2020 Form 990 Instructions

2020 Form 990 Instructions - An officer must sign and date the tax return. On this page you may download the 990 series. Web form 990 2020 return of organization exempt from income tax schedule a organization exempt under section 501(c)(3). Ad register and subscribe now to work on your irs 990 instructions & more fillable forms. Web to file your tax return(s), simply follow these instructions: And form 4720, return of. Ey has prepared annotated versions of. For calendar year 2020 or tax year beginning, 2020, and ending, 20name of. Accordingly, where the form 990 references. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions.

Web exempt organization business income tax returnomb no. See instructions alternative minimum tax (trusts only). Web for instructions and the latest information. Baa for paperwork reduction act notice, see the. Ad register and subscribe now to work on your irs 990 instructions & more fillable forms. Web form 990 schedules with instructions. An officer must sign and date the tax return. Exempt organization business income tax return. Web see the 990 instructions and irs annual filing and forms page for details. Ey has prepared annotated versions of.

Exempt organization business income tax return. Web for instructions and the latest information. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Baa for paperwork reduction act notice, see the. Sign and date your return. Web for paperwork reduction act notice, see the separate instructions. For calendar year 2020 or tax year beginning, 2020, and ending, 20name of. On this page you may download the 990 series. See instructions alternative minimum tax (trusts only). • to figure the tax based on investment income, and • to report charitable distributions and activities.

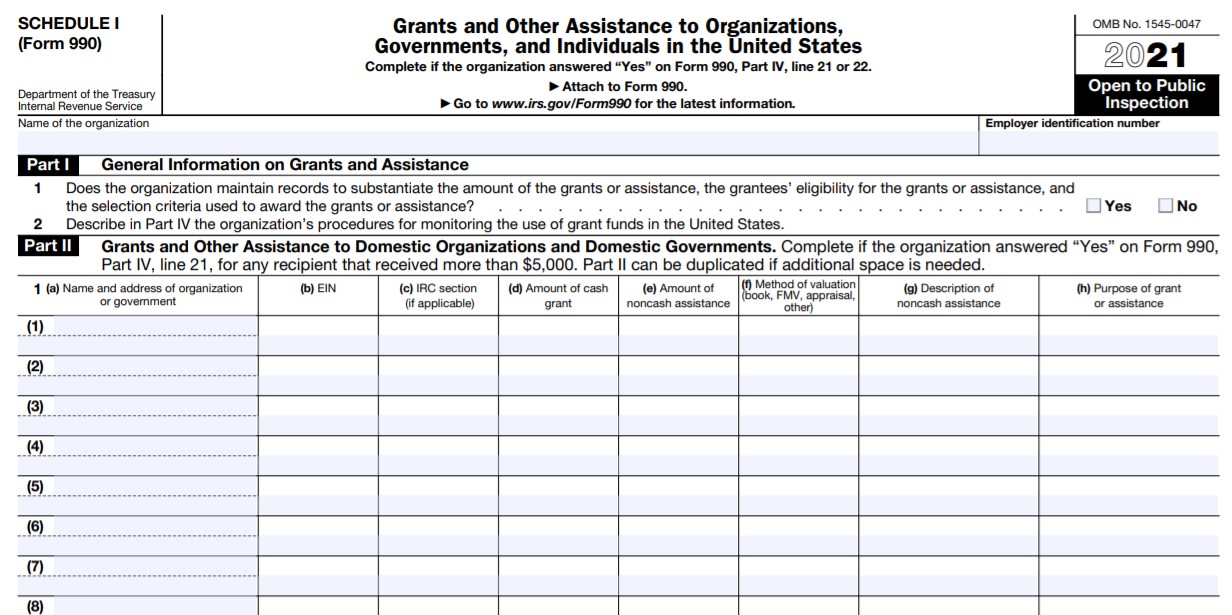

IRS Form 990 Schedule I Instructions Grants & Other Assistance

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Ey has prepared annotated versions of. Web exempt organization business income tax returnomb no. Web part i, line 11 from: Web for paperwork reduction act notice, see the separate instructions.

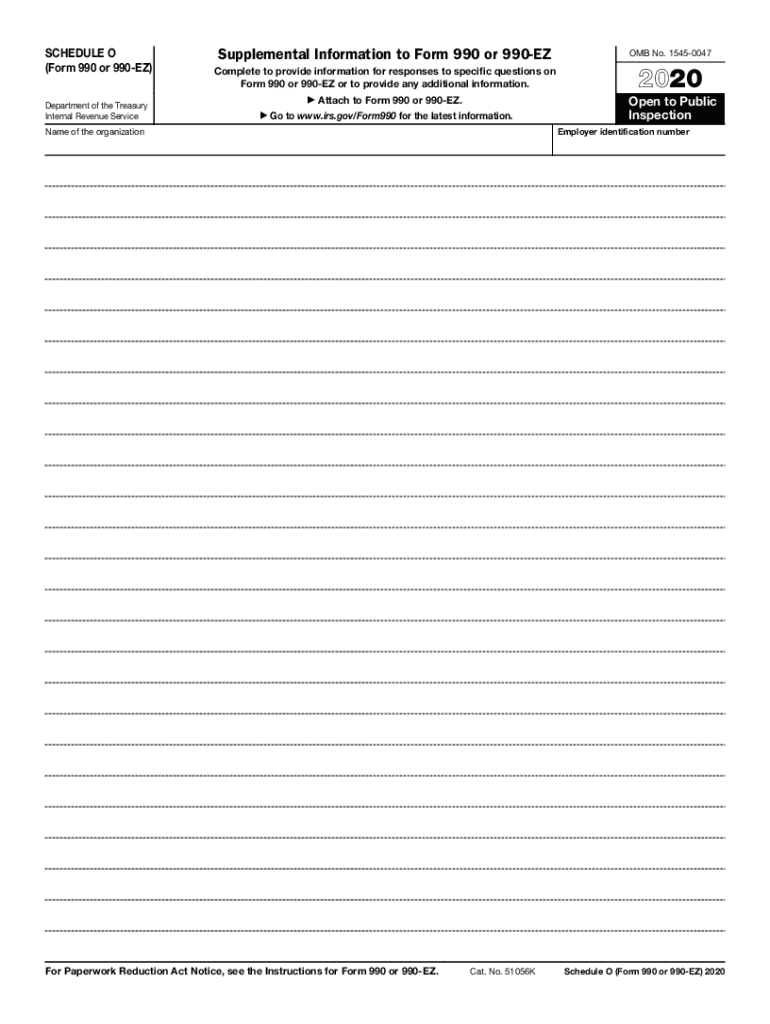

form 990 schedule o Fill Online, Printable, Fillable Blank form990

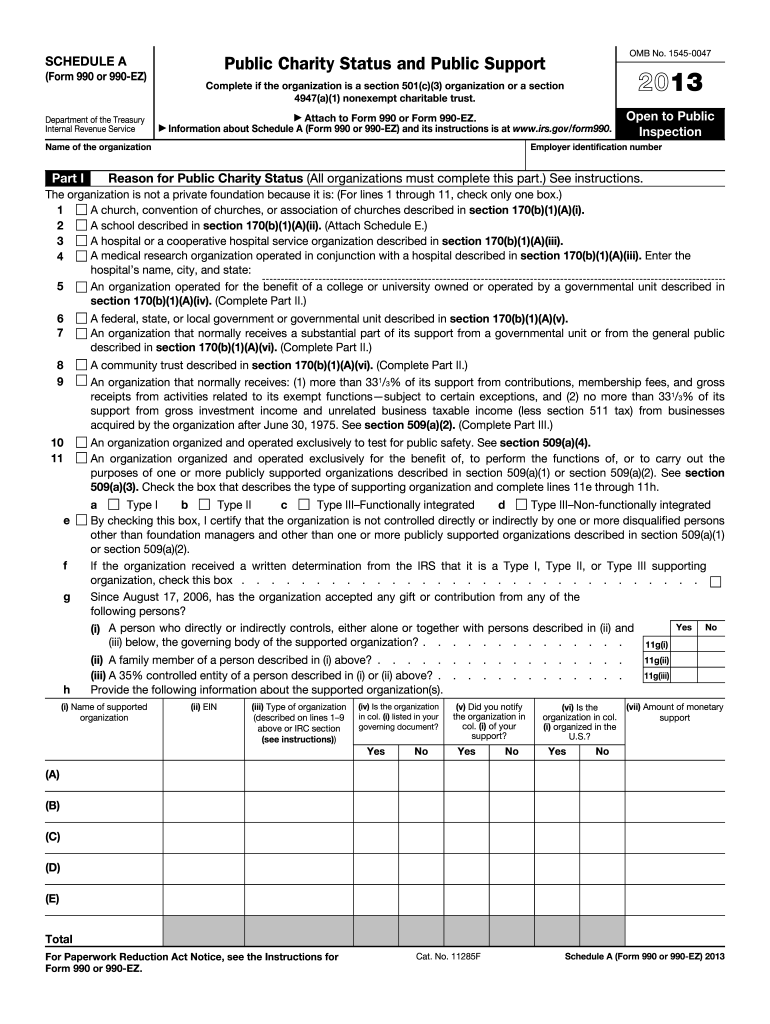

Web form 990 2020 return of organization exempt from income tax schedule a organization exempt under section 501(c)(3). A late return incurs a. Web part i, line 11 from: Web form 990 schedules with instructions. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file.

990 Schedule O Fill Out and Sign Printable PDF Template signNow

Web exempt organization business income tax returnomb no. A late return incurs a. Accordingly, where the form 990 references. Web form 990 2020 return of organization exempt from income tax schedule a organization exempt under section 501(c)(3). On this page you may download the 990 series.

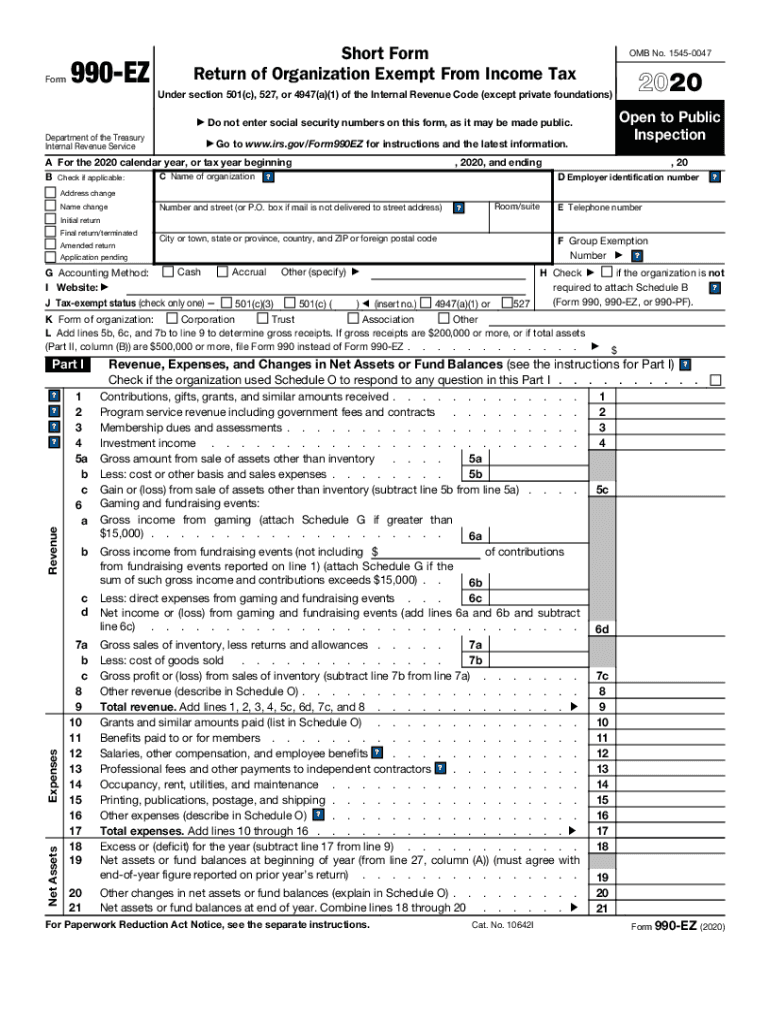

990 Ez Form Fill Out and Sign Printable PDF Template signNow

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. On this page you may download the 990 series. Complete irs tax forms online or print government tax documents. Web to file your tax return(s), simply follow these instructions: Exempt organization business income tax.

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. See instructions other tax amounts. Accordingly, where the form 990 references. Complete irs tax forms online or print government tax documents. See instructions alternative minimum tax (trusts only).

2020 Form IRS 990 Fill Online, Printable, Fillable, Blank pdfFiller

Web in 2020, the irs issued modified regulations that allow organizations seeking to calculate ubti for purposes of the public support test to choose either the aggregate method or. Web form 990 2020 return of organization exempt from income tax schedule a organization exempt under section 501(c)(3). The following schedules to form 990, return of organization exempt from income tax,.

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Complete irs tax forms online or print government tax documents. Ad get ready for tax season deadlines by completing any required tax forms today. For calendar year 2020 or tax year beginning, 2020, and ending, 20name of. Web part i, line 11 from: Accordingly, where the form 990 references.

2020 Form IRS 990EZ Fill Online, Printable, Fillable, Blank pdfFiller

Web for paperwork reduction act notice, see the separate instructions. See instructions alternative minimum tax (trusts only). On this page you may download the 990 series. Web part i, line 11 from: See instructions other tax amounts.

2020 Form IRS Instructions Schedule A (990 or 990EZ) Fill Online

Accordingly, where the form 990 references. Exempt organization business income tax return. On this page you may download the 990 series. Baa for paperwork reduction act notice, see the. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal.

2020 Form IRS 990 or 990EZ Schedule N Fill Online, Printable

Tax rate schedule or schedule d (form 1041) proxy tax. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Complete irs tax forms online or print government tax documents. • to figure the tax based on investment income, and • to report charitable.

Web Form 990 Schedules With Instructions.

Complete irs tax forms online or print government tax documents. Ad register and subscribe now to work on your irs 990 instructions & more fillable forms. On this page you may download the 990 series. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file.

And Form 4720, Return Of.

Web in 2020, the irs issued modified regulations that allow organizations seeking to calculate ubti for purposes of the public support test to choose either the aggregate method or. Web to file your tax return(s), simply follow these instructions: Web for instructions and the latest information. Ey has prepared annotated versions of.

• To Figure The Tax Based On Investment Income, And • To Report Charitable Distributions And Activities.

Web exempt organization business income tax returnomb no. Web see the 990 instructions and irs annual filing and forms page for details. Web for paperwork reduction act notice, see the separate instructions. Web form 990 2020 return of organization exempt from income tax schedule a organization exempt under section 501(c)(3).

Baa For Paperwork Reduction Act Notice, See The.

The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. For calendar year 2020 or tax year beginning, 2020, and ending, 20name of. Accordingly, where the form 990 references. Tax rate schedule or schedule d (form 1041) proxy tax.