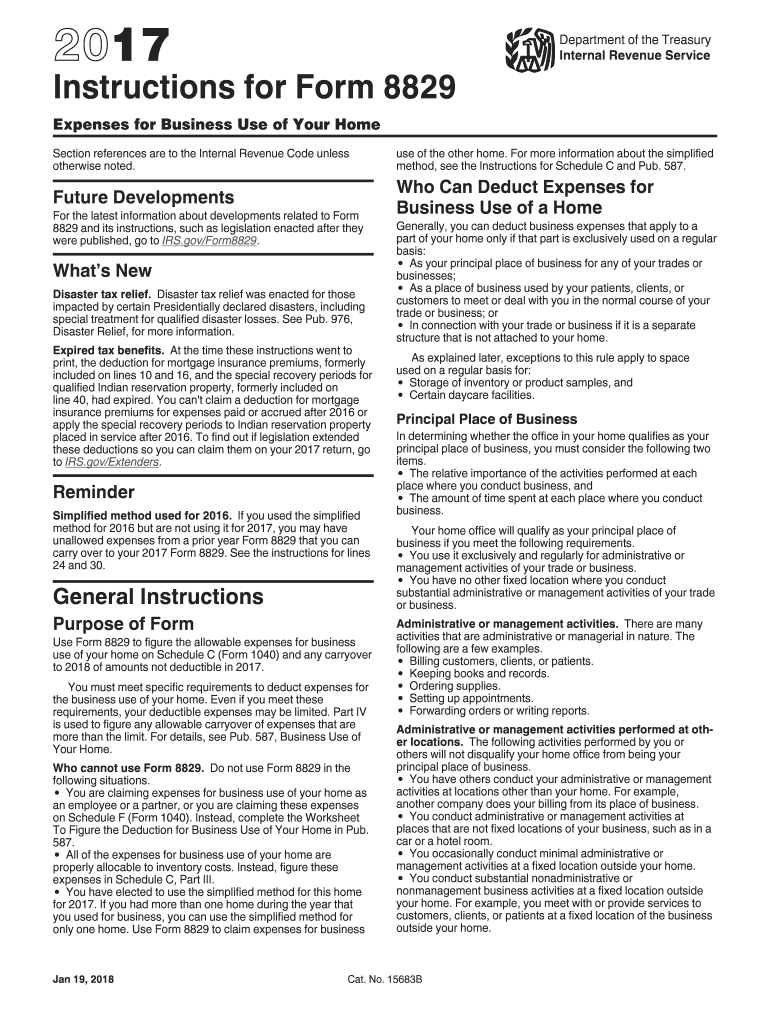

2022 Form 8829

2022 Form 8829 - Irs form 8829 is used by small business. Get ready for tax season deadlines by completing any required tax forms today. Ad edit, sign and print tax forms on any device with signnow. Web follow the simple instructions below: Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Web internal revenue service (irs) form 8829 is the form used to calculate these deductions. Web there are two ways to claim the deduction: Choose the template you want from the collection of legal form samples. Try it for free now! Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file.

Are you looking for a fast and efficient solution to complete irs 8829 at an affordable price? Ad upload, modify or create forms. Web what is irs form 8829? And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Web form 8829 expenses for business use of your home is used to figure the allowable expenses for business use of your home on schedule c (form 1040) profit or loss from. Click the get form key to. Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). This form is for income earned in tax year 2022, with tax returns due in april. The balance who uses irs form 8829?

This form is for income earned in tax year 2022, with tax returns due in april. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Ad edit, sign and print tax forms on any device with signnow. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your. Web form 8829 expenses for business use of your home is used to figure the allowable expenses for business use of your home on schedule c (form 1040) profit or loss from. Web intuit help intuit common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form. Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Web form 8829 department of the treasury internal revenue service (99) expenses for business use of your home. Download or email irs 8829 & more fillable forms, register and subscribe now!

Revisiting Form 8829 Business Use of Home Expenses for 2020 Lear

Taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes. Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. Web internal revenue service (irs) form 8829 is the form used to calculate these deductions. Web use form 8829 to figure the.

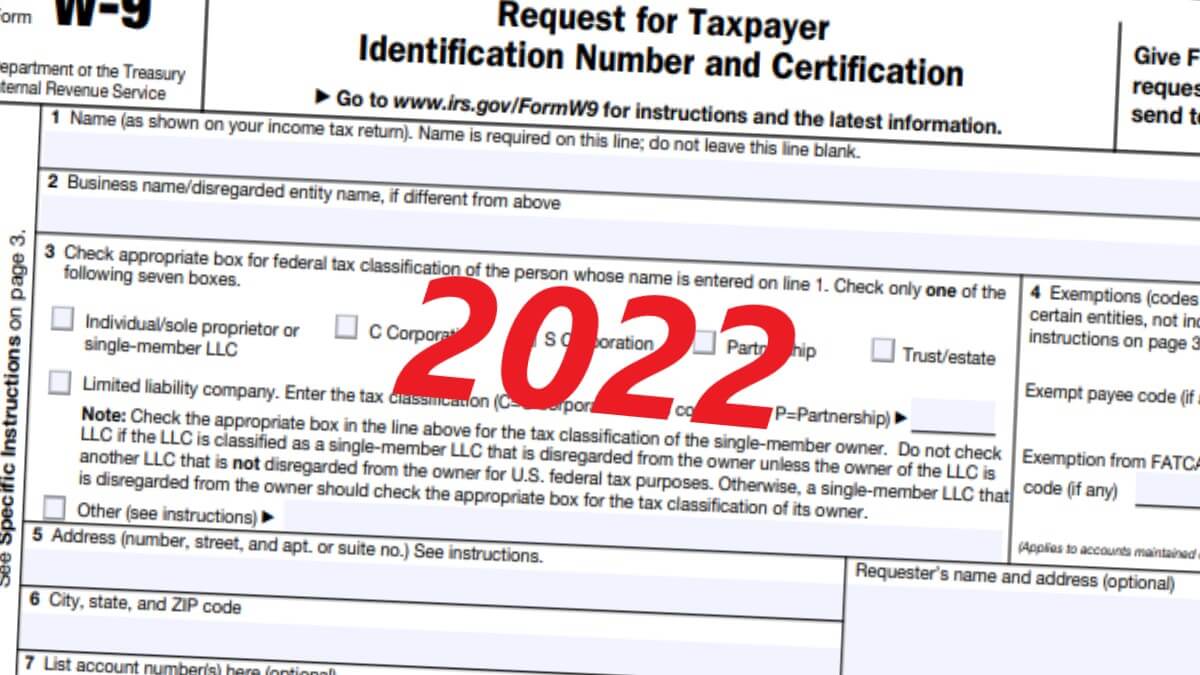

W9 Form 2022

Web form 8829 expenses for business use of your home is used to figure the allowable expenses for business use of your home on schedule c (form 1040) profit or loss from. Web there are two ways to claim the deduction: And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Business owners use irs form 8829.

IRS Form 8829 LinebyLine Instructions 2022 Expenses for Business Use

Click the get form key to. Web internal revenue service (irs) form 8829 is the form used to calculate these deductions. Download or email irs 8829 & more fillable forms, register and subscribe now! Choose the template you want from the collection of legal form samples. Business owners use irs form 8829 to claim tax deductions for the.

Simplified method worksheet 2023 Fill online, Printable, Fillable Blank

Web we last updated the expenses for business use of your home in december 2022, so this is the latest version of form 8829, fully updated for tax year 2022. Web intuit help intuit common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form. Web there.

IRS Form 8829 for Remote Workers Here’s How to Complete Flyfin

Web what is irs form 8829? Choose the template you want from the collection of legal form samples. Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Business owners use.

Instructions Form 8829 Fill Out and Sign Printable PDF Template signNow

Ad upload, modify or create forms. Web execute irs 8829 within a couple of minutes following the instructions listed below: Web form 8829 department of the treasury internal revenue service (99) expenses for business use of your home. The balance who uses irs form 8829? Web we last updated the expenses for business use of your home in december 2022,.

Business Use Of Home (Form 8829) Organizer 2014 printable pdf download

Are you looking for a fast and efficient solution to complete irs 8829 at an affordable price? Web irs form 8829 (2022). Our platform will provide you with a rich. Ad upload, modify or create forms. Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form.

Form 1099MISC Legal Templates

And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Web we last updated the expenses for business use of your home in december 2022, so this is the latest version of form 8829, fully updated for tax year 2022. Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. This.

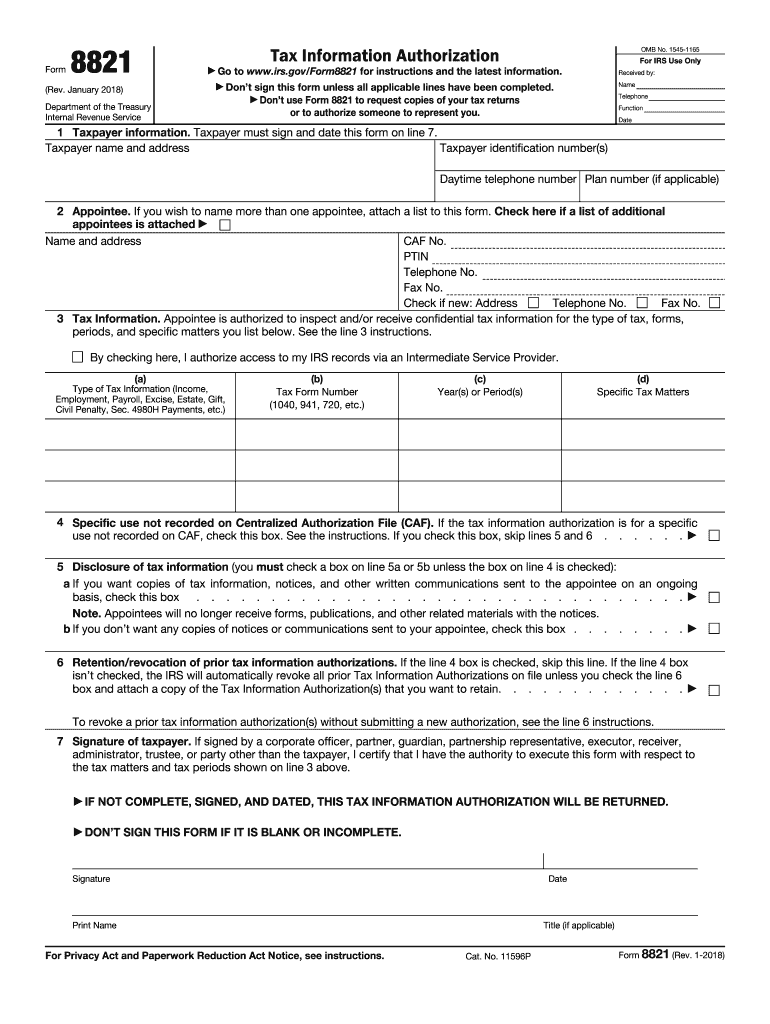

Form 8821 Fill Out and Sign Printable PDF Template signNow

The balance who uses irs form 8829? Web we last updated the expenses for business use of your home in december 2022, so this is the latest version of form 8829, fully updated for tax year 2022. Web form 8829 is only for taxpayers filing form 1040 schedule c. Web follow the simple instructions below: Web form 8829 expenses for.

Simplified Method Worksheet 2021 Home Office Simplified Method

Taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your. Web follow the simple instructions below: Click the get form key to. Web irs form 8829 (2022).

Web Form 8829 Department Of The Treasury Internal Revenue Service (99) Expenses For Business Use Of Your Home.

Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your. Are you looking for a fast and efficient solution to complete irs 8829 at an affordable price? Irs form 8829 is used by small business.

Choose The Template You Want From The Collection Of Legal Form Samples.

The balance who uses irs form 8829? Ad edit, sign and print tax forms on any device with signnow. Web execute irs 8829 within a couple of minutes following the instructions listed below: Click the get form key to.

Web Follow The Simple Instructions Below:

Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Web intuit help intuit common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form. Web irs form 8829 (2022). Taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes.

Web Internal Revenue Service (Irs) Form 8829 Is The Form Used To Calculate These Deductions.

Web there are two ways to claim the deduction: This form is for income earned in tax year 2022, with tax returns due in april. Web form 8829 expenses for business use of your home is used to figure the allowable expenses for business use of your home on schedule c (form 1040) profit or loss from. Web we last updated the expenses for business use of your home in december 2022, so this is the latest version of form 8829, fully updated for tax year 2022.