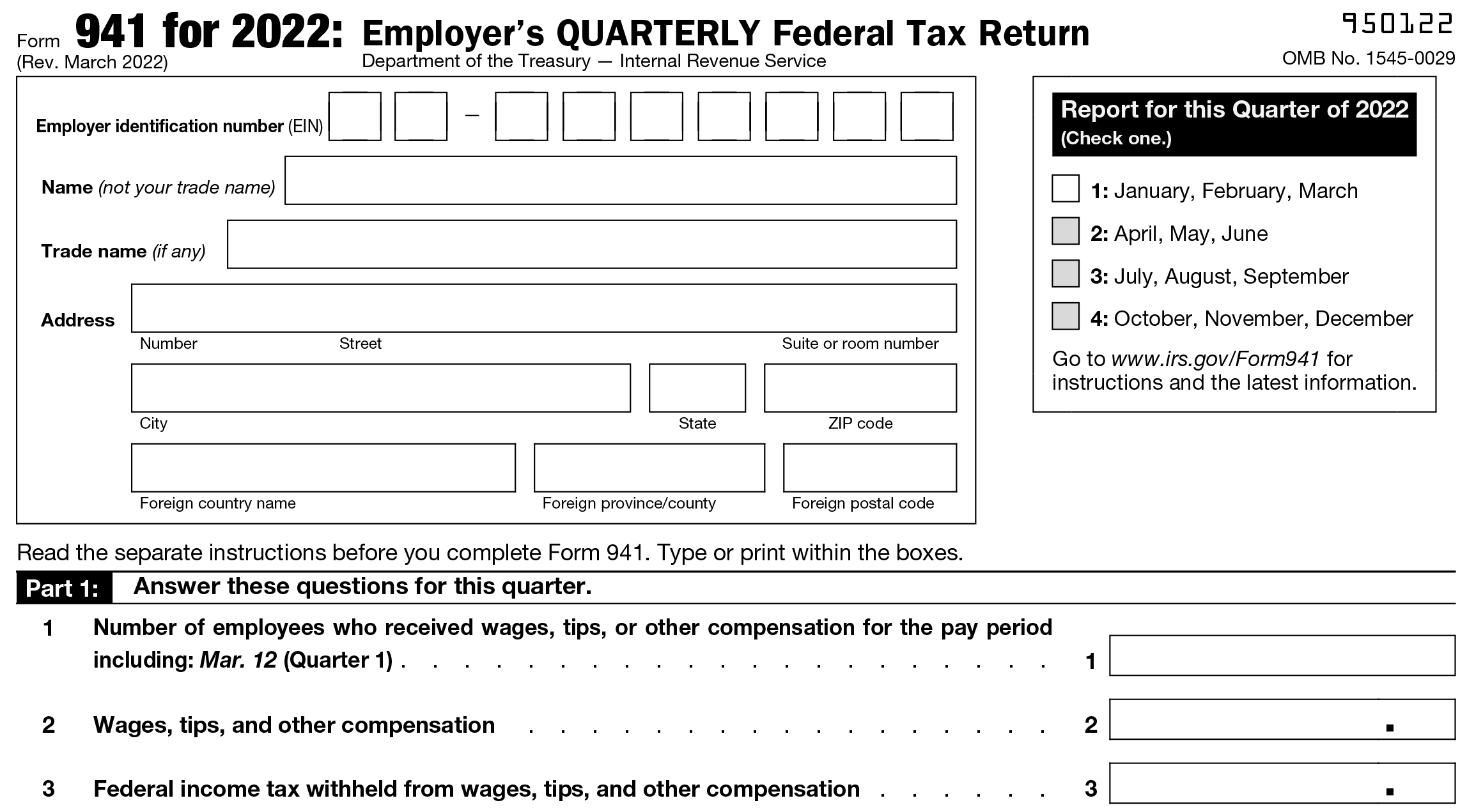

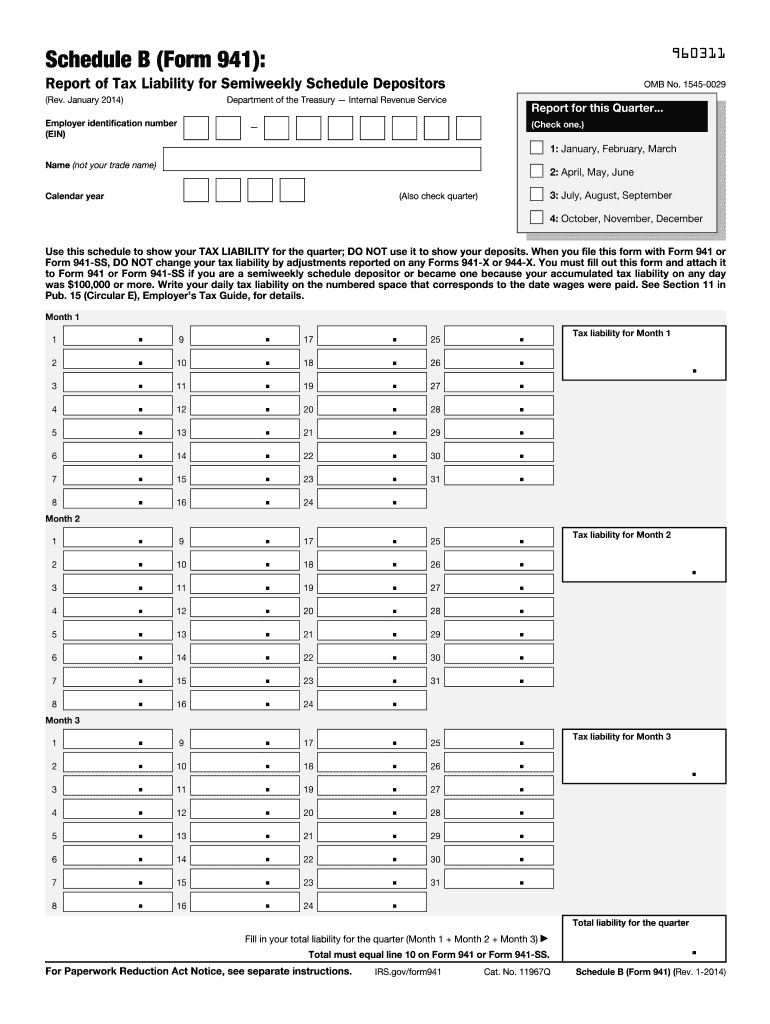

2022 Form 941 Schedule B

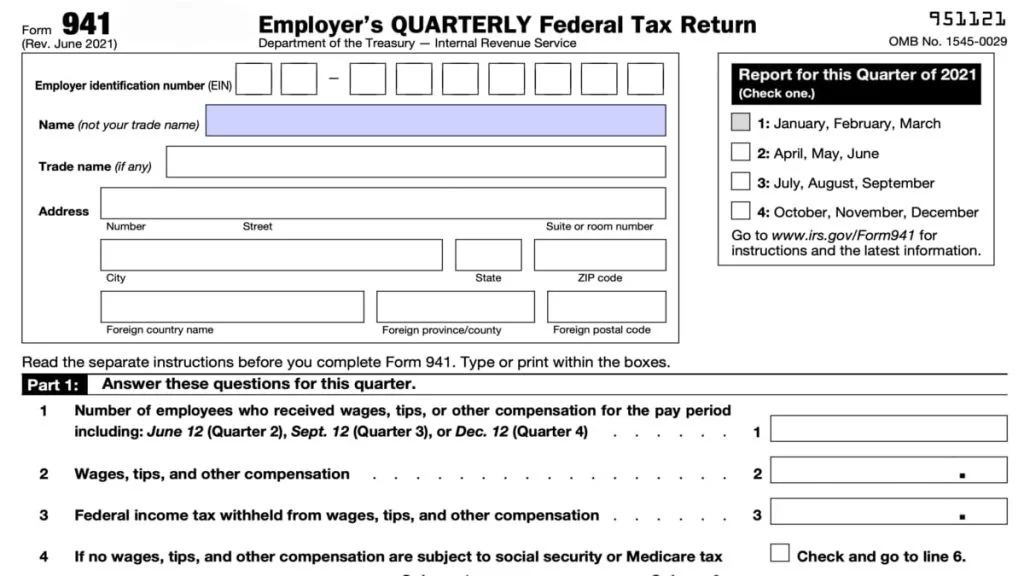

2022 Form 941 Schedule B - Employers are classified into one of two deposit schedules: Web file schedule b if you’re a semiweekly schedule depositor. Web form 941 for 2023: As well as quarters 1 and 2. Web for tax years beginning before january 1, 2023, a qualified small business may elect to claim up to $250,000 of its credit for increasing research activities as a payroll tax. Explore instructions, filing requirements, and tips. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. You must complete all three. If you deposit monthy or semiweekly, you'll want to declare that as you file 941 in quickbooks so that. Your tax liability is based on the dates wages were paid.

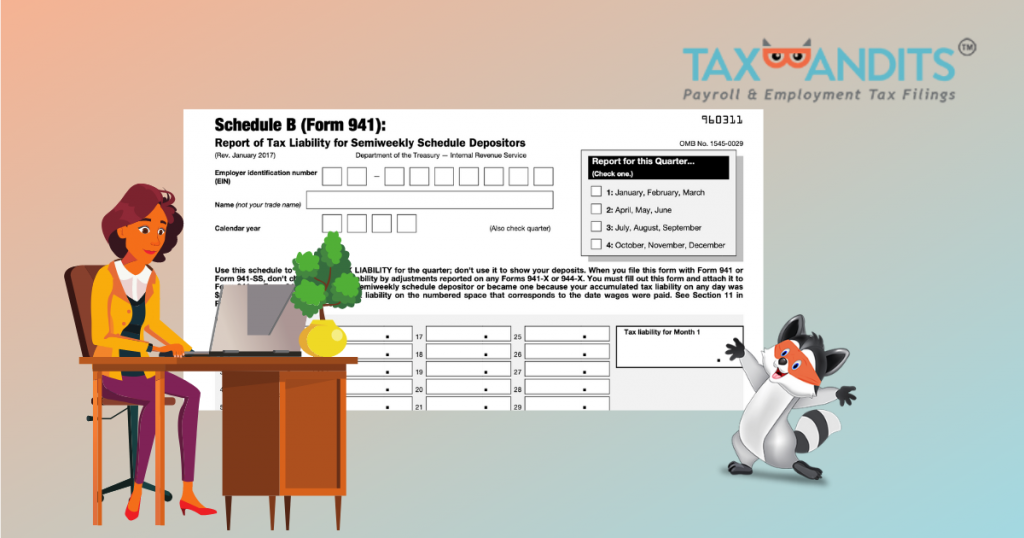

Explore instructions, filing requirements, and tips. This form must be completed by a semiweekly schedule depositor who. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Web on schedule b, list your tax liability for each day. Web the filing of schedule b depends on your deposit frequency. Your tax liability is based on the dates wages were paid. It started with 'interview questions'. Web for tax years beginning before january 1, 2023, a qualified small business may elect to claim up to $250,000 of its credit for increasing research activities as a payroll tax. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Reported more than $50,000 of employment taxes in.

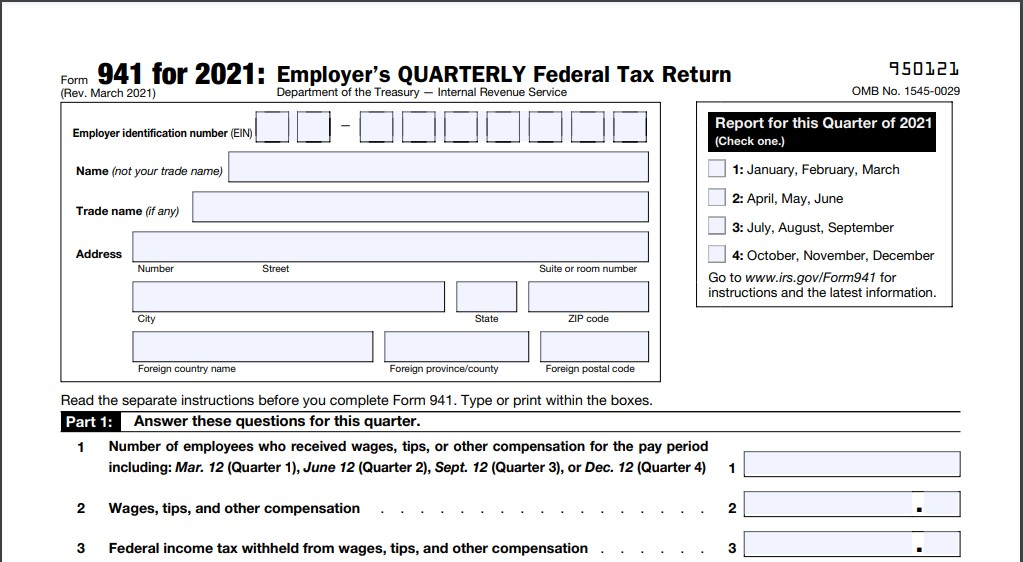

Web latest irs changes for filing form 941 and schedule b. If you need the instructions for adjusting tax liability. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the lookback period. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. If you reported more than $50,000, you’re a. Explore instructions, filing requirements, and tips. You are a semiweekly depositor if you: Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web form 941 for 2023: Irs has set the wheels in motion for revisions of.

File 941 Online Efile 941 for 4.95 IRS Form 941 for 2022

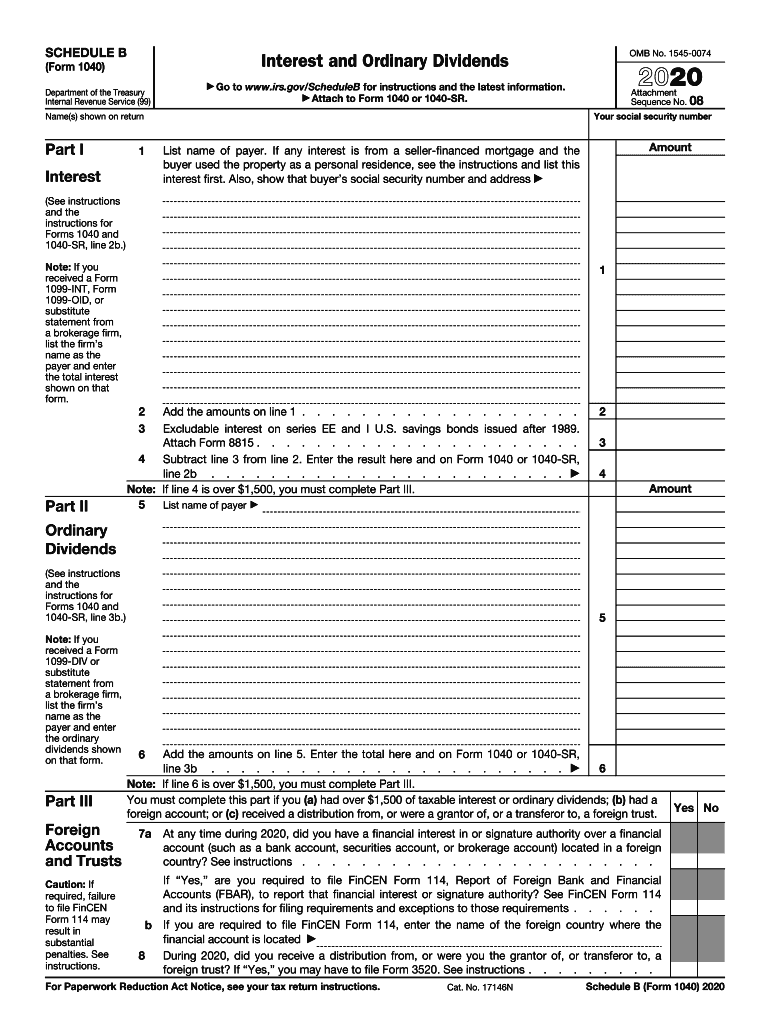

This form must be completed by a semiweekly schedule depositor who. Web the filing of schedule b depends on your deposit frequency. Web file schedule b if you’re a semiweekly schedule depositor. Here’s a simple tax guide to help you understand form 941 schedule b. Web the lookback period directly impacts the deposit schedule for form 941.

941 Form 2023

Web latest irs changes for filing form 941 and schedule b. Web the filing of schedule b depends on your deposit frequency. 3 by the internal revenue service. This form must be completed by a semiweekly schedule depositor who. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

Fill Free fillable Allocation Schedule for Aggregate Form 941 Filers

Web for tax years beginning before january 1, 2023, a qualified small business may elect to claim up to $250,000 of its credit for increasing research activities as a payroll tax. If you deposit monthy or semiweekly, you'll want to declare that as you file 941 in quickbooks so that. Web latest irs changes for filing form 941 and schedule.

941 Form 2022 schedule b Fill online, Printable, Fillable Blank

Reported more than $50,000 of employment taxes in. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Here’s a simple tax guide to help you understand form 941 schedule b. If you need the instructions for adjusting tax liability. The employer is required to withhold federal income tax and.

Schedule B Fill Out and Sign Printable PDF Template signNow

As well as quarters 1 and 2. Reported more than $50,000 of employment taxes in. The employer is required to withhold federal income tax and. Web the lookback period directly impacts the deposit schedule for form 941. Employers are classified into one of two deposit schedules:

What is Form 941 Schedule B, Who Should Complete It? Blog TaxBandits

Web file schedule b (form 941) if you are a semiweekly schedule depositor. If you reported more than $50,000, you’re a. Web on schedule b, list your tax liability for each day. Explore instructions, filing requirements, and tips. Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb.

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

If you deposit monthy or semiweekly, you'll want to declare that as you file 941 in quickbooks so that. Employers are classified into one of two deposit schedules: Web 941 basic requirements; 3 by the internal revenue service. Here’s a simple tax guide to help you understand form 941 schedule b.

Form 941 Schedule B YouTube

You are a semiweekly depositor if you: Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. If you deposit monthy or semiweekly, you'll want to declare that as you file 941 in quickbooks so that. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting.

How to Print Form 941 ezAccounting Payroll

Reported more than $50,000 of employment taxes in. If you reported more than $50,000, you’re a. Web i started the process to fill out our qtly fed tax return for payroll 941 schedule b form today, for 2022 1st quarter. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Your tax liability is based on the.

Printable 941 Form 2021 Printable Form 2022

Here’s a simple tax guide to help you understand form 941 schedule b. As well as quarters 1 and 2. Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. 3 by the internal revenue service. Employers are classified into one of two deposit schedules:

Reported More Than $50,000 Of Employment Taxes In.

Web i started the process to fill out our qtly fed tax return for payroll 941 schedule b form today, for 2022 1st quarter. The employer is required to withhold federal income tax and. If you reported more than $50,000, you’re a. Web the filing of schedule b depends on your deposit frequency.

Web For Tax Years Beginning Before January 1, 2023, A Qualified Small Business May Elect To Claim Up To $250,000 Of Its Credit For Increasing Research Activities As A Payroll Tax.

Employers are classified into one of two deposit schedules: Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. Web file schedule b if you’re a semiweekly schedule depositor. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the lookback period.

The Federal Income Tax You.

Irs has set the wheels in motion for revisions of. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Explore instructions, filing requirements, and tips. Web 941 basic requirements;

Web Complete Schedule B (Form 941), Report Of Tax Liability For Semiweekly Schedule Depositors, And Attach It To Form 941.

If you need the instructions for adjusting tax liability. Here’s a simple tax guide to help you understand form 941 schedule b. Web we last updated the report of tax liability for semiweekly schedule depositors in january 2023, so this is the latest version of 941 (schedule b), fully updated for tax year 2022. Web on schedule b, list your tax liability for each day.