1031 Exchange Form 8824 Example

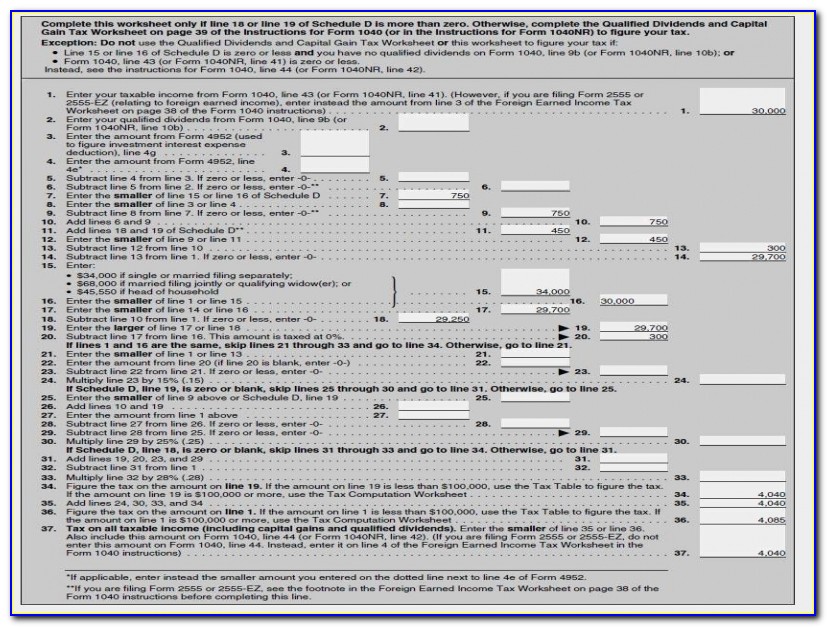

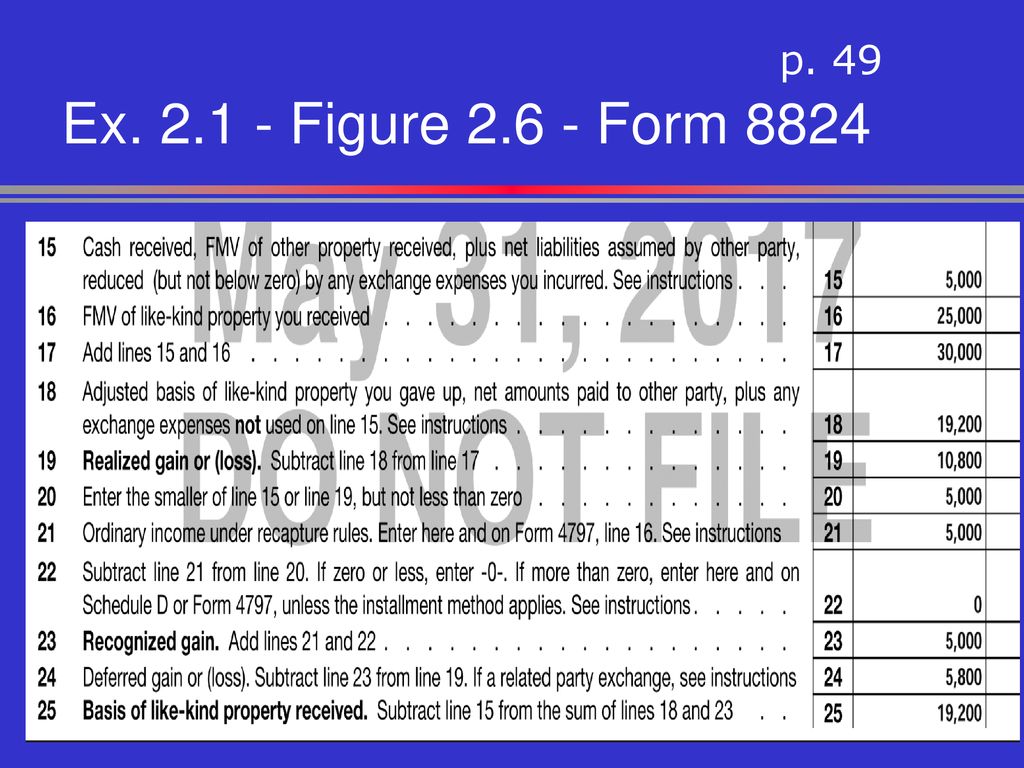

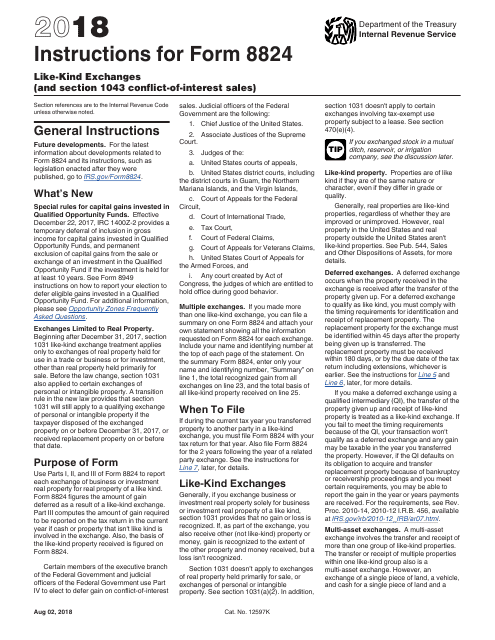

1031 Exchange Form 8824 Example - Then, prepare worksheet 1 after you have finished the preparation of worksheets 2 and 3. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind. Web for example if a furnished rental property was sold and an unfurnished rental property was purchased as the replacement property, this would give rise to reporting on lines 12 through 14. 14, 2015, and then settles on replacement property may 1, 2016. See definition of real property, later, for more details. Web exchanges limited to real property. Subtract line 15 from the sum of lines 18 and 23. This is comprised of the following four elements: He assigned a value of. Alan adams bought a duplex ten years ago for $200,000 cash.

This is comprised of the following four elements: Do not send them with your tax return. Web exchanges limited to real property. He assigned a value of. See definition of real property, later, for more details. To allow business owners to report the deferral of gains through section 1031 tax deferred exchange transactions; Web form 8824, the 1031 exchange form. 14, 2015, and then settles on replacement property may 1, 2016. Alan adams bought a duplex ten years ago for $200,000 cash. Exchanger settles on relinquished property on dec.

See definition of real property, later, for more details. Web form 8824, the 1031 exchange form. Then, prepare worksheet 1 after you have finished the preparation of worksheets 2 and 3. How do we report the exchange? Subtract line 15 from the sum of lines 18 and 23. To allow business owners to report the deferral of gains through section 1031 tax deferred exchange transactions; Web exchanges limited to real property. He assigned a value of. This is comprised of the following four elements: Web for example if a furnished rental property was sold and an unfurnished rental property was purchased as the replacement property, this would give rise to reporting on lines 12 through 14.

How can/should I fill out Form 8824 with the following information

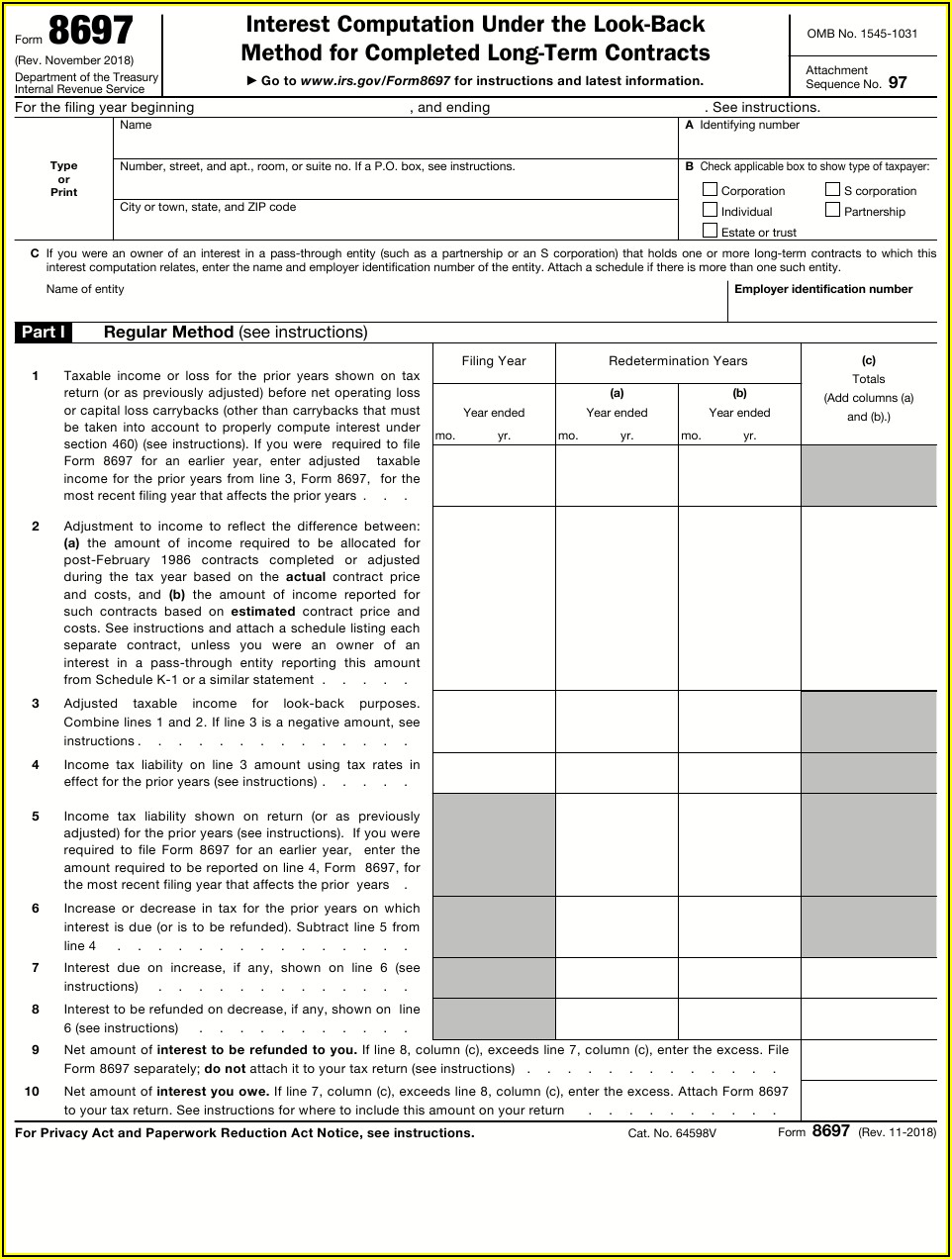

See definition of real property, later, for more details. Web use of the §1031 exchange. Web form 8824, the 1031 exchange form. For review, we are dealing with the following scenario. How do we report the exchange?

turbotax entering 1031 exchange Fill Online, Printable, Fillable

Web for example if a furnished rental property was sold and an unfurnished rental property was purchased as the replacement property, this would give rise to reporting on lines 12 through 14. 14, 2015, and then settles on replacement property may 1, 2016. Web use of the §1031 exchange. Web tax deferred exchanges under irc § 1031worksheet 1 taxpayerexchange propertyreplacement.

1031 Exchange Form Irs Form Resume Examples erkKebJ5N8

Alan adams bought a duplex ten years ago for $200,000 cash. Web tax deferred exchanges under irc § 1031worksheet 1 taxpayerexchange propertyreplacement propertydateclosed before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. Web exchanges limited to real property. Web form 8824, the 1031 exchange form. To allow business owners to report the deferral of gains.

Section 1031 Irs Form Universal Network

Web use of the §1031 exchange. Then, prepare worksheet 1 after you have finished the preparation of worksheets 2 and 3. Web form 8824, the 1031 exchange form. See definition of real property, later, for more details. Subtract line 15 from the sum of lines 18 and 23.

Irs.gov Form 1031 Form Resume Examples WjYD1gB0VK

Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind. This is comprised of the following four elements: How do we report the exchange? Web tax deferred exchanges under irc § 1031worksheet 1 taxpayerexchange propertyreplacement propertydateclosed before preparing worksheet 1, read the attached instructions for preparation.

Ex Figure Form 8824 P. 49 Universal Network

How do we report the exchange? Do not send them with your tax return. This is comprised of the following four elements: Exchanger settles on relinquished property on dec. Web form 8824, the 1031 exchange form.

Download Instructions for IRS Form 8824 LikeKind Exchanges PDF, 2018

Web use of the §1031 exchange. Web let’s look at an example: See definition of real property, later, for more details. 14, 2015, and then settles on replacement property may 1, 2016. Then, prepare worksheet 1 after you have finished the preparation of worksheets 2 and 3.

Like Kind Exchange Worksheet Excel And Irs 1031 Exchange Worksheet

How do we report the exchange? Web tax deferred exchanges under irc § 1031worksheet 1 taxpayerexchange propertyreplacement propertydateclosed before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. Alan adams bought a duplex ten years ago for $200,000 cash. 14, 2015, and then settles on replacement property may 1, 2016. Web let’s look at an example:

Irs Form 8824 Simple Worksheet herofinstant

How do we report the exchange? Web for example if a furnished rental property was sold and an unfurnished rental property was purchased as the replacement property, this would give rise to reporting on lines 12 through 14. Then, prepare worksheet 1 after you have finished the preparation of worksheets 2 and 3. See definition of real property, later, for.

What is a 1031 Exchange?

Web exchanges limited to real property. Web let’s look at an example: For review, we are dealing with the following scenario. Web tax deferred exchanges under irc § 1031worksheet 1 taxpayerexchange propertyreplacement propertydateclosed before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. Exchanger settles on relinquished property on dec.

Web Let’s Look At An Example:

To allow business owners to report the deferral of gains through section 1031 tax deferred exchange transactions; How do we report the exchange? This is comprised of the following four elements: See definition of real property, later, for more details.

Do Not Send Them With Your Tax Return.

14, 2015, and then settles on replacement property may 1, 2016. Exchanger settles on relinquished property on dec. Web form 8824, the 1031 exchange form. Alan adams bought a duplex ten years ago for $200,000 cash.

Web Exchanges Limited To Real Property.

Web tax deferred exchanges under irc § 1031worksheet 1 taxpayerexchange propertyreplacement propertydateclosed before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. Then, prepare worksheet 1 after you have finished the preparation of worksheets 2 and 3. He assigned a value of. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind.

For Review, We Are Dealing With The Following Scenario.

Web use of the §1031 exchange. Web for example if a furnished rental property was sold and an unfurnished rental property was purchased as the replacement property, this would give rise to reporting on lines 12 through 14. Subtract line 15 from the sum of lines 18 and 23.