1099 S Form Instructions

1099 S Form Instructions - In most situations, you must report the income shown on form 1099 when. By the name itself, one can easily identify that the tax form used to report the sale or. Postal mail recipient copies by mail or online. In box 1, the filer must enter the date of closing for the property. Web irs form 1099 s also known as “proceeds from real estate transactions”. Web the consolidated form 1099 reflects information that is reported to the internal revenue service (irs). Ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. If you sold your main home. This revised form and condensed instructions streamline the materials and. Web copy a for internal revenue service center file with form 1096.

Ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. In addition to these specific instructions, you should also use the current year general instructions for certain information returns. Organizations now face hefty fines for incorrectly filing 1099s. It is generally filed by the person responsible for closing the. Web the consolidated form 1099 reflects information that is reported to the internal revenue service (irs). In box 1, the filer must enter the date of closing for the property. For privacy act and paperwork reduction act notice, see the 2021 general instructions for certain. In box 2, enter the gross proceeds, this. Web irs form 1099 s also known as “proceeds from real estate transactions”. By the name itself, one can easily identify that the tax form used to report the sale or.

Organizations now face hefty fines for incorrectly filing 1099s. For privacy act and paperwork reduction act notice, see the 2021 general instructions for certain. In addition to these specific instructions, you should also use the current year general instructions for certain information returns. This revised form and condensed instructions streamline the materials and. Web irs form 1099 s also known as “proceeds from real estate transactions”. If you sold your main home. Web copy a for internal revenue service center file with form 1096. Ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. In most situations, you must report the income shown on form 1099 when. It is generally filed by the person responsible for closing the.

1099 S Form Fill Online, Printable, Fillable, Blank pdfFiller

The sales price is the gross proceeds you received in. Report the sale of your rental property on form 4797. Volume based pricing for high volume filers. Postal mail recipient copies by mail or online. Ad irs penalties rose again:

Free download 1099 form free download pdf

It is generally filed by the person responsible for closing the. Those preparing the form will need to include the date of closing and the gross proceeds. In box 1, the filer must enter the date of closing for the property. Sign in to turbotax and select pick up where you left off;. The sales price is the gross proceeds.

What is a 1099 & 5498? uDirect IRA Services, LLC

Web irs form 1099 s also known as “proceeds from real estate transactions”. This revised form and condensed instructions streamline the materials and. Organizations now face hefty fines for incorrectly filing 1099s. Those preparing the form will need to include the date of closing and the gross proceeds. For privacy act and paperwork reduction act notice, see the 2021 general.

What the Heck is "IRS Form 1099S" and Why Does it Matter? REtipster

Volume based pricing for high volume filers. By the name itself, one can easily identify that the tax form used to report the sale or. In box 2, enter the gross proceeds, this. Report the sale of your rental property on form 4797. For privacy act and paperwork reduction act notice, see the 2021 general instructions for certain.

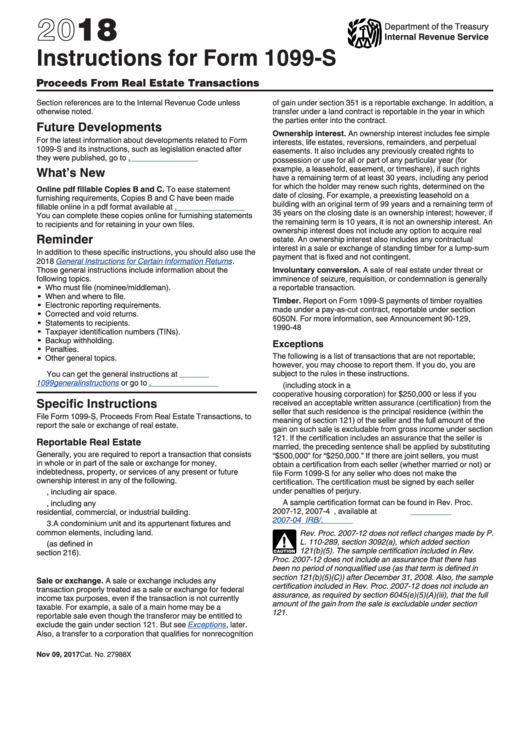

Instructions for Form 1099s Proceeds From Real Estate Transactions

Volume based pricing for high volume filers. In box 2, enter the gross proceeds, this. Web the consolidated form 1099 reflects information that is reported to the internal revenue service (irs). For privacy act and paperwork reduction act notice, see the 2021 general instructions for certain. In most situations, you must report the income shown on form 1099 when.

Instructions For Form 1099S Proceeds From Real Estate Transactions

This revised form and condensed instructions streamline the materials and. The sales price is the gross proceeds you received in. If you sold your main home. Ad irs penalties rose again: Web irs form 1099 s also known as “proceeds from real estate transactions”.

What the Heck is "IRS Form 1099S" and Why Does it Matter? REtipster

Ad irs penalties rose again: Web the consolidated form 1099 reflects information that is reported to the internal revenue service (irs). The sales price is the gross proceeds you received in. In box 2, enter the gross proceeds, this. If you sold your main home.

Form 1099A Acquisition or Abandonment of Secured Property Definition

In box 1, the filer must enter the date of closing for the property. Web the consolidated form 1099 reflects information that is reported to the internal revenue service (irs). Web copy a for internal revenue service center file with form 1096. Those preparing the form will need to include the date of closing and the gross proceeds. By the.

Form 1099 S Fill and Sign Printable Template Online US Legal Forms

By the name itself, one can easily identify that the tax form used to report the sale or. Sign in to turbotax and select pick up where you left off;. In box 1, the filer must enter the date of closing for the property. Ad irs penalties rose again: Volume based pricing for high volume filers.

1099 S Fillable Form Form Resume Examples X42M5Ra2kG

In box 2, enter the gross proceeds, this. In most situations, you must report the income shown on form 1099 when. This revised form and condensed instructions streamline the materials and. Those preparing the form will need to include the date of closing and the gross proceeds. Sign in to turbotax and select pick up where you left off;.

Ap Leaders Rely On Iofm’s Expertise To Keep Them Up To Date On Irs Regulations.

In box 2, enter the gross proceeds, this. Web irs form 1099 s also known as “proceeds from real estate transactions”. Volume based pricing for high volume filers. For privacy act and paperwork reduction act notice, see the 2021 general instructions for certain.

By The Name Itself, One Can Easily Identify That The Tax Form Used To Report The Sale Or.

Report the sale of your rental property on form 4797. The sales price is the gross proceeds you received in. This revised form and condensed instructions streamline the materials and. If you sold your main home.

Reportable Real Estate Generally, You Are Required.

Postal mail recipient copies by mail or online. Organizations now face hefty fines for incorrectly filing 1099s. In box 1, the filer must enter the date of closing for the property. Those preparing the form will need to include the date of closing and the gross proceeds.

In Most Situations, You Must Report The Income Shown On Form 1099 When.

In addition to these specific instructions, you should also use the current year general instructions for certain information returns. Web copy a for internal revenue service center file with form 1096. Ad irs penalties rose again: Web the consolidated form 1099 reflects information that is reported to the internal revenue service (irs).

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png)