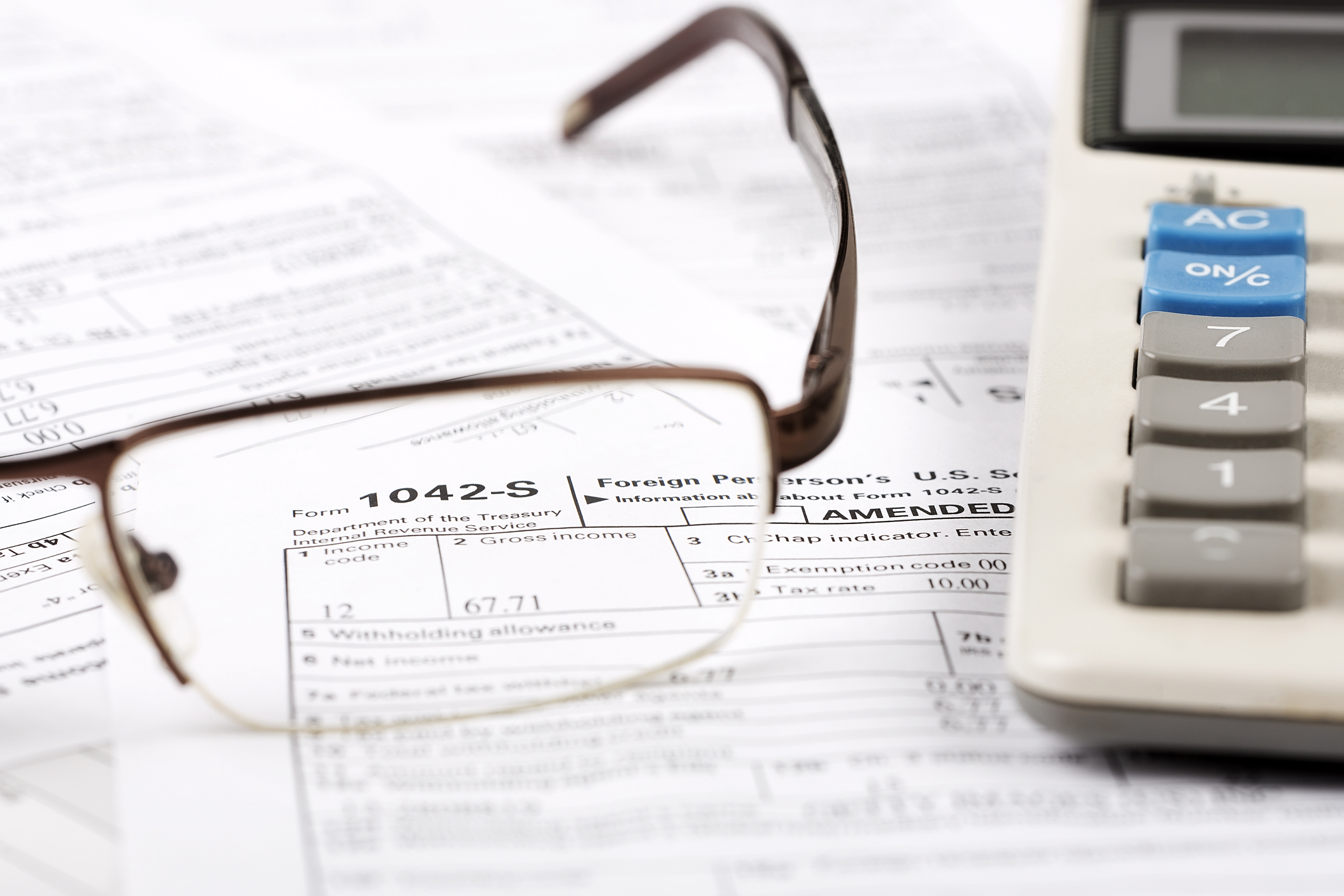

1042-S 2022 Form

1042-S 2022 Form - Additionally, a withholding agent may use the extended due date for filing a form 1042. Web what's new for 2022. Complete, edit or print tax forms instantly. Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. 56 dividend equivalents under irc section 871(m) as a result of applying the combined transaction rules added:. Source income subject to withholding, to the internal revenue service. Ad get ready for tax season deadlines by completing any required tax forms today. Web understanding when u.s. So, i see, it is the top of the hour. Get ready for tax season deadlines by completing any required tax forms today.

Complete, edit or print tax forms instantly. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Source income subject to withholding, is used to report any payments made to foreign persons. 56 dividend equivalents under irc section 871(m) as a result of applying the combined transaction rules added:. Complete, edit or print tax forms instantly. Source income subject to withholding. Source income of foreign persons go to www.irs.gov/form1042 for. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web what's new for 2022. Additionally, a withholding agent may use the extended due date for filing a form 1042.

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Web what's new for 2022. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Source income subject to withholding, to the internal revenue service. Source income subject to withholding. Source income of foreign persons go to www.irs.gov/form1042 for. The amounts that make up this total are detailed. 56 dividend equivalents under irc section 871(m) as a result of applying the combined transaction rules added:. Source income subject to withholding, is used to report any payments made to foreign persons.

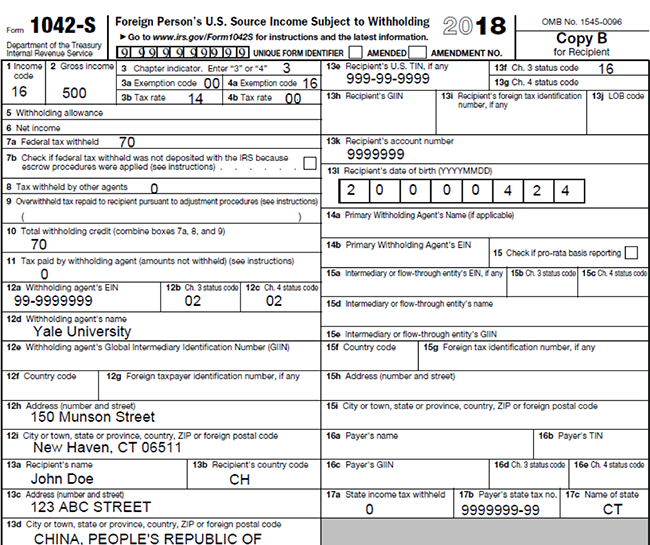

Form 1042S It's Your Yale

So, i see, it is the top of the hour. Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income subject.

1042 S Form slideshare

Additionally, a withholding agent may use the extended due date for filing a form 1042. The amounts that make up this total are detailed. Source income subject to withholding, to the internal revenue service. Web what's new for 2022. Source income subject to withholding.

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

Source income of foreign persons go to www.irs.gov/form1042 for. Web understanding when u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income subject to withholding. Complete, edit or print tax forms instantly.

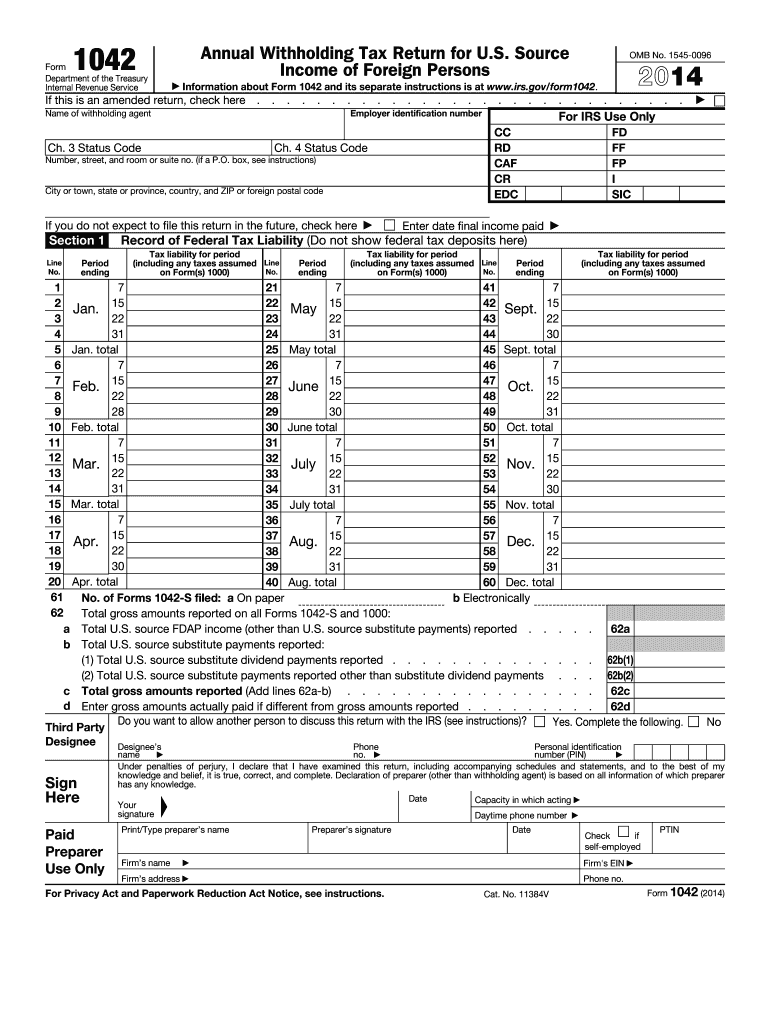

2014 form 1042 Fill out & sign online DocHub

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Web what's new for 2022. Source income subject to withholding, to the internal.

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

Web understanding when u.s. Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Source income of foreign persons go to www.irs.gov/form1042 for. Source income subject to withholding is used to report amounts paid to foreign persons (including persons.

IRS Form 1042s What It is & 1042s Instructions Tipalti

Ad get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding, to the internal revenue service. Source income subject to withholding, is used to report any payments made to foreign persons. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that.

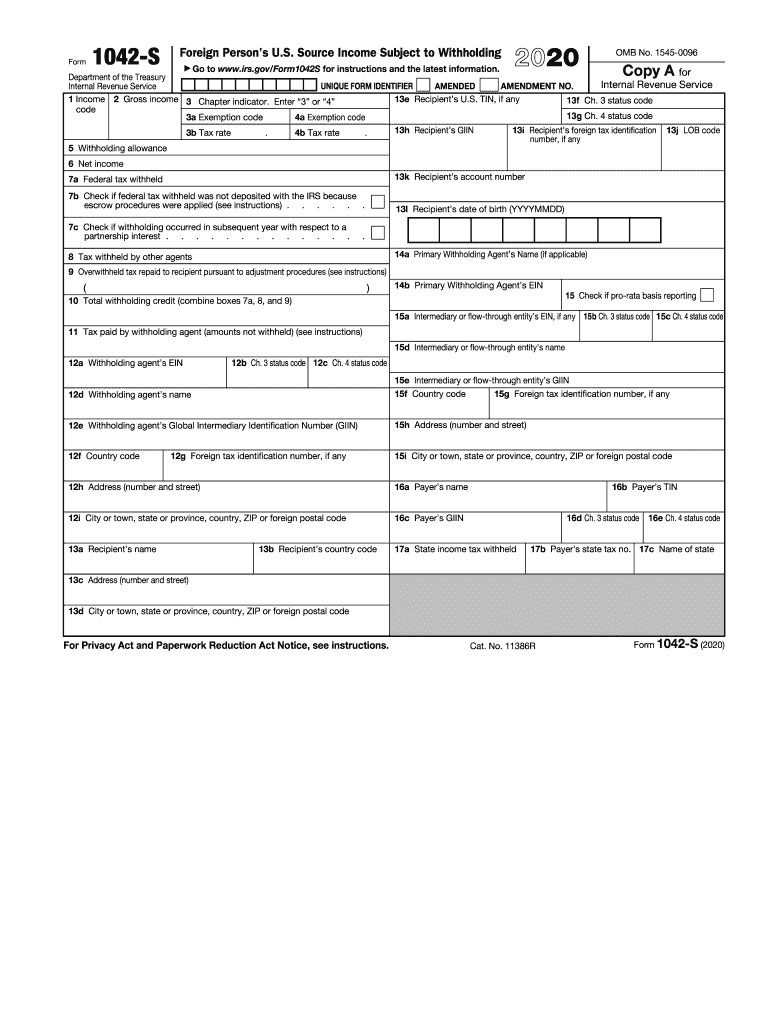

2020 Form IRS 1042S Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Source income subject to withholding, to the internal revenue service. Source income subject to withholding. Additionally, a withholding agent may use the extended due date for filing a form 1042. Source income of foreign persons go to www.irs.gov/form1042 for.

Form 1042S USEReady

Source income subject to withholding, to the internal revenue service. Web understanding when u.s. Source income subject to withholding, is used to report any payments made to foreign persons. So, i see, it is the top of the hour. Ad get ready for tax season deadlines by completing any required tax forms today.

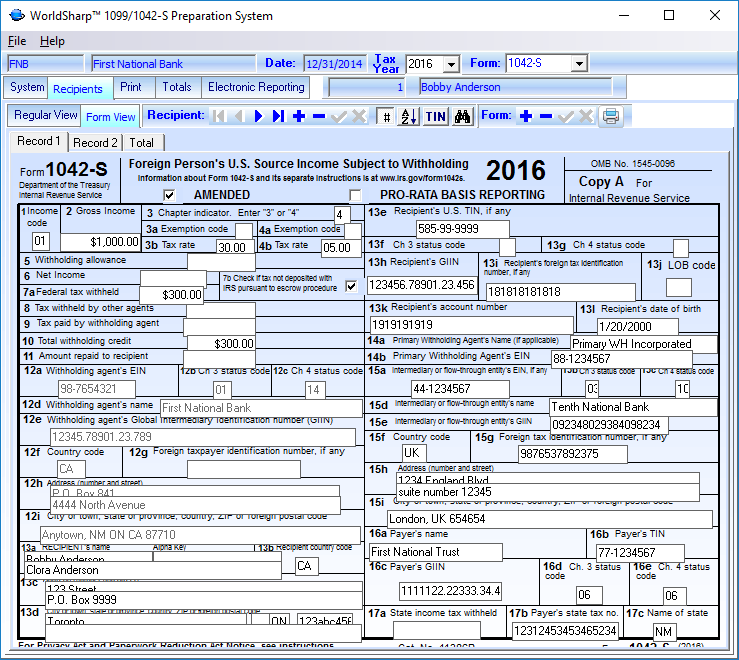

1042S Software WorldSharp 1099/1042S Software features

The amounts that make up this total are detailed. 56 dividend equivalents under irc section 871(m) as a result of applying the combined transaction rules added:. Source income subject to withholding, to the internal revenue service. So, i see, it is the top of the hour. Get ready for tax season deadlines by completing any required tax forms today.

2022 Master Guide to Form 1042S Compliance Institute of Finance

Source income subject to withholding, is used to report any payments made to foreign persons. Source income subject to withholding, to the internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. The amounts that make up this.

Complete, Edit Or Print Tax Forms Instantly.

Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. So, i see, it is the top of the hour. Source income of foreign persons go to www.irs.gov/form1042 for. Get ready for tax season deadlines by completing any required tax forms today.

Additionally, A Withholding Agent May Use The Extended Due Date For Filing A Form 1042.

56 dividend equivalents under irc section 871(m) as a result of applying the combined transaction rules added:. The amounts that make up this total are detailed. Web what's new for 2022. Web understanding when u.s.

Source Income Subject To Withholding, Is Used To Report Any Payments Made To Foreign Persons.

Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s.

Source Income Subject To Withholding.

Source income subject to withholding, to the internal revenue service. Source income subject to withholding, including recent updates, related forms, and instructions on how to file.