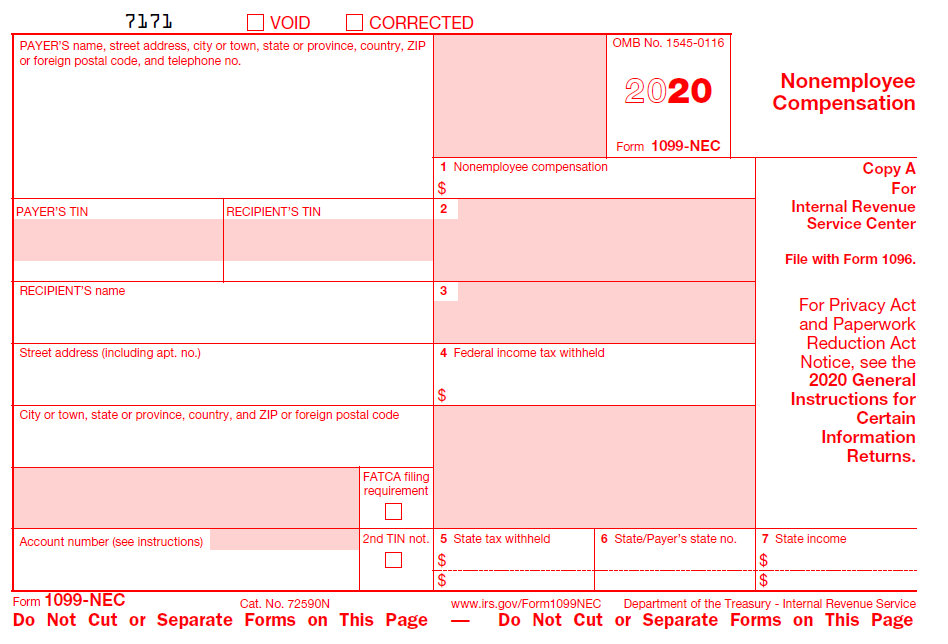

1099-Nec Form 2019

1099-Nec Form 2019 - Copy a for internal revenue service center. Simply create a yearli account, enter or import your data, review, update and validate your data, then checkout. Only few simple steps to complete & transmit to the irs. In addition to filing with the irs, you are required to send a copy to your recipient. If you had income under $600 from. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Deliver form copies by mail or online. Fill out the nonemployee compensation online and print it out for free. Ad file form 1099 nec for 2022 with irs & state. Do not miss the deadline.

Deliver form copies by mail or online. Simply create a yearli account, enter or import your data, review, update and validate your data, then checkout. Fill out the nonemployee compensation online and print it out for free. Copy a for internal revenue service center. Ad file form 1099 nec for 2022 with irs & state. Only few simple steps to complete & transmit to the irs. Do not miss the deadline. If you had income under $600 from. In addition to filing with the irs, you are required to send a copy to your recipient. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online.

Copy a for internal revenue service center. If you had income under $600 from. Simply create a yearli account, enter or import your data, review, update and validate your data, then checkout. Deliver form copies by mail or online. Only few simple steps to complete & transmit to the irs. Fill out the nonemployee compensation online and print it out for free. In addition to filing with the irs, you are required to send a copy to your recipient. Do not miss the deadline. Ad file form 1099 nec for 2022 with irs & state. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online.

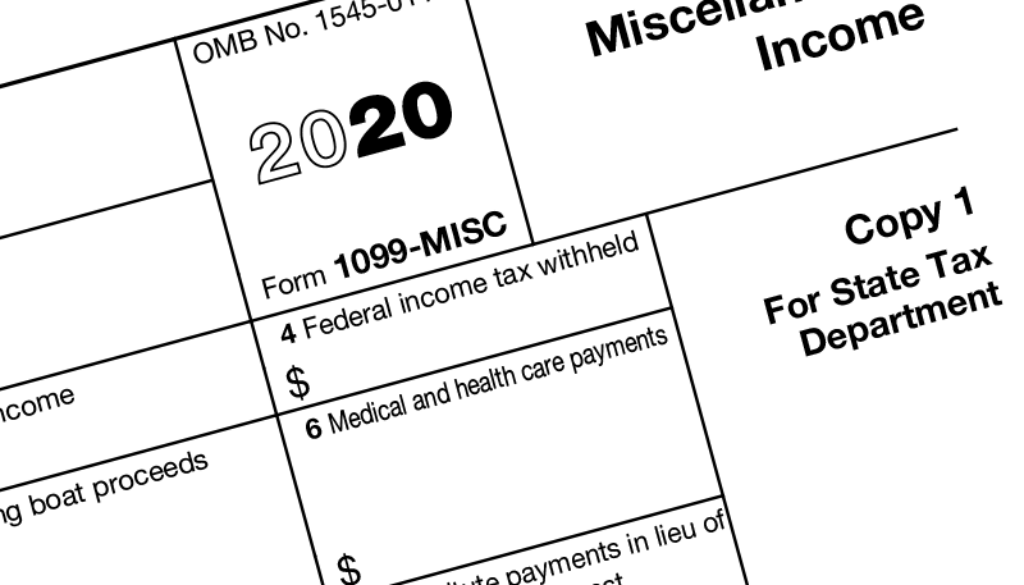

1099MISC or 1099NEC? What You Need to Know about the New IRS

Only few simple steps to complete & transmit to the irs. Simply create a yearli account, enter or import your data, review, update and validate your data, then checkout. Ad file form 1099 nec for 2022 with irs & state. Copy a for internal revenue service center. Ad uslegalforms allows users to edit, sign, fill & share all type of.

Form 1099NEC or Form 1099MISC? Delano Sherley & Associates Inc.

Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Only few simple steps to complete & transmit to the irs. If you had income under $600 from. Ad file form 1099 nec for 2022 with irs & state. Simply create a yearli account, enter or import your data, review, update and validate your data,.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Simply create a yearli account, enter or import your data, review, update and validate your data, then checkout. Deliver form copies by mail or online. If you had income under $600 from. Copy a for internal revenue service center. Ad file form 1099 nec for 2022 with irs & state.

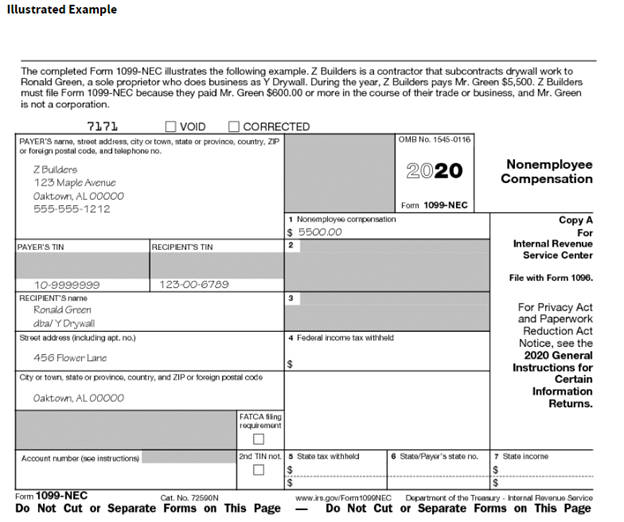

Form 1099NEC Instructions and Tax Reporting Guide

In addition to filing with the irs, you are required to send a copy to your recipient. Copy a for internal revenue service center. Simply create a yearli account, enter or import your data, review, update and validate your data, then checkout. Deliver form copies by mail or online. Ad uslegalforms allows users to edit, sign, fill & share all.

Move Over, 1099MISC IRS Throwback Season Continues With Form 1099NEC

Copy a for internal revenue service center. Fill out the nonemployee compensation online and print it out for free. Only few simple steps to complete & transmit to the irs. In addition to filing with the irs, you are required to send a copy to your recipient. Ad uslegalforms allows users to edit, sign, fill & share all type of.

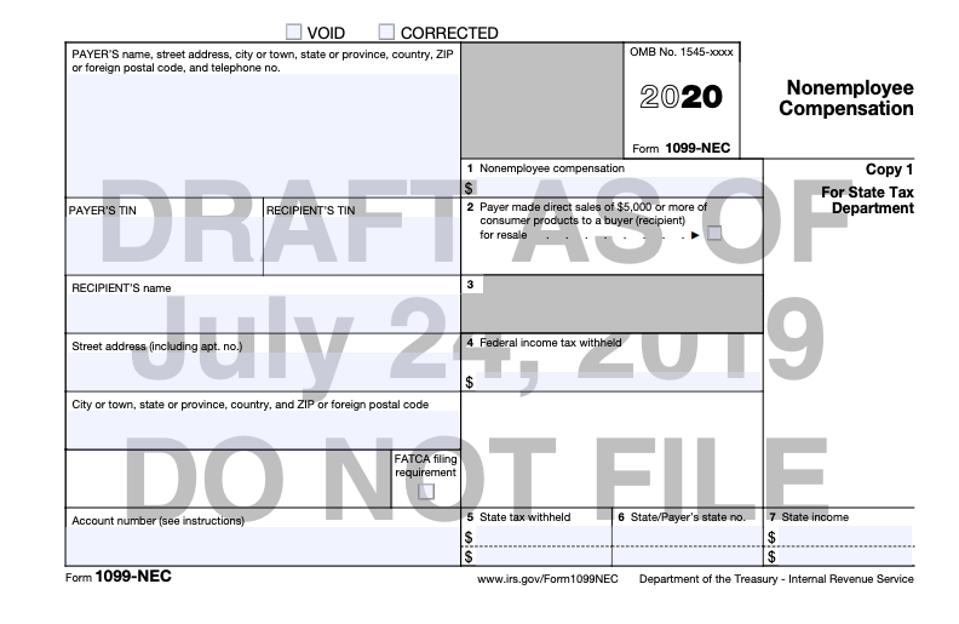

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

Simply create a yearli account, enter or import your data, review, update and validate your data, then checkout. Do not miss the deadline. If you had income under $600 from. Ad file form 1099 nec for 2022 with irs & state. Only few simple steps to complete & transmit to the irs.

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

Fill out the nonemployee compensation online and print it out for free. Only few simple steps to complete & transmit to the irs. If you had income under $600 from. Ad file form 1099 nec for 2022 with irs & state. Copy a for internal revenue service center.

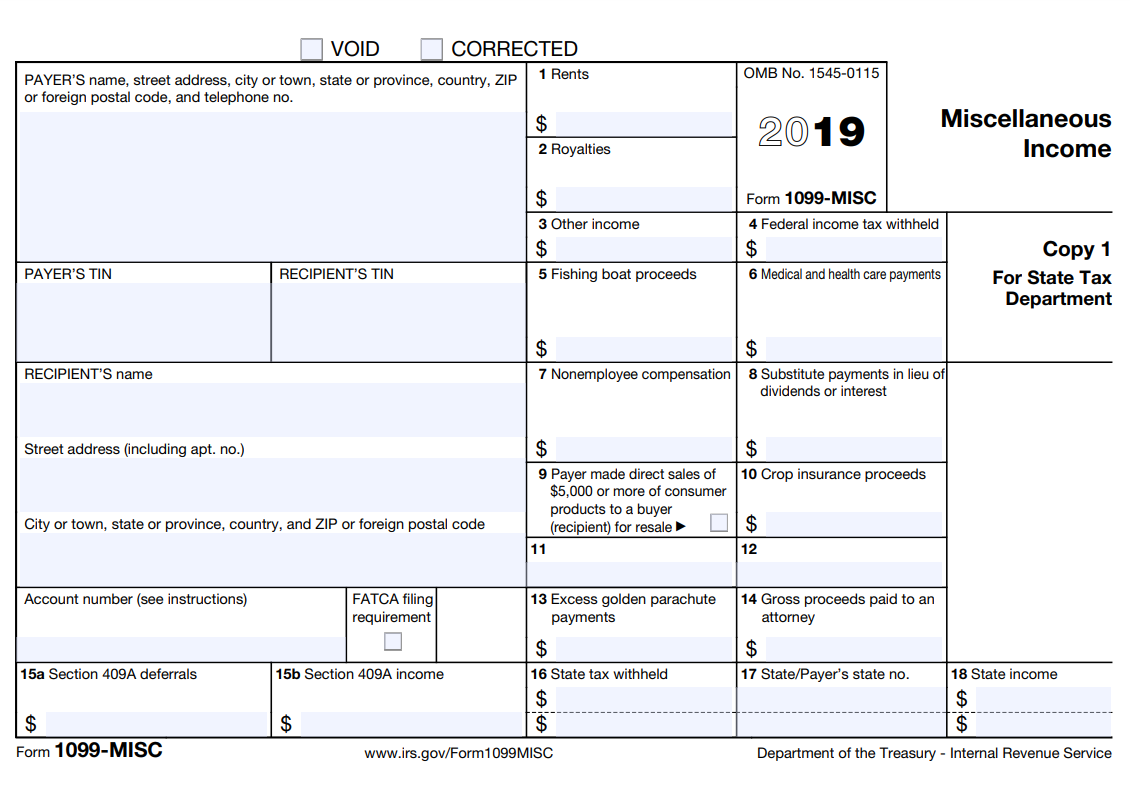

1099MISC 2019 Sample Form Crestwood Associates

Do not miss the deadline. Ad file form 1099 nec for 2022 with irs & state. Fill out the nonemployee compensation online and print it out for free. In addition to filing with the irs, you are required to send a copy to your recipient. If you had income under $600 from.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Copy a for internal revenue service center. Only few simple steps to complete & transmit to the irs. If you had income under $600 from. Simply create a yearli account, enter or import your data, review, update and validate your data, then checkout. In addition to filing with the irs, you are required to send a copy to your recipient.

Accounts Payable Software for Small Business Accurate Tracking

Ad file form 1099 nec for 2022 with irs & state. If you had income under $600 from. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Fill out the nonemployee compensation online and print it out for free. In addition to filing with the irs, you are required to send a copy to.

Simply Create A Yearli Account, Enter Or Import Your Data, Review, Update And Validate Your Data, Then Checkout.

In addition to filing with the irs, you are required to send a copy to your recipient. Only few simple steps to complete & transmit to the irs. Fill out the nonemployee compensation online and print it out for free. Deliver form copies by mail or online.

Ad Uslegalforms Allows Users To Edit, Sign, Fill & Share All Type Of Documents Online.

Ad file form 1099 nec for 2022 with irs & state. If you had income under $600 from. Do not miss the deadline. Copy a for internal revenue service center.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://static.wixstatic.com/media/9fe6e6_c02527d741474d7e88dbd9fa3595b59f~mv2.png/v1/fit/w_1000%2Ch_853%2Cal_c%2Cq_80/file.jpg)