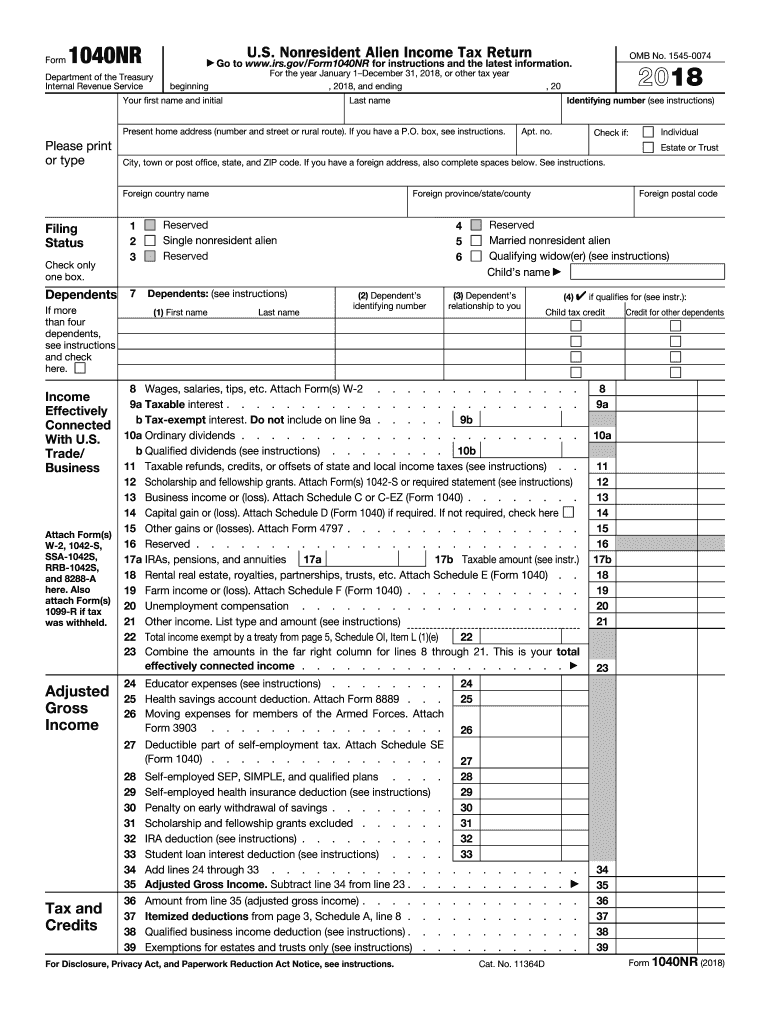

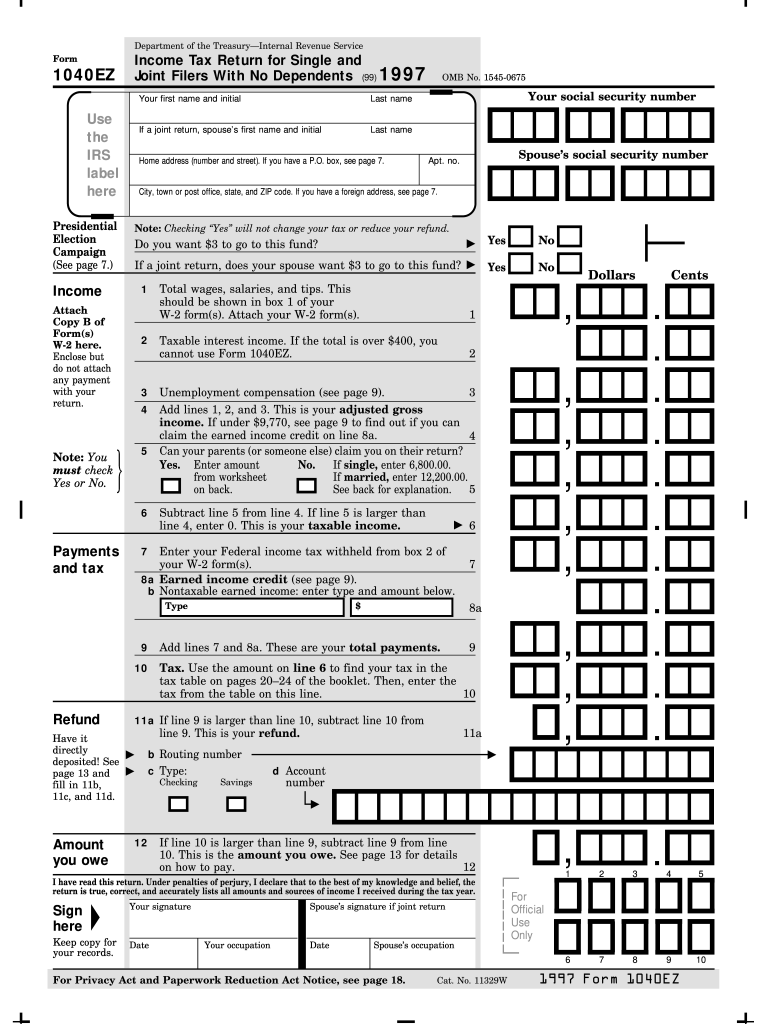

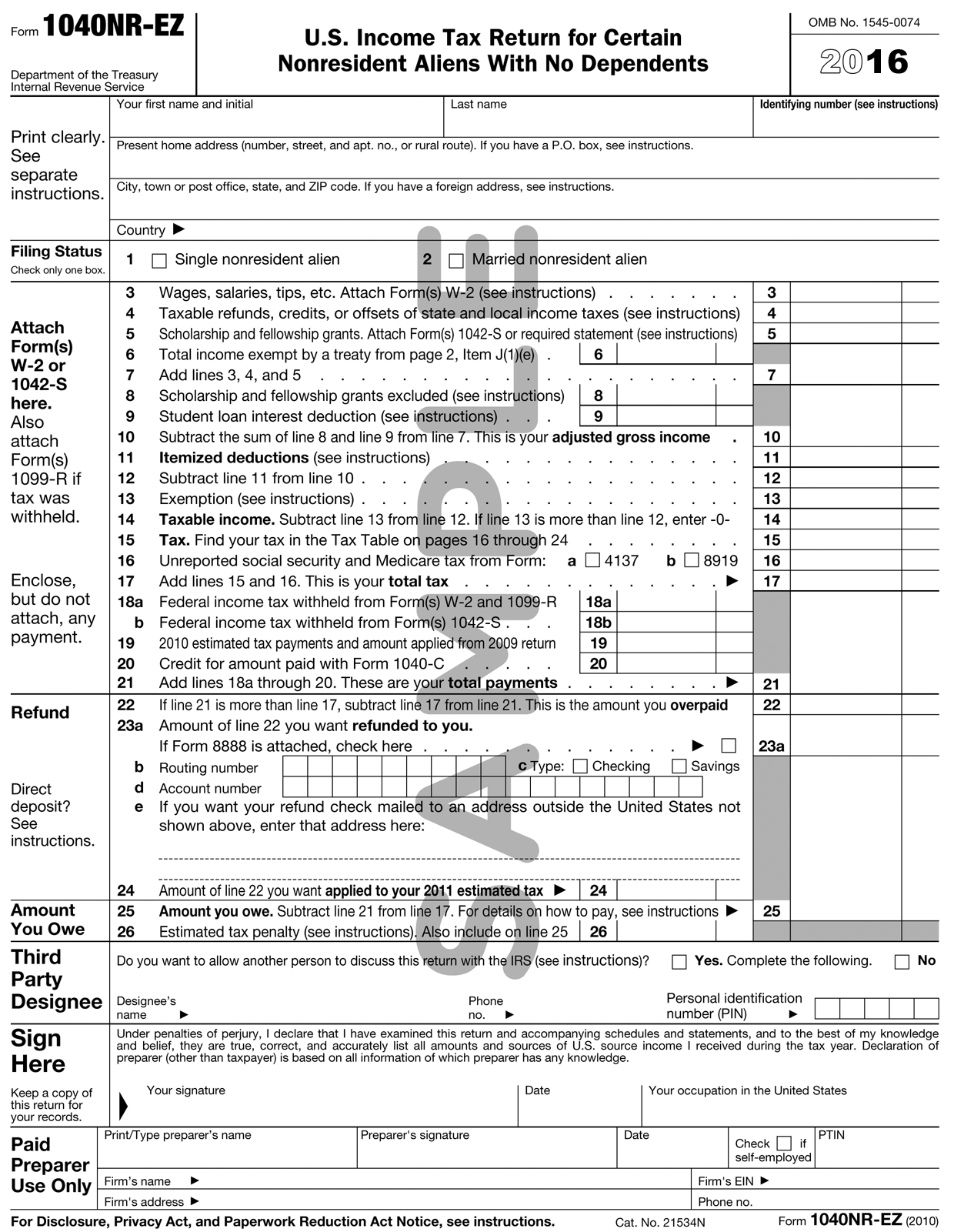

1040Nr-Ez Form

1040Nr-Ez Form - Nonresident alien income tax return (99) 2021. This form looks similar to the standard. $34.00 glacier tax prep will prepare your us federal income tax return (1040nr ez or 1040nr) as well as form 8843. Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual: Specifically, the form is used by: You have no income from a trade or business conducted in the united states, This is the personal exemption amount. Filing status check only one box. 31, 2022, or other tax year beginning, 2022, ending , 20 see separate instructions. Schedule 1 (form 1040), additional income and adjustments to income;

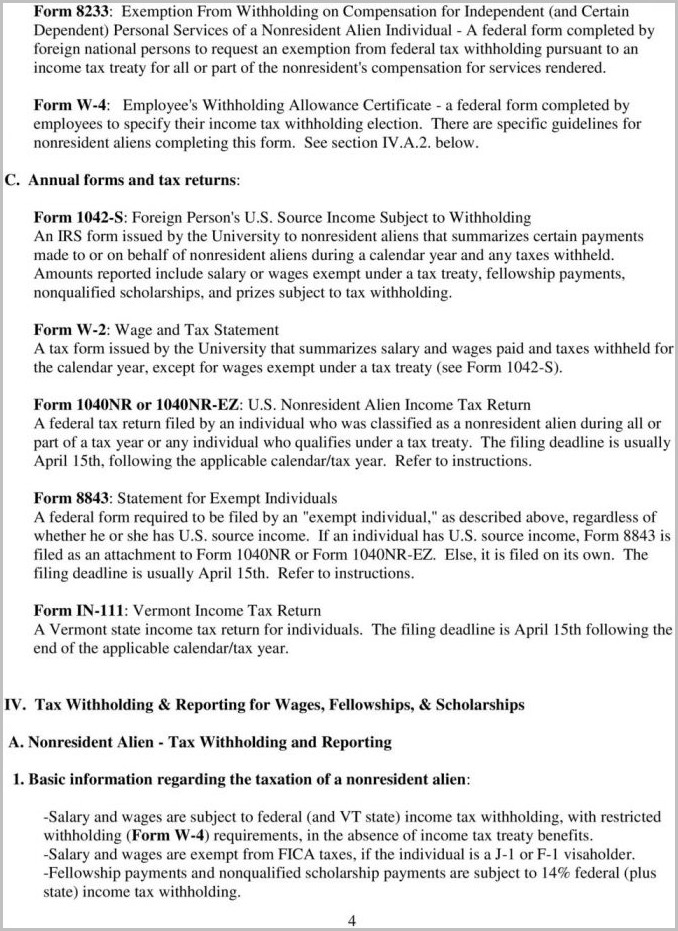

Irs use only—do not write or staple in this space. Nonresident alien income tax return (99) 2021. Filing status check only one box. $34.00 glacier tax prep will prepare your us federal income tax return (1040nr ez or 1040nr) as well as form 8843. You may also need the three form 1040 numbered schedules: Web the 1040nr schedule a (which is part of the 1040nr form itself) contains all the itemized deductions that nonresident aliens can claim. Were a nonresident alien engaged in a trade or business in the united states. Follow the same procedures for preparing 1040 returns or extensions for electronic filing to prepare form 1040nr for electronic filing. Nonresident if they do not have a green card or do not satisfy the substantial presence test. The irs does not allow electronic filing for.

You may also need the three form 1040 numbered schedules: Nonresident alien income tax return 2022 omb no. A taxpayer is considered a u.s. Were a nonresident alien engaged in a trade or business in the united states. Before you get started on the oit website you will find: Web extensions for form 1040nr can also be filed electronically. Single married filing separately (mfs) (formerly married) qualifying widow(er) (qw) Nonresident if they do not have a green card or do not satisfy the substantial presence test. You don't need a schedule for it.) Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual:

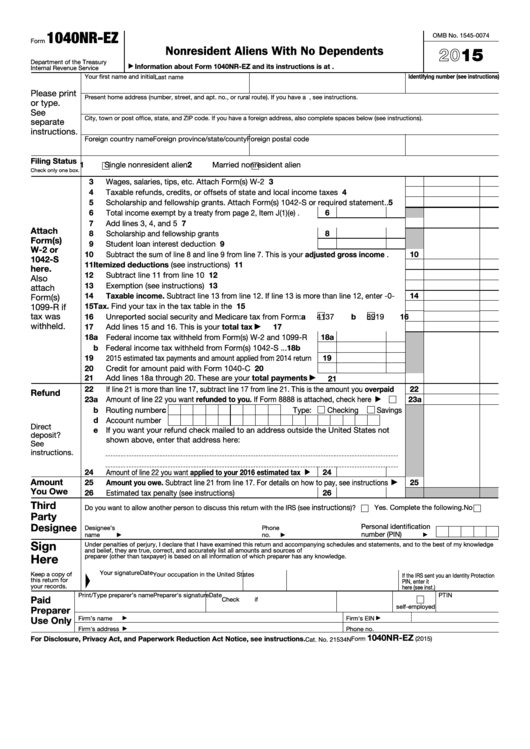

1040nrez tax table

Follow the same procedures for preparing 1040 returns or extensions for electronic filing to prepare form 1040nr for electronic filing. Specifically, the form is used by: Irs use only—do not write or staple in this space. For instructions and the latest information. Department of the treasury internal revenue service.

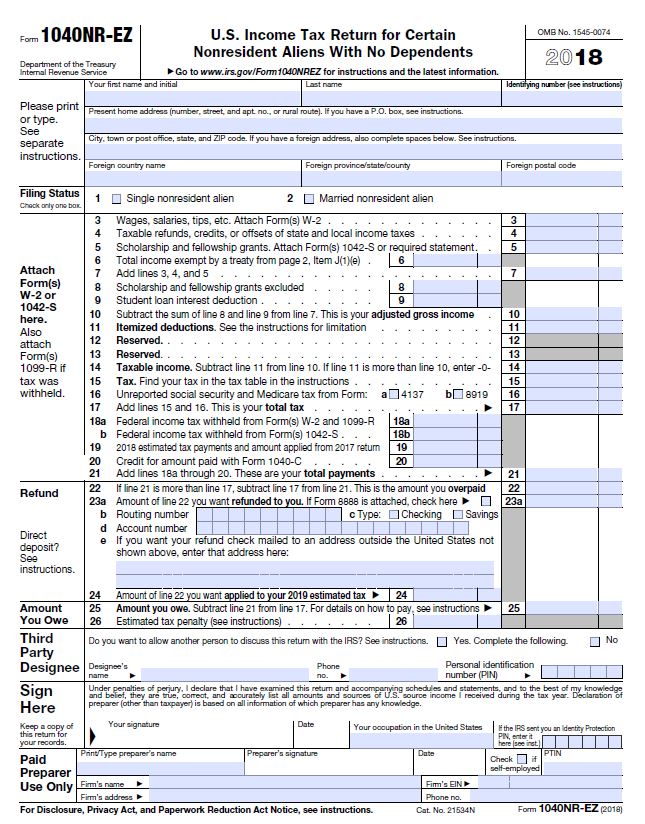

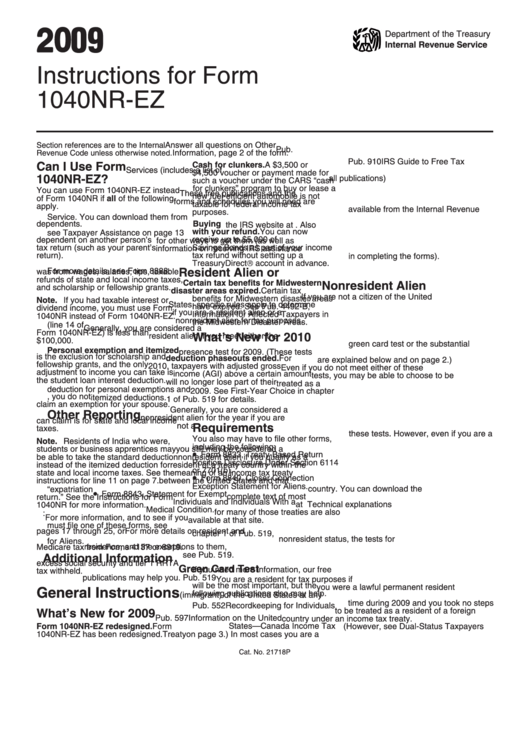

Instructions For Form 1040nrEz U.s. Tax Return For Certain

For instructions and the latest information. This is the personal exemption amount. Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual: Nonresident if they do not have a green card or do not satisfy the substantial presence test. You don't need a schedule for it.)

Important Tax Information and Tax Forms · Camp USA · InterExchange

Before you get started on the oit website you will find: Income tax return for certain nonresident aliens with no dependents in july 2021, and the latest form we have available is for tax year 2020. Married filing separately (mfs) qualifying widow(er) (qw) if you checked the qw box, enter the child’s name. Individual income tax return, is the only.

Forms 1040, 1040NR and 1040NREZ Which Form to File? [2021]

Nonresident alien income tax return 2022 omb no. You must file even if: A taxpayer is considered a u.s. Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual: This is the personal exemption amount.

1040Nr Fill Out and Sign Printable PDF Template signNow

Specifically, the form is used by: Married filing separately (mfs) qualifying widow(er) (qw) if you checked the qw box, enter the child’s name. 31, 2022, or other tax year beginning, 2022, ending , 20 see separate instructions. Filing status check only one box. As of the 2018 tax year, form 1040, u.s.

Form 1040NREZ Edit, Fill, Sign Online Handypdf

Single married filing separately (mfs) qualifying widow(er) (qw) if you checked the qw box, enter the child’s name if the qualifying person is a child but not your dependent a Web the 1040nr schedule a (which is part of the 1040nr form itself) contains all the itemized deductions that nonresident aliens can claim. Web extensions for form 1040nr can also.

1040nrez tax table

This form has been redesigned. This form looks similar to the standard. Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual: Follow the same procedures for preparing 1040 returns or extensions for electronic filing to prepare form 1040nr for electronic filing. The irs does not allow electronic filing for.

5 important US tax documents every international student should know

Income tax return for certain nonresident aliens with no dependents in july 2021, and the latest form we have available is for tax year 2020. Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual: We last updated the u.s. Income tax return for certain nonresident aliens with no dependents. For instructions and.

Fillable Form 1040nrEz U.s. Tax Return For Certain

Application for automatic extension of time to file u.s. Nonresident alien income tax return 2020 department of the treasury—internal revenue service (99) omb no. You may also need the three form 1040 numbered schedules: Were a nonresident alien engaged in a trade or business in the united states. Single married filing separately (mfs) qualifying widow(er) (qw) if you checked the.

You May Also Need The Three Form 1040 Numbered Schedules:

Individual income tax return, is the only form used for personal (individual) federal income tax returns filed with the irs. Single married filing separately (mfs) (formerly married) qualifying widow(er) (qw) Schedule 1 (form 1040), additional income and adjustments to income; Web the 1040nr schedule a (which is part of the 1040nr form itself) contains all the itemized deductions that nonresident aliens can claim.

For Instructions And The Latest Information.

Single married filing separately (mfs) qualifying widow(er) (qw) if you checked the qw box, enter the child’s name if the qualifying person is a child but not your dependent a As of the 2018 tax year, form 1040, u.s. This is the personal exemption amount. Nonresident alien income tax return (99) 2021.

This Form Has Been Redesigned.

On the first page, you’re going to need to indicate your personal details: You must file even if: You have no income from a trade or business conducted in the united states, 31, 2022, or other tax year beginning, 2022, ending , 20 see separate instructions.

Exemption From Withholding On Compensation For Independent (And Certain Dependent) Personal Services Of A Nonresident Alien Individual:

Income tax return for certain nonresident aliens with no dependents download this form print this form it appears you don't have a pdf plugin for this browser. Web the form 1040 is used to report your income for a given tax year. Nras whose total us income for 2015 was more than $4,000. Filing status check only one box.

![Forms 1040, 1040NR and 1040NREZ Which Form to File? [2021]](http://blog.sprintax.com/wp-content/uploads/2020/07/image-4.jpg)