1099 Form For Rent Paid

1099 Form For Rent Paid - Property managers must do the same for all contractors not taxed as corporations that were hired and paid in excess of $600 over the course of the year. Web in the real estate industry, these documents become necessary when a landlord receives more than $600 in rent annually. The irs defines rental property as any single home, mobile home, vacation home, apartment, condominium, or similar dwelling rented out more than 15 days a year. There are 20 different variations of the 1099 form, but only a few are relevant to landlords. Medical and health care payments. Web how to fill out form 1099 for rent paid. Web the 1099 form is a tax form that documents income from a source that isn’t an employer. Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. If you rent out your property for $1,000/month and earn $12,000 by the end of the year, the remaining amount after deductions is taxable income.

Web the 1099 form is a tax form that documents income from a source that isn’t an employer. Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. Web in the real estate industry, these documents become necessary when a landlord receives more than $600 in rent annually. Examples include rental income, earnings made as an independent contractor, and a tax refund from the state or local level. The irs defines rental property as any single home, mobile home, vacation home, apartment, condominium, or similar dwelling rented out more than 15 days a year. Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord. Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. There are 20 different variations of the 1099 form, but only a few are relevant to landlords. Additionally, you will need the landlord's social security number or federal employer id number (ein). Medical and health care payments.

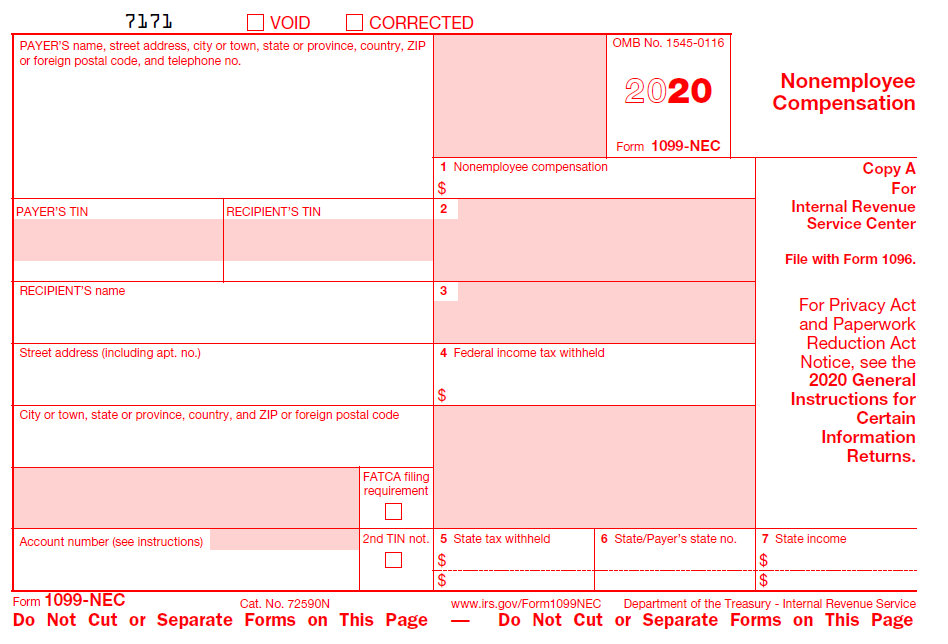

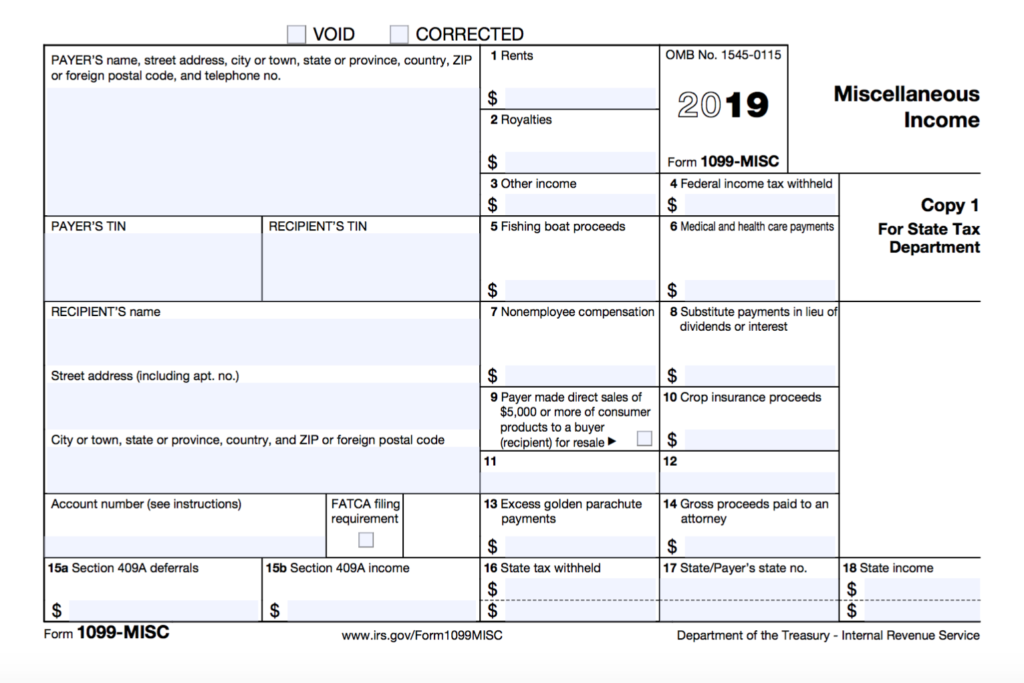

Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. Web the 1099 form is a tax form that documents income from a source that isn’t an employer. Rents (box 1) royalties (box 2) other income (box 3), including prizes and awards federal income tax withheld (box 4), including backup withholding fishing boat proceeds (box 5) medical and health care services (box 6) Additionally, you will need the landlord's social security number or federal employer id number (ein). Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord. Examples include rental income, earnings made as an independent contractor, and a tax refund from the state or local level. Web how to fill out form 1099 for rent paid. Medical and health care payments. If you rent out your property for $1,000/month and earn $12,000 by the end of the year, the remaining amount after deductions is taxable income. The irs defines rental property as any single home, mobile home, vacation home, apartment, condominium, or similar dwelling rented out more than 15 days a year.

Seven Form 1099R Mistakes to Avoid Retirement Daily on TheStreet

Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. Medical and health care payments. Additionally, you will need the landlord's social security number or federal employer id number (ein). There are 20 different variations of the 1099 form, but only a few are relevant to landlords. Tenants in commercial leases may need.

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

There are 20 different variations of the 1099 form, but only a few are relevant to landlords. Property managers must do the same for all contractors not taxed as corporations that were hired and paid in excess of $600 over the course of the year. Additionally, you will need the landlord's social security number or federal employer id number (ein)..

How to Calculate Taxable Amount on a 1099R for Life Insurance

Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. Examples include rental income, earnings made as an independent contractor, and a tax refund from the state or local level. Web in the real estate industry, these documents become necessary when a landlord receives more than.

Now is the Time to Start Preparing for Vendor 1099 Forms Innovative

If you rent out your property for $1,000/month and earn $12,000 by the end of the year, the remaining amount after deductions is taxable income. Rents (box 1) royalties (box 2) other income (box 3), including prizes and awards federal income tax withheld (box 4), including backup withholding fishing boat proceeds (box 5) medical and health care services (box 6).

Accounts Payable Software for Small Business Accurate Tracking

Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. Web the 1099 form is a tax form that documents income from a source that isn’t an employer. Web in the real estate industry, these documents become necessary when a landlord receives more than $600 in.

Prepare for the Extended Tax Season With Your Rental Property These

Examples include rental income, earnings made as an independent contractor, and a tax refund from the state or local level. Rents (box 1) royalties (box 2) other income (box 3), including prizes and awards federal income tax withheld (box 4), including backup withholding fishing boat proceeds (box 5) medical and health care services (box 6) Web any contractor making over.

IRS Form 1099 Reporting for Small Business Owners Best Practice in HR

The irs defines rental property as any single home, mobile home, vacation home, apartment, condominium, or similar dwelling rented out more than 15 days a year. Web the 1099 form is a tax form that documents income from a source that isn’t an employer. If you rent out your property for $1,000/month and earn $12,000 by the end of the.

Form 1099 Misc Fillable Universal Network

Examples include rental income, earnings made as an independent contractor, and a tax refund from the state or local level. Property managers must do the same for all contractors not taxed as corporations that were hired and paid in excess of $600 over the course of the year. Web how to fill out form 1099 for rent paid. Web the.

Form 1099K Wikipedia

Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord. Web the 1099 form is a tax form that documents income from a source that isn’t an employer. Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. If you rent out.

All That You Need To Know About Filing Form 1099MISC Inman

Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord. Web how to fill out form 1099 for rent paid. The irs defines rental property as any single home, mobile home, vacation home, apartment, condominium, or similar dwelling rented out more than 15 days a year. Property managers must.

There Are 20 Different Variations Of The 1099 Form, But Only A Few Are Relevant To Landlords.

The irs defines rental property as any single home, mobile home, vacation home, apartment, condominium, or similar dwelling rented out more than 15 days a year. Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. Medical and health care payments.

Additionally, You Will Need The Landlord's Social Security Number Or Federal Employer Id Number (Ein).

Rents (box 1) royalties (box 2) other income (box 3), including prizes and awards federal income tax withheld (box 4), including backup withholding fishing boat proceeds (box 5) medical and health care services (box 6) If you rent out your property for $1,000/month and earn $12,000 by the end of the year, the remaining amount after deductions is taxable income. Property managers must do the same for all contractors not taxed as corporations that were hired and paid in excess of $600 over the course of the year. Web the 1099 form is a tax form that documents income from a source that isn’t an employer.

Web In The Real Estate Industry, These Documents Become Necessary When A Landlord Receives More Than $600 In Rent Annually.

Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord. Web how to fill out form 1099 for rent paid. Examples include rental income, earnings made as an independent contractor, and a tax refund from the state or local level.