1099-Div Form 2022

1099-Div Form 2022 - Web furnish copy b of this form to the recipient by january 31, 2022. Web information for tax filing helpful resources for your income taxes computershare makes gathering your tax information and filing a little easier. Web you'll need at least $10 in earnings. All taxable distributions from your fund (including any capital gains) and. January 2022 on top right and bottom left corners. If you have paid capital. File copy a of this form with the irs by february 28, 2022. Web www.irs.gov/form1099misc (if checked) federal income tax withheld $ copy b for recipient this is important tax information and is being furnished to the irs. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Both the form and instructions will be updated as needed.

Web sample excel import file: Web information for tax filing helpful resources for your income taxes computershare makes gathering your tax information and filing a little easier. January 2022 on top right and bottom left corners. All taxable distributions from your fund (including any capital gains) and. If you have paid capital. If you received dividends from more than. Web updated for tax year 2022 • june 2, 2023 08:40 am overview if some of the stocks you own pay dividends, or a mutual fund you invest in made a capital gains. File copy a of this form with the irs by february 28, 2022. Web business income deduction under section 199a. Supports 1099 state filings & corrections.

If you file electronically, the due date is march 31,. File copy a of this form with the irs by february 28, 2022. Web information for tax filing helpful resources for your income taxes computershare makes gathering your tax information and filing a little easier. January 2022 on top right and bottom left corners. Web sample excel import file: If you have paid capital. Web www.irs.gov/form1099misc (if checked) federal income tax withheld $ copy b for recipient this is important tax information and is being furnished to the irs. All taxable distributions from your fund (including any capital gains) and. Web you'll need at least $10 in earnings. Ad most dependable payroll solution for small businesses in 2023 by techradar editors.

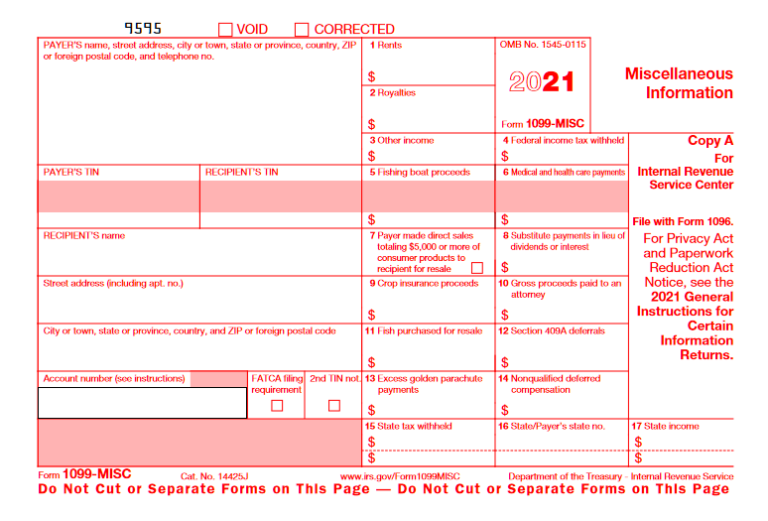

Top10 US Tax Forms in 2022 Explained PDF.co

Web information for tax filing helpful resources for your income taxes computershare makes gathering your tax information and filing a little easier. Web you'll need at least $10 in earnings. Web updated for tax year 2022 • june 2, 2023 08:40 am overview if some of the stocks you own pay dividends, or a mutual fund you invest in made.

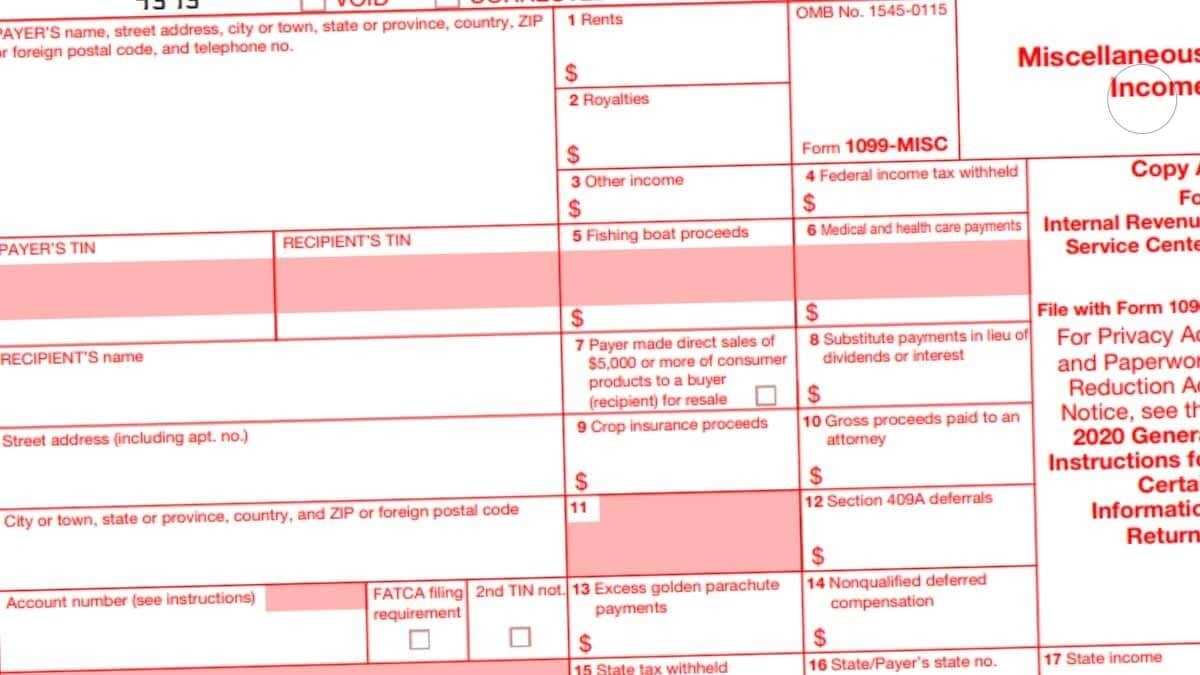

Understanding 1099 Form Samples

January 2022 on top right and bottom left corners. File copy a of this form with the irs by february 28, 2022. Web information for tax filing helpful resources for your income taxes computershare makes gathering your tax information and filing a little easier. All taxable distributions from your fund (including any capital gains) and. If you received dividends from.

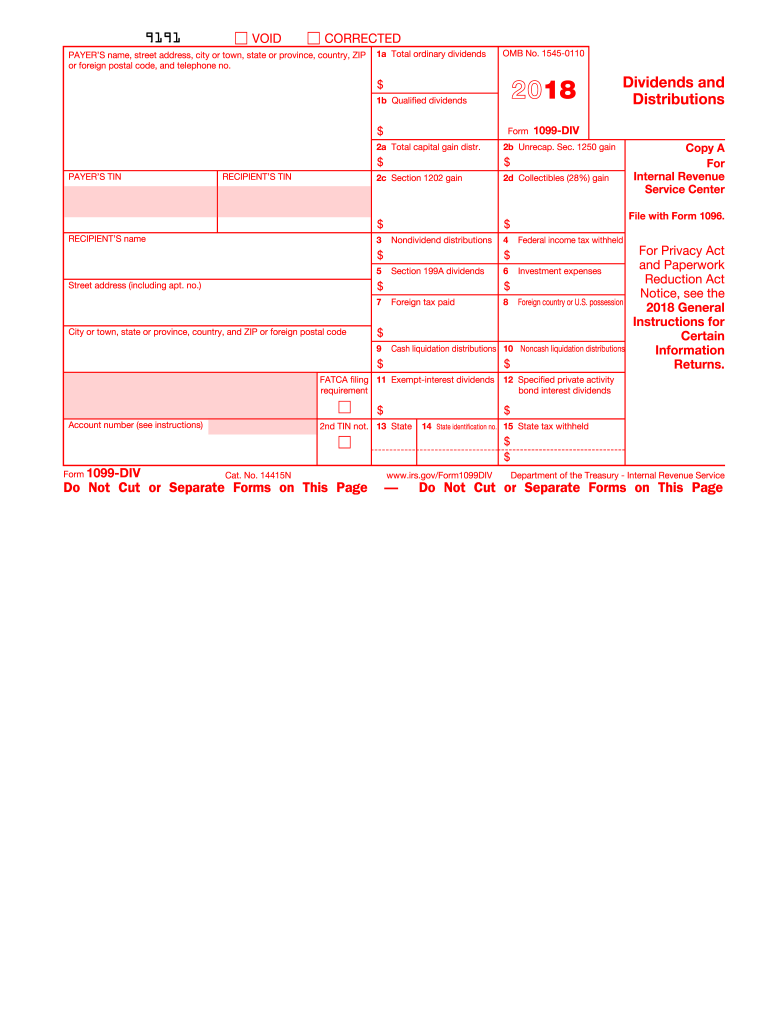

1099DIV Software Software to Print & EFile Form 1099DIV

January 2022 on top right and bottom left corners. Web www.irs.gov/form1099misc (if checked) federal income tax withheld $ copy b for recipient this is important tax information and is being furnished to the irs. Web business income deduction under section 199a. Supports 1099 state filings & corrections. If you file electronically, the due date is march 31,.

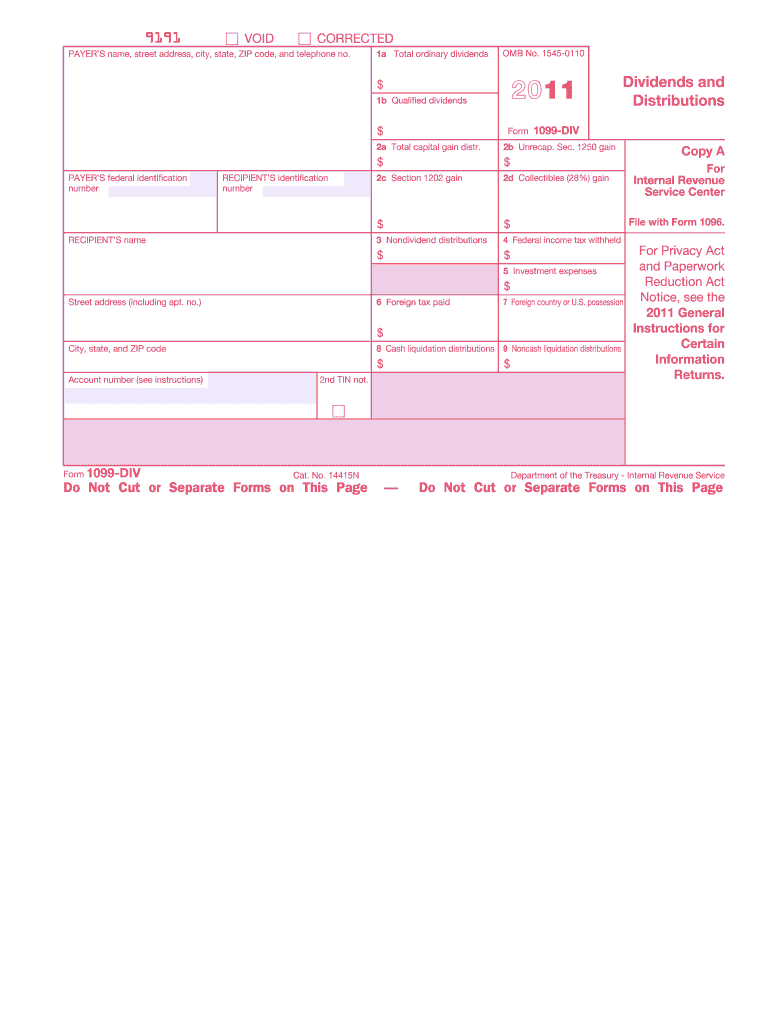

Instructions For Form 1099 Div Blank Sample to Fill out Online in PDF

File copy a of this form with the irs by february 28, 2022. Both the form and instructions will be updated as needed. Web information for tax filing helpful resources for your income taxes computershare makes gathering your tax information and filing a little easier. If you received dividends from more than. Supports 1099 state filings & corrections.

Form 1099DIV, Dividends and Distributions Definition

Web information for tax filing helpful resources for your income taxes computershare makes gathering your tax information and filing a little easier. Web furnish copy b of this form to the recipient by january 31, 2022. Web business income deduction under section 199a. If you received dividends from more than. Ad most dependable payroll solution for small businesses in 2023.

1099 Div Fillable Form Fill Out and Sign Printable PDF Template signNow

Web business income deduction under section 199a. January 2022 on top right and bottom left corners. File copy a of this form with the irs by february 28, 2022. If you file electronically, the due date is march 31,. Web information for tax filing helpful resources for your income taxes computershare makes gathering your tax information and filing a little.

1099 Forms 2021 Printable Calendar Template Printable

Both the form and instructions will be updated as needed. If you file electronically, the due date is march 31,. All taxable distributions from your fund (including any capital gains) and. Web www.irs.gov/form1099misc (if checked) federal income tax withheld $ copy b for recipient this is important tax information and is being furnished to the irs. If you have paid.

1099 MISC Form 2022 1099 Forms TaxUni

All taxable distributions from your fund (including any capital gains) and. If you have paid capital. File copy a of this form with the irs by february 28, 2022. Supports 1099 state filings & corrections. Web updated for tax year 2022 • june 2, 2023 08:40 am overview if some of the stocks you own pay dividends, or a mutual.

Irs Form 1099 Ssa Form Resume Examples

All taxable distributions from your fund (including any capital gains) and. Web sample excel import file: Web you'll need at least $10 in earnings. January 2022 on top right and bottom left corners. File copy a of this form with the irs by february 28, 2022.

IRS 1099DIV 2018 Fill and Sign Printable Template Online US Legal

January 2022 on top right and bottom left corners. Both the form and instructions will be updated as needed. If you have paid capital. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Web furnish copy b of this form to the recipient by january 31, 2022.

Web Business Income Deduction Under Section 199A.

All taxable distributions from your fund (including any capital gains) and. Web furnish copy b of this form to the recipient by january 31, 2022. If you have paid capital. January 2022 on top right and bottom left corners.

File Copy A Of This Form With The Irs By February 28, 2022.

Both the form and instructions will be updated as needed. Web information for tax filing helpful resources for your income taxes computershare makes gathering your tax information and filing a little easier. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. If you received dividends from more than.

If You File Electronically, The Due Date Is March 31,.

Supports 1099 state filings & corrections. Web updated for tax year 2022 • june 2, 2023 08:40 am overview if some of the stocks you own pay dividends, or a mutual fund you invest in made a capital gains. Web www.irs.gov/form1099misc (if checked) federal income tax withheld $ copy b for recipient this is important tax information and is being furnished to the irs. Web sample excel import file:

:max_bytes(150000):strip_icc()/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)