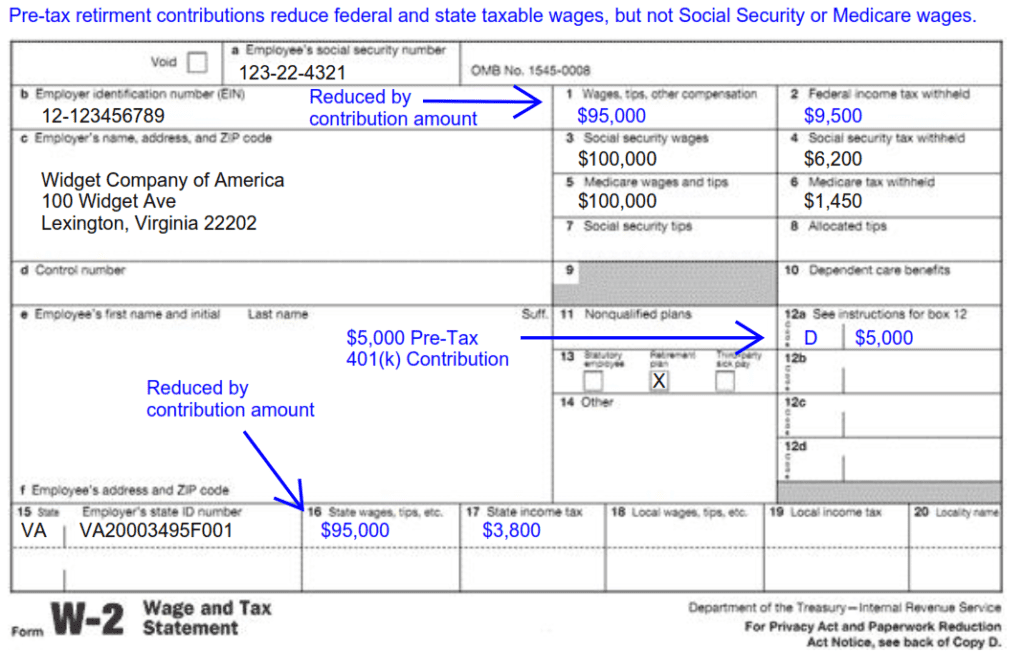

Understanding Tax Season Form W2 Remote Financial Planner

Web if you have met the qualifications for a distribution and are electing to roll the proceeds directly into an individual retirement account, 403(b) or other qualified plan account,. 2021 403(b) plan summary information. 2021 north kansas city schools investment. Web employer sponsored retirement plans such as 403(b), simple ira, and sep iras. Web ordinary dividends are taxed at ordinary.

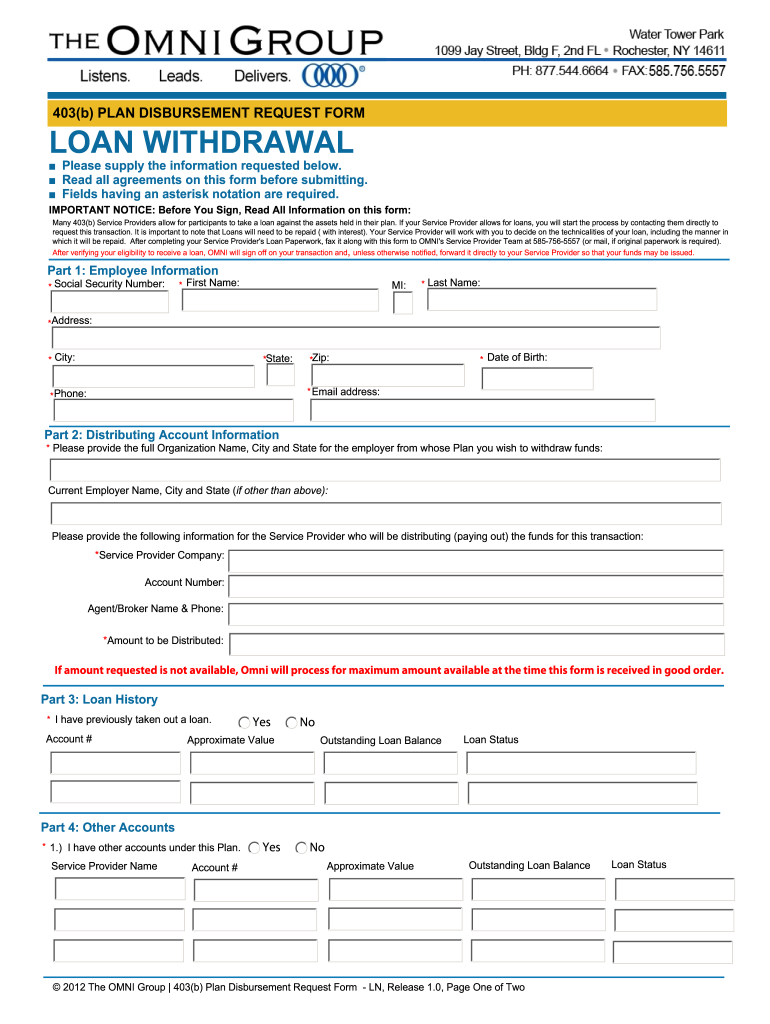

Form 403 Fill Out and Sign Printable PDF Template signNow

Plans based on iras (sep, simple ira) do not offer loans. Web 403(b) transfer form use this form to process a transfer from a morgan stanley 403(b) custodial account to a 403(b) account with another custodian. Web retirement options to help make a lasting financial plan. 2021 403(b) plan summary information. Web if you have met the qualifications for a.

TAX IRA, 403B & 401K accounts! Classic Round Sticker Zazzle

2021 403(b) plan summary information. Web educators make equitable the #1 choice for 403(b) plans since 1859, equitable has helped people build and secure their financial futures. Web 403(b) plan it’s important to know the tax rules that apply to a 403(b) plan to help you get the maximum benefit from your plan. Our 403(b) plan is designed to meet.

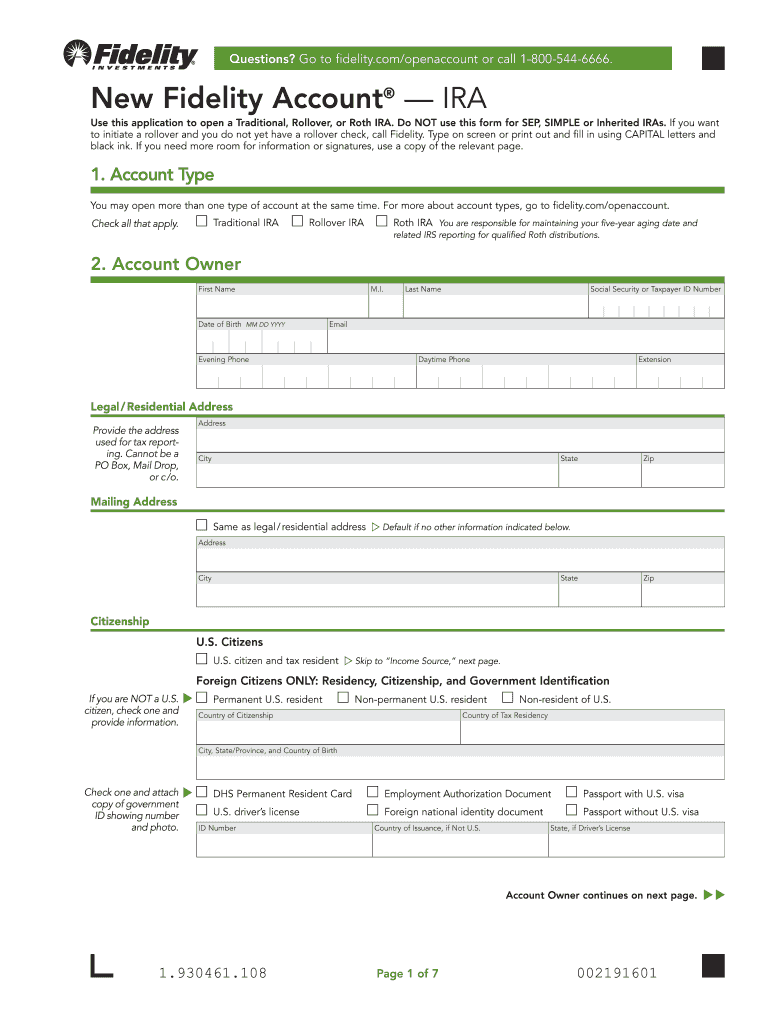

Fidelity Application Form 20202022 Fill and Sign Printable Template

Plans based on iras (sep, simple ira) do not offer loans. The irs commonly finds mistakes in 403(b) plans. Web if you have met the qualifications for a distribution and are electing to roll the proceeds directly into an individual retirement account, 403(b) or other qualified plan account,. Web 403(b) plan it’s important to know the tax rules that apply.

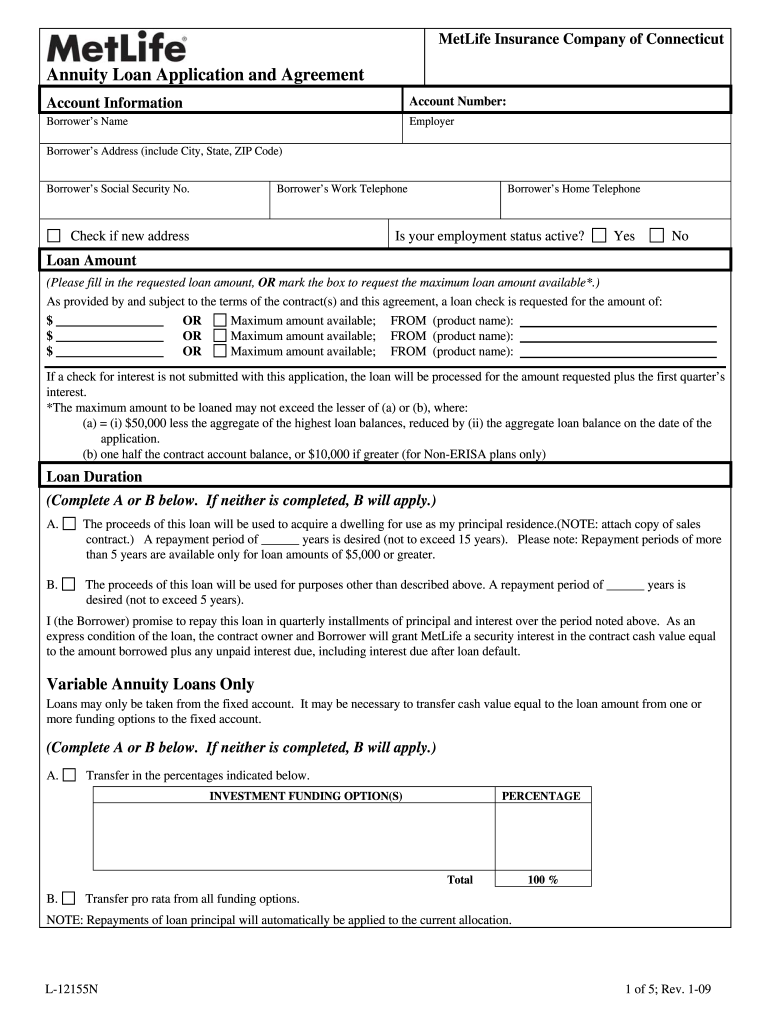

Metlife Annuity Loan Fill Online, Printable, Fillable, Blank pdfFiller

To determine if a plan offers. It’s a path and a destination. Qualified dividends are taxed at lower capital gains tax rates, which can range from 0%. Plans based on iras (sep, simple ira) do not offer loans. 2021 north kansas city schools investment.

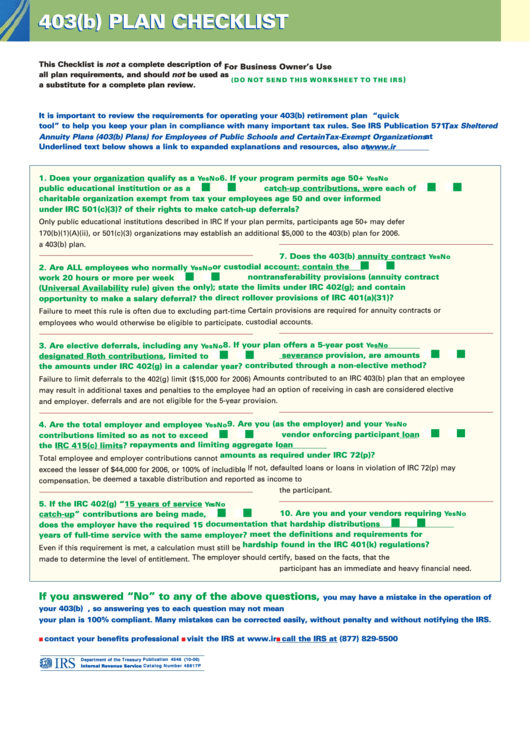

Form 403(B) Plan Checklist Sheet printable pdf download

Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. Web to a 403(b) with the same employer or requesting a direct rollover to a 403(b) with a different employer with another custodian, please complete our 403(b) transfer form. Web 403(b) transfer form use this form to process a transfer from a morgan stanley 403(b) custodial.

Fillable Online omni group 403b plan disbursement request form Fax

Web if you have met the qualifications for a distribution and are electing to roll the proceeds directly into an individual retirement account, 403(b) or other qualified plan account,. The irs commonly finds mistakes in 403(b) plans. 1) your organization isn’t eligible to sponsor a 403 (b) plan. Web what is a 403 (b) plan? Web employer sponsored retirement plans.

What is a 403b Plan? Consumer Boomer

Our 403(b) plan is designed to meet the. Plans based on iras (sep, simple ira) do not offer loans. Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. Web educators make equitable the #1 choice for 403(b) plans since 1859, equitable has helped people build and secure their financial futures. Web to a 403(b) with.

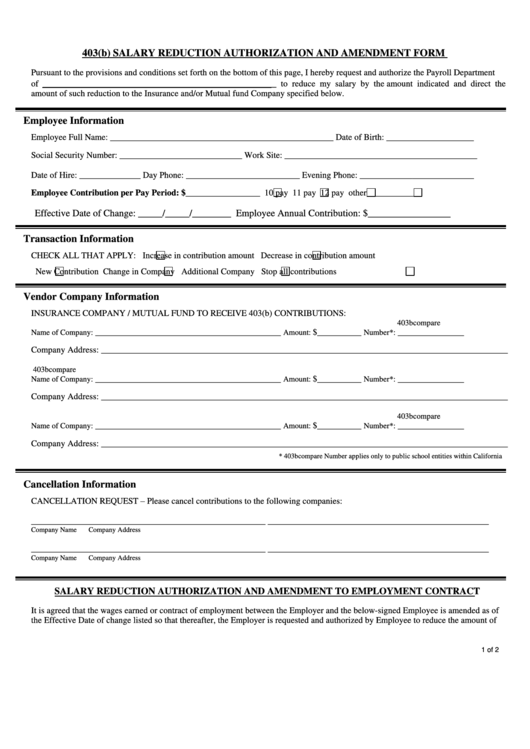

Fillable 403(B) Salary Reduction Authorization And Amendment Form

Plans based on iras (sep, simple ira) do not offer loans. Ad oppenheimerfunds & more fillable forms, register and subscribe now! Web employer sponsored retirement plans such as 403(b), simple ira, and sep iras. Our 403(b) plan is designed to meet the. The irs commonly finds mistakes in 403(b) plans.

Lincoln Benefit Life Forms Fill Online, Printable, Fillable, Blank

It’s a path and a destination. Web retirement options to help make a lasting financial plan. 1) your organization isn’t eligible to sponsor a 403 (b) plan. To determine if a plan offers. Ad oppenheimerfunds & more fillable forms, register and subscribe now!

2021 North Kansas City Schools Investment.

Ad oppenheimerfunds & more fillable forms, register and subscribe now! Web the internal revenue service (irs) expanded its individually designed determination letter program to include 403(b) retirement plans in november 2022,. The irs commonly finds mistakes in 403(b) plans. Web 403(b) transfer form use this form to process a transfer from a morgan stanley 403(b) custodial account to a 403(b) account with another custodian.

Web Educators Make Equitable The #1 Choice For 403(B) Plans Since 1859, Equitable Has Helped People Build And Secure Their Financial Futures.

Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. Web what is a 403 (b) plan? Web retirement options to help make a lasting financial plan. 2021 403(b) 457(b) plan administrators.

1) Your Organization Isn’t Eligible To Sponsor A 403 (B) Plan.

Build the future you want. 2021 403(b) plan summary information. Web to a 403(b) with the same employer or requesting a direct rollover to a 403(b) with a different employer with another custodian, please complete our 403(b) transfer form. It’s a path and a destination.

Our 403(B) Plan Is Designed To Meet The.

To determine if a plan offers. Qualified dividends are taxed at lower capital gains tax rates, which can range from 0%. Web if you have met the qualifications for a distribution and are electing to roll the proceeds directly into an individual retirement account, 403(b) or other qualified plan account,. Plans based on iras (sep, simple ira) do not offer loans.