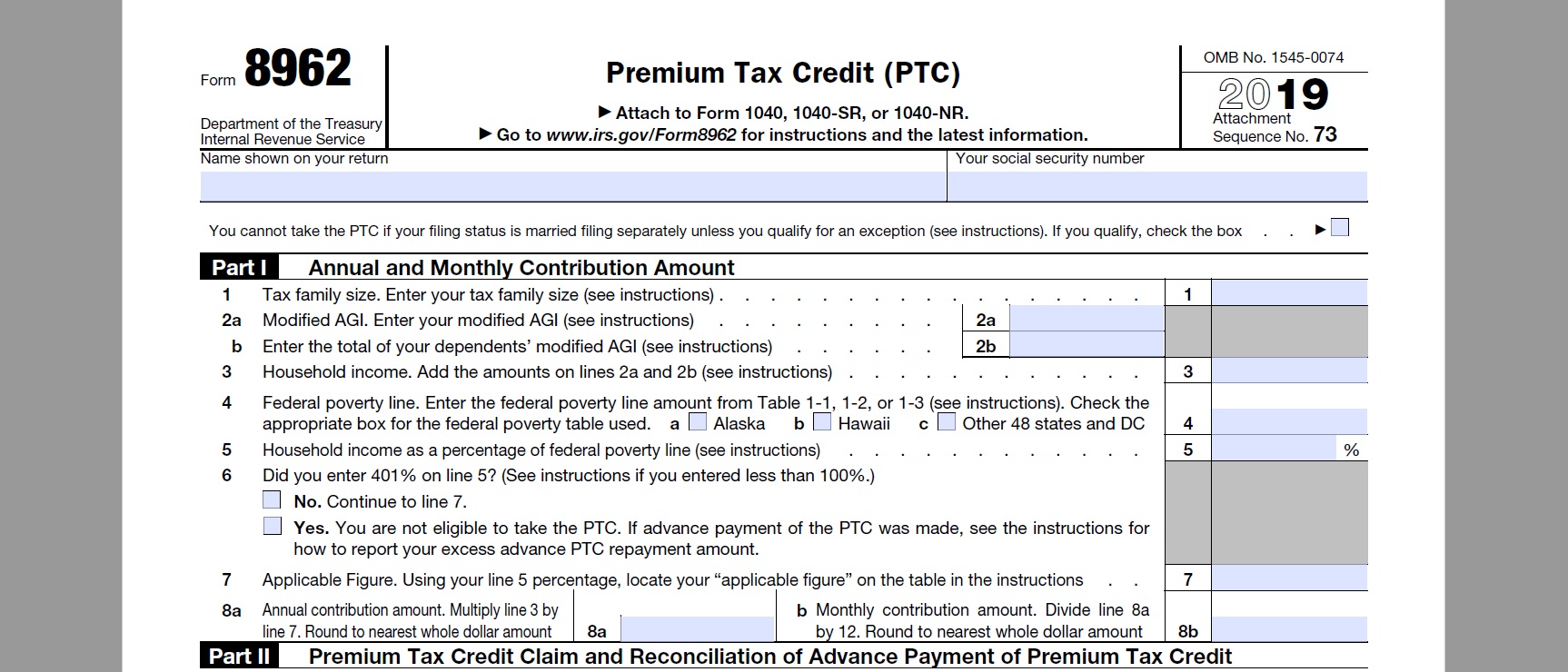

2019 Form 8962

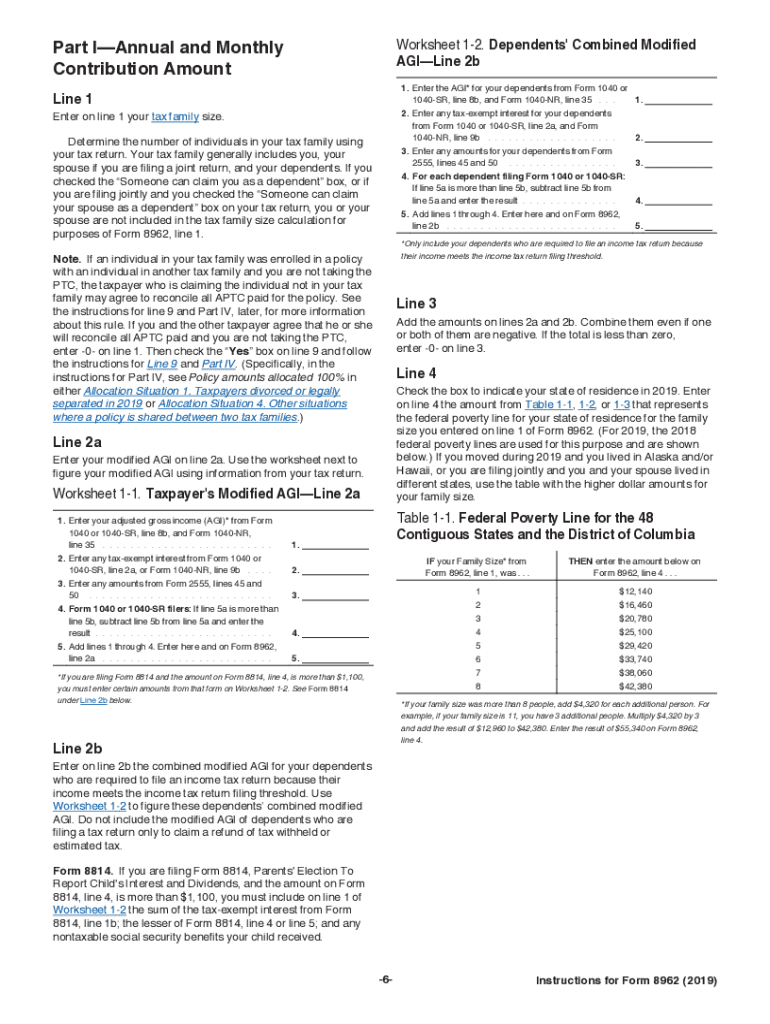

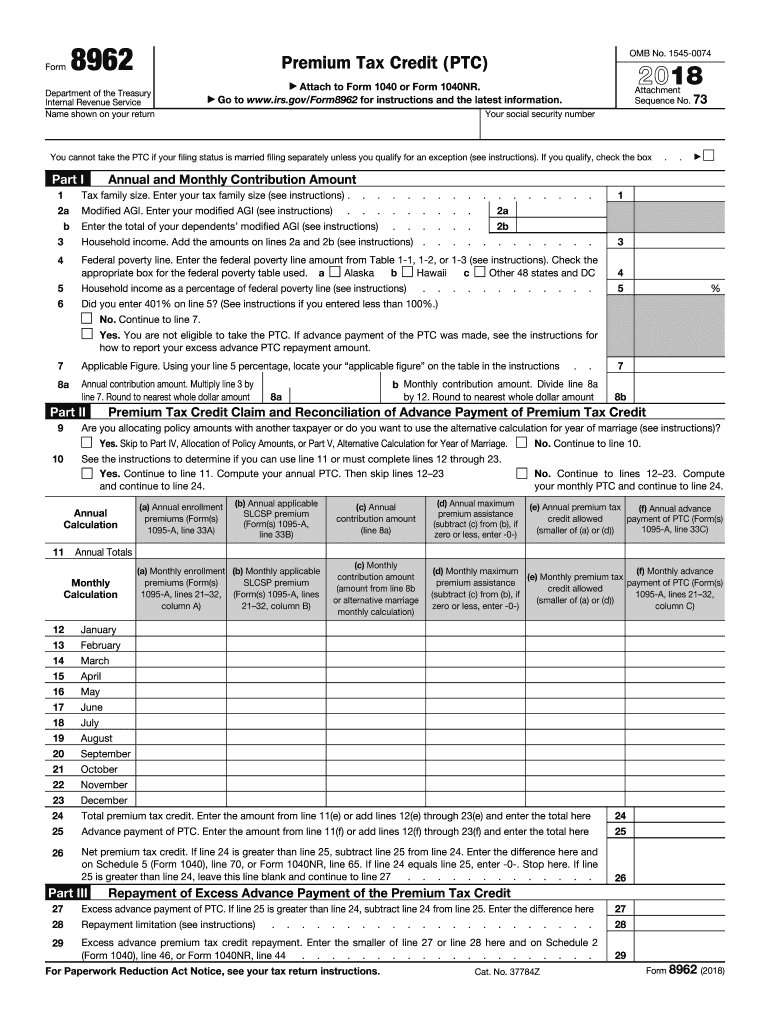

2019 Form 8962 - Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit (aptc). Web if the irs sends you a letter about a 2019 form 8962, that means we need more information from you to finish processing your 2019 tax return. Try it for free now! Use form 8962 to reconcile your premium tax credit — compare the amount you used in 2019 to. The amount of excess premium tax credit repayment, calculated on line 29 of federal form 8962 premium tax. Complete, edit or print tax forms instantly. Web you don’t have to fill out or include form 8962, premium tax credit, when you file your federal taxes. Get ready for tax season deadlines by completing any required tax forms today. This form is only used by taxpayers who.

Upload, modify or create forms. Web follow this guideline to properly and quickly fill in irs instructions 8962. Select the document you want to sign and click upload. Reminders applicable federal poverty line percentages. If you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with. Try it for free now! Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Click the button get form to open it and begin. Web form 8962, premium tax credit.

Ad access irs tax forms. Complete, edit or print tax forms instantly. The best way to submit the irs instructions 8962 online: This form is only used by taxpayers who. Try it for free now! Select the document you want to sign and click upload. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Use form 8962 to reconcile your premium tax credit — compare the amount you used in 2019 to. Form 8962 is used either (1) to reconcile a premium tax.

IRS 2019 Health Insurance Subsidy Tax Credit Reconciliation

This form is only used by taxpayers who. Complete, edit or print tax forms instantly. Web form 8962, premium tax credit. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Form 8962 is used either (1) to.

2019 Form 8962 Instructions Fill Out and Sign Printable PDF Template

Complete, edit or print tax forms instantly. Reminders applicable federal poverty line percentages. Web if the irs sends you a letter about a 2019 form 8962, that means we need more information from you to finish processing your 2019 tax return. Click the button get form to open it and begin. If you paid full price.

2019 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

Ad access irs tax forms. Ad get ready for tax season deadlines by completing any required tax forms today. Reminders applicable federal poverty line percentages. Complete, edit or print tax forms instantly. The amount of excess premium tax credit repayment, calculated on line 29 of federal form 8962 premium tax.

How to fill out the Form 8962 in 2019 update YouTube

Use form 8962 to reconcile your premium tax credit — compare the amount you used in 2019 to. Click the button get form to open it and begin. Try it for free now! Ad access irs tax forms. Web you don’t have to fill out or include form 8962, premium tax credit, when you file your federal taxes.

Instructions 8962 2018 2019 Blank Sample to Fill out Online in PDF

Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. If you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with. Reminders applicable federal poverty line percentages. Upload, modify or create forms. Ad access.

Breanna Image Of Form 8962

The amount of excess premium tax credit repayment, calculated on line 29 of federal form 8962 premium tax. Form 8962 is used either (1) to reconcile a premium tax. Use form 8962 to reconcile your premium tax credit — compare the amount you used in 2019 to. Web follow this guideline to properly and quickly fill in irs instructions 8962..

Form 8962 Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. Use form 8962 to reconcile your premium tax credit — compare the amount you used in 2019 to. Try it for free now! The best way to submit the irs instructions 8962 online: Web follow this guideline to properly and quickly fill in irs instructions 8962.

Fill Free fillable Form 8962 Premium Tax Credit PDF form

Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Web form 8962, premium tax credit. Click the button get form to open it and begin. Upload, modify or create forms. Web form 8962 is used to figure.

Tax Season 2018 File IRS Form 8962 for Health Insurance Credit

Ad access irs tax forms. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Get ready for tax season deadlines by completing any required.

Tax Season 2019 File IRS Form 8962 for Health Insurance Credit

The best way to submit the irs instructions 8962 online: Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Select the document you want to sign and click upload. Web form 8962 is used to figure the.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web you don’t have to fill out or include form 8962, premium tax credit, when you file your federal taxes. Try it for free now! Select the document you want to sign and click upload. Complete, edit or print tax forms instantly.

Reminders Applicable Federal Poverty Line Percentages.

Web if the irs sends you a letter about a 2019 form 8962, that means we need more information from you to finish processing your 2019 tax return. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Upload, modify or create forms.

The Amount Of Excess Premium Tax Credit Repayment, Calculated On Line 29 Of Federal Form 8962 Premium Tax.

Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit (aptc). Click the button get form to open it and begin. Web follow this guideline to properly and quickly fill in irs instructions 8962. If you paid full price.

Web Form 8962, Premium Tax Credit.

This form is only used by taxpayers who. The best way to submit the irs instructions 8962 online: If you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with. Use form 8962 to reconcile your premium tax credit — compare the amount you used in 2019 to.