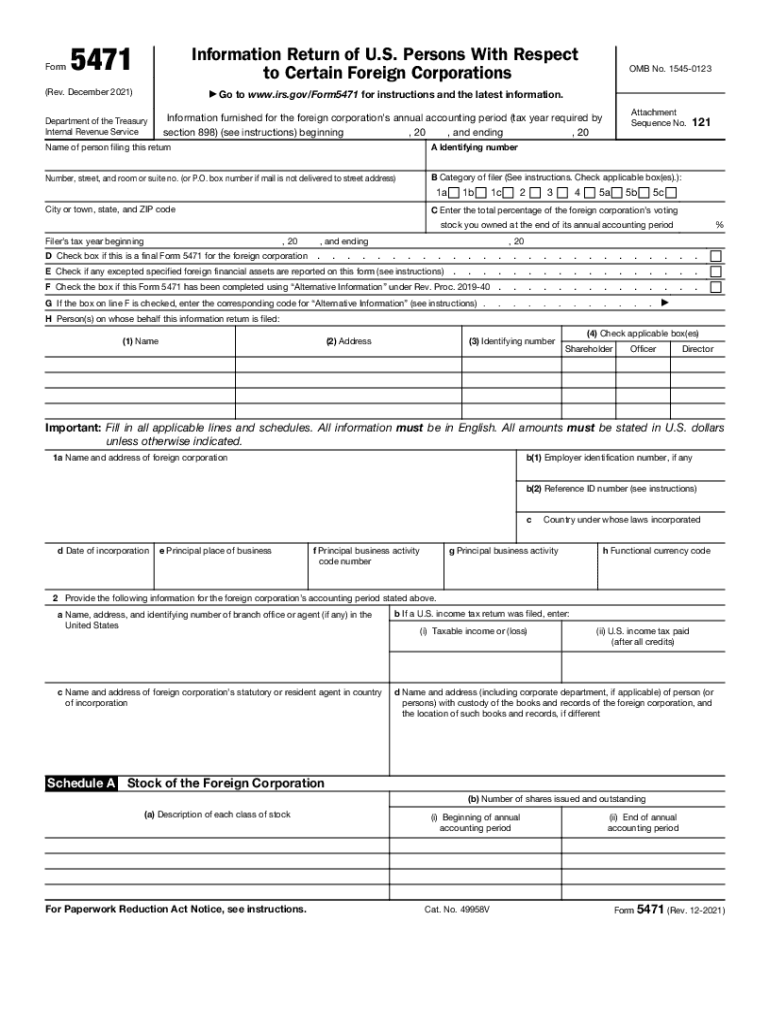

2021 Form 5471

2021 Form 5471 - Complete, edit or print tax forms instantly. Go to the section, miscellaneous forms, and then go to the screen, information of u.s. Web to generate form 5471: Ad register and subscribe now to work on your irs 5471 & more fillable forms. Web instructions for form 5471(rev. The form and schedules are used to satisfy the reporting. The december 2021 revision of separate. Transactions between controlled foreign corporation and shareholders or other. Web the year the internal revenue service (“irs”) added new categories of filers for the form 5471. Web taxact supports form 5471 information return of u.s.

Schedule 1 is designed to report any foreign taxes paid or accrued directly by a cfc. December 2021) department of the treasury internal revenue service. Upload, modify or create forms. Try it for free now! This article will also discuss the new category of filers. At this time, we only support the creation and electronic filing of. This is available in the following tax types:. As a warning, the irs form 5471 is easily one of th. The taxpayer must not only. Web form 5471 is used by certain u.s.

This is available in the following tax types:. Web this is the first video in a series which covers the preparation of irs form 5471 for the 2021 tax year. Persons with respect to certain foreign corporations. This article will also discuss the new category of filers. Web in january of 2021, just keep in mind, tcja came out at the end of 2018 and changed the rules for filing form 5471, because the downward attribution of stock from a foreign. What is it, how to file it, & when do you have. The december 2021 revision of separate. Schedule 1 is designed to report any foreign taxes paid or accrued directly by a cfc. Recently, the irs expanded the reporting requirements, and introduced a new category. Web form 5471 filing deadline for expats in 2021 (and 2022), the filing date for expats is june 15th unless they request an additional extension until october 15th by.

irs form 5471 Fill Online, Printable, Fillable Blank

Web irs form 5471 refers to the reporting of foreign corporations to the u.s. December 2021) department of the treasury internal revenue service. At this time, we only support the creation and electronic filing of. The form and schedules are used to satisfy the reporting. This article will also discuss the new category of filers.

Demystifying the New 2021 IRS Form 5471 Schedule E and Schedule E1

Web instructions for form 5471(rev. At this time, we only support the creation and electronic filing of. Web usa december 13 2021 form 5471 form 5471 is becoming an increasingly important form for any us taxpayer in the world with interest in a foreign corporation. Recently, the irs expanded the reporting requirements, and introduced a new category. Schedule 1 is.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Try it for free now! Persons who are officers, directors, or shareholders in certain foreign corporations. Go to the section, miscellaneous forms, and then go to the screen, information of u.s. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; The form and schedules are used to satisfy the reporting.

Demystifying the 2021 IRS Form 5471 Schedule J SF Tax Counsel

Complete, edit or print tax forms instantly. Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. At this time, we only support the creation and electronic filing of. Persons with respect to certain foreign corporations. Try it for free now!

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web this is the first video in a series which covers the preparation of irs form 5471 for the 2021 tax year. Web instructions for form 5471(rev. Information return for foreign corporation 2023. At this time, we only support the creation and electronic filing of. Web taxact supports form 5471 information return of u.s.

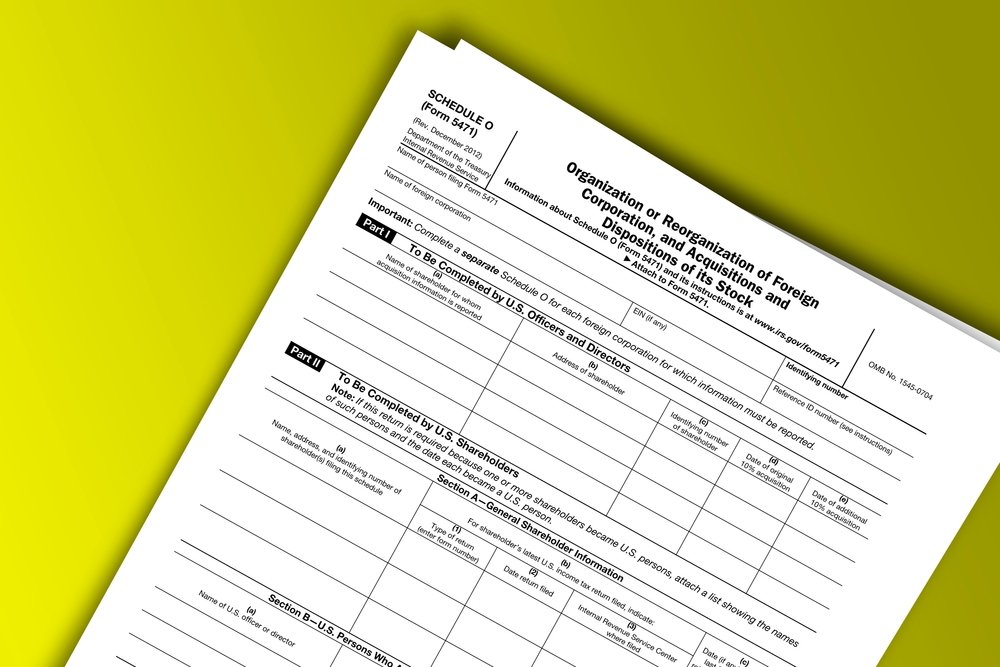

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

This is available in the following tax types:. Form 5471, officially called the information return of u.s. Try it for free now! Ad register and subscribe now to work on your irs 5471 & more fillable forms. Web instructions for form 5471(rev.

2012 form 5471 instructions Fill out & sign online DocHub

Schedule 1 is designed to report any foreign taxes paid or accrued directly by a cfc. As a warning, the irs form 5471 is easily one of th. Web this is the first video in a series which covers the preparation of irs form 5471 for the 2021 tax year. Web form 5471 is used by certain u.s. Ad register.

2021 Schedule I1 for IRS Form 5471 SF Tax Counsel

Web form 5471 filing deadline for expats in 2021 (and 2022), the filing date for expats is june 15th unless they request an additional extension until october 15th by. Schedule 1 is designed to report any foreign taxes paid or accrued directly by a cfc. Web form 5471 is used by certain u.s. Web this is the first video in.

A Deep Dive into the 2021 IRS Form 5471 Schedule J SF Tax Counsel

Web to generate form 5471: This article will also discuss the new category of filers. Web instructions for form 5471(rev. Upload, modify or create forms. Web taxact supports form 5471 information return of u.s.

2021 Form IRS 5471 Fill Online, Printable, Fillable, Blank pdfFiller

This article will also discuss the new category of filers. Ad register and subscribe now to work on your irs 5471 & more fillable forms. Persons with respect to certain foreign corporations. December 2022) department of the treasury internal revenue service. The taxpayer must not only.

Web In January Of 2021, Just Keep In Mind, Tcja Came Out At The End Of 2018 And Changed The Rules For Filing Form 5471, Because The Downward Attribution Of Stock From A Foreign.

Transactions between controlled foreign corporation and shareholders or other. Web instructions for form 5471(rev. This is available in the following tax types:. Form 5471, officially called the information return of u.s.

Web To Generate Form 5471:

Web form 5471 filing deadline for expats in 2021 (and 2022), the filing date for expats is june 15th unless they request an additional extension until october 15th by. Go to the section, miscellaneous forms, and then go to the screen, information of u.s. Web this is the first video in a series which covers the preparation of irs form 5471 for the 2021 tax year. Web instructions for form 5471(rev.

Persons Who Are Officers, Directors, Or Shareholders In Certain Foreign Corporations.

Persons with respect to certain foreign corporations. Persons with respect to certain foreign corporations. The december 2021 revision of separate. Try it for free now!

Web What Is Form 5471?

Upload, modify or create forms. Web the year the internal revenue service (“irs”) added new categories of filers for the form 5471. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; This article will also discuss the new category of filers.