1116 Form Instructions

1116 Form Instructions - Use form 2555 to claim. Web key takeaways u.s expats can use the irs form 1116 to claim the foreign tax credit. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. While there are rare instances that the foreign tax credit is available without filing form. Web on form 1116, all income and taxes are reported in us dollars except where specified otherwise in part ii. Lines 3d and 3e for lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Web per irs instructions for form 1116, on page 16: Web however, forpurpose of formdeduct foreign income taxes on this purpose, passive income alsoincludes (a) income subject to thewho should file. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1116.

Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1116. Use form 2555 to claim the. Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; Web key takeaways u.s expats can use the irs form 1116 to claim the foreign tax credit. While there are rare instances that the foreign tax credit is available without filing form. The foreign tax credit can be claimed for tax paid. To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i, line. Web 6 rows schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Lines 3d and 3e for lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),.

File form 1116 to schedule a. The foreign tax credit can be claimed for tax paid. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. When converting to us dollars, use the conversion rate in effect on. Use form 2555 to claim the. Web 6 rows schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your. To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i, line. Web to help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately compute the credit using form 1116,. Web everyone should utilize instructions to form 1116 and pub 514 ftc for individuals. Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met;

Form 55183 Edit, Fill, Sign Online Handypdf

Web election to claim the foreign tax credit without filing form 1116. Lines 3d and 3e for lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to.

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

Web on form 1116, all income and taxes are reported in us dollars except where specified otherwise in part ii. Web per irs instructions for form 1116, on page 16: Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. Web a form.

Fill Free fillable Form 1116 2019 Foreign Tax Credit PDF form

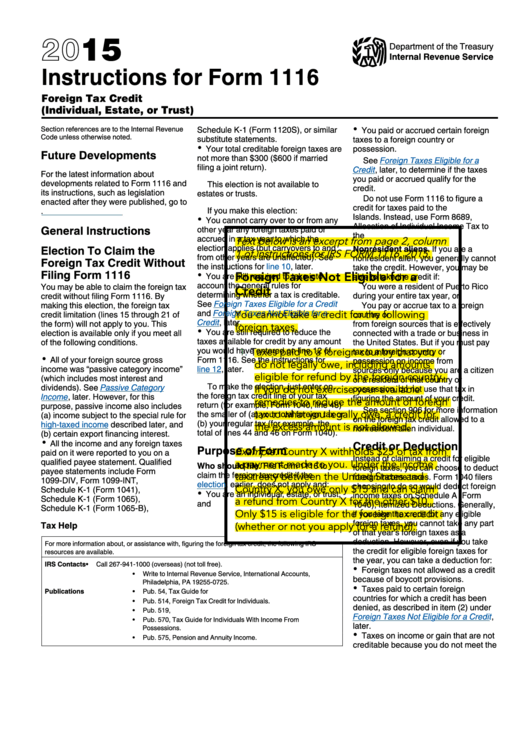

Web on form 1116, all income and taxes are reported in us dollars except where specified otherwise in part ii. These two resources can give you all the guidance you need, but we're just going to summarize. See the instructions for line 12, later. When converting to us dollars, use the conversion rate in effect on. While there are rare.

2015 Instructions For Form 1116 printable pdf download

These two resources can give you all the guidance you need, but we're just going to summarize. When converting to us dollars, use the conversion rate in effect on. Web per irs instructions for form 1116, on page 16: Use form 2555 to claim the. While there are rare instances that the foreign tax credit is available without filing form.

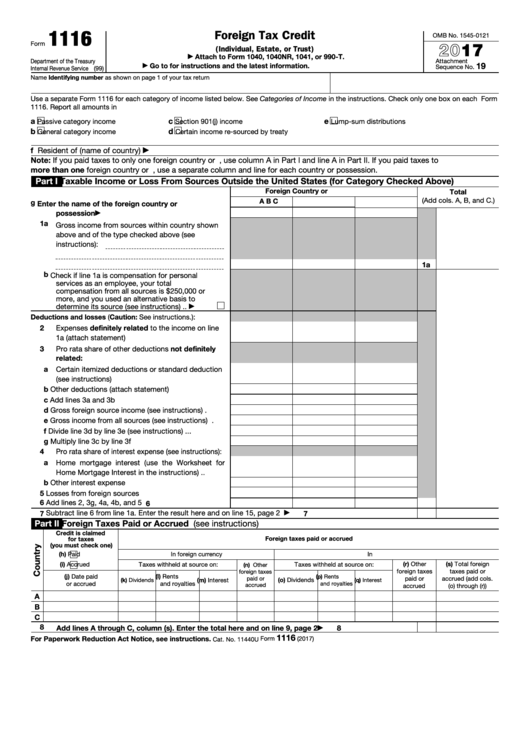

Fillable Form 1116 Foreign Tax Credit 2017 printable pdf download

Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. See the instructions for line 12, later. Web however, forpurpose of formdeduct foreign income taxes on this purpose, passive income alsoincludes (a) income subject to thewho should file. These two resources can give.

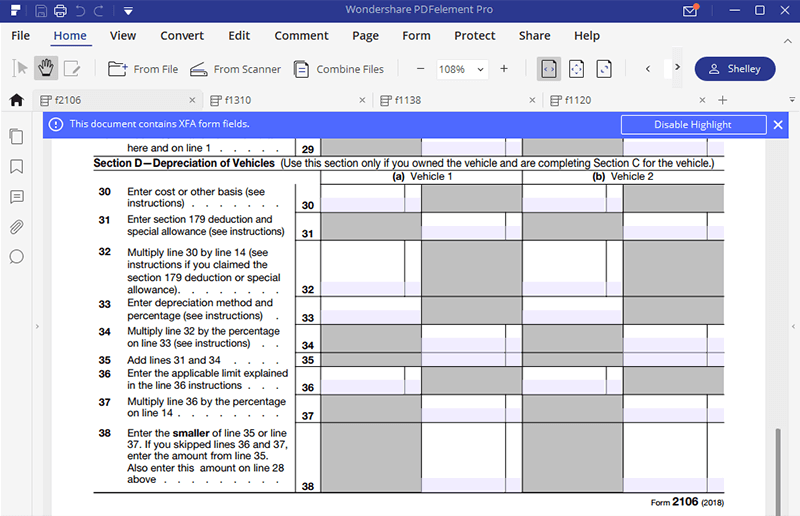

Breanna Form 2106 Instructions 2016

Use form 2555 to claim the. File form 1116 to schedule a. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. Web election to claim the foreign tax credit without filing form 1116. Web general instructions election to claim the foreign tax.

Demystifying IRS Form 1116 Calculating Foreign Tax Credits SF Tax

Lines 3d and 3e for lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Web however, forpurpose of formdeduct foreign income taxes on this purpose, passive income alsoincludes (a) income subject to thewho should file. Web 6 rows schedule b (form 1116) is used to reconcile your prior year foreign.

Irs Forms W 2 Instructions Form Resume Examples GM9O6kg2DL

See the instructions for line 12, later. Web everyone should utilize instructions to form 1116 and pub 514 ftc for individuals. Web key takeaways u.s expats can use the irs form 1116 to claim the foreign tax credit. File form 1116 to schedule a. Lines 3d and 3e for lines 3d and 3e, gross income means the total of your.

Form 1116 part 1 instructions

Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1116. The foreign tax credit can be claimed for tax paid. When converting to us dollars, use the conversion rate in effect on. Web key takeaways u.s expats can use the irs form 1116 to claim.

Instructions for 1116 2016

Web general instructions election to claim the foreign tax credit without filing form 1116 you may be able to claim the foreign tax credit without filing form 1116. Web 6 rows schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your. The foreign tax credit can be claimed for tax paid. Web on form.

Web To Help These Taxpayers, You Must Determine Which Taxes And Types Of Foreign Income Are Eligible For The Foreign Tax Credit And Accurately Compute The Credit Using Form 1116,.

These two resources can give you all the guidance you need, but we're just going to summarize. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web 6 rows schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your. Web on form 1116, all income and taxes are reported in us dollars except where specified otherwise in part ii.

See The Instructions For Line 12, Later.

Use form 2555 to claim. Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. Use form 2555 to claim the.

Web Everyone Should Utilize Instructions To Form 1116 And Pub 514 Ftc For Individuals.

When converting to us dollars, use the conversion rate in effect on. Web per irs instructions for form 1116, on page 16: File form 1116 to schedule a. Web key takeaways u.s expats can use the irs form 1116 to claim the foreign tax credit.

Web Election To Claim The Foreign Tax Credit Without Filing Form 1116.

To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i, line. Web general instructions election to claim the foreign tax credit without filing form 1116 you may be able to claim the foreign tax credit without filing form 1116. Lines 3d and 3e for lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1116.