1099 Form Ct

1099 Form Ct - Ad don't just get the job done, get the job done right at staples®. Web expenditure section forms 1099 and special compensation 8.0 federal income tax reporting, form 1099 the comptroller's office will report the following types of. Web while electronic versions of the 1099g tax forms can immediately be downloaded online, the labor department can mail a copy to claimants requesting one through the online 1099g. Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022. The gross connecticut nonpayroll amounts reported on form ct‑945 or form ct‑941x, line 2, must agree with total nonpayroll. 1999 amended income tax return for individuals. Staples provides custom solutions to help organizations achieve their goals. 2) the due date for filing. Web what types of 1099 forms does connecticut require? Web the publication includes that:

Notifications will also be immediately sent to the 2,556. Ad don't just get the job done, get the job done right at staples®. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Please allow up to 14 days for it to be received. For internal revenue service center. How must forms 1099 be filed with. The gross connecticut nonpayroll amounts reported on form ct‑945 or form ct‑941x, line 2, must agree with total nonpayroll. Web the publication includes that: Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in connecticut during calendar year 2023. Web what types of 1099 forms does connecticut require?

For internal revenue service center. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. 2) the due date for filing. Web while electronic versions of the 1099g tax forms can immediately be downloaded online, the labor department can mail a copy to claimants requesting one through the online 1099g. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. 1999 amended income tax return for individuals. Web what types of 1099 forms does connecticut require? Web the publication includes that: How must forms 1099 be filed with.

1099 MISC Form 2022 1099 Forms TaxUni

Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in connecticut during calendar year 2023. Web expenditure section forms 1099 and special compensation 8.0 federal income tax reporting, form 1099 the comptroller's office will report the following types of. Ad ap leaders rely on iofm’s expertise to keep.

IRS Form 1099 Reporting for Small Business Owners Best Practice in HR

The gross connecticut nonpayroll amounts reported on form ct‑945 or form ct‑941x, line 2, must agree with total nonpayroll. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in connecticut during calendar year 2023. Ad ap leaders rely on iofm’s expertise to keep them up to date on.

What is a 1099 & 5498? uDirect IRA Services, LLC

1999 amended income tax return for individuals. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in connecticut during calendar year 2023. The gross connecticut nonpayroll amounts reported on form ct‑945 or form ct‑941x, line 2, must agree with total nonpayroll. Web 1099r's for 2021 distributions out of.

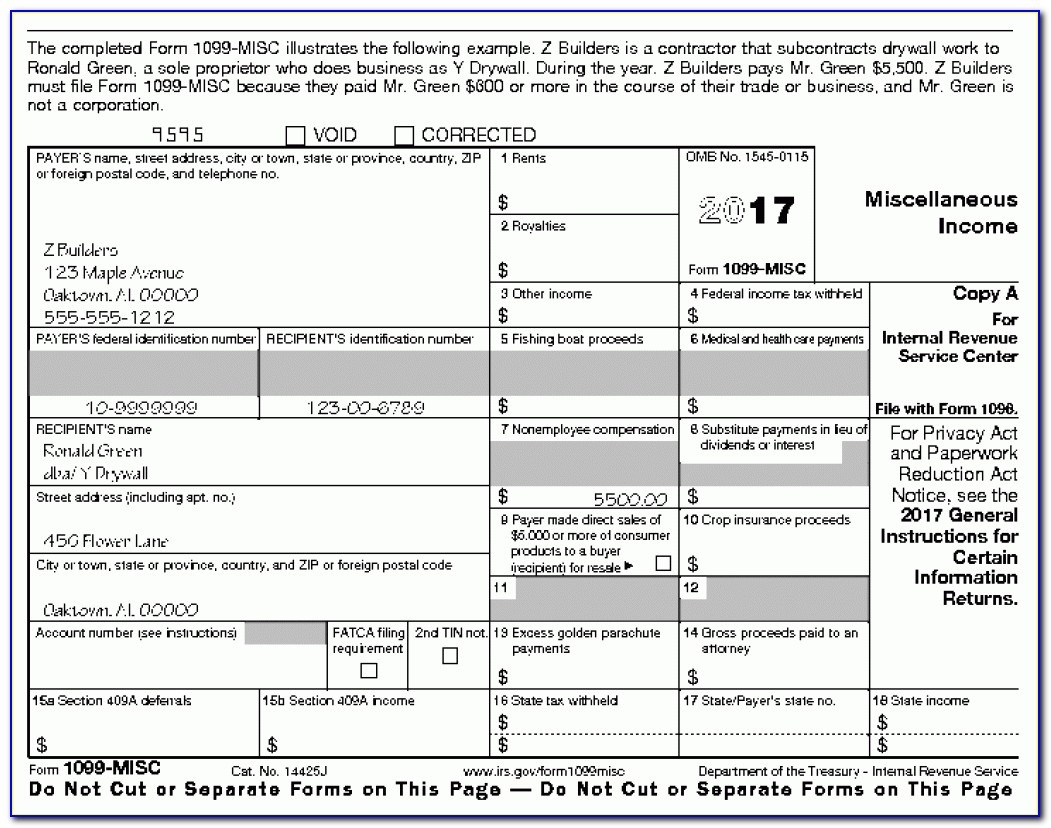

What is a 1099Misc Form? Financial Strategy Center

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web what types of 1099 forms does connecticut require? Ad don't just get the job done, get the job done right at staples®. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns.

Form1099NEC

Web the publication includes that: Web while electronic versions of the 1099g tax forms can immediately be downloaded online, the labor department can mail a copy to claimants requesting one through the online 1099g. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Staples provides custom solutions to help organizations achieve their goals..

11 Common Misconceptions About Irs Form 11 Form Information Free

The gross connecticut nonpayroll amounts reported on form ct‑945 or form ct‑941x, line 2, must agree with total nonpayroll. How must forms 1099 be filed with. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. 2) the due date for filing. Staples provides custom solutions to help organizations achieve their goals.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Web what types of 1099 forms does connecticut require? Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022. Staples provides custom solutions to help organizations achieve their goals. 1999 amended income tax return for individuals. Web while electronic versions of the 1099g tax forms can immediately be downloaded online, the labor.

How to Calculate Taxable Amount on a 1099R for Life Insurance

Please allow up to 14 days for it to be received. How must forms 1099 be filed with. 2) the due date for filing. Notifications will also be immediately sent to the 2,556. Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Staples provides custom solutions to help organizations achieve their goals. For internal revenue service center. Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022. Please allow up to 14 days for it to be received. Web the publication includes that:

Form 1099INT Interest Definition

Staples provides custom solutions to help organizations achieve their goals. Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022. Web what types of 1099 forms does connecticut require? Web while electronic versions of the 1099g tax forms can immediately be downloaded online, the labor department can mail a copy to claimants.

For Internal Revenue Service Center.

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web expenditure section forms 1099 and special compensation 8.0 federal income tax reporting, form 1099 the comptroller's office will report the following types of. The gross connecticut nonpayroll amounts reported on form ct‑945 or form ct‑941x, line 2, must agree with total nonpayroll.

Ad Don't Just Get The Job Done, Get The Job Done Right At Staples®.

Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. Web while electronic versions of the 1099g tax forms can immediately be downloaded online, the labor department can mail a copy to claimants requesting one through the online 1099g. Staples provides custom solutions to help organizations achieve their goals. 1999 amended income tax return for individuals.

Web These Where To File Addresses Are To Be Used Only By Taxpayers And Tax Professionals Filing Individual Federal Tax Returns In Connecticut During Calendar Year 2023.

Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022. Web what types of 1099 forms does connecticut require? Please allow up to 14 days for it to be received. 2) the due date for filing.

Web The Publication Includes That:

How must forms 1099 be filed with. Notifications will also be immediately sent to the 2,556.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)